Copy trade crypto allows investors to mirror the strategies of expert traders, making it easier for beginners to enter the market. In 2024, platforms like Margex, Kraken, and Binance offer powerful tools for those looking to grow their portfolios through automated trading. Discover the top platforms and how copy trading works in this guide.

What is Crypto Copy Trading?

Crypto copy trading is a revolutionary approach to investing in the cryptocurrency market that empowers individuals of all experience levels to participate in the exciting world of digital assets.

At its core, copy trading allows you to automatically mirror the trades of experienced and successful traders, essentially riding their coattails to potentially profitable outcomes. Imagine having a seasoned financial expert guide your investments, making all the crucial decisions for you, while you sit back and watch your portfolio grow.

This is the essence of copy trading, a concept that has gained immense traction in recent years, making it accessible to a wider range of investors.

How does Crypto Copy Trading work?

Choosing a Platform and Selecting a Trader

The first step in your copy trading journey is choosing a reputable platform. Various platforms offer distinct features, fees, and trader profiles. Researching and comparing platforms is crucial to finding one that aligns with your investment goals and risk tolerance.

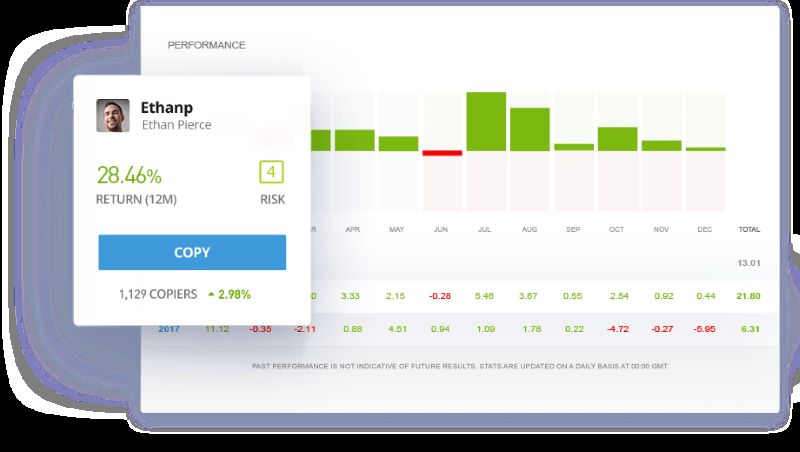

Once you’ve settled on a platform, you can explore the profiles of available traders, examining their past performance, trading strategies, and risk profiles. This selection process is crucial as it determines the success of your copy trading experience.

Risk Management and Portfolio Allocation

While copy trading offers a convenient and accessible path to crypto investment, it’s essential to remember that no investment is without risk. It’s crucial to understand the risks associated with copy trading and implement proper risk management strategies.

This involves setting realistic profit expectations, diversifying your portfolio, and, most importantly, never investing more than you can afford to lose. Additionally, allocating specific portions of your portfolio to various traders and strategies can further mitigate risks and maximize returns.

Monitoring Performance and Making Adjustments

Copy trading isn’t a set-and-forget approach. Regular monitoring of your portfolio and the performance of the traders you’re copying is essential. This allows you to track progress, identify trends, and make informed decisions about your investment strategy.

If a trader’s performance starts to decline, you have the flexibility to switch to a different trader or adjust your investment allocation. This proactive approach ensures you remain in control of your portfolio and adapt to the ever-changing crypto market dynamics.

Pros and Cons of Crypto Copy Trading

Advantages of Copy Trading

Copy trading offers several compelling advantages for both novice and experienced investors. Its primary benefit lies in its accessibility, allowing individuals with limited time or technical expertise to enter the world of cryptocurrency trading.

Copy trading empowers you to leverage the expertise of seasoned traders, potentially generating returns while learning the ropes of the market.

Additionally, copy trading simplifies portfolio diversification, enabling you to invest in a wide range of cryptocurrencies without the burden of individual research and analysis. This diversified approach reduces risk and potentially enhances returns.

Risks and Drawbacks: Lack of Control, Potential for Losses, and Choosing the Right Trader

While copy trading holds significant potential, it’s essential to acknowledge its drawbacks. The most prominent concern is the loss of control over your investments. You relinquish direct control over your trades to the chosen trader, relying entirely on their decisions and expertise.

