Ready to dig into the digital currency boom? As your go-to expert, I'll guide you through the thrill of **cryptocurrency market analysis**. Our dive starts with the current layout of digital money. We'll look at how these digital coins are doing and what's cooking on the blockchain. Next, I'll share hot trends and secrets from the lesser-known altcoin scene. Let's conquer this together and make sense of the crypto craze.

Understanding the Current Landscape of Digital Currencies

Analyzing Crypto Asset Performance and Blockchain Valuations

To get it, you must watch the market closely. Prices go up and down fast. It’s due to news, hype, and what big players do. Think of it like a game where you need a sharp eye to win. By watching crypto asset performance analysis, we learn what’s hot and what’s not.

We check how often people buy and sell each coin. This shows if a coin’s worth your time. We also look at blockchain asset valuations. This tells us what people think the tech behind the coin is worth. Right now, everyone’s watching how tech upgrades make some coins shine.

Identifying Key Digital Currency Trends and Altcoin Market Insights

Now, let’s dig into what’s trending. Digital currency trends are about what’s now and what’s next. Big news like a country saying yes or no to crypto changes the game.

Altcoin market insights give us the low-down on coins that aren’t Bitcoin. There are lots of them! Some are cheap and new, with big ideas to fix problems. Others move with Bitcoin, the big boss of coins.

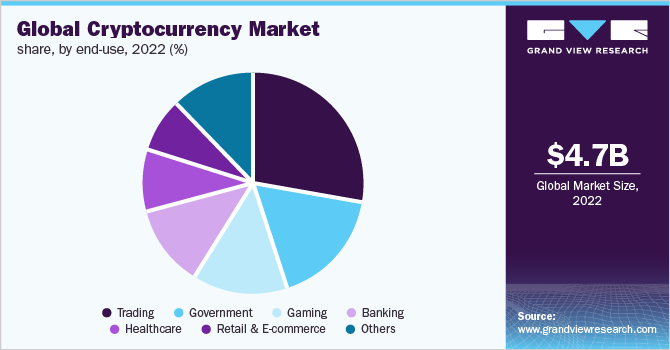

With all this info, we build crypto investment strategies. Our goal? Make money while dodging big drops. We dive into DeFi market analysis, where finance goes wild without banks. Here, new ways to make cash are born every day.

Token economic indicators show how these new money-makers will do. We use them like a map to find treasure. In crypto, rules are changing. Governments step in, which can scare some. We call this virtual currency regulatory impact. It influences how we play the game.

We keep an eye on all things crypto. From bitcoin price fluctuation analysis to Ethereum market predictions, we want to know. It helps us guess if prices will fly high or take a dip. It’s all about timing.

Crypto exchange liquidity assessment means we see how easy it is to sell. If it’s hard to cash out, it’s a risky move. We also check digital wallet transaction patterns. This is like being a detective, seeing where the money moves.

Crypto mining influence on market is about how new coins are made. It can change how much your coins are worth. Stablecoin analysis in trading gives us a safe spot when things get wild.

NFT market trends keep us on our toes. These are like digital art, and people pay big bucks for them. Last, we keep our ears open for cryptocurrency taxation implications. No one likes surprises come tax time.

In crypto land, every piece of news can help or hurt. We soak it all up to help guide us. Whether it’s smart contract development or new rules, we’re on it. Because in the end, knowing the game means we can play it better.

Strategic Investment Approaches in the Cryptosphere

Formulating Effective Crypto Investment Strategies

Smart moves make winning games in crypto. You need a plan that fits your goals. Start by learning what drives prices up or down. Look at how often people trade Bitcoin or Ether. These coins often lead the way for others. Use this info to predict where the market might go.

Don’t put all your eggs in one basket. Diversify. Mix big names like Bitcoin with smaller, up-and-coming coins. Keep an eye on trends. Use tools to check which coins people talk about most. This shows what’s hot or not in the cryptosphere.

