**Technical Analysis of Cryptocurrency:** Unlocking Market Trends for High Profits_

With the right know-how, technical analysis of cryptocurrency can open doors to major gains. I’m here to guide you through the world of dips, highs, and the patterns that signal where the market’s headed next. Think of this place as your map to the treasure trove of crypto trading. You’ll see how candlestick patterns can almost predict the future, find out how to spot the make-or-break levels, and learn why every smart trader respects both support and resistance. So let’s dive right in, and turn those complicated charts into powerful profits!

Understanding the Fundamentals of Cryptocurrency Technical Analysis

The Role of Candlestick Patterns in Predicting Market Movements

Candlestick patterns in crypto are your secret keys. They unlock what’s next in a market. Picture a candlestick chart as a row of lights. Each light tells a story of the day’s trading. Green ones mean prices went up. Red ones tell you they went down. The length of the light or shadow shows how much the price moved. Learning these patterns guides your crypto journey.

For instance, a ‘hammer’ pattern can hint at a market rise. It looks like a hammer and appears when the price drops then bounces back up. This bounce can mean traders are pushing prices up. It’s a turn in a story. A savvy trader sees this. They think, “Ah, a change is coming.” If you spot a hammer after a price dip, it could be a sign. It could mean prices might start to rise now.

Establishing Key Support and Resistance Levels

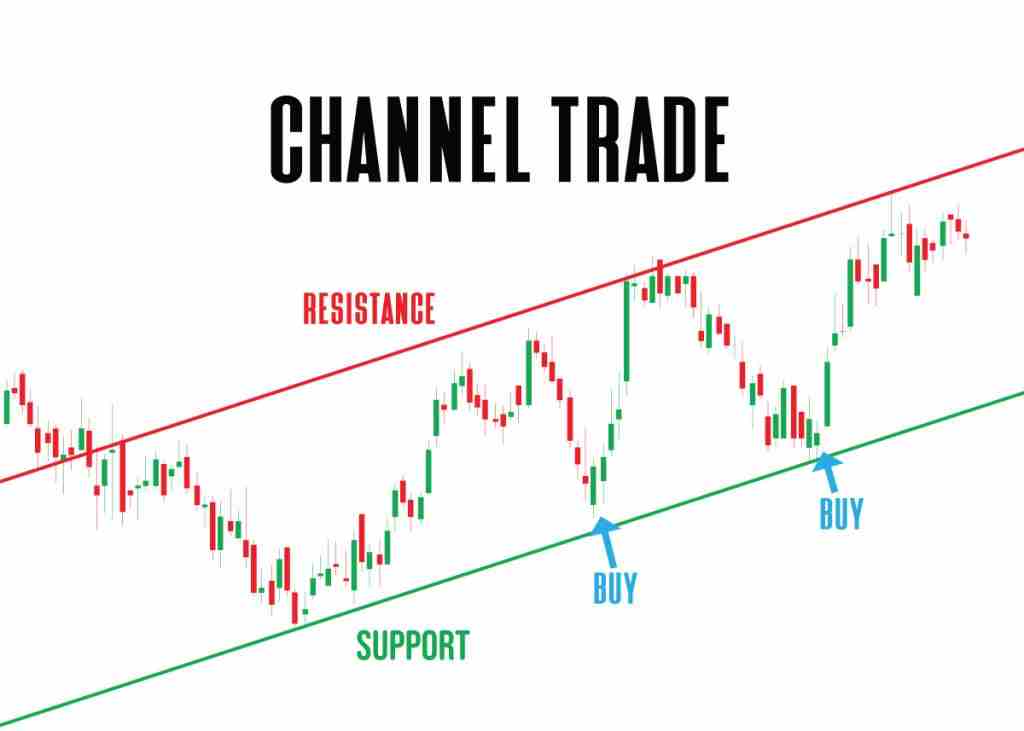

Imagine you’re in a game of tug-of-war. The ground beneath you is priced. The spots where your team keeps slipping? Those are support levels in trading. The points where you just can’t pull the other team past? Those are resistance levels. These invisible lines show you where the price struggles to break through.

Support levels are floors where the price might bounce back up. Resistance levels are ceilings the price has a hard time busting through. When you find these in a chart, you get clues. You see where prices may rise or fall again. Seeing these, you can say, “Here is where I stand firm and maybe sell or buy.”

To draw these lines, connect the dots. Look at lows and highs on your cryptocurrency chart analysis. Draw a line where the lows hit the most. Do the same for the highs. Now, you’ve got your map for the battlefield. When prices near these lines, watch out. Prices might change their path, or break through and start a new trend.

Traders keep an eye on these key tools. They help you choose when to enter or leave a trade. A price slip below support could mean it’s time to say goodbye. A push past resistance could welcome a buying spree. Think like a captain steering a ship. Support and resistance levels are your compass in stormy crypto seas.

In our market stories, candlestick patterns and levels help us decide. They help us say, “It’s time to act!” or “Wait for a better day.” This is our foundation in reading the markets. With them, we’re more ready to ride the waves and snatch profits from the sea of crypto trends.

