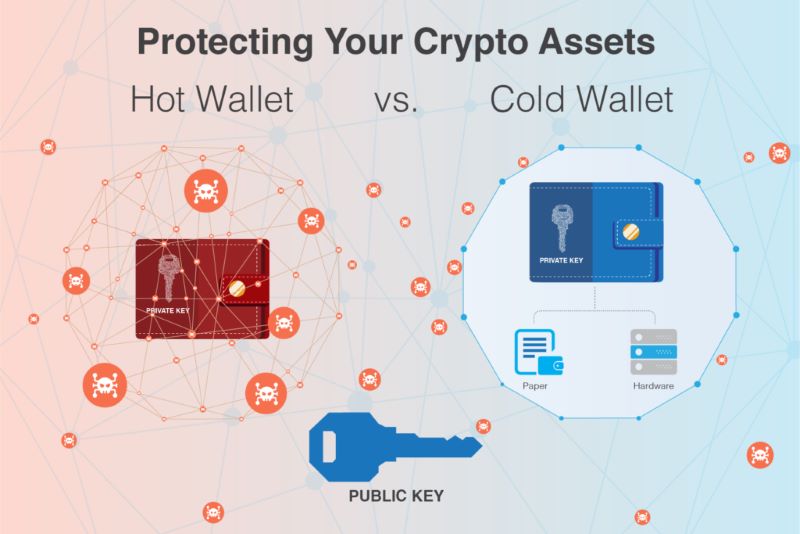

In the world of cryptocurrency, choosing between a hot wallet and cold wallet can define the fate of your digital treasure. As sure as coins stack and markets swing, the place where you stash your crypto matters. Imagine hot wallets as your everyday wallet, always within reach for that quick coffee or online deal, but also catching the eye of crafty pickpockets. Cold wallets, by contrast, are like a safe buried under your house, not as handy for daily spends but a fortress against nefarious netizens. As you journey through this conundrum, you’ll uncover how each wallet plays its part in your crypto realm – from the sleekness of hot online stashes to the bunker-level security of cold storage. Sit tight as we break down their strengths, vulnerabilities, and help you lock down your coins with wisdom.

Understanding Hot Wallets: The Digital Gateway to Cryptocurrency

The Pros and Cons of Hot Storage Crypto Solutions

Hot wallets are like your everyday wallet. They’re online tools that let you use your cryptocurrency fast. They’re linked to the internet, which makes them easy to use but also brings some risks. For example, they’re more open to hackers since they’re online. But they’re great for trading and spending crypto on the move.

Implementing Security Measures in Online Crypto Storage

To keep your hot wallet safe, you need good security. Things like two-factor authentication, strong passwords, and keeping your software up to date matter a lot. These steps put up barriers against hackers trying to get in. It’s also smart to not keep too much crypto in your hot wallet. Think of it like you wouldn’t walk around with all your cash in your pocket.

Exploring Cold Wallets: The Fort Knox of Crypto Assets

Offline Crypto Storage: How It Works and Its Advantages

Think of an offline crypto storage, also known as a cold wallet, like your piggy bank. It holds your digital coins away from the web. Here’s the deal: it’s like a safe that no hacker can touch because it’s not hooked up to the internet. By keeping your crypto offline, you cut the cord that thieves often use to snatch digital funds. Sound good? You bet! Cold wallets are the go-to for anyone serious about keeping their crypto safe. They are the muscle in the digital wallet security game.

What makes them shine? Offline wallets keep your private keys — that’s your crypto’s secret code — out of reach from online bandits. For folks with a hefty chunk of digital cash or aiming to hold on to their crypto for the long haul, cold storage is a smart move. It’s security with a capital “S” for your digital buck.

Now, don’t think that a cold wallet will make spending your coins hard. You can transfer crypto from your cold wallet to a hot wallet when you’re ready to trade or spend. Easy, right? Just remember, safety first — don’t move more crypto than you need to.