Invest for the long run, or trade day by day. Pick the style that suits you best. Both ways can win if done right. But remember, prices can swing fast. Stay on top of the news. Everything from a tweet to new laws can change prices quick.

For all coins, think about what makes them special. Each one has a job. Some are for fast payments. Others let you use apps without your ID getting out. These jobs can make one coin more valuable than another.

Assessing ICO Performance and DeFi Market Developments

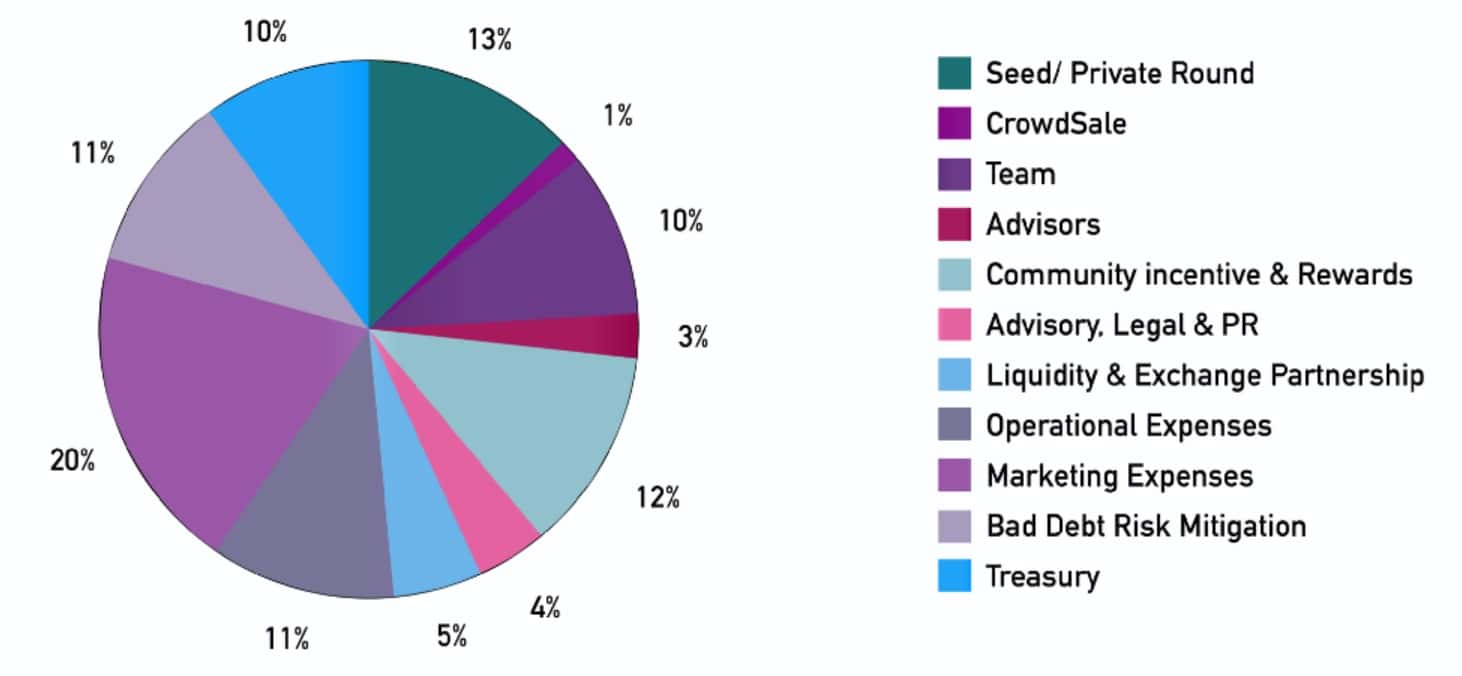

Initial Coin Offerings, or ICOs, are like the first sale of a coin. Check the team behind the coin. Good teams with strong plans often do well. But beware; some ICOs promise big things but don’t deliver. Always dig deep before you buy.

DeFi, or Decentralized Finance, is a game changer. It lets you lend, trade, and earn without banks in the middle. Watch for DeFi coins that hook up with lots of apps. These tend to grow as DeFi gets bigger.

