Custodial vs Non-Custodial Wallets: Choosing Your Crypto Keeper

You’ve got crypto, but how do you keep it safe? That’s where wallets step in. But don’t just pick any holder for your digital coins. It’s crucial to know the difference between custodial and non-custodial options. Custodial wallets mean a third party holds your crypto keys, while non-custodial wallets put you in the driver’s seat with total control. It’s a choice between convenience and command. Ready to secure your crypto? Let’s dive into how each one works and what it means for your digital treasure.

Understanding the Basics of Cryptocurrency Wallets

Demystifying the Types of Crypto Wallets

Think of a wallet, but for your digital coins. A spot to keep them safe. In the crypto world, there’s a bunch to choose from. But they fall into two big families: hot wallets and cold wallets. Hot wallets connect to the internet. You get to your coins online to trade or spend fast. Cold wallets, on the other hand, stay offline. They’re more like vaults, super safe for saving lots of coins.

Hot wallets can be apps on your phone, software on your PC, or services from a crypto exchange. Cold wallets come as hard devices like a USB stick or even a piece of paper with codes on it. You’re looking for safety and ease? Get both in different ways from these wallet types.

How Secure Digital Wallets Function

How does a wallet keep your digital money safe? It locks it behind a secret code, called a private key. If you’ve got the key, you’ve got the power over the coins. That’s where the whole safekeeping game starts.

A wallet doesn’t just hold your coins. It also wraps every deal with safety layers and talks to the crypto network for you. It checks the balance and sends or gets coins when you want it to.

But remember, not all wallets are built the same. Some give you the full control over your keys and coins, like a trusty guard dog. We call these non-custodial. Others take care of your keys, like a bank does with money in your account. Those are called custodial.

Custodial wallets are run by third parties, and they’re a bit like checking accounts for your crypto. These wallets are common when you use a cryptocurrency exchange. These exchanges give you a wallet when you create an account. With them, it’s the exchange that holds the keys. It’s like saying, “Here, you take care of this for me.”

Now, it’s crucial to know who’s in charge of your keys. With a non-custodial wallet, that’s all you. You call the shots, but you also wear the cape if issues pop up. Your keys, your kingdom. The perks? You’ve got the reins. The downside? If you lose your keys or forget them, there’s no reset button or customer support to call. It’s lost for good.

Secure digital wallets use fancy math to protect your coins with encryption. Encryption is a way to scramble your private key into a code that’s hard to crack. So, even if someone gets their hands on your wallet, they can’t do much without your key.

Talking about keys, that’s what wallet security measures are all about. Safe keys mean safe coins. Keep your keys away from prying eyes by using keys storage solutions. These could be as simple as writing it down in a secret spot or using a hardware wallet.

When we dive into setting up digital wallets, we always start with security. We look at the wallet encryption protocols. These are the rules that say how wallets lock away the crypto. They make sure no one can sneak a peek at your funds or make unapproved trades.

In crypto, financial privacy is golden. It means keeping your deals and your wealth on the down-low. Both hot and cold wallets aim to do just that, in their unique ways.

The last bit in the wallet world is about backup and recovery. Ever thought, “What if I lose my wallet?” Well, crypto wallets have a plan for that. They use seed phrases, kind of a backup code. Write down your seed phrase and put it someplace super safe. That way, if your wallet ever gets lost or stops working, you can get your coins back.

So, there you go, crypto wallets in a nutshell. Simplified, sure, but that’s the ground level of what you need to know. Remember, your choice in wallet can shape your whole crypto experience. Choose wisely!

Choosing Between Custodial and Non-Custodial Wallet Solutions

How Custodial Wallets Work and Their Convenience

Custodial wallets are like bank accounts for your crypto. A third party keeps your coins safe. You don’t hold the keys, they do. This makes trading easy. It lets you worry less about key management. But if they get hacked or shut down, you could lose your crypto.

This option fits you if you want simple access to your coins. With a custodial wallet, buying and trading happen fast. It’s great if you’re new to crypto and need a hand.

For instance, think of your crypto exchange wallet. Here, a company holds your funds. Getting started is as easy as signing up and jumping in. They back up your wallet’s data too. So, you don’t lose your coins if you forget a password.

The Freedom and Responsibility of Non-Custodial Wallets

Non-custodial wallets give you full control. You manage your keys and coins. No middle-man is in your business. It feels good to call the shots. But with great power comes great care. You need to keep your keys safe and back them up. Lose them, and your coins are gone for good.

