What is a Stable Coin? The Anchors of Cryptocurrency Volatility

Ever faced the roller coaster of Bitcoin prices? You’re not alone. But there’s a fix to the wild ups and downs – and it’s called what is a stable coin. These digital bucks keep their cool, even when crypto markets go haywire. They’re tied to steady stuff like dollars or gold, so you can trade and save without the sweat. Think of them as the chill-out zone in the crypto party, letting you enjoy the fun without the usual freak-out. Ready to see how they make that happen? Let’s dive in.

Understanding Stablecoins: The Basics and Beyond

Defining Stablecoins and Their Role in Reducing Cryptocurrency Volatility

Imagine a sea. In it, the waves move up and down. This is like the crypto market. Now, picture a strong ship that does not rock much, even when waves hit. This ship is like a “stablecoin.” A stablecoin is a special kind of digital money. It’s made to have a steady price where other cryptocurrencies go up and down a lot.

Why is this steady price so key? Well, when you use money, you want to know it will be worth the same tomorrow. Without this trust, folks might not use digital money at all. Stablecoins help us trust and use digital money.

Exploring How Stablecoins Maintain Value Amid Market Fluctuations

You might wonder, “How do stablecoins keep their value?” The answer lies in what backs them up. There are different ways to do this. Some stablecoins have real money, like dollars, saved in a bank. We call these “fiat-collateralized stablecoins.” They are simple and easy to understand. For every digital stablecoin, there is real money saved that holds its value.

Then, we have “crypto-collateralized stablecoins.” These are a bit trickier. They use other digital monies as backing. To stay safe, they keep more digital money than stablecoins issued.

Lastly, “algorithmic stablecoins” are like smart robots. They work by rules set in code to keep their value. They don’t use real money or other coins to stay stable. Instead, they use smart ways to keep their price from changing too much.

No matter the type, all stablecoins aim for one thing: keeping their value the same, no matter how wild the crypto market gets. This makes it easier for us to use them for daily stuff like buying a sandwich or paying a friend back. They link the new world of crypto with the steady and reliable value we know from regular money, with skills to stay calm in turbulent markets.

The Different Flavors of Stablecoins

Fiat-Collateralized Stablecoins: A Glimpse into Digital Currencies Anchored by Traditional Assets

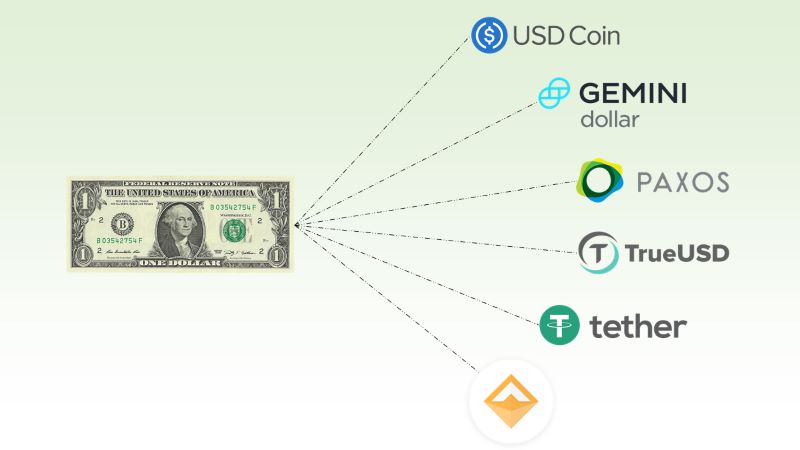

Picture your everyday dollar, but online. That’s the essence of fiat-collateralized stablecoins. They are digital currencies tied to real-world assets like dollars or euros. Think of it as an online voucher you can trade for something stable (e.g., dollars) anytime you want.

These stablecoins are the digital twins of regular money. They’re so tightly bound to an asset you know (like cash in a bank), they barely move in value. So, if you’re wary of the wild ups and downs in cryptocurrency, these stablecoins might just be the anchor you’re looking for.

Companies that create these stablecoins keep a bunch of real dollars or other assets stashed away. When you buy the stablecoin, they lock away an equal amount of the real thing. This way, the stablecoin’s value doesn’t dance to the wild cryptocurrency tunes. It stays put, calm and collected. One popular example is tether (USDT), whose name hints at its peg to the US dollar.

Crypto-Collateralized and Algorithmic Stablecoins: Innovations in Stability Mechanisms

Now, let’s venture into a more complex neighborhood: crypto-collateralized stablecoins. Here, instead of cold, hard cash backing up your digital currency, it’s another cryptocurrency doing the job. It’s like backing up gold with silver in the digital world. These types require more crypto to be stashed as security, just in case the values take a hit.