Look at the token rules—tokenomics. This tells you how many coins there will be and how they get around. Coins that are too common may not grow much in price. If coins are hard to get, they might be worth more over time.

In DeFi, watch for hacking news. Good projects work hard to keep safe. But when hacks happen, prices can fall. Always check how your DeFi choices keep your money safe.

Keep track of your picks. Use charts to see how they move against Bitcoin. See if they move the same way or their own way. Coins that move on their own might be good when Bitcoin drops.

Trading volume is key. More trading can mean a coin is in demand. It can also mean a coin is easy to sell when you need to.

Remember, crypto taxes are real. Know the rules. Taxes can take a big bite out of your wins if you’re not ready.

Lastly, it’s about timing. Keep your cool when prices go wild. Wise traders know when to hold on and when to let go.

Using these strategies, you can better ride the crypto wave. Make moves based on knowledge, not just gut feelings. With enough homework, you can spot the best times to jump in or cash out. Stay sharp, and you might just find success in this digital gold rush.

The Mechanics of Cryptocurrency Markets

Exploring the Impact of Crypto Exchange Liquidity and Mining Activities

Imagine a busy market. Think of sellers, buyers, and loads of goods. Now, picture that market for digital cash. That’s a crypto exchange. It’s where people trade virtual coins, like Bitcoin and Ethereum. But here’s the catch: the market needs enough coins and cash to run smooth. That’s what we call liquidity. If you can sell or buy fast without changing the price much, the market is liquid.

So, why does this matter? Liquidity means trust. More trust brings more traders. More traders mean more activity. It makes sense, right? But wait, there’s more. Mining plays a part too. Mining is not digging for coins. It’s computers solving puzzles to keep the coin’s network safe. This gives miners new coins as rewards.

But, this mining affects the market. How? More mining could mean more coins out there. When there are more coins, prices can drop. It’s simple; it’s supply and demand. Too many apples on the market, the price of apples drops.

In short, liquidity keeps trades moving. Mining adds or takes coins from the market. Both shape how much your digital money is worth.

Delving into Stablecoin Use and NFT Market Dynamics

Let’s dive into stablecoins now. Coins like tether or USDC are stablecoins. They stick to a set value, like the dollar. Why use them? They’re like safe boats in choppy seas. When other coins’ prices go up and down, stablecoins stay calm. Traders use them to move cash or to take a break from wild price swings.

NFTs, or non-fungible tokens, are unique. They’re like digital trading cards—no two are the same. The NFT market is crazy. Sometimes prices shoot up fast. Other times, they fall. It’s newer than other parts of the crypto world. So, it can be riskier. People buy NFTs with Ethereum mostly. That means, as NFTs get hot, demand for Ethereum can go up. That can push its price up too.

So, there you have it. Liquidity ensures our crypto market doesn’t get stuck. Mining adds new coins, nudging the prices. Stablecoins offer a calm spot among wild price swings. NFTs stir up demand for coins like Ethereum, which can change their worth. All these gears work together to keep the crypto market turning. And that, my friends, is a peek into the mechanics of how your digital cash lives and breathes in the online world of trading.

Advanced Analytics and Prediction Methodologies

Applying Technical and Fundamental Analysis in Cryptocurrency Trading

When we trade in crypto, we must look at numbers and charts. They help us guess where prices will go. They are tools in technical analysis. Fundamental analysis is different. We look at the health of coins or tokens and their place in the market. We ask, “Is this coin useful? Does it solve problems?” When we combine these two, we can make smart guesses.

We start with simple line charts, bars and candles. Candles show us how prices move during a certain time. Green means prices went up. Red means they went down. We see patterns. Like mountains and valleys in a price chart. These patterns help us predict future prices.

Then we look at moving averages. It’s like smoothing out bumpy rides. It gives us a clearer picture. How are prices moving over time? Is there a trend?

