What is Lido? Lido is a pioneering platform in the cryptocurrency space that offers liquid staking solutions for Proof of Stake (PoS) blockchains. By allowing users to stake assets like Ethereum while retaining liquidity through representative tokens, Lido reshapes how individuals engage with staking and DeFi.

What is Lido?

Lido is a leading platform that redefines how users interact with cryptocurrency assets through staking solutions. It offers a liquid staking mechanism for Proof of Stake (PoS) blockchains, such as Ethereum and Polygon, enabling users to stake their assets and receive representative tokens (like stETH for ETH). This innovative approach allows users to participate in decentralized finance (DeFi) protocols while still earning staking rewards.

What is Staking?

Staking is a security mechanism within PoS blockchain networks, where users contribute their assets to support network operations in exchange for rewards. Unlike the energy-intensive Proof of Work (PoW), PoS utilizes a consensus mechanism based on asset ownership.

Staking provides various benefits, including:

- Earning Returns: Users receive staking rewards proportional to their contributed assets.

- Governance Participation: Holding staked assets allows users to vote and make decisions within the network.

- Network Security: Staked assets incentivize users to protect the network, as attacks could jeopardize their own interests.

With the rise of PoS blockchains like Ethereum, Solana, and Cardano, staking has become increasingly popular in the crypto community.

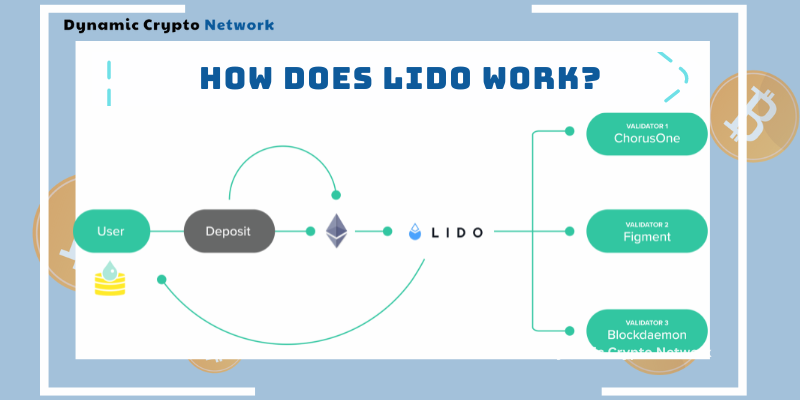

How Does Lido Work?

When users deposit assets into Lido, those assets are staked on the corresponding blockchain. Lido employs a network of validators to efficiently perform staking. These validators are randomly allocated to verify transactions and generate new blocks.

Lido issues stAsset tokens at a 1:1 ratio with the amount of assets staked. For example, if you stake 1 ETH, you will receive 1 stETH. These stAsset tokens represent ownership of the underlying asset and the corresponding staking rewards.

Advantages of Lido Over Traditional Staking

- High Liquidity: Users receive stETH tokens that can be traded or used in other DeFi services, providing greater flexibility.

- No Quantity Limit: Users can stake any amount of ETH without adhering to the 32 ETH rule, allowing broader participation in staking.

- DeFi Support: stETH can act as collateral for DeFi transactions, enhancing the usability of staked assets within the DeFi ecosystem.

- Full Staking Rewards: Users receive the entire staking reward without management or transaction fees, optimizing returns.

Lido and DeFi: Expanding Yield Potential for Staked Assets

Lido has created a new wave in the DeFi sector, allowing users to maximize profits from staking while expanding the yield potential of their assets. The stETH token can be utilized in various DeFi protocols, such as:

- Lending: Using stETH as collateral for borrowing to generate additional profits.

- Yield Farming: Contributing stETH to liquidity pools to earn rewards.

- Trading: Trading stETH on decentralized exchanges (DEX) to capitalize on price differences.

What is LDO?

LDO is the governance token of Lido DAO, allowing users to participate in the decision-making processes of the protocol. The amount of LDO held influences voting power, enabling holders to vote on:

- Protocol Updates: Modifications to parameters and functionalities of Lido.

- Resource Allocation: Decisions on how Lido’s treasury is utilized.

- Development Initiatives: Supporting new development proposals for Lido.

LDO also plays a crucial role in managing the risks associated with the Lido network. Holding LDO enables users to engage in governance and protect the network from potential threats.

Benefits for LDO Holders

Holders of LDO have the right to participate in governance and influence the future direction of Lido. This enhances user empowerment in shaping the future of the liquid staking platform.

Future Growth Potential of LDO

LDO has significant growth potential due to its critical role in managing Lido. As the demand for liquid staking increases, the value and utility of LDO are likely to rise, making it a valuable asset in the evolving DeFi landscape.

Assessing Potential and Risks in Participating in Lido Finance

Lido’s Leading Position in the Liquid Staking Market

Currently, Lido is one of the top staking platforms, with a Total Value Locked (TVL) exceeding $21 billion. The platform has attracted substantial interest from the crypto community, thanks to its effective and secure liquid staking solutions.

Potential Risks of Participating in Lido and Mitigation Strategies

Despite its advantages, users should remain aware of potential risks, including technical issues, smart contract errors, and governance-related challenges. Some inherent risks include:

- Smart Contract Failures: Bugs in smart contracts can lead to asset loss.

- Security Risks: Cyberattacks may damage the Lido network.

- Governance Risks: DAO governance could lead to unfavorable decisions for users.

To mitigate these risks, users should:

- Educate Themselves: Conduct thorough research on Lido and its associated risks.

- Diversify Assets: Avoid staking all assets with Lido.

- Monitor Regularly: Stay updated with announcements regarding Lido.

The Future of Lido: Independent Blockchain and New Developments

Recently, Lido proposed developing an independent blockchain to enhance performance and value accrual for the LDO token. An independent blockchain would allow Lido to operate autonomously from Ethereum, creating new opportunities for users and the LDO token.

Lido is rapidly evolving, making strides in expanding supported blockchains and improving functionalities. The platform has immense potential to become a leading liquid staking solution in the future.

For daily news updates, Follow Dynamic Crypto Network!