Delegated Proof of Stake Explained: Revolutionizing Crypto Consensus

Welcome to the world of what is delegated proof of stake in crypto, where the rules of game change and so does who calls the shots. Picture a system smarter and faster than the old guard, a way to secure our digital coins that’s as slick as it is savvy. We’re talking no delays, high speed, where you, my friend, play a bigger part than just watching from the sidelines. In the journey ahead, we dive deep into the core of Delegated Proof of Stake or DPoS, unwrap its elements, and weigh its pros against the cons. It’s a faceoff: the fresh-faced DPoS versus the old boys Proof of Work and Proof of Stake. Ready to get the lowdown on how this tech is flipping the script in crypto land? Let’s break the ice!

Understanding the Basics of Delegated Proof of Stake

What is Delegated Proof of Stake (DPoS)?

Think of DPoS as a club’s voting system, but for crypto stuff. In DPoS, people hold coins but don’t all make the big decisions themselves. Instead, they vote for a few trusted folks to do the job. These folks, the elected ones, handle the blockchain’s security and keep things running smooth. It’s not like everyone’s guessing numbers like in Bitcoin mining. It’s more like a group of chosen reps who work to keep promises and manage the blockchain.

Core Elements of the DPoS Mechanism

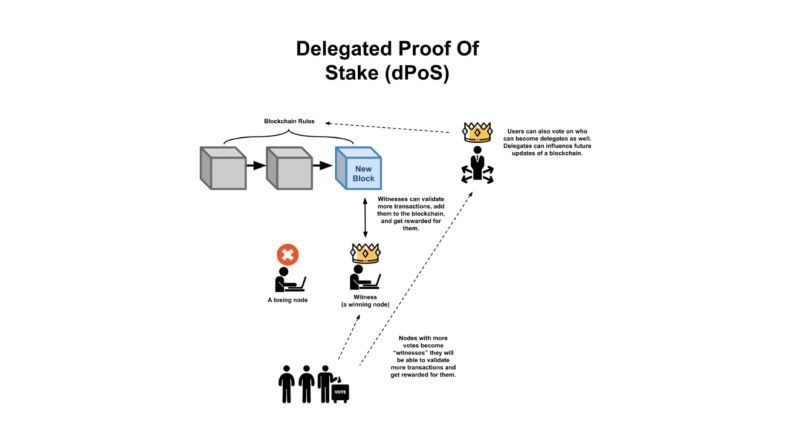

So, you now know that in DPoS, coin holders have a say on who’s in charge. But how does it really work, right? Let’s dive in. First, picture that a DPoS blockchain is like a tiny country. In this country, the citizens (that’s you and other folks with coins) vote for who they think should be in the group that makes sure everything tallies up right – these big shots are called witnesses.

Each witness gets a turn to make new blocks in the blockchain. The cool part here is that if these block makers mess up or act fishy, the people can chuck them out. It’s all about keeping trust and being open. Voters look at how each witness performs, what gear they use, and if they’re all about that blockchain life. Then they vote to pick the best ones. This setup makes it all work fast and snap – like sending a text instead of mailing a letter.

In the case with block producers, these are the busy bees making sure your crypto transactions are packaged neat into blocks. Everyone who holds coins can help pick who gets this job. It means even if you’re not super rich or a tech whiz, you still get a say. It’s democracy in action, but for your digital cash.

Now, staking in crypto, including DPoS, is a cool way you can earn more coin. You lock up some of your crypto to help the network, like putting down a security deposit. Then, you can get more crypto back as a thank you, kind of like earning interest.

DPoS shines in speed and not using much power, which is super good for our planet. Your transactions zip through fast, and you don’t need crazy amounts of electricity. It’s a win-win – speedy and green.

But not everything is perfect. Some folks worry that DPoS might lead to a few folks having too much sway, like a club where only the cool kids make all the calls. That’s something we’ve got to watch. Then there’s the whale accounts – these are the guys with heaps of coin. If they throw their weight around, they can have a big say, which can ruffle some feathers.

In the end, DPoS tries to blend the best of both worlds. It wants to be fast, easy on resources, and let everyone have their voice heard. It’s all about finding that delicate balance – keeping things fair while pushing the speed limit on how we do crypto transactions. And that, my friend, is a glimpse into the world of DPoS.

The Advantages and Challenges of DPoS Systems

Exploring DPoS Benefits: Efficiency and Speed

Delegated Proof of Stake, or DPoS, changes the game for blockchain. It’s a way to agree on what’s true in a shared ledger. Imagine a group where only some get to validate transactions. They are chosen because many trust them. This is what happens in DPoS, and it’s fast.

