What is Low Cap Coin might sound like tech jargon, but it’s a simple idea with vast potential. Imagine finding hidden treasure in a vast ocean of cryptocurrencies; those treasures are often the coins with a low market capitalization—low cap coins, in short. As a seasoned crypto enthusiast, I’ve seen how they offer an exhilarating chance to strike it big before the masses catch on. But with great promise comes great risk. Every low cap coin carries the possibility of sky-high gains, but also the risk of sudden drops. Think of this as your no-nonsense map to navigating the highs and lows of these crypto assets. Ready to learn how these digital underdogs could be your ticket to potential crypto riches? Let’s dive deep into the world of low cap coins, and I’ll guide you through discovering, analyzing, and strategically investing in the crypto market’s hidden gems.

Understanding Low Cap Cryptocurrencies

Defining Low Market Cap in the Crypto Realm

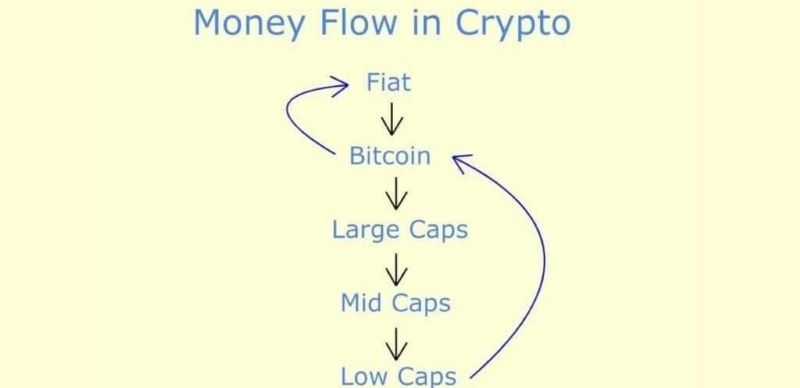

Low market cap cryptocurrencies are digital assets with a small total value of coins in the market. Think of them as the small fish in the big crypto pond. Market cap, short for market capitalization, tells us how much the world thinks a cryptocurrency is worth. To find this, multiply the current price of a single coin by the total number of them out there. When this number is low, we’re talking about low market cap coins.

These crypto coins often don’t get a lot of attention. Yet, they can be diamonds hiding in the rough. They can have huge potential for growth since they start from a smaller base compared to giants like Bitcoin.

Market Cap vs. Token Value: An Investor’s Primer

The market cap of a coin is different from its price. Think of token value as the price tag on a single apple in a basket. Market cap is the total cost of all apples in that basket. Just because one apple is cheap doesn’t mean all of them together are not worth a lot.

Investors like you and me use market cap to see the big picture of a cryptocurrency’s worth. It shows us if a coin’s price is high or low compared to how many coins there are. This helps us to spot if a coin is truly undervalued.

When we look at altcoins with low market capitalization, we’re looking for growth stars. We check their tech, their team, and if their idea solves real problems. We also eye the community backing them. A strong community can push a coin from the shadows to the spotlight.

A small market cap can mean big price swings. With fewer coins out there, it takes less money to move their price. This can mean bigger gains, but also bigger risks. Knowing this, you can see why smart investors don’t put all their eggs in one basket.

Finding undervalued cryptos takes work. It means digging beyond the price tag. It’s about understanding the promise and the risks. Watch out, though. Sometimes low cap coins can be targets for market manipulation. This is where big players mess with the price to make it look better than it is. Keep sharp and do your homework.

Exploring early-stage cryptocurrency projects can be thrilling. It’s like you’re part of a secret club with inside info on the next big thing. But remember, not all secrets pan out, and ICOs can be hit or miss. Look past the hype and focus on solid facts and figures.

Jumping into low cap cryptocurrencies can be your ticket to potential crypto riches. But it’s not a sure thing. You need guts, patience, and smarts. Remember, the crypto world is a roller coaster. Buckle up and get ready for the ride.