But why stop there? Enter algorithmic stablecoins, the smarty-pants of the bunch. No real money or other crypto propping these up. They use fancy computer programs (algorithms) that manage the supply of the stablecoins to keep their value from bouncing around. These can be trickier to understand and a bit more of a gamble. Their stability is all math and no treasure chest, changing the number of coins out there to keep prices steady.

What makes stablecoins truly shine, including USD coin (USDC), is their ability to bridge the gap between old school money systems and futuristic fintech. They are a part of both worlds, helping people pay for things and move money across the globe fast, without the headaches of regular banks or the queasy stomach from crypto volatility.

But, while stablecoins promise smoother sailing in choppy crypto waters, they carry their own risks. From the scary “what if” of regulatory changes to the horror story of a hack, the stable world of stablecoins can face storms too. Yet, they remain a cornerstone in the grand building of blockchain and stablecoins are spreading far and wide with their mix of safety and tech charm.

When it comes to types of stablecoins, these digital assets are the built-in shock absorbers of the crypto race car. Whether it’s a steady fiat-collateralized coin, a multi-backed crypto hybrid, or an agile, algorithm-fueled flyer, there’s a flavor for every taste in the quest for cryptocurrency stability.

Navigating the Advantages and Risks of Stablecoins

The Perks of Using Stablecoins Over Conventional Currency

Have you heard of stablecoins? These are a special kind of digital money. They’re like a steady ship in the wild storm of crypto prices. With stablecoins, you can buy and sell things just like with regular money, but it’s all online.

Stablecoins can be tied to everyday money, like dollars, or to other assets. This link helps them stay steady. Most of them don’t hop around in value as much as Bitcoin does. That’s great if you need to send cash across the world or pay for something without the price changing before you hit ‘send’.

Some stablecoins are called ‘fiat-collateralized.’ This just means they have real money in a bank to back them up. For every stablecoin, there’s a real dollar waiting safe and sound. This makes people trust that they’re worth something.

Then there are ‘crypto-collateralized’ stablecoins. They have a buffer using other cryptocurrencies. It’s like building a fort with different blocks to protect against the wild swings in value.

And how about those ‘algorithmic stablecoins’? They use smart software rules to keep their value. No real money or other crypto needed! They check the price and can make more coins or fewer to keep that price just right.

One of the big wows for stablecoins over regular money is how quick and cheap it is to send them. It doesn’t matter if you’re sending $10 or $10,000, it’s all done in a snap and you’re not shelling out loads in fees like you do at the bank.

Assessing the Risks: From Regulatory Hurdles to Market Volatility

Sure, stablecoins sound great, but what about the risks? First off, there’s the law. Lawmakers still aren’t sure how to handle these digital bucks. They want to make sure everything’s safe and honest. That means rules can change, and that can shake things up for stablecoin users.

Market trouble can also be a problem. If lots of people try to sell their stablecoins all at once, things can go south. The hard work behind keeping them stable is put to the test.

Even with those ‘real money-backed’ stablecoins, you need to trust that the bank actually has your back. Audits, where experts check the records, help, but it’s still about trust.

And here’s the thing: a stablecoin’s strength is all about its anchor. If it’s tied, say, to the dollar, and the dollar starts to slide, your stablecoin might do the same.

We’ve got big names like tether (USDT) and USD coin (USDC) – huge players in the stablecoin game. They’re massive and popular, which helps people feel good about using them.

Understanding stablecoins means getting why people pick them for their digital wallets. They can be a safe space when crypto prices do somersaults. But you’ve got to keep your eyes open for what’s happening in law and the market, too. Choose wisely, and stablecoins could be your best pal in the crypto world.

The Future of Stablecoins in the Financial Ecosystem

Integrating Stablecoins in Decentralized Finance (DeFi) and Traditional Banking

Let’s talk about stablecoins, friends! They are special kinds of digital money. These coins keep their value same, unlike Bitcoin or Ethereum which can change a lot. They are key to using crypto easily every day.

How do stablecoins maintain value?

Stablecoins stay stable because they are linked to things that do not change much in value. This can be regular money like dollars, or it can be other stuff like gold or a group of cryptocurrencies.

Unlike wild cryptocurrencies, stablecoins do not jump up and down in price. This makes them great for buying and selling things without worry. And when you earn interest from them, it’s like getting extra candy for being patient!