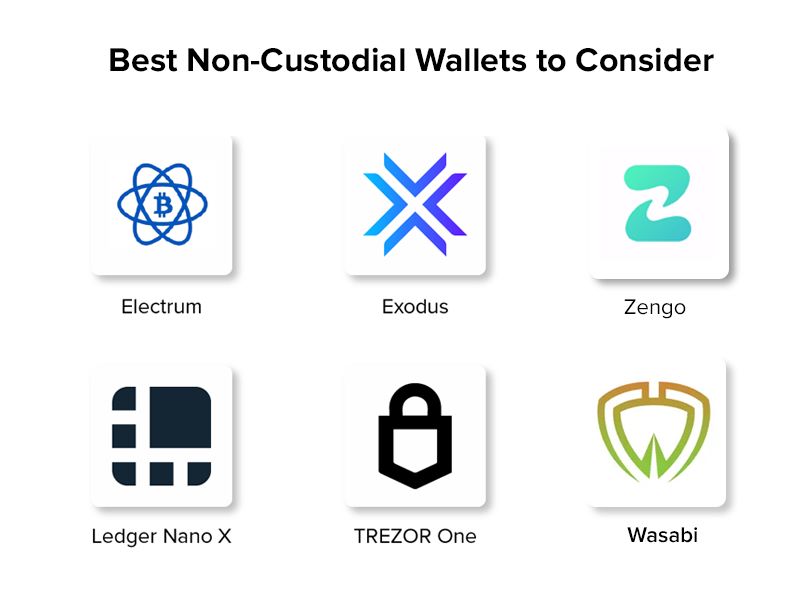

This choice is top-notch if you like to hold the reins. It means you’re up for the task of tight security and key care. Types of crypto wallets that are non-custodial include hardware and software ones. A hardware wallet stores your keys offline. It keeps them out of reach from online threats. Software wallets put keys on your device. They’re handy, but you must guard them from viruses and hackers.

Let’s dive into backup solutions. With non-custodial wallets, backup is on you. You write down a seed phrase, a list of words that brings back your wallet if needed.

Security is key here. Always go for wallets with strong security. This means a wallet with a good track record and solid backup features. Non-custodial wallets are for you if you’re keen on holding your own. They’re for folks who find peace in personal control and want full say over their crypto journey. Remember, with no central authority, your digital treasure is in your hands.

Both wallet styles have their pros and cons. It’s about what fits your needs and skills. Think about ease against control. Think about how much responsibility you want to take on. The right wallet keeps your crypto safe and serves you best. Do your homework, pick wisely, and your crypto keeper will match your crypto stride.

Evaluating Security and Control in Wallet Storage

Keys Storage Solutions and Private Key Management

When you pick a wallet for your crypto, think about your keys first. Your keys are like the secret code to your money—the crypto kind. If someone else gets them, they could take your coins. So, we keep these codes safe.

Think about where to store your keys. Many choose to keep them offline, where hackers can’t reach. This is often safer. Hardware wallets, those little devices you plug into a computer, are good for this. They keep your keys locked away when not in use.

Software wallets, though easier for day-to-day use, store your keys on devices that might connect to the internet. It means they are at more risk. If you pick this route, you need strong passwords and maybe even extra security layers, like multi-signature features. These require more than one key to okay a transaction, keeping your coins safer.

Staying safe matters, but you must also remember how to access your crypto. Forgetting a password for your hardware wallet or losing it can be a huge problem.

The Importance of Wallet Backup Solutions and Recovery Processes

Always have a backup plan. What if you lose your wallet? What if it breaks? Or what if you forget how to get into it?

For this, you need to know about wallet backups and recovery. If you ever lose access to your crypto, a backup saves the day. This could be writing down your key on paper (a paper wallet) or using a seed phrase. A seed phrase is a list of words that store all the info needed to get your crypto.

Each wallet gives you a unique seed phrase. Never share it. It’s the master key to your crypto. If someone gets it, they get everything. Keep it somewhere safe that only you can get to. Not on a computer. Remember, computers can get hacked.

Lots of people ask, “Is a custodial wallet safer because someone else is looking after my keys?” It’s kind of like putting your money in a bank. They keep it safe, but they also control it. Some like this. It’s less to worry about. But remember, custodial means the wallet service has your keys. Not you. They help with lost passwords and backups, but you must trust them a lot.

On the other hand, non-custodial means you’re in charge. You hold the keys. You do the backup. You run the show. This can be nice. You are your own boss in a way. But, if you’re not careful, you could lose your crypto for good with no one to help get it back.

It’s clear then. You must balance control and safety when picking your crypto keeper. Always know how to back up and recover your wallet. Without this, your digital riches could get lost in the digital world, with no way back.

Knowing all this, you’re better set to choose the right wallet. Whether it’s hardware for safekeeping or an app for easy use, you decide how safe and in control you want to be. But remember, with great power comes great responsibility – especially in crypto.