Advantages and Risks of Low Cap Coins

Benefits of Investing in Emerging Cryptocurrencies

Low market cap cryptocurrencies are often like hidden gems. They hold big promise for growth. When you put money into small cap cryptos, you are getting in early. Think of it like getting a slice of cake before it’s all gone. Your small slice could turn into a big one if that crypto takes off.

Investing in these coins can lead to high rewards. These coins are cheap, which lets you buy lots of them without spending much. If they grow, even a small increase in price can mean big percentage gains for you. And because these are new, you have a chance to support fresh, exciting ideas that could change the game.

Potential Perils of Low Cap Crypto Investments

Now, let’s get real. Risks are also part of the deal with low cap crypto investments. One big scare is price volatility. Prices of low cap coins can jump or fall fast. You could wake up to double your money, or to find it’s halved.

Finding true info on these coins is tough. Not much is out there to guide you. Scams can pop up, dressed as the next big thing, ready to take your cash. It’s key that we get how to check a coin’s worth. This means understanding cryptocurrency market capitalization and what’s behind a coin.

Liquidity can also be a pain point. You might not be able to sell your coins when you want. Fewer people trade them, and that leads to another problem: market manipulation. Sneaky folks can mess with prices, making them look great, then crash them down.

Remember, rules can change and affect your

All in all, low cap coins are a mix of risk and reward. I always say, know what you’re getting into. Learn about what drives their price and how they fit in the whole crypto world. Spotting that diamond in the rough could pay off, but never jump in without doing your homework first.

When looking to spot a potential winner, understand that info is your best tool. And remember, CoinMarketCap is a great place to dig deep into the data. It’s where you can see a coin’s history, its total worth, and get a feel for the market. Keep an eye on those early-stage cryptocurrency projects. They might just be the next big hit.

So, what do we take from this? Simple. Low cap coins can be a ride to riches, but it’s no free lunch. You’ve got to weigh the good points against the risks. Make smart, informed moves, and you could find those low market cap cryptocurrencies that turn into tomorrow’s stars.

Identifying and Researching Potential Low Cap Gems

How to Discover Undervalued Cryptos

Finding hidden gems in the crypto world feels like a treasure hunt. You’re on the search for low market cap cryptocurrencies. But what does “low market cap” mean? It’s the total value of all the coins out there. And “low” means not many people have caught on yet. These cryptos have a small price tag for each coin. The trick is to spot the ones that could really take off. It’s like getting a superhero action figure before it becomes a collector’s dream. So now, how do you find these undervalued cryptos?

First, look where others might not. Check out new projects or ones that don’t make the news. Websites like CoinMarketCap list tons of cryptos. From there, you can dig into each one. It’s a bit like being a detective. You’re checking for clues that show a crypto has a solid plan and a good team. If you see that, it might just be a winner. But remember, this takes time and lots of reading.

Analyzing Liquidity and Price Volatility in Low Cap Markets

Now let’s chat about two big words in crypto: liquidity and volatility. Liquidity is all about how easy you can buy or sell without the price changing a lot. In the playground, it’s like how fast you can trade your trading cards with others. Volatility is about price going up and down super fast. It’s like a yo-yo, but with money. Low cap coins can go wild with price swings. This can be good or bad, depending on how you play it. To check liquidity, see how much of the coin gets traded every day. If it’s a lot, that’s a good sign.

For price swings, you want to be smart. Too much volatility can be risky. You might buy a coin, and before you know it, the price drops. It’s like grabbing a hot potato. But if you play it right, these price jumps could work for you. Say you buy when the price is low, and then it shoots up – you’ve got a win! Just make sure you know the game.

In all, low cap coins can be like finding a cool toy before it’s cool. You do your homework, you check it twice, and you might land on something big. But just like with toys, you need to know which are worth keeping and which are not. Play it smart, and these low cap coins could be your ticket to the crypto riches.

Investment Strategies for Low Cap Assets

Tailored Approaches for Small Cap Cryptocurrency Investments

You want to invest in low market cap cryptocurrencies. Great! But move with care. Small caps are young coins with small price tags. They hold a promise: big returns. Yet, they hide a risk: big losses. The trick is finding coins ready to grow.