In DPoS, coin holders vote for block producers. These are the chosen few who get to secure the network. You can think of them like town hall leaders. They have a big job: to validate new entries in our digital ledger. If they do well, they earn rewards. If not, voters can kick them out!

Voters play a key role in this. By voting, they keep block producers in check. They don’t just watch; they act. Everyone with coins has a say. This is the beauty of DPoS. It invites people to take part and shape the network.

Now, what about speed? DPoS shines here too. It can handle more transactions in a snap. This is because fewer are making the call on what’s valid. It is different from everyone shouting at once. That’s what the old Proof of Work was like. DPoS is the cool, collected way that gets stuff done quicker.

Then there’s energy. DPoS uses less, much less. We’re not burning coal to agree on who owes what. This is a win for our planet. It means we can do our digital thing and not hurt our home.

It’s all sounding great, right? But there is another side to this coin, a sharper edge we need to handle with care.

Common DPoS Drawbacks: Risk of Centralization

So, we talk about voters and block producers. How does someone become a producer? By getting lots of votes. Here’s where things get tricky. If someone has many coins, they hold more power. They can sway things. We call them “whales”. Whales can make waves in our small pool.

What about the rest? The small fish with fewer coins? Their voice is softer, not as heard. This can lead to a few having too much say. This is centralization, and it’s not what we want. It’s a challenge DPoS faces. We got into this for a shared world, not a ruled one.

There’s also a need for trust. In DPoS, we pick leaders. Trust is key. If they fail or act badly, it can hurt us all. The safety of our coins, our trades, and deals depends on them. If trust breaks, the system shakes. It’s why voters must stay sharp and ready to act.

In DPoS, people staking also earn passive income. Yes, you can make money while sleeping! You back a block producer; they win; you win. But remember, with rewards come risks. Be sure to choose wisely.

DPoS has lots to offer: it’s sleek, it’s green, and it’s a team effort. But like any good dish, it needs the right mix. Too much power in too few hands can spoil it. We must work together. That way, we make sure this digital wonder stays fair and runs smooth.

DPoS in Practice: Governance and Stakeholder Roles

The Voting Process and Witness Selection

In the DPoS world, your vote matters. A lot. Here’s how it works. Anyone with coins can vote for block producers, also known as witnesses. These witnesses manage the blockchain. In simple terms, they make sure all transactions follow the rules. The more coins you have, the more your vote counts.

This is key in choosing who runs the show. Everyone votes on a set of witnesses to secure the network. It’s a bit like choosing a class president. Only here, the class holds your money! We want fair play. So, witnesses get swapped out regularly. This keeps things fresh and honest.

Now, let’s get real for a second. Sure, you might think, “But I only have a small stash of coins!” That’s okay. Every single vote can sway decisions in the DPoS world. Your voice matters. Wouldn’t it be grand if all systems worked like that?

How DPoS Encourages Community Involvement and Participation

DPoS aims to get folks to play a part in the community. It’s not just for tech wizards or the rich. Nope, it’s for everyone. If you stake coins, you get to help steer the ship. And you’re not just a passenger; you can help choose the captain and crew!

So, how does DPoS keep you hooked? It offers a juicy carrot: passive income from staking coins. The more you engage, the more you earn. It’s like getting a thank-you note, but better, because it’s money.

Think of it this way. A well-run ship has a happy crew and a clear course. By taking part, you can make sure the ship of DPoS sails smooth. And guess what? The community decides where it’s headed. When folks like you get involved, it helps make the blockchain fairer for all.

What’s super cool about DPoS is that it’s swift. Transactions zip through like greased lightning. Why? Because a small number of trusted witnesses handle the blockchain. It’s like having an express lane at the grocery store!

But here’s a head-scratcher—centralization. Some folks worry that DPoS could put too much power in a few hands. They fear a small group could call the shots. But don’t fret. Most DPoS setups are cleverly designed to spread power wide, keeping the network in check.

Being a part of DPoS is like joining a club where your opinion truly counts. When you vote, you’re nudging the whole blockchain in a direction you think is right. Cool, right?

Now, remember the big fish in the pond—the whale accounts? They have loads of coins, and so, loads of voting power. It’s crucial to keep an eye on them to guard the network from tipping into their favor. In a solid DPoS system, safeguards help keep these whales in check, ensuring everyone plays fair.

There you have it, my friends. DPoS is our own crypto democracy at work. It’s exciting, involving, and rewards you for being part of the club. Together, we harness the power of the blockchain and sail towards a future that’s efficient, fast, and just plain awesome!

Comparing DPoS to Other Consensus Models

DPoS vs Proof of Stake: A Detailed Analysis

What sets DPoS apart from simple Proof of Stake (PoS)? Well, DPoS uses a voting system to choose who maintains the blockchain. This makes it really different from PoS where anyone with tokens can help run things. It’s kind of like DPoS has a special club of trusted people who do most of the work.

