Navigating the world of arbitrage trading bots can be overwhelming. With a plethora of options available, how do you find the perfect fit for your trading style and goals? Let’s dive into the key features and considerations to help you make an informed decision.

Introdution to Arbitrage Trading Bot

Arbitrage trading, a strategy employed by seasoned investors and traders, involves capitalizing on price discrepancies across different markets. In the context of cryptocurrency, arbitrage traders seek to exploit price differences between exchanges, aiming to profit from these variances.

The core principle revolves around buying a cryptocurrency on one exchange where it’s priced lower and simultaneously selling it on another exchange where it commands a higher price. This strategy leverages the inherent inefficiencies within the cryptocurrency market, where exchanges often exhibit price disparities due to factors such as liquidity fluctuations, trading volume discrepancies, and market sentiment differences.

Think of it as a classic “buy low, sell high” approach, amplified by the rapid and often volatile nature of the cryptocurrency market. The key lies in identifying these fleeting arbitrage opportunities, reacting quickly to exploit them before the price discrepancies vanish, and efficiently executing trades across multiple exchanges.

Understanding Arbitrage Opportunities

The opportunities for arbitrage trading are primarily influenced by the following factors:

- Exchanges with lower liquidity tend to exhibit wider price spreads, providing lucrative arbitrage opportunities but posing higher risks due to potentially slower and less efficient trade execution.Trading Volume

- Exchanges with higher trading volumes generally display tighter price spreads, offering smaller arbitrage opportunities but providing more stable and reliable trading environments.

- Differing market sentiment across exchanges can lead to significant price discrepancies, particularly during periods of high volatility or sudden market shifts.

Advantages and Risks of Crypto Arbitrage

Arbitrage trading offers several advantages:

- Arbitrage can generate substantial profits by exploiting even minor price differences, especially in volatile markets.

- Unlike other trading strategies that involve directional bets, arbitrage trading aims to profit from price discrepancies rather than market movements, minimizing exposure to market risk.

- Arbitrage bots can actively monitor and exploit arbitrage opportunities across multiple exchanges simultaneously, allowing traders to scale their operations and increase potential profits.

However, it’s crucial to acknowledge the risks:

- Setting up and maintaining arbitrage bots requires technical expertise, along with the ability to manage potential risks like network outages and exchange disruptions.

- The arbitrage trading space is highly competitive, with numerous individuals and teams vying for the same opportunities.

- The crypto market’s inherent volatility can negatively impact arbitrage strategies, as sudden price fluctuations can wipe out profits or even lead to losses.

- Each exchange charges its own fees for transactions, potentially eroding profits if not carefully considered and factored into trade execution.

- The regulatory landscape surrounding cryptocurrency is constantly evolving, posing potential challenges for arbitrage traders.

Key Features To Consider

Arbitrage trading bots are becoming increasingly popular among professional traders and investment funds. These automated systems leverage price discrepancies across different cryptocurrency exchanges to generate profits by executing trades at lightning speed. Choosing the right arbitrage trading bot can be challenging with numerous options available in the market.

Supported Exchanges And Trading Pairs

One of the most crucial factors to consider when choosing an arbitrage trading bot is the range of supported exchanges and trading pairs. Some bots support only a few exchanges, while others offer a wider selection, including both major and minor exchanges.

The more exchanges and trading pairs a bot supports, the more opportunities it has to find profitable arbitrage opportunities. Moreover, the availability of specific trading pairs is also important, as some bots may not support all the pairs you are interested in.

Fees And Pricing Structures

Another crucial aspect to evaluate is the fee structure of the arbitrage trading bot. Most bots charge a combination of monthly subscription fees and a percentage of profits. Some bots may offer free trial periods or tiered pricing plans based on the volume of trades or profit generated. It is essential to understand the fee structure and compare it with other options before making a decision.

Security Measures

As arbitrage trading bots handle your cryptocurrency assets, it is crucial to ensure they implement robust security measures to protect your funds. Look for bots that utilize two-factor authentication, encryption, and other security protocols to prevent unauthorized access. Consider the reputation of the bot provider and their track record in terms of security.

User Interface And Ease Of Use

The user interface and ease of use are significant considerations when choosing an arbitrage trading bot. It should be intuitive and user-friendly, allowing you to easily monitor trades, adjust settings, and withdraw profits. Consider the level of customization and control offered by the bot.