Advanced Technical Indicators and Their Application in Crypto Trading

Utilizing RSI and Bollinger Bands for Market Sentiment Analysis

When you trade crypto, knowing the crowd’s mood helps a lot. RSI and Bollinger Bands do just that. RSI stands for Relative Strength Index. This fancy term just means how fast prices change over time. Imagine it like a heartbeat monitor for crypto. It tells you if a coin is tired from running up too much or ready to sprint after resting.

Now, if RSI goes below 30, that’s like a secret whisper saying, “Hey, this might be a bargain!” But if it shoots above 70, it’s warning you, “Careful, this might be too hot!” Simple, right? But powerful.

Bollinger Bands are like rubber bands for crypto prices. When prices stretch far from the middle line – think of it as a rest area – they tend to snap back. These bands help you spot when coins are extreme bargain hunters or flashy show-offs. If prices hug the top band, lots of people want in. If they’re near the bottom band, not so much love there.

Combine RSI and Bollinger Bands, and you’ve got a crowd mood ring for crypto. They guide you on when to join the party or sneak out the back door.

Applying Fibonacci Retracement and MACD for Precision Trading

You’ve probably heard of Fibonacci, the math whiz from way back. His numbers pop up in rabbit populations and all sorts of nature stuff. In trading, they help spot U-turns in price roads. If you draw lines at special Fibonacci points – usually around 38.2%, 50%, and 61.8% – they’re like hidden trapdoors that prices might fall back to before jumping up again. These are your “maybe I should buy” signals.

MACD is another cool tool called Moving Average Convergence Divergence. Sounds like a mouthful, but here’s the deal: it’s two moving lines racing around a track. When they cross, it’s a hint that prices might start running or getting tired. These crossings can be your “go” or “stop” signals.

Fibonacci shows you possible price pit stops, and MACD shouts “ready, set, go” or “whoa, slow down.” Together, they’re like a treasure map and a compass, helping you find the gold and then the best path to it.

Technical analysis in crypto can sound like a bunch of jargon. But once you get it, you unlock secrets in the price charts. Think of it as learning to read a map of Treasure Island. It doesn’t guarantee you’ll find the loot, but without it, you’re just wandering in the jungle. Combine RSI, Bollinger Bands, Fibonacci, and MACD, and you’re geared up for a savvy trading adventure. Keep an eye on those swings and patterns, use your tools, and you might just sail off with a pirate’s bounty.

Strategic Trade Execution in Cryptocurrency Markets

The Importance of Volume Analysis and Moving Averages

Seeing a big green bar on a crypto chart can be exciting! It means lots of people are buying. This is called volume analysis. The more people buy or sell, the more we can trust the move. Moving averages are also cool. They smooth out price data over time. It’s like looking at the average score of your favorite game. A line on the chart shows if the average price goes up or down.

Crypto moves fast, and we need to know if a trend is real. With volume, when the price jumps high and a lot of people are trading, it’s like everyone is shouting, “This is hot!” It makes us more sure that the price may keep going that way. If the price changes but no one is trading much, it could be a fake out. So, we look at volume to feel safe about our trades.

Moving averages help too. They can tell you if it’s mostly up or down. Think of it as your crypto speedometer. We can use different ones, like the simple or exponential. The simple moving average is just like its name. You add the closing prices and divide by the days. Exponential moving averages are a bit smarter. They give more power to recent prices. They’re quick to show when the trend shifts.

So, why use them? Moving averages are like a blanket for the price, showing us the trend. You can see if prices are above or below the average. Above might mean keep holding; below might tell you to sell.

Volume and moving averages are like best buddies. When we see a big price move, we check the volume to make sure it’s not lying. Then we look at the moving average to see where we stand. Together, they help us trade smarter, not harder.

Mastering the Art of Swing and Day Trading Tactics

To win in crypto trading, you need a plan. Swing trading is a cool way to catch price waves. You can hold for days or weeks. It’s less crazy than day trading but can give big wins. You need patience and you watch the market’s swing.

Day trading is the wild cousin. Buying and selling happen on the same day. You need quick thinking and a good eye on the charts. Both ways need you to stay calm and be quick.

Swing traders look at crypto trend lines. They show the price path. Touching the line several times makes it stronger. These traders also watch for candlestick patterns in crypto. They tell a story of the bulls and bears. Knowing these patterns can give swing traders the upper hand.

Day traders live for fast moves. They use crypto market indicators like RSI in crypto trading. It tells if crypto is overbought or oversold. Bollinger Bands are another cool tool. They show if the price is too high or low. Day traders need to think fast. They watch the price and these bands to jump in and out.

Risk is big in both swing and day trading. So, smart traders manage their risk. They don’t bet the farm on one trade. They size their positions right to stay in the game. They also learn from paper trading. This way, they trade with fake money to get better without losing cash.

