What is LSDFi in crypto? Let’s cut straight to the chase. LSDFi stands for Liquid Staking DeFi— a game changer in digital money. It’s not just a buzzword; it’s the evolving face of finance where you make the rules. Think of it as your VIP pass to smarter investments and bolder opportunities in blockchain. Here, I’ll break down how LSDFi reshapes our approach to crypto assets and powers up market liquidity. This is more than an intro; it’s your new playbook for the frontier of DeFi. So, buckle in as we dive into the foundations and roles of LSDFi, and why it’s the talk of the town for finance buffs and tech heads alike.

Understanding LSDFi in the Blockchain Ecosystem

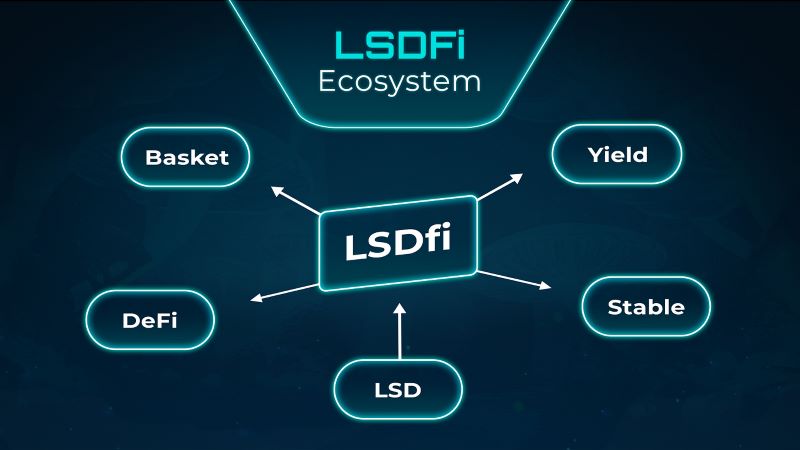

Exploring the Foundations of LSDFi

LSDFi stands for Liquidity Support Decentralized Finance. In simple words, it’s like a tool that makes sure there’s always money available for people to use in the DeFi space. By using LSDFi, platforms can offer users a way to swap, trade, and invest without worrying about running out of funds. This is crucial in the world of decentralized finance (DeFi) because it keeps things moving smoothly.

At its core, LSDFi is built on blockchain, the same tech that powers Bitcoin. But it does more than just track who owns what. It uses smart contracts, or sets of rules, that run automatically to handle the money flows. This helps turn crypto financial instruments into something you can trust and rely on. Understanding LSDFi means you’re looking into the nuts and bolts of how modern crypto markets work.

The Role of LSDFi in Enhancing DeFi Liquidity

DeFi projects need something called liquidity to work well. Liquidity means having enough money in the system so everyone who wants to trade can do so easily. LSDFi plays a big part in making sure there’s enough liquidity. It uses special pools of money, called liquidity pools. These pools let people trade their crypto tokens without waiting.

Without enough liquidity, things slow down, and it can be hard for you to swap your crypto or cash out when you need to. But with LSDFi, DeFi platforms get better at dealing with big amounts of trades and can offer users better prices. Plus, for people who choose to invest in these liquidity pools, they can earn rewards. This process is known as yield farming with LSDFi. It’s like planting seeds in a garden, but instead, you’re putting your crypto to work and watching it grow.

In a nutshell, LSDFi plays a huge role in making DeFi more powerful and user-friendly. With solid LSDFi strategies, the crypto market becomes more robust and ready for more people to join in. It’s changing the game by offering better security, reliability, and chances for everyone to get into the world of finance technology in crypto.

To sum things up, LSDFi is shaping up to be a big deal for long-term crypto investments. It’s about building a system that’s not just fancy and innovative but also one you can count on day in and day out. As we watch this space grow, it’s clear that LSDFi isn’t just a passing trend. It’s setting the stage for an even more exciting future in the world of cryptocurrency.

The Mechanics of LSDFi: How It Powers Crypto Markets

Smart Contracts and Their Integration with LSDFi

Let’s dive into how LSDFi works in crypto. Think of it as a special engine. It runs on rules set in smart contracts. These are like magic spells in a game. They make things happen without a person saying so. With LSDFi, smart contracts bring money into the market. This means more cash for folks to trade with.