A bot with a complex interface may require technical expertise, while a simpler interface might be more suitable for beginners. Look for bots that provide comprehensive documentation and support resources to help you navigate their features.

Exploring the Top Arbitrage Trading Bots

Pionex: Free Built-in Arbitrage Bot

Pionex is a cryptocurrency exchange that stands out for its integration of free built-in arbitrage trading bots. The platform offers a variety of arbitrage bots, including Grid Trading, Smart Trade, and Leveraged Grid Trading, allowing users to execute trades across different exchanges simultaneously. This eliminates the need for users to set up their own bots and minimizes the risk of technical errors.

Pionex: Free Built-in Arbitrage Bot

Pionex’s free built-in arbitrage bots are particularly attractive to beginners who are new to automated trading. The platform’s user-friendly interface and intuitive design simplify the process of setting up and managing arbitrage trades. Furthermore, Pionex’s comprehensive security measures ensure the safety of users’ funds.

Bitsgap: Cross-Exchange Arbitrage

Bitsgap is a multi-exchange trading platform that provides a comprehensive suite of tools for crypto traders, including arbitrage trading capabilities. Bitsgap’s arbitrage bot focuses on cross-exchange arbitrage, enabling traders to exploit price discrepancies between different exchanges. The bot automatically identifies arbitrage opportunities and executes trades to maximize profit potential.

Bitsgap: Cross-Exchange Arbitrage

Bitsgap’s platform boasts advanced features such as real-time market data, customizable trading parameters, and advanced order types. The platform also offers a user-friendly interface and comprehensive reporting tools, allowing traders to monitor their arbitrage trades and analyze their performance.

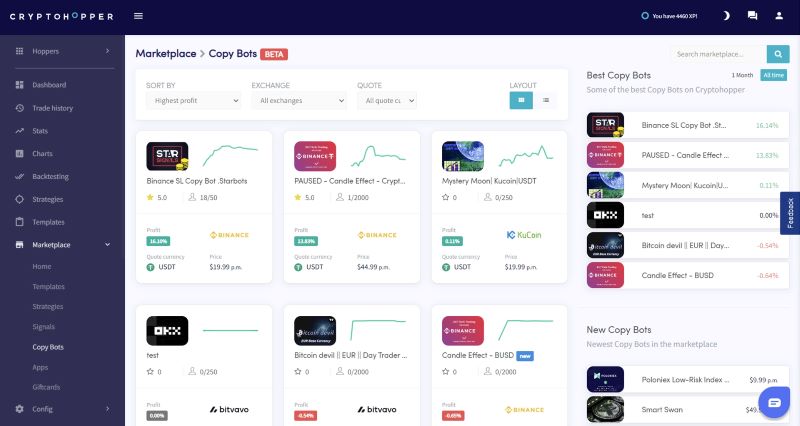

Cryptohopper: Customizable Trading Strategies

Cryptohopper is a popular automated trading platform known for its customizable trading strategies, including arbitrage trading capabilities. Cryptohopper’s arbitrage bot allows users to define their own arbitrage rules and parameters, enabling them to tailor their trading strategy to specific market conditions.

Cryptohopper: Customizable Trading Strategies

Cryptohopper’s platform offers a wide range of trading strategies, including trailing stop-loss, dollar-cost averaging, and trend following. The platform also provides a user-friendly interface, comprehensive documentation, and a dedicated community forum for support.

Trality: Code-Based Bot Creation

Trality is a platform that empowers users to create their own custom trading bots using code. The platform provides a drag-and-drop interface for visual bot creation, allowing users to create bots without writing code. However, Trality also offers a more advanced option for experienced coders, enabling them to create complex trading strategies using the platform’s Python-based coding environment.

Trality: Code-Based Bot Creation

Trality’s platform is well-suited for users who prefer a hands-on approach to trading. The platform’s code-based bot creation feature allows users to fine-tune their trading strategies to achieve their desired results. Trality also offers a dedicated community forum where users can share their code and collaborate with other traders.

Choosing the right arbitrage trading bot can significantly impact your trading success. By carefully evaluating your needs, budget, and risk tolerance, you can find a bot that empowers you to capitalize on market inefficiencies and maximize your profits.

For more insights and resources on crypto trading and arbitrage bots, visit Dynamic Crypto Network!