In the rapidly expanding world of cryptocurrency, the choice of exchange can significantly impact your trading success. As more investors flock to this digital frontier, understanding which platforms are the most trusted is essential. Join us as we reveal the top 5 most trusted cryptocurrency exchanges that stand out for their security, features, and user experience. Discover why these platforms are leading the charge in the crypto space and how they can enhance your trading journey.

Understanding the Rise of Cryptocurrency Exchanges

The cryptocurrency market has witnessed explosive growth in recent years, attracting millions of investors seeking to capitalize on the potential of digital assets. Crucial to this burgeoning ecosystem are cryptocurrency exchanges, platforms that facilitate the buying, selling, and trading of digital currencies. Exchanges play a vital role in connecting buyers and sellers, providing liquidity and enabling the smooth operation of the crypto market.

Top 5 most trusted cryptocurrency exchanges

The Role of Exchanges in the Crypto Ecosystem

Cryptocurrency exchanges act as intermediaries between buyers and sellers, matching orders and executing trades. These platforms provide a centralized marketplace where individuals can interact and exchange digital currencies. They offer a wide range of features including:

- Trading Pairs: Exchanges support various trading pairs, allowing users to exchange one cryptocurrency for another or for fiat currencies (such as USD or EUR).

- Order Books: Exchanges display the current market depth, showcasing the volume and price of buy and sell orders.

- Trading Fees: Exchanges charge fees for each trade executed, typically expressed as a percentage of the transaction value.

Factors Driving the Popularity of Crypto Trading

The rise of cryptocurrency trading can be attributed to several key factors:

- Technological Advancements: The development of blockchain technology has enabled the creation of decentralized and secure digital currencies.

- Growing Adoption: Increasing adoption of cryptocurrencies by businesses, institutions, and individuals has fueled demand for trading platforms.

- Market Volatility: While the crypto market is known for its volatility, it also attracts traders seeking to profit from rapid price fluctuations.

- Accessibility: Cryptocurrency exchanges have become more accessible, offering user-friendly platforms and mobile applications.

Exploring the Top 5 Cryptocurrency Exchanges

The cryptocurrency exchange landscape is highly competitive, with numerous platforms vying for market share. Several exchanges have emerged as industry leaders, gaining popularity for their security, features, and user experience. Here’s a breakdown of the top 5:

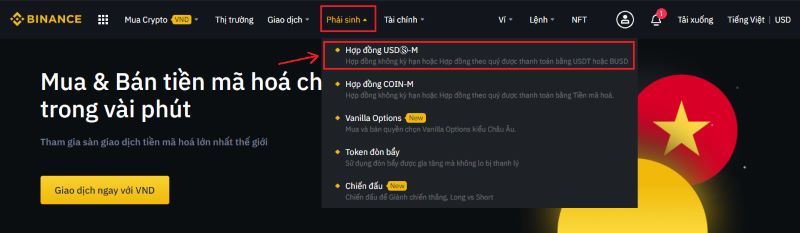

Binance: A Deep Dive into the Industry Giant

Binance (binance.com) is a global cryptocurrency exchange founded in 2017 by Changpeng Zhao (CZ). The platform has rapidly ascended to become the world’s largest cryptocurrency exchange by trading volume, processing over 16 billion USD worth of trades daily, with over 1.4 million orders per second.

Binance boasts impressive trading volume and supports over 500 cryptocurrencies. This wide selection caters to a diverse range of traders, from seasoned veterans seeking niche assets to newcomers exploring the crypto market.

Binance offers numerous advantages, including:

- Extensive Features: Binance provides a comprehensive platform with an array of trading tools, charts, and analysis capabilities.

- User-Friendly Interface: The platform boasts a user-friendly interface, making it accessible to both beginners and experienced traders.

- Strong Security Measures: Binance employs robust security measures, including multi-factor authentication and cold storage for crypto assets.

However, Binance has also faced challenges:

- Cybersecurity Issues: Binance has experienced security breaches in the past, highlighting the need for constant vigilance and improvement in security protocols.

- Regulatory Concerns: The exchange has faced regulatory scrutiny in some jurisdictions, leading to challenges in certain markets.

Remitano: A Peer-to-Peer Trading Platform

Remitano (remitano.com), established in 2016 and headquartered in Seychelles, differentiates itself as a peer-to-peer (P2P) cryptocurrency exchange, facilitating direct transactions between users. Remitano supports over 20 cryptocurrencies, offering a decentralized alternative to traditional exchanges.

Remitano: A Peer-to-Peer Trading Platform

Focus on Security and User Experience

Remitano prioritizes security with features such as two-factor authentication (2FA) and cold storage, ensuring the safety of user funds. The platform emphasizes a seamless user experience, providing an intuitive interface and responsive customer support.