Smart contracts do a couple big things. They work like deal-makers. When you sign up, the contract knows, and the money starts to flow. You can trust it. It does what it says, no tricks here. This trust pulls more people to play in the crypto world.

Now, smart contracts tie close to LSDFi. They handle money without getting it wrong. This helps everyone feel safe. It’s the glue that sticks all the parts together. And with that, we get a strong money playground where everyone can join in.

Crypto Tokens and Liquidity Pools: The Building Blocks of LSDFi

Crypto tokens and liquidity pools make LSDFi tick. First, what’s a token? Think of tokens like arcade coins. In crypto, these coins are special digital cash. You use them to play, trade, and win more in the game of crypto.

Liquidity pools are like big pots of these arcade coins. They sit there for anyone to use to make trades smooth. They make sure there are enough coins for trading. This is huge. When there’s plenty to go around, trading is fast and fair.

In LSDFi, these pools play a star role. They let you trade your tokens any time, no waiting. It’s like having a toy store that never shuts. You can walk in, swap toys, and walk out. Simple as that.

So, these tokens and pools work together like a dream team. They offer a way to trade and play that’s easy for everyone. It means more fun, more trades, and a bigger, happier crypto world.

With LSDFi, everyone gets to join the party. More players make for a bigger game. This means even more chances to win or make a deal. It really is a whole new world of digital cash. And all thanks to these nifty tools that make it possible.

The Strategic Advantages of LSDFi Over Traditional DeFi Systems

Assessing the Unique Benefits of LSDFi Investments

LSDFi stands for Liquidity Support Decentralized Finance. It’s a new twist in the crypto world. LSDFi gives DeFi projects a way to have more cash on hand. That means they can handle more trades and serve more people.

Why does this matter? In simple terms, more cash means more action. Projects can work better and grow faster. LSDFi works by using smart contracts on the blockchain. These are like super-smart programs that handle money safely.

You might ask, why not stick with regular DeFi? Well, LSDFi is special. It uses finance technology in crypto to solve big problems. These are problems like finding enough cash to support trading. This means crypto financial instruments, like tokens, can be traded more easily.

With better liquidity support, DeFi platforms can avoid big price changes. Price stability helps everyone. Users feel safer, and projects become less risky. It’s a win-win!

Think of LSDFi as a helper for crypto tokens and DeFi projects. It keeps everything flowing smoothly, like oil in an engine. Projects get the funds they need to operate without hiccups.

So, the big LSDFi benefit is that it gives new life to the crypto market. It makes trading simpler and safer. And safer trading calls for more people to join in. More people means more growth, and more growth is what crypto is all about.

Yield Farming and Crypto Innovation Within LSDFi Platforms

Now, let’s talk about yield farming with LSDFi. Yield farming is a way to earn more crypto with your crypto. It’s like planting seeds and watching them grow into more coins. With LSDFi, yield farming is even better.

Why? Because LSDFi provides a steady flow of money into these liquidity pools. These are like big pots of money that help people trade without waiting. With more money in the pools, there’s more to earn from yield farming.

Yield farming is a key part of crypto innovation. It’s exciting because it’s a smart way to invest. With LSDFi, farmers can plant their seeds (I mean, crypto) and feel more at ease. They can trust that the pools won’t dry up.

LSDFi platforms also bring in new ways to do things in finance. They mix the latest tech with crypto smarts. This creates new tools and strategies for managing money. Think of it as the new frontier of digital finance.

In the end, LSDFi is about giving DeFi a boost. It helps people trade and invest without so much worry. And it offers a smart way to earn more from your crypto stash. This is why more folks are looking at LSDFi in the blockchain. They see it as a path to a brighter, richer crypto future.

Navigating the Risks and Security in LSDFi

Identifying Challenges and Mitigating Risks in LSDFi

In the world of LSDFi, figuring out the risks can be tough. But it’s key if you want to keep your crypto safe. To start, LSDFi, short for Liquidity Support Decentralized Finance, is all about making money flow easily in the DeFi world. Just like a busy city needs good roads, DeFi projects need lots of cash moving around to work well. LSDFi helps make that happen. But, just like driving, there are risks. And in crypto, these risks can hit your wallet hard.