The Different Faces of Cold Storage: From USB Wallets to Paper Wallets

Let’s talk gear. There are a few types of cold storage to choose from. USB crypto wallets look like regular flash drives but they are much smarter. They hold your crypto secure until you decide it’s spending time. Plug it into a computer, and boom, you’re in business.

Paper wallet creation is another route. It’s like a high-value secret note. You print your private keys on a piece of paper and stash it somewhere safe, like a locked box or a safe deposit.

Consider the pros and cons. Paper wallets cost almost nothing but can be a headache to use. USB crypto wallets cost more, but they’re easier to use for trading back and forth. And there are even fancy hardware wallets that look like little gadgets. They’re the cool kids on the cold wallet block.

Backup is vital, no matter what you choose. If you lose access to your cold storage, wave goodbye to your crypto. So, always keep a secure copy of your private keys, be it on paper or stored on a backup USB in a separate location.

Bottom line – cold wallets are the guardians of your crypto kingdom. They offer pockets of peace in a world full of digital pickpockets. They’re not just for tech gurus; they’re for anyone who values their crypto safety. Taking the time to set one up could be the best move you make for your future self. And rest assured, when it comes to the cold wallet cost implications, what you get in security far outweighs the price. Ready to take control and keep your digital treasure in a Fort Knox of your own? Cold wallets are your key.

Comparing Hot Wallets and Cold Wallets: What You Need to Know

Crypto Wallet Comparison: Security, Accessibility, and Convenience

When you pick a wallet to hold your precious crypto, you’re choosing between safety and ease. Hot wallets connect to the internet. This means they are easy to use. But, connecting to the web comes with risks. Hackers are out there, and they want your coins.

What about cold wallets? They are offline. This makes them super safe from online threats. No net means no easy way in for thieves. But, because they’re offline, they’re not as easy to use on the go. To move your crypto out, you need to plug in or sync up first.

Hot wallets sparkle with convenience. You can trade, shop, and handle coins with a click. They fit right in your phone or computer. But it’s a trade-off – are they secure enough? The key is in the words “online crypto storage.” Online risks are everywhere.

Cold wallets, then, are the best for security. Think of them as your safe box, far from prying eyes. They are like USB drives or even paper with details written down. They’re great for saving coins long term. They are kind of old-school, but they work.

From Mobile Wallets to Hardware: Choosing Your Crypto Storage Wisely

What’s your crypto lifestyle? Always trading or setting aside for the future? Your answer matters here. Mobile wallets are perfect for active traders. You can pay for a coffee or swap coins with friends. It’s all about having your crypto by your side.

Hardware wallets keep your digital cash locked up when not using them. They are gadgets like USB drives. These hold the keys to your coins offline. And they’re neat for sure. With them, losing your coins is harder. But, every time you want to use your crypto, it’s a process. You need to plug in, transfer, and confirm.

How do you set these wallets up? It’s not rocket science, but you must be careful. For hot wallets, download an app or visit a website. Make sure it’s a legit one. Then, dive into the world of wallet encryption methods. This is how you keep your wallet private keys safe.

For cold wallets? Choose a trusted brand first. Some look like fancy USB drives. Got a paper wallet? You print or write down your keys. Just don’t forget where you put it!

To wrap this up, ask yourself this. How much risk can you take? And how often will you need to reach your crypto? Knowing this will guide you through the types of cryptocurrency storage. Then, securing your investments is just a matter of sticking to some smart moves.

Remember, there’s no perfect pick. It’s about finding the right balance for you. It’s trading off between hot wallet convenience and cold wallet safety. It’s a choice, and it’s yours to make.

Best Practices for Protecting Your Digital Currency Investments

Strengthening Wallet Encryption and Private Key Management

You must keep crypto safe, right? Digital wallet security is key. Wallet encryption methods help. They lock away your funds like a treasure chest. So, what’s a wallet private key? It’s like a super-secret password. Only you should have it. It opens your wallet. So never share it! To keep keys safe, write them down. Store them like rare diamonds. Deal with trusted wallet providers too. They have strong vault doors to your digital coins.