Big tip: emotions can mess up your trading. Always stick to your plan. This keeps you from making bad trades on a bad day. It’s like not shopping when you’re hungry. You make better choices.

Together, these tactics make you a trading ninja. You’ll spot the right times to strike and step back. The crypto market waits for no one. But with these skills, you can ride the waves like a pro.

Risk Management and Psychological Aspects of Crypto Trading

Implementing Robust Risk Management Techniques

In crypto, prices can swing big and fast. This means your money is at risk. How do you protect it? Start with a rule: don’t bet the farm. Only risk cash you can lose.

Next, learn about stop losses. They can save you when the market dives. Put them just below support levels—that’s where prices tend to bounce back.

Smart folks also size their positions well. How much to buy or sell? It’s not guesswork. Use a percentage of your total funds to keep risks even.

Now, let’s talk charts. Ever seen lines zig-zagging across a crypto chart? They’re trend lines and they give clues about which way the price might head next. If you’re savvy, use them when you plan your buying and selling points.

To add more tools, consider volume analysis. It’s like a lie detector for price moves. Big volume means a strong move, while low volume may signal a weak trend.

Navigating Emotions with Trading Psychology Principles

Ever felt fear or greed when trading? They’re traders’ big enemies. But don’t worry. With some knowledge, you’ll handle them like a champ.

First up: have a plan. Before you trade, decide when you’ll get in and out. Stick to it, and don’t let a hot tip or a bad day sway you.

Remember FOMO? The fear of missing out? It’s a trap. Just because everyone’s buying doesn’t mean you should. Look at the data, not the hype.

Then, there’s hindsight. Ever kicked yourself for a missed chance? Forget it! Missed trades are just that—missed. Focus on the next opportunity instead.

Finally, keep a journal. Write down what you did and why. This helps you learn from wins and losses.

Trading crypto can be a wild ride. But with risk rules and a solid head, you can make it work for you. Always remember, the market’s tough. But with the right skills, so are you.

We dove into the deep world of crypto tech and how it helps us predict market moves. We checked out candlesticks and learned how to spot key levels that show where prices may stop or bounce. Then, we jumped into advanced tools like RSI and Bollinger Bands, digging into market vibes, and saw how smart tools like Fibonacci and MACD help us make tight, sharp trades.

Next, we explored how to make smart moves in trading by looking at volume and averages. We even tackled the tricks of quick buying and selling and how to play the long game in trading. Last up, we faced the big risks and the mind game of trading. We covered how to guard our cash and keep our heads cool when making deals.

Thinking about all this, remember that trading crypto is a mix of good tech know-how and staying steady. Use these tools and keep your mind clear to make the best calls in the crypto game. Keep learning and trading smart!

Q&A :

What is technical analysis in the context of cryptocurrency?

Technical analysis is a method used to forecast the future price movements of cryptocurrencies based on the study of past market data, primarily price and volume. It involves the use of charts, patterns, and various analytical tools to identify trading opportunities. Unlike fundamental analysis, technical analysis does not focus on a coin’s underlying value but rather on the statistical trends visible in the market.

How can you apply technical analysis to trading cryptocurrencies?

Applying technical analysis to cryptocurrency trading involves several steps. Firstly, traders choose a cryptocurrency and gather historical price and volume data. Next, they often use indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands to identify trends and potential reversals. Chart patterns like head and shoulders, triangles, or flags may also help forecast future price movements. Traders use this analysis to inform their buy or sell decisions.

What are the most common indicators in crypto technical analysis?

The most common indicators in crypto technical analysis include:

- Moving Averages (MA): Helps smooth out price data over a specified time frame and is used to identify trends.

- Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): A trend-following momentum indicator that shows the relationship between two moving averages of price.

- Bollinger Bands: Consists of a middle band being an N-period simple moving average along with upper and lower bands that are N-period standard deviations away from the middle band.

- Fibonacci Retracement: A tool used to identify potential reversal levels based on the Fibonacci sequence and golden ratio.

Are there any limitations to using technical analysis for cryptocurrencies?

Yes, there are several limitations to using technical analysis for cryptocurrencies:

- Volatility: The extreme volatility of cryptocurrencies can lead to false signals and unpredictability.

- Market Manipulation: Smaller or less liquid markets are prone to manipulation, which can skew technical analysis.

- Lack of Historical Data: Some cryptocurrencies are relatively new and have limited historical data, which may reduce the effectiveness of certain analysis tools.

- Self-Fulfilling Prophecy: Popular patterns and indicators can sometimes lead to trader behavior that reinforces these patterns, rather than truly indicating market direction.

Can technical analysis alone be sufficient for successful cryptocurrency trading?

While technical analysis can be a powerful tool for traders, relying solely on it may not be sufficient for successful cryptocurrency trading. Combining technical analysis with fundamental analysis, which evaluates the intrinsic value of a cryptocurrency, provides a more rounded approach. Additionally, traders should consider market sentiment, news, and broader economic factors that can influence cryptocurrency prices. Risk management and emotional discipline are also crucial for maintaining a successful trading strategy.