So, what are some dangers in LSDFi? First off, smart contracts are super important in DeFi, but they’re not perfect. A bug in the code could mean losing your money. Cyber-attacks are another big worry. Hackers are always out there, trying to break into DeFi platforms and take what’s not theirs.

But you can fight these risks. How? By picking DeFi projects that get checked out a lot. Teams that take time to test their code and get other experts to check it are your best bet. Also, look for projects with insurance. This means if things go bad, you might not lose everything.

Future-Proofing Investments: Stability and Security Measures in LSDFi

You want your crypto to work for you in the long run, right? LSDFi can help. In LSDFi, smart contracts and stablecoins work together to keep your investments steady, even when the crypto market goes wild. Stablecoins are like the anchors of the crypto world. They try to stay the same price all the time, which helps keep things from going too crazy in LSDFi.

Security in LSDFi has to stay top-notch. Projects that use advanced tech and stay up-to-date can keep your crypto safer. Plus, DeFi projects with a plan for when things go wrong can get back on their feet quicker.

Making your investments future-proof means staying sharp. Keep learning about how LSDFi works, the new things coming up, and how to protect what you’ve got. Choose DeFi projects that don’t just look good today but are making plans for tomorrow too. This way, you can feel stronger about your crypto doing well as time goes on.

In short, LSDFi is pretty exciting, and it brings a lot to the table in the world of cryptocurrency. But, like any adventure, it’s best to go in with your eyes wide open. Know the risks, plan for them, and keep an eye on new gear that can help your investments last. That’s how you make LSDFi work for you.

In this post, we’ve delved into LSDFi in the blockchain world. First, we looked at its basics and how it boosts DeFi’s cash flow. Next, we dug into how it works, with smart contracts and liquidity pools at its heart. We also explored how LSDFi beats old DeFi in many ways, like better yields and more growth.

But it’s not all smooth sailing. We also checked out the risks and how to stay safe using LSDFi. To wrap up, LSDFi has a lot to offer in crafting a more robust crypto market, but like any investment, it calls for smart moves and careful thought. Keep these tips in mind, and you can make LSDFi work for you. Let’s embrace the crypto future smartly and safely. Stay in the know, and you’ll be set!

Q&A :

What Exactly Is LSDFi in Cryptocurrency?

LSDFi, or Lending Stability Debt Finance, is a concept in the cryptocurrency market where stable debt is used as a part of the lending protocol to ensure financial stability. It aims to minimize the volatility in lending rates and provide a more stable borrowing environment for cryptocurrency users.

How Does LSDFi Contribute to the Crypto Lending Space?

LSDFi contributes to the crypto lending space by managing debt in a way that aims to reduce the effects of high volatility often associated with cryptocurrencies. It typically involves algorithms and financial instruments that attempt to provide a buffer against market instability, making it safer for individuals to engage in lending and borrowing activities on crypto platforms.

Can LSDFi Impact the Overall Stability of a Cryptocurrency?

Yes, LSDFi can potentially impact the overall stability of a cryptocurrency by providing a mechanism to control and stabilize the rates at which users can borrow said cryptocurrency. This helps in creating a more predictable and reliable financial ecosystem for both borrowers and lenders, which can encourage more participation and investment.

In What Ways Is LSDFi Used in Decentralized Finance (DeFi)?

In decentralized finance (DeFi), LSDFi is used to create more stable conditions for transactions, especially in terms of lending and borrowing. By using smart contracts and other DeFi technologies, LSDFi ensures that rates are kept at a more constant level, mitigating the risk of sudden interest rate spikes and making the overall DeFi space more appealing to mainstream financial participants.

Are There Any Specific Crypto Platforms That Utilize LSDFi?

While LSDFi is a relatively new and evolving concept, some crypto lending platforms might start incorporating LSDFi strategies to offer better stability in their lending products. It’s essential to research and keep an eye on emerging DeFi platforms and protocols that announce the implementation of LSDFi methodologies to provide a more stable lending environment.