What if you could trade cryptocurrencies with expert-level precision, anytime, anywhere? The Royal Q trading bot provides unparalleled support, ensuring your investments are optimized 24/7. But what exactly does this mean for your trading strategy? Dive in to uncover the full potential!

Overview of Royal Q Trading Bot

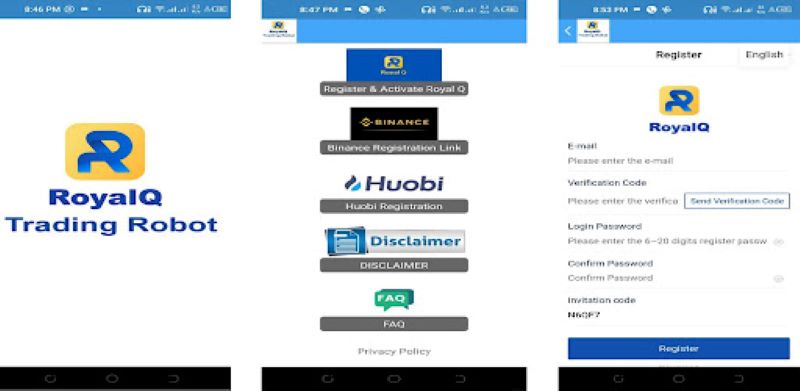

Royal Q Trading Bot is a popular automated trading platform designed to help traders execute trades on cryptocurrency exchanges. It uses pre-programmed algorithms to analyze market data, identify potential trading opportunities, and execute trades automatically.

The platform is known for its user-friendly interface and a range of customizable trading strategies, making it attractive to both new and experienced traders.

Understanding Algorithmic Trading

Algorithmic trading, also known as automated trading, involves the use of software programs to execute trades based on pre-defined rules and algorithms. This method eliminates the need for manual intervention and allows traders to capitalize on market opportunities even when they are not actively monitoring their accounts.

Algorithmic trading offers several key benefits

- Increased efficiency: Automated trading eliminates the emotional component of trading and executes trades quickly and efficiently.

- Reduced trading errors: Algorithms are not prone to human errors and follow pre-defined rules consistently.

- Improved risk management: Trading bots can be programmed to manage risk effectively by setting stop-loss orders and other pre-defined risk parameters.

- Access to more markets: Automated trading allows traders to access and monitor multiple markets simultaneously, enabling opportunities for diversification.

Key Features and Functionality of Royal Q

Royal Q is a comprehensive trading bot platform that offers a range of features and functionalities:

- Multiple exchange support: Royal Q supports a wide range of popular cryptocurrency exchanges, allowing traders to manage their assets across multiple platforms.

- Customizable trading strategies: The platform offers predefined trading strategies or allows traders to create their own strategies based on technical indicators and market conditions.

- Real-time market monitoring: Royal Q provides traders with real-time market data and insights, enabling them to make informed trading decisions.

- Backtesting capabilities: Traders can test their trading strategies on historical data to evaluate their performance before real-world deployment.

- Advanced order types: Royal Q supports a wide array of order types, including market orders, limit orders, stop-loss orders, and take-profit orders.

- Security measures: The platform implements robust security measures to protect users’ accounts and funds.

How does Royal Q stack up against other Trading Bots?

While Royal Q has gained popularity in the cryptocurrency trading community, it’s essential to compare it with other available trading bots to determine if it suits your needs and preferences. Let’s delve into a comparative analysis of Royal Q with its competitors, focusing on key factors like exchange support, trading strategies, fees, user experience, and additional features.

Royal Q vs. Competitors

One of the key considerations when choosing a trading bot is its compatibility with the exchanges you use. Royal Q supports a wide array of popular cryptocurrency exchanges, including Binance, Huobi, OKEx, and KuCoin. This broad compatibility enables traders to manage their assets across multiple platforms using a single interface.

However, some competing trading bots offer a wider selection of supported exchanges, including smaller and more niche platforms. Therefore, it’s essential to check the compatibility list of each trading bot before making a decision.

Trading Strategies and Customization Options

Trading bots are designed to execute trades based on pre-defined rules and algorithms, known as trading strategies. Royal Q offers both predefined strategies and the ability for traders to create their own customized strategies. The predefined strategies often include popular technical indicators and trend-following algorithms, making it a good option for both new and experienced traders.

However, some competitors offer a more advanced and flexible approach to strategy customization, allowing traders to integrate a wider array of technical indicators, custom scripts, and even machine learning models. If you’re an experienced trader seeking highly customized strategies, be sure to explore the customization options offered by competing bots.

Fee Structures and Cost-Effectiveness

Trading bots typically charge fees for their services, which can vary depending on the platform, service level, and transaction volume. Royal Q’s fee structure is generally considered competitive, with a subscription-based model that offers tiered pricing based on the features and services included.

However, some competitors offer more flexible fee structures, including pay-per-trade models or even completely free options for basic features. Be sure to carefully compare the fee structures of different trading bots to find the most cost-effective option based on your trading habits and budget.

User Experience and Interface Design

Royal Q is known for its user-friendly interface, making it accessible to both beginner and advanced traders. The platform is well-designed, with intuitive navigation and clear explanations of its features.

However, some competitors offer more intuitive and visually appealing interfaces, especially for experienced traders who may require access to advanced features and data visualization. It’s essential to evaluate the interface design of each bot and choose one that aligns with your comfort level and trading preferences.

Additional Features and Tools

Beyond core functionalities, some trading bots offer additional features and tools that can enhance your trading experience. Royal Q includes features like:

- Paper trading: Allows traders to test their strategies on simulated markets before deploying them with real funds.

- Community support: Offers forums and chat channels where traders can connect with each other and share knowledge.

- Educational resources: Provides resources and tutorials to help traders learn about algorithmic trading and related topics.

However, some competitors offer even more advanced tools, such as:

- Machine learning integration: Allows traders to incorporate machine learning algorithms into their strategies for more sophisticated analysis.

- Social trading: Enables traders to follow and copy the strategies of experienced traders.

- Signal services: Provides real-time trading signals based on technical analysis or market sentiment.

Tips for Safe and Effective Bot Trading

While automated trading offers numerous benefits, it’s crucial to approach it with caution and best practices:

- Start with a demo account: Familiarize yourself with the bot’s interface and features using a demo account before risking real funds.

- Backtest your strategies: Test your trading strategies on historical data to evaluate their performance and effectiveness.

- Start with a small investment: Begin with a small amount of capital to minimize potential losses in the early stages.

- Monitor your trades: Regularly review your trading activity and performance to ensure your bot is operating as intended.

- Use risk management tools: Implement stop-loss orders and other risk management measures to limit potential losses.

- Stay informed: Keep up-to-date with industry news and trends to stay ahead of market changes.

The Future of Automated Trading

The field of automated trading is constantly evolving, driven by advancements in technology and changing market dynamics.

Artificial intelligence (AI) and machine learning (ML) are playing an increasingly significant role in automated trading. AI-powered bots can analyze vast amounts of data, identify complex patterns, and make trading decisions with greater accuracy and speed.

The cryptocurrency industry is subject to evolving regulations, which can impact automated trading. Regulations may influence how trading bots are designed, implemented, and used. It’s essential to stay informed about regulatory changes and their potential effects.

When choosing a trading bot provider, prioritize security and reputation. Look for providers with a proven track record, robust security measures, and a commitment to transparency.

With the Royal Q trading bot’s 24/7 support, you can navigate the volatile crypto market with confidence. Don’t leave your investments to chance—explore the resources available at Dynamic Crypto Network to boost your trading strategies and secure your financial future!