Next, we use tools like RSI or MACD. RSI stands for Relative Strength Index. It tells us if a coin is bought too much or too little. MACD is Moving Average Convergence Divergence. It shows us how two moving averages relate. Are they getting closer or moving apart?

Implementing Predictive Modelling for Accurate Crypto Price Forecasts

Now let’s talk about using math to guess future prices. That’s what predictive modeling does. We feed past data into a computer. It looks for patterns. These patterns tell us what might happen next.

One popular method is called regression. It’s like drawing a line through a set of points. We try to find the line that fits best. This line can show us where prices might go.

Then there’s machine learning. It’s a smart computer that learns from data. It gets better at guessing the more it learns. We give it loads of data on prices, trading volumes, and world news. The smart computer uses all this to make predictions.

Remember, crypto prices can go up and down very fast. Big news, new laws, or even tweets can change prices. So our models must learn quickly and adapt. We use the latest prices and information to keep our guesses fresh.

Tools are helpful, but they are not always right. Careful traders always ask, “What if I’m wrong?” We should never put all our money in just one prediction. It’s smarter to spread out. Use many different tools. Check them against each other. This way we stay safe and are ready for surprises.

Predictive models are great. But even the best model can’t see the future for sure. So we must watch the market every day. Stay sharp. Keep learning. And never stop asking, “What’s next for crypto?”

There you go – a peek into how we use analytics and predictions to navigate the exciting world of crypto trading. We use past data to sharpen our guesses and try to stay one step ahead of the game. Whether you’re just starting or you’ve been trading for a while, remember: knowledge is power, especially in the crypto market. Keep your eyes open and your mind ready to learn!

In this post, we’ve looked at the big picture of digital currencies. We explored how crypto assets do on the market and checked out the latest trends and altcoin insights. We then dove into smart ways to invest in cryptos, looked at ICOs, and saw what’s up with DeFi.

We also untangled how crypto markets work, from what affects exchange liquidity to the roles of mining, stablecoins, and NFTs. Lastly, we shared tips on using tech and stats to make better trade calls and predict prices.

Here’s my final take: staying sharp and informed matters most in the fast-paced world of crypto. Use what we’ve covered to make smart moves and keep up with the game. Remember, knowledge is your best tool for success in the cryptosphere!

Q&A :

What factors influence cryptocurrency market fluctuations?

The volatility in cryptocurrency markets can be attributed to a variety of factors such as market sentiment, regulatory news, technological advancements, security issues, market liquidity, and the entry of institutional investors. Changes in any of these areas can lead to rapid and significant price movements.

How does one conduct a cryptocurrency market analysis?

To conduct a cryptocurrency market analysis, you must evaluate both technical and fundamental factors. Technical analysis involves examining charts and using statistical figures to identify trends and patterns. Fundamental analysis, on the other hand, involves looking at the broader market conditions, such as the technology behind a coin, current regulations, market news, and new technological developments. Additionally, sentiment analysis can be useful to understand the mood of market participants.

Can historical data be used to predict cryptocurrency prices?

While historical data can provide insight into past trends and patterns in the cryptocurrency market, it is not a guaranteed predictor of future prices. The cryptocurrency market is highly volatile and influenced by many unpredictable external factors. However, many traders use historical price charts to try to identify repeating patterns and make predictions based on technical analysis.

What are some common tools used for cryptocurrency market analysis?

Common tools for cryptocurrency market analysis include charting software for technical analysis, such as TradingView or Coinigy. Additionally, platforms like CoinMarketCap and CryptoCompare provide market data and metrics, while sites like Google Trends can offer insight into public interest levels. Fundamental analysis may involve staying updated with news from cryptocurrency news outlets, forums, and social media.

Is it possible to analyze the cryptocurrency market without technical expertise?

Yes, it is possible to analyze the cryptocurrency market without technical expertise by focusing on fundamental analysis. This involves understanding the broader ecosystem, keeping up with industry news, market trends, and regulatory changes. There are also many online resources, courses, and tools designed to help beginners learn how to analyze the cryptocurrency market effectively.