This lack of control can be unsettling for some investors who prefer a hands-on approach. Furthermore, despite the guidance of experienced traders, the cryptocurrency market remains volatile, and losses are always a possibility.

Choosing the right trader, evaluating their track record, and understanding their trading strategies are crucial to mitigating these risks.

Crypto Copy Trading vs. Crypto Social Trading

Differentiating Between Copy Trading and Social Trading Platforms

Crypto copy trading and crypto social trading are often used interchangeably, but they represent distinct approaches to investing. Both involve communities of traders sharing insights and strategies, but their execution differs significantly.

While copy trading involves automated replication of trades, social trading typically involves observing and learning from other traders’ strategies, making decisions based on your own research and analysis. Social trading platforms provide a platform for discussion, sharing ideas, and learning from the collective wisdom of the community.

Choosing the Right Approach for Your Investment Strategy

The choice between copy trading and social trading depends heavily on your investment goals and comfort level. If you’re seeking a hands-off approach, leveraging the expertise of seasoned traders, copy trading is an excellent option.

However, if you prefer a more active approach, involving research, analysis, and independent decision-making, social trading provides a platform for learning, engaging with the community, and refining your investment strategy.

9 Best Crypto Copy Trading Platforms

Margex

Margex is recognized as the overall best copy trading platform for 2024. It stands out with its user-friendly interface and risk management tools, suitable for both novice and seasoned traders.

The platform offers up to 100x leverage with a transparent fee structure, and it is known for its advanced security features that protect users against price manipulation and system abuse.

Kraken

Kraken is celebrated for its unbroken security record since launch. The platform places a strong emphasis on security, having never been hacked. It’s a regulated platform, compliant with global financial regulations, offering a variety of cryptocurrencies for trading, alongside excellent customer support.

eToro

eToro is a leading platform for social trading and offers powerful CopyTrader tools. Its key feature is allowing users to follow and copy top-performing traders in real-time. eToro is widely known for its social trading network, where traders can interact, share strategies, and engage in market discussions, making it an ideal choice for those who want to learn from others while trading.

PrimeXBT

PrimeXBT allows users to build diversified copy trading portfolios. The platform supports trading across various assets, including cryptocurrencies, forex, and commodities, giving users the flexibility to diversify. PrimeXBT also offers customizable risk management features and competitive fees for high-volume traders.

OKX

OKX provides a great option for copy trading crypto futures. The platform is renowned for its futures and perpetual contracts, offering high liquidity and competitive trading fees. With its robust copy trading infrastructure, OKX enables users to follow experienced futures traders and benefit from their strategies.

Bybit

Bybit is a leading derivatives platform with high leverage limits. It’s particularly known for offering leverage as high as 100x on Bitcoin and other major cryptocurrencies. Bybit’s copy trading feature allows users to mirror top traders in the derivatives market, making it a strong option for those looking for high-risk, high-reward opportunities.

Binance

Binance is the largest copy trading platform in terms of daily volume and liquidity. Known for its vast array of cryptocurrency offerings, Binance’s copy trading feature benefits from high liquidity, ensuring fast execution of trades. The platform also offers a broad selection of tools and educational resources for traders at all levels.

Gate.io

Gate.io allows users to copy automated bot strategies for 24/7 crypto exposure. The platform’s key feature is its automated bot trading, enabling users to set strategies and execute trades around the clock. Gate.io supports a wide range of cryptocurrencies and is known for its flexibility in catering to both manual and algorithmic traders.

Gate.io trading bot

MEVX trading bot

MEVX is a standout platform in the crypto copy trading space, offering advanced features for users to replicate the trades of successful investors.

With MEVX, users can effortlessly follow and mirror the strategies of experienced traders, even without in-depth market knowledge. The platform provides robust analytical tools, detailed reports, and high-level security features to safeguard user assets. MEVX is an ideal choice for those looking to invest efficiently without needing to constantly monitor the market.

Stay updated with expert insights, platform reviews, and the latest trends by following Dynamic Crypto Network.