In recent days, the price of Solana (SOL) has surged by 5%, trading above the critical threshold of $150. This upward trajectory can be attributed to a combination of factors that highlight the underlying strength of the Solana ecosystem and the broader cryptocurrency market. Understanding Why is Solana going up involves a closer examination of several key dynamics, including the performance of memecoins, increased on-chain activity, rising revenue, and favorable market structure.

Solana’s Price Surge Driven by Meme Coin Phenomenon

One of the most compelling reasons behind the recent surge in Solana’s price is the rally of memecoins on its network. As investors flock to memecoins, often seen as speculative assets, Solana has emerged as a prominent platform for these digital currencies.

The increase in trading activity for Solana-based memecoins, such as Dogwifhat (WIF) and Bonk (BONK), has sparked renewed interest in the Solana ecosystem. These tokens have posted significant gains, often exceeding double-digit percentages, which in turn has positively influenced SOL’s market performance.

This trend is noteworthy not only for its immediate impact on price but also for its implications for network activity. The influx of traders engaging with memecoins fosters a more vibrant and active community, leading to increased transaction volumes across the Solana blockchain. Consequently, the price movement of SOL is closely tied to the speculative behavior of memecoins, amplifying its market dynamics.

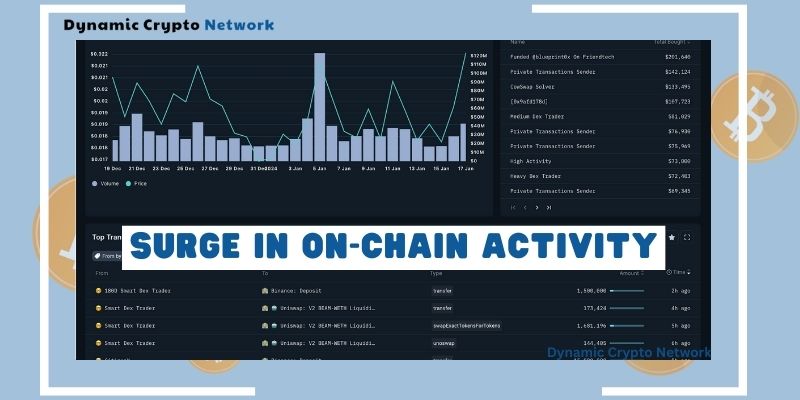

Surge in On-Chain Activity

Another pivotal factor contributing to the increase in SOL’s price is the remarkable uptick in on-chain activity. Recent data shows that daily transactions on the Solana blockchain surged from 13,351 to 19,283 within just a few days. This impressive growth in user engagement is a clear indicator of the network’s escalating popularity and utility.

Increased on-chain activity signifies that more users are interacting with the Solana platform, whether through decentralized applications (dApps), NFT transactions, or other blockchain-based services. This heightened interaction not only enhances the overall user experience but also generates additional demand for SOL tokens, driving up their value.

As the Solana network becomes a go-to platform for various applications, it solidifies its position in the competitive landscape of blockchain technologies.

Revenue Growth: A Sign of Vitality

The financial health of a blockchain network can often be gauged by its revenue streams. Solana has witnessed a dramatic increase in its daily revenue, climbing from approximately $136,330 in mid-September to about $745,570. This surge reflects the growing adoption of the Solana platform and its capacity to generate income through transaction fees and other services.

Such revenue growth is not merely a metric of financial success; it serves as a fundamental indicator of the platform’s robustness. Increased revenue suggests that the network is experiencing heightened demand for its services, further reinforcing the case for why Solana is going up. As more projects and users engage with the Solana ecosystem, the potential for sustained revenue growth remains strong.

Why is Solana going up?

Examining the technical landscape of SOL reveals a favorable market structure that suggests potential for further price appreciation. The recent price action has formed an ascending triangle pattern, a classic bullish continuation formation. Currently trading at around $152, SOL is positioned just below the triangle’s upper trendline, which sits at approximately $162.

If SOL can maintain its momentum and close above this resistance level, it may trigger a bullish breakout that could propel the price toward a target of $200. The presence of a strong buyer congestion zone between $144 and $152 provides a solid foundation for continued upward movement, indicating that market participants are confident in SOL’s trajectory.

Moreover, the Relative Strength Index (RSI) is trending upward, nearing the 70 mark, which suggests that buying pressure is dominant. This combination of technical indicators supports the notion that SOL is poised for further gains, lending credence to the question of why Solana is going up.

The Broader Crypto Market Recovery

Solana’s rise cannot be discussed in isolation; it is also reflective of a broader recovery within the cryptocurrency market. Following a challenging period marked by volatility and uncertainty, many cryptocurrencies are experiencing renewed interest from investors. This market-wide recovery has injected optimism and liquidity into the space, benefiting assets like SOL.

As confidence returns to the market, institutional and retail investors alike are seeking opportunities in promising blockchain projects. Solana, with its strong technological foundation and vibrant community, has positioned itself as an attractive option for those looking to capitalize on the next wave of crypto adoption.

In summary, the recent increase in Solana’s price can be attributed to a confluence of factors, including the rally of memecoins, heightened on-chain activity, significant revenue growth, and a favorable market structure. As the Solana ecosystem continues to thrive, it becomes increasingly clear why SOL is experiencing upward momentum.

The interplay between these elements not only underscores Solana’s potential but also highlights the broader trends within the cryptocurrency market. For investors and enthusiasts alike, the question of why Solana is going up may serve as a springboard for further exploration into the dynamic and ever-evolving world of blockchain technology. As we look ahead, Solana appears well-positioned to capitalize on its recent successes, making it a project to watch closely in the coming months.

See more information at Dynamic Crypto Network !