Target Audience and Regional Presence

Remitano enjoys significant popularity in Vietnam, where it is recognized for its security and reliability. The platform caters to both individual users and businesses seeking a secure environment for cryptocurrency transactions.

MEXC Global: Catering to a Diverse Range of Traders

MEXC Global (mexc.com), established in 2018 (formerly known as MXC), is a rapidly growing cryptocurrency exchange with a focus on providing a wide range of trading options and features. The platform boasts a diverse selection of cryptocurrencies, exceeding 850, catering to a wide range of trading preferences.

Wide Selection of Cryptocurrencies and Trading Pairs

MEXC Global distinguishes itself by offering a vast selection of cryptocurrencies and trading pairs, including both established assets and emerging projects. This extensive selection provides users with a diverse range of investment opportunities.

Potential Risks and Considerations for Users

While offering a wide selection of cryptocurrencies, MEXC Global also includes a number of “meme coins” and lesser-known assets, sometimes referred to as “shitcoins.” This can expose users to higher risks, as the value of these assets can fluctuate dramatically.

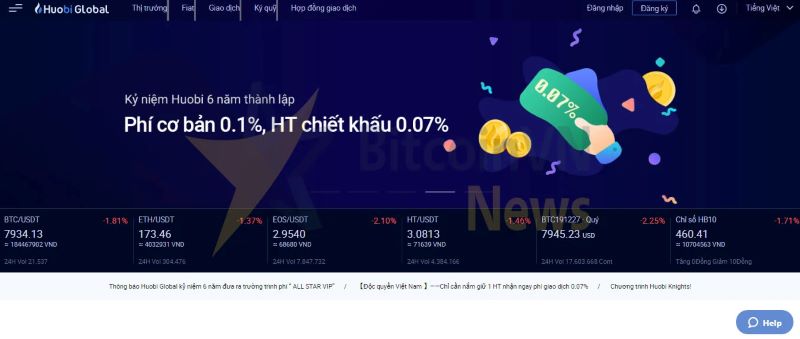

Huobi Global: A Global Player with a Strong Reputation

Huobi Global (htx.com), established in 2013 in China, has established a strong reputation within the cryptocurrency exchange industry. The platform has consistently ranked among the top exchanges by trading volume, processing up to 32 billion USD in daily trades.

Security Measures and Regulatory Compliance

Huobi Global prioritizes security and regulatory compliance, implementing robust security measures and demonstrating adherence to industry standards. The platform’s commitment to security and compliance has contributed to its reputation as a trustworthy and reliable exchange.

Historical Performance and Market Influence

Huobi Global actively participates in the global cryptocurrency market, contributing significantly to trading liquidity. The platform’s historical performance and market influence have solidified its position as a major player in the crypto exchange industry.

Gate.io: Offering a Wide Array of Altcoins

Gate.io, established in 2013 (originally known as Bter.com), distinguishes itself as a cryptocurrency exchange specializing in altcoins, supporting over 1,400 cryptocurrencies, including a wide selection of emerging tokens. The platform caters to experienced traders seeking exposure to a diverse range of assets.

Features and Tools for Experienced Traders

Gate.io offers a comprehensive set of features and tools designed to meet the needs of experienced traders. The platform provides advanced charting tools, technical indicators, and real-time market data, empowering sophisticated trading strategies.

Assessing the Platform’s Suitability for Different Investors

Given its focus on altcoins and advanced trading features, Gate.io is best suited for experienced traders comfortable with risk and navigating the volatile nature of emerging assets. Beginner investors might find the platform’s extensive selection and advanced features overwhelming.

Navigating the Risks and Challenges of Cryptocurrency Exchanges

Cryptocurrency exchanges present both opportunities and risks. Cybercriminals often target these platforms, exploiting vulnerabilities. Key threats include phishing attacks, malware, and insider threats. To protect assets, users should enable two-factor authentication, use strong passwords, keep software updated, and consider hardware wallets for secure storage.

The regulatory landscape is evolving, with governments establishing guidelines to ensure compliance and security. Choosing compliant exchanges is crucial, as they typically implement stronger security measures.

Market volatility in cryptocurrencies creates both opportunities and risks. Diversification helps mitigate losses, while strategies like dollar-cost averaging and stop-loss orders can manage investment risks effectively.

Looking ahead, decentralized exchanges (DEXs) are rising in popularity, offering secure trading options. The integration of blockchain and DeFi applications is transforming the landscape. Increased regulation and institutional adoption are expected to enhance market stability and investor confidence.

In summary, the future of cryptocurrency exchanges will depend on technological advancements and regulatory clarity. A strong investment strategy should focus on diversification and careful risk assessment, as the industry continues to evolve.

To learn more about top exchanges and stay updated with the latest information, visit Dynamic Crypto Network today!