Balancing Risks and Accessibility in Crypto Storage

Comparing Hot Wallets and Cold Wallets for Everyday Use

What are hot wallets and cold wallets? Hot wallets connect to the internet. They let you access your crypto fast. Cold wallets do not connect to the internet. They keep your crypto safe offline.

To use crypto day to day, you might lean towards hot wallets. These wallets are apps on your phone or computer. They’re handy but less secure because they’re online. Think of them like a wallet in your pocket. It’s easy to get your cash, but you could lose it.

Now, cold wallets are like a safe in your house. They take more time to get into but better protect your money. Hardware wallets are a common type. They look like USB sticks and keep your crypto offline. You plug them into your computer when you need to use your crypto. This means they’re safer from hackers.

Deciding on Wallet Services Based on User Experience and Security Measures

Why choose one wallet type over another? It’s about balance. It’s about how you use your crypto and how safe you need to be. For everyday spending, a hot wallet is simple. For big savings, a cold wallet is smarter.

To pick a wallet service, ask about user experience and safety. Does the wallet make it easy to send and get crypto? Are there extra steps to keep your crypto safe? Some wallets need a password plus a mobile code to get in. This is a security step called two-factor authentication.

Wallet security also means controlling your private keys. A key is like a password for your crypto. With custodial wallets, the service keeps the key. This is easy but risky. If the service goes down, your crypto could be locked or lost.

Non-custodial wallets give you the key. You have more control and responsibility. You must keep your key safe. If you lose your key, you could lose your crypto forever. But you stay in control, always.

Wallet services can offer backup options too. Seed phrases are backup passwords that help you recover your wallet. Imagine losing your phone with your wallet app. With your seed phrase, you can get your wallet back on a new phone.

Secure digital wallets are a must in the crypto world. They’re key storage solutions that fit different needs. Hot wallets for fast access. Cold wallets for strong security. Both are part of using crypto today. It’s your choice: go for ease or extra safety? That’s the crypto keeper question. Remember, it’s your money, your crypto, and your choice.

When setting up your digital wallet, think about encryption, backup, and your peace of mind. Use what fits your life. Stay safe out there in the crypto world!

We’ve explored the world of cryptocurrency wallets, diving into the different types and how they keep your digital coins safe. We examined the choice between custodial and non-custodial wallets, highlighting the ease of the first and the self-reliance required for the second. Key management and backup options are crucial for your wallet’s security, as we discussed in detail.

For final thoughts, remember that managing crypto means balancing risks with ease of access. Hot wallets give quick access, while cold wallets offer strong security. Your personal need for convenience or safety should guide your choice. Whatever service you pick, make sure it aligns with your needs for both security and user experience. Stay educated and choose wisely to keep your digital assets secure.

Q&A :

What is the main difference between custodial and non-custodial wallets?

Custodial and non-custodial wallets differ primarily in who holds the private keys associated with the cryptocurrency funds. In a custodial wallet, a third party holds and manages the private keys on behalf of the user. This means that the user relies on that third party for the security and accessibility of their funds. On the other hand, a non-custodial wallet gives full control to the user, with the responsibility for managing and safeguarding the private keys resting entirely in their hands.

How does the security of custodial wallets compare to non-custodial wallets?

The security of custodial and non-custodial wallets can be seen from different perspectives. Custodial wallets may offer a degree of security by relying on specialized organizations with robust security measures in place to protect the digital assets. However, they also create a central point of failure that could be targeted by hackers. Non-custodial wallets offer users complete control of their security, reducing the risks associated with centralization, but require the user to be knowledgeable and diligent in maintaining the security of their keys.

Which type of wallet is more user-friendly for beginners: custodial or non-custodial?

For beginners, custodial wallets tend to be more user-friendly because they generally offer an experience similar to traditional online banking, with straightforward interfaces and customer support. Since the management of keys and backup is handled by the service provider, the barrier to entry is lower. Conversely, non-custodial wallets require a greater understanding of blockchain technology and demand more responsibility from the users, which might be overwhelming for people new to cryptocurrency.

Can you regain access to a non-custodial wallet if you lose the private key?

Unlike custodial wallets, where the service provider can assist with the recovery of accounts, access to non-custodial wallets is solely dependent on having the correct private keys. If you lose these keys, regaining access to the wallet and the funds within is typically not possible. That’s why it’s crucial to securely back up your private keys when using a non-custodial wallet.

What are the benefits of using a non-custodial wallet over a custodial wallet?

Non-custodial wallets offer a higher level of financial sovereignty, as users are in complete control of their funds without the need to trust a third party. They enhance privacy since you’re not sharing your transaction details or personal information. Additionally, they allow users to interact directly with various decentralized applications (dApps) without intermediaries. The trade-off is that they demand a more thorough knowledge of cryptocurrency concepts and vigilant personal security practices.