Small caps are like hidden gems. They shine but few see them. To see them, know the game. The game is: research, patience, and a cool head. Start with a look at coinmarketcap. It’s a site full of data on coins big and small. It shows prices, volumes, and, you guessed it, market caps.

Understanding market capitalization helps a ton. It’s a coin’s total worth. Market cap = (price per coin) x (total coins). Low cap means not many people own it, yet. But if they did, your small investment could turn big, quick.

But, hold up. There’s more to check out. Learn about the coin. Read its “white paper.” It’s like a secret plan that tells you everything. Get to know the team. Do they have smarts? Have they done this before? Are they real?

Talk to others. Find investors like you. Some have seen things you haven’t. They can share tales of wins and losses. You can learn so much from their stories. Listen a lot. It’s free advice from people who have walked this path.

Navigating ICOs and Early-Stage Cryptocurrency Projects

Now, let’s chat about ICOs. An ICO, or initial coin offering, is a coin’s first sale. It’s a new coin’s hello to the world. ICOs can be gold mines. Or they can be money pits. The key is knowing the difference.

An ICO is a bet. A bet that this new coin will take off. Investing here is not for weak hearts. Prices jump all over. One day up, next day down. It can be wild.

With small caps, you might find the next star. Or not. It’s like a treasure hunt but with lots of question marks. To win, mix some facts with your gut feeling. No one knows it all, but some guesses are better than none.

Risks? Sure, there are risks. There’s always a chance that a coin could fall hard. Any coin can get hit by bad news or bad luck. Worst of all is a scam. Some coins aren’t what they seem. Those hurt investors a lot.

Growth is what you’re after. Some coins start small and then zoom! They find a place in the world. More people want them. Their price goes up. And your small bet can turn into big money.

In the end, you need a plan. A solid plan. One that fits who you are. It should tell you when to say yes and when to walk away. There’s no sure win in the game of low cap coins. But play it smart and you just might find your ticket to crypto riches.

In this post, we dived into the world of low cap cryptocurrencies. From what makes a crypto ‘low cap’ to the unique risks, you now have a clearer idea. I shared insights on spotting undervalued gems and gave tips on investing strategies. Remember, knowing the perks and dangers matters. Taking the right steps can lead you to make smart choices in the exciting, yet challenging, world of emerging cryptos. Keep research and caution as your guides and be wise about your next move in the crypto space.

Q&A :

What are Low Cap Coins in Cryptocurrency?

Low cap coins are digital assets with a small market capitalization. In the cryptosphere, they’re often considered as emerging coins that have the potential for substantial growth but also carry a higher risk compared to more established cryptocurrencies. Market capitalization is calculated by multiplying the current price per coin by the total number of coins in circulation.

Why Do Investors Choose Low Cap Coins?

Investors may opt for low cap coins due to the significant growth potential they can offer. Since these coins are not as well-known or as large as major cryptocurrencies, they sometimes present opportunities to get in early before the coin gains more recognition and increases in value. However, the risk with such investments is also proportionately higher.

What is Considered a Low Market Cap in Crypto?

There isn’t a strict threshold for what constitutes a low market cap, but it is generally applied to coins outside of the top-tier cryptocurrencies. Typically, low cap cryptocurrencies are those with a market cap of less than $1 billion. This definition can vary with the overall market dynamics and sentiment.

How Can You Identify a Promising Low Cap Coin?

To identify a promising low cap coin, investors often conduct thorough research which includes evaluating the coin’s use case, the project’s road map, the expertise of the development team, community support, tokenomics, and market trends. It’s important to look for unique features or problem-solving capabilities that could drive demand for the coin.

What Are the Risks of Trading in Low Cap Coins?

Trading in low cap coins entails several risks, including high volatility, liquidity issues, the possibility of pump-and-dump schemes, and less available information for proper due diligence. Since these coins can have smaller trading volumes, they can be more susceptible to price manipulation. Always do adequate research and consider risk management strategies before investing.