Every coin holder gets a say in who makes it into this club. They can vote with the coins they own. More coins mean more votes. When picked, these trusted folks are called “witnesses” or “block producers”. They’re in charge of validating transactions and creating new blocks. It’s a big deal because these people keep the crypto world ticking.

And because of this picking and choosing, DPoS is super fast and efficient. It has fewer people doing the heavy lifting. This means transactions zip through without a hitch, and at a low cost, too! But on the other hand, there’s a risk that a few big players could end up with most of the control. It’s like having a few people with all the power in a game.

Understanding the Differences: DPoS vs Proof of Work

Now let’s talk about Proof of Work (PoW), the granddaddy of them all. It’s the original way to make sure everyone agrees on the transactions in a blockchain. Bitcoin uses it, and it’s all about solving tough puzzles to create new blocks, like a race where the fastest computer wins.

DPoS doesn’t need these puzzles, which makes it way less power-hungry. No more high energy bills just for making some digital money. This is huge for our planet. And no major league computers are required, so it’s not all about who has the biggest tech muscle.

But the real kicker? DPoS flies past PoW in the speed department. Transactions are done in the blink of an eye. So, while PoW is like mailing a letter, DPoS is like sending a text message—fast and easy.

Now, if you want to join in and make some passive income from DPoS, you can! Just hold onto some coins and vote for these block producers. They share some of their earnings from creating blocks. It’s like getting a thank-you note with cash inside just for helping pick the team.

So there you have it. DPoS needs less grunt from computers, saves on power, and speeds things up like crazy. And you, as just one of many coin holders, get to take part in it all.

Remember, though, no system is perfect. Every change you make to speed and efficiency could shake up how power is spread out. Is it worth it? That’s for you and the rest of the crypto community to decide. After all, your votes shape the blockchain world!

We dived into the world of Delegated Proof of Stake or DPoS, learning its nuts and bolts. It sets itself apart with a unique voting system and roles for people who own the coins. We know it’s all about speed and a smart way to confirm deals on a blockchain. Yet, it’s not perfect – risks like too much control in few hands pop up.

We also looked at how DPoS stands next to other methods like Proof of Stake and Proof of Work. While they’re all about keeping things secure and fair, they each have their twist.

So there we have it, DPoS is a cool option in the blockchain game with lots to offer, but like any player, it’s got to watch its moves, especially on the power play. It’s an exciting piece of the tech puzzle, helping folks come together to steer the ship and keep the chain on course.

Q&A :

Sure, here are the FAQ sections for the keyword “what is delegated proof of stake in crypto”:

What is Delegated Proof of Stake (DPoS) and how does it work in cryptocurrency?

Delegated Proof of Stake (DPoS) is a consensus mechanism used in blockchain networks where selected members, known as delegates, are voted into power by token holders to manage the blockchain on their behalf. This system is designed to be more efficient and scalable, allowing for faster transaction times and reduced energy consumption when compared to traditional proof-of-work (PoW) systems. In a DPoS system, token holders leverage their coin ownership as votes to elect a certain number of delegates who are responsible for validating transactions and creating new blocks.

What are the advantages of Delegated Proof of Stake in blockchain technology?

DPoS offers several advantages, including increased transaction speeds due to a smaller number of validators, energy efficiency since it doesn’t require the extensive computational work found in PoW, and potentially better governance as stakeholders have a say in who is validating transactions. Additionally, DPoS can enhance security by incentivizing delegates to perform honestly; if they don’t, they risk being voted out by token holders.

How is Delegated Proof of Stake different from Proof of Work?

Delegated Proof of Stake differs from Proof of Work in its consensus approach. In PoW, miners compete to solve complex mathematical puzzles to validate transactions and create new blocks, which requires substantial computational power and energy. In contrast, DPoS relies on elected delegates to validate transactions, which requires significantly less energy and computing resources, allowing for a more scalable and environmentally friendly network.

Can Delegated Proof of Stake be considered more sustainable than other consensus mechanisms?

Yes, DPoS can be considered more sustainable than other mechanisms like Proof of Work due to its lower energy consumption. By removing the need for energy-intensive mining activities, DPoS networks reduce their environmental footprint. The focus on voting and stakeholder engagement also provides a governance framework that may be more adaptable and sustainable in the long-term.

What are the potential risks associated with Delegated Proof of Stake?

Like all consensus mechanisms, DPoS has its potential risks. These include centralization concerns, as a small number of elected delegates hold significant power over the network. There is also the risk of collusion between delegates or the potential for a lack of engagement from token holders, which may lead to an unrepresentative group of delegates. Additionally, the security of the network is highly dependent on the integrity and performance of the chosen delegates.