The crypto market is notoriously volatile, driven by a relentless 24/7 news cycle where information overload is common. For investors and enthusiasts, navigating these crypto market news updates is critical. This guide provides a clear framework to help you distinguish meaningful signals from market noise, enabling you to make more strategic and informed decisions in the ever-evolving world of digital assets.

Why following crypto market news is essential

In the fast-paced world of digital assets, staying informed is not an advantage; it is a necessity. The crypto market operates 24/7, influenced by a constant stream of information that can trigger significant price swings in minutes. Understanding crypto market news updates is fundamental to navigating volatility, managing risk, and identifying potential opportunities before they become mainstream. It allows you to move beyond speculation and build a strategy based on tangible developments and evolving market sentiment.

- Risk Management: Timely news helps you anticipate market downturns caused by regulatory crackdowns or security breaches.

- Opportunity Identification: Being aware of a project’s new partnership or a technological breakthrough can signal a growth opportunity.

- Informed Decisions: A clear view of the market landscape prevents emotional decisions driven by hype or fear.

Ultimately, a disciplined approach to consuming news separates a reactive amateur from a proactive, strategic investor. It transforms participation from a gamble into a calculated strategy, empowering you to act with confidence using a sound cryptocurrency analysis method in the digital asset space.

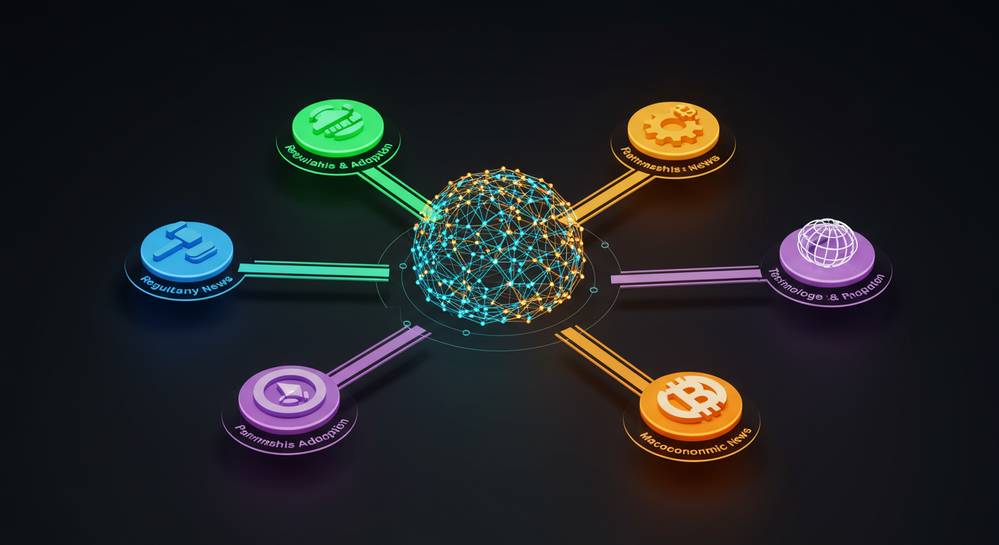

Key types of news that move the crypto market

Not all information is created equal. To effectively interpret the market, you must learn to categorize crypto market news updates and understand their potential impact. Certain types of news consistently act as major catalysts for price movement, affecting specific assets or the entire market.

Regulatory and governmental actions

Announcements from government bodies like the SEC can have a profound impact. News related to ETF approvals, tax policies, or outright bans often leads to massive rallies or sharp declines. These updates shape the long-term viability and mainstream adoption of cryptocurrencies.

Technological updates and project milestones

The core value of many crypto assets lies in their technology. News about a major network upgrade or a significant partnership can boost investor confidence. These developments signal growing real-world utility and often drive positive price action for the project.

Macroeconomic factors and market sentiment

Cryptocurrencies do not exist in a vacuum. They are increasingly correlated with traditional financial markets. News on inflation rates or interest rate decisions can influence investor appetite for riskier assets like crypto, affecting capital flow into the market.

Where to find credible sources for crypto news

The sheer volume of information can be overwhelming. The key is to focus on sources known for accuracy, objectivity, and in-depth reporting. Building a curated list of reliable outlets is a critical step in filtering out noise from valuable crypto market news updates. This practice helps you avoid misinformation and make sound decisions based on trustworthy data.

- Established Crypto News Outlets: Prioritize platforms with a history of journalistic integrity. They have dedicated teams providing timely reporting on the crypto industry.

- Financial News Giants: Mainstream financial sources often provide a macro-level perspective. Their analysis connects crypto events to the broader global economy.

- Direct-from-Source Information: Follow the official blogs and communication channels of projects you are invested in. This provides direct information without third-party interpretation.

- Data Aggregators: These platforms offer deep insights into market health and trends, highlighting undefined.

Avoid relying solely on social media influencers or anonymous accounts for your primary news, as they can be prone to significant bias.

How to analyze market news like a professional

Accessing news is only half the battle. The real skill lies in analyzing crypto market news updates to make informed decisions. Professionals do not just read headlines; they dig deeper to understand the context, sentiment, and potential chain of events. This involves a critical and methodical approach to separate signal from noise, turning information into a strategic advantage.

Look beyond the headline

Always read the full article. Headlines are designed to grab attention and may not tell the whole story. Determine if the news is based on a confirmed source or a rumor. A partnership announcement, for example, has a different impact depending on the scale and commitment of the companies involved. Assess the true significance of the information.

Assess the market sentiment

Observe how the market reacts in the hours after major news breaks. Sometimes, positive news results in a price drop if it was already priced in, a phenomenon known as “buy the rumor, sell the news”. Tools that measure market sentiment can provide a general snapshot, but watching price action offers direct feedback on how traders are interpreting the event.

Connect the dots

Consider the second-order effects of any news. If a major economy announces a friendly regulatory framework, how might that influence other countries to follow? If a major blockchain has a successful upgrade, which projects built on it stand to benefit the most? Thinking strategically about these ripple effects is what creates a true informational edge.

Staying ahead in the crypto market requires more than just luck. It demands a structured process for gathering, understanding, and acting on information. By focusing on credible sources, recognizing key news categories, and analyzing events critically, you can turn market noise into a strategic advantage. For continuous insights and expert analysis, make Dynamic Crypto Network your trusted partner in the world of digital assets.