How to choose a secure crypto wallet for beginners? That’s the puzzle we’re cracking today. If you’re tired of technical talks that sound like alien code, fret not. We’ll get you set up with a wallet that’s like a vault for your digital dollars—and it’s easier than you think. Think of this as your shield in the wild west of the web, an armor you need to tackle crypto head-on. Ready to be the smart new kid on the blockchain? Let’s dive in to keep your coins safe and your mind at ease.

How to Choose a Secure Crypto Wallet: Understanding the Basics of Crypto Wallets

Hot Storage Wallets vs. Cold Storage Wallets

Choosing a crypto wallet is like picking a safe for your digital money. Crypto wallets come in many types, but the main ones you’ll hear about are hot wallets and cold wallets. Hot wallets connect to the internet; they’re great for easy access to your coins. Cold wallets stay offline, which makes them super safe from online attacks.

For everyday spending, a hot wallet works well. It’s like the cash in your pocket; easy to use, but you wouldn’t carry your life savings there. Cold wallets are like bank vaults. Harder to get into, but super secure. They’re best for storing big amounts of crypto you don’t need to move often.

Public vs. Private Keys: The Foundation of Your Crypto Security

Keys are a big deal in crypto. They’re not like the keys in your pocket, though. Public keys are like your crypto address, letting folks send you coins. Anyone can see it, but that’s fine! It’s just where your crypto mails get sent.

Now, private keys are secret. They’re like the password to your safe. They prove you own your coins and let you spend them. Never share these. Lose them, and you’re locked out of your wallet, with no way back in. That’s why you write down your seed phrase and keep it safe. It’s the rescue map to your coins if your private key is lost.

Remember, even as a newbie, it’s all about keeping it simple. Hot wallets for spending, cold wallets for saving, and your keys are your power. With these basics, you’re on your way to making smart, secure choices in the crypto world.

Evaluating Security Features in Crypto Wallets

The Crucial Role of Multi-Factor Authentication

When you pick a crypto wallet, safety comes first. Think of it like a bank account. You wouldn’t want others to get in easily, right? This is where multi-factor authentication (MFA) steps in. MFA is a must for protecting your coins. It’s like having a secret handshake and a password. Even if someone knows one, they need both to get in.

So, how does it work? MFA uses at least two proofs before letting you in. These could be something you know, like a PIN code. Or, something you have, like your phone. Sometimes, it’s even something you are, like your fingerprint. Having these steps makes a hacker’s job tough. It’s one of the best ways to keep your coins secure.

To use MFA, set it up in your wallet’s security settings. Always choose all the proofs it offers. It means more steps to log in. Yet, it’s a small task for a big boost in safety.

Importance and Management of Seed Phrases

Next, let’s talk about seed phrases. They’re a string of words given when you set up a wallet. Think of them as the master key for your wallet. If you lose your wallet, these words are your one shot to get back in.

Keep your seed phrase hidden and safe. It’s best to write it down on paper. Don’t just save it on your computer or phone. These can get hacked or break. Once written, store it somewhere safe. A lockbox is a good spot.

Never share your seed phrase. Not with friends, not online, not ever. If someone else gets it, they can steal all your coins in a snap. It’s as if you gave them the code to your house. And just like a house code, you can’t change your seed phrase. So, it’s crucial to protect it from the start.

In a nutshell, your wallet’s security hedges on strong MFA and a safe seed phrase. Staying on top of these can keep your digital treasure locked away from thieves. Ready to learn more? Follow these digital currency storage tips, and you’re on a solid path to keeping your crypto safe and sound.

Always remember, taking time to secure your crypto now can save you a lot of trouble later. So, go ahead, set those layers of security up. Be the gatekeeper of your digital castle.

Deciding Between Wallet Types for Optimum Security

Hardware Wallet Benefits and Software Wallet Safety

When choosing a crypto wallet, safety comes first. Let’s break down wallet types. Imagine a wallet as your digital bank. You keep crypto safe just like money in a bank. Now, hardware wallets are like safes in your home. They keep your crypto offline, away from hackers. Brands like Ledger or Trezor offer these kinds of wallets. They’re great for holding crypto you don’t need to move often.

Software wallets live on your computer or phone. They’re good because you can get to your coins fast. Perfect for the crypto you use a lot. But, since they’re online, you need strong passwords and always think about how you connect to the internet. Banks have vaults for a reason; always keep most of your money tucked away safe.

The Significance of Custodial vs. Non-Custodial Wallets

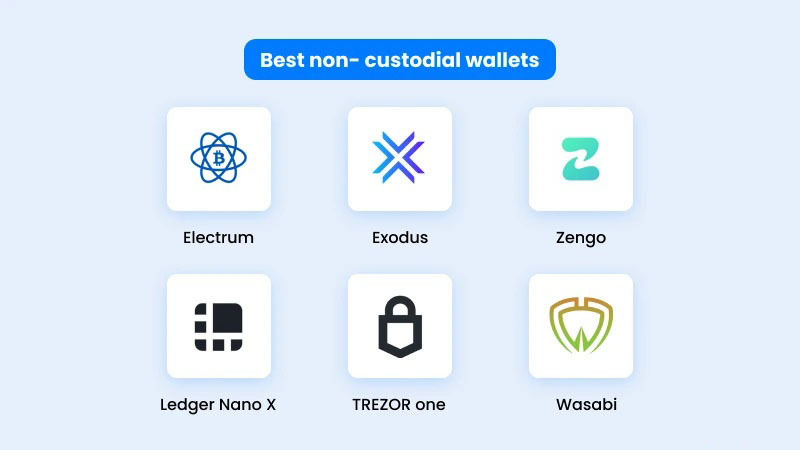

Now, let’s talk about who has the keys to your wallet. In crypto, if you don’t own your keys, it’s not really your money. Custodial wallets are like storing your cash at a friend’s house. You trust them to keep it safe. Exchanges like Coinbase offer this. Easy to use, but they hold the keys, not you.