Let’s talk about making copies. Just like you keep photos safe, back up keys too. Paper views make it real but handle it like a fragile egg. Some folks go for USB crypto wallets. It’s about what feels right for you.

Learn setting up a crypto wallet? It’s like learning to ride a bike. Follow instructions. You’ll be zooming safe in no time. Always double-check all steps. Mistakes here can hurt.

The Importance of Two-Factor Authentication and Trusted Wallet Providers

What’s two-factor authentication (2FA) for wallets? Think of it as a double lock. Your wallet needs two keys instead of one. It’s a must-have. It keeps sneaky hackers away. Use it whenever you can.

And guess what? Even kids know not to take candy from strangers. Same with wallets. Only go for trusted wallet providers. They’re the good guys, keeping your coins snug. They have these thick digital walls. Hackers have a tough time breaking in.

When choosing a wallet, think of your day. Need quick access to your coins? Then hot wallet applications may be your jam. Like having a wallet for cash. But, if you’re saving up, say for a cool bike, you might want a cold wallet. They’re like secret hideouts. Harder to reach, but very safe.

Some say mobile wallet vs hardware wallet. Which wins? The mobile wallet is handy but think about this: phones can get lost. Hardware wallets are sturdy little things. Tough and secure. But they can cost more.

Remember a goal without a plan is just a wish. Secure your crypto like your future depends on it. Plan, pick the right tools and keep it locked tight. And hey, stay smart up there. The crypto world is wild but you’ve got this!

We’ve dug deep into the world of crypto wallets in this post. Hot wallets are easy to use but come with risks. Cold wallets are safer, like a strong safe for your digital cash. We’ve looked at how they work and their different types.

When picking a wallet, think about safety and how easy it is to use. Always go for strong passwords and extra security like two-factor authentication. Remember to choose a wallet from a trusted source.

In the end, protecting your digital money is key. Be smart and pick the right wallet. Stay safe out there!

Q&A :

What is the difference between a hot wallet and a cold wallet?

Hot wallets are digital currency wallets that are connected to the internet, making them more convenient for daily transactions and trades. They are software-based and can be accessed through computers or mobile devices. Cold wallets, on the other hand, are digital currency storage solutions that are not connected to the internet, which significantly increases security against online thefts and hacks. Cold wallets are typically hardware devices or paper wallets.

How secure are cold wallets compared to hot wallets?

Cold wallets are generally considered to be the most secure form of digital currency storage due to their offline nature, which minimizes the risk of unauthorized access, cyber hacks, and other online vulnerabilities. Hot wallets are less secure than cold wallets because they are constantly connected to the internet; however, they are encrypted and can provide a level of security suitable for smaller amounts of digital currency intended for regular use.

Can I transfer cryptocurrency from a hot wallet to a cold wallet?

Yes, transferring cryptocurrency from a hot wallet to a cold wallet is a common practice for those looking to secure their assets. The process usually involves generating a transaction from the hot wallet addressed to the public key of the cold wallet. Once the transaction is confirmed on the blockchain, the funds will be securely stored in the cold wallet.

What are the advantages of using a hot wallet for cryptocurrencies?

Using a hot wallet offers several advantages, including easy access to funds for quick transactions and trades, user-friendly interfaces, and the ability to manage multiple types of cryptocurrencies in one place. Hot wallets are ideal for those who perform frequent transactions and require immediate access to their digital assets.

Should I use a hot wallet or a cold wallet for storing a large amount of crypto?

For storing large amounts of cryptocurrency, a cold wallet is generally recommended due to its enhanced security features. Cold wallets keep your private keys offline, safe from online attacks. However, for added flexibility, it’s common to use a combination of both: storing the majority of funds in a cold wallet for security and a smaller amount in a hot wallet for convenience and accessibility.