Non-custodial wallets are when you’re in full control. You’re the boss, and only you have the keys. This means you also have to take care of the safety, like a true boss. This is where you understand the power of the secret codes, your seed phrase, and private keys.

Remember, no one size fits all. Think about what you’ll do with your crypto and pick a wallet that fits that plan. Whether it’s a hardware wallet or a software one, make sure it has what you need. Look out for stuff like backup solutions in case things go wrong. Check for updates to the wallet software. This keeps you ahead of the bad guys.

Finding the right wallet doesn’t have to be tough. Start with what you need and how much safety you want. From there, it’s all about taking charge of your own crypto security. Keep learning more and stay ahead in this new world of digital money!

Best Practices and Maintenance for Wallet Security

Regular Backups and Recovery Processes

Keeping your crypto safe means backing it up often. Just like you save game points before the big boss fight, you need to save your crypto details too. Imagine having your own safety net under a tightrope; that’s what backups are for your digital cash. It’s key to have a few copies of your backup, in different spots.

Make sure your backups are in places that only you can get to. Places like a locked drawer or a personal safe work great. It’s not just about having backups but being able to get back in if you lose your keys. Think of it like keeping spare keys for your treasure chest.

Set up a recovery process. It’s a plan for how to get back into your wallet if things go wrong. Follow all the steps your wallet gives you to make this plan. It’s your map to finding lost treasure if you ever need it.

Avoiding Phishing Attacks and the Importance of Regular Updates

Watch out for the baddies trying to steal your crypto with fake messages or emails. These scams try to trick you into giving away your secrets. They are called phishing attacks. Think of it as someone fishing for your wallet keys using bait. Don’t take the bait!

Always check emails and messages carefully. If something looks off, it probably is. Don’t click on weird links or give away your secret keys. Your keys open your crypto wallet, so keep them safe.

Another way to guard your coins is by keeping your wallet software fresh. Updates to your wallet are like new armor for a knight. They keep your wallet tough against attacks.

How to Choose a Secure Crypto Wallet

Every so often, your wallet will need to update. Doing this keeps your digital money locked down tight. It’s like adding a stronger lock to your door.

So remember, back up your stuff, keep your recovery plan ready, and stay sharp about scams. Keep your wallet updated to build a strong fort around your crypto. That’s smart, and that’s how you keep your digital coins safe and sound.

We’ve dug deep into the world of crypto wallets. From hot and cold storage to the must-knows of public and private keys, we covered it all. Multi-factor authentication isn’t just a buzzword; it’s a shield for your crypto coins. Seed phrases? They’re the secret keys to your digital vault.

Deciding on a wallet is more than just picking a brand. It’s about safety. Hardware wallets offer tough security while software wallets are user-friendly. Remember, choosing between custodial and non-custodial wallets affects who controls your keys and your coins.

Finally, keeping your wallet safe is not a one-time deal. Back it up, update it, and stay sharp to dodge those phishing hooks. Your crypto’s safety relies on these habits.

Stay secure, and your digital treasure will thank you. Your coins deserve the best guard – and that’s you. Keep it tight, keep it right, and crypto peace of mind will follow. Stay safe out there! Follow Dynamic Cryto network to update more knowledge about Crypto.

Q&A :

What Features Should Beginners Look for in a Secure Crypto Wallet?

When starting out, choosing a secure crypto wallet comes down to a few key features: Security measures like two-factor authentication, multi-signature support, and hardware wallet options are vital. Look for wallets that have a strong track record and positive reviews regarding their security. Usability also matters, so consider wallets with a beginner-friendly interface.

How Do You Determine the Safety of a Crypto Wallet?

Evaluate the safety of a crypto wallet by researching the wallet’s development history, community and expert reviews, and any past security incidents. Additionally, check whether the wallet is open-source, which can provide greater transparency and security auditing by the community.

Are Hardware Wallets Safer for Beginners Than Software Wallets?

Hardware wallets are generally considered safer than software wallets as they store private keys offline, making them immune to online hacking attempts. For beginners, the trade-off is between convenience and security. While hardware wallets provide a higher level of security, they might be less intuitive than software wallets.

What Is the Importance of Private Key Management for Crypto Wallet Security?

Private key management is crucial because it grants full access to your cryptocurrencies. Secure crypto wallets ensure your private keys are encrypted and remain under your control. Beginners should look for wallets that offer a straightforward way to back up and restore their keys while maintaining strong encryption.

Can Beginners Rely on Mobile Crypto Wallets for Security?

Mobile crypto wallets can be reliable and convenient for beginners, but the level of security varies widely. Opt for mobile wallets that emphasize security features, such as requiring a PIN or biometric verification for access, and offer backup and recovery options. Always download wallets from official sources to avoid fraudulent applications.