Folks are now putting stablecoins into DeFi, where people trade and lend money without banks. It’s like a giant online market that is always open. Because of stablecoins, people all over the world can join in, even if they do not have a bank nearby.

What are the types of stablecoins?

To keep it simple, there are three main kinds:

- Fiat-collateralized stablecoins are backed by real money, like dollars in a bank. Using them is like using a digital dollar bill.

- Crypto-collateralized stablecoins are backed by other cryptocurrencies. They are a bit trickier, but they still try to stay steady in value.

- Algorithmic stablecoins are not backed by money or other crypto. They use smart computer programs to keep their price right.

The Evolving Landscape: CBDCs, Stablecoin Adoption, and Legal Considerations

Stablecoins are getting more attention, not just from people but from countries too! Some countries are thinking about making their digital money, called CBDCs (Central Bank Digital Currency). It’s like the country’s own special stablecoin.

People are using stablecoins more because they can be sent quickly and do not cost much to move around. And they can be a safer bet than other cryptocurrencies when prices go up and down.

What is stablecoin regulation?

Governments are making rules for stablecoins to keep things safe and fair. They want to make sure stablecoins are really stable and people can trust them.

But why should we care? Stablecoins could change how everyone uses money. One day you might pay for your groceries with stablecoins on your phone! And they could help folks in places without good banks to save and send money safely.

Stablecoins might become just as normal as using cards or cash. So, it’s important we all understand what they are and how they work. They might just be the next big thing in how we all spend, save, and invest our money.

Remember, stablecoins mix the best of both worlds: the quick, digital ways of crypto and the steady value of regular money. And as the world gets more digital, stablecoins might just be the anchors we need in the wild seas of cryptocurrency volatility. Keep an eye on them, they’re set to sail far!

In this post, we dug deep into stablecoins. We started with the basics, explaining their role in smoothing out the wild ups and downs of crypto prices. Then, we looked at how these coins keep their value steady, even when markets go on a roller coaster ride.

We also tackled different types of stablecoins. You’ve learned about those backed by real-world money and the ones hooked to other cryptocurrencies or controlled by smart software.

Next, we talked about the good and the iffy parts of using stablecoins. They’re handy, yes, but they come with some risks and rules to think about.

Lastly, we peeked at what’s next for stablecoins. They’re making waves in online money and even in regular banks. New rules are coming, and everyone’s figuring out how to deal with these digital dollars.

Here’s the take-home: Stablecoins can make dealing with money online easier and safer. But, like anything else, you’ve got to play it smart. Keep an eye on the risks, stay informed, and you’ll be set. That’s the scoop on stablecoins. They’re a big deal now and will be even bigger in the future. Stay sharp!

Q&A :

What Exactly Is a Stablecoin in the Cryptocurrency World?

Stablecoins are a type of cryptocurrency designed to minimize price volatility by being pegged to a stable asset or basket of assets, such as fiat money (like the US dollar or the Euro), commodities (like gold), or even other cryptocurrencies. Their stability is achieved through a variety of methods, including collateralization (backing) or algorithmic mechanisms that control the stablecoin’s supply.

How Do Stablecoins Maintain Their Peg to the Dollar or Other Currencies?

Stablecoins maintain their peg through different mechanisms, depending on the type of stablecoin. Fiat-collateralized stablecoins, for example, hold reserves of a specific fiat currency (like USD) at a 1:1 ratio, allowing users to redeem their stablecoins for the equivalent amount of the underlying currency. Crypto-collateralized stablecoins use a surplus of cryptocurrency as collateral, often over-collateralizing to absorb price fluctuations. Algorithmic stablecoins, on the other hand, manage their supply automatically, contracting or expanding it in response to changes in demand to maintain the peg.

Can Stablecoins Be Trusted as a Safe Investment Compared to Other Cryptocurrencies?

While stablecoins are designed to be less volatile than other cryptocurrencies, their safety depends on the credibility of their backing and the robustness of their pegging mechanism. It’s important for investors to conduct due diligence on the stablecoin issuer, the audibility of the reserve assets, and the regulatory framework governing them. However, even with a well-structured system, stablecoins can still face risks that might affect their stability, such as market crashes or regulatory changes.

What Are the Most Popular Stablecoins Available Today?

The stablecoin market has several prominent players, some of which include Tether (USDT), which is pegged to the US Dollar, USD Coin (USDC), a stablecoin backed by a consortium called Centre, Binance USD (BUSD), which is issued by Binance in partnership with Paxos, and Dai (DAI), a crypto-collateralized stablecoin governed by an organization called MakerDAO. These stablecoins have gained popularity due to their stability and ease of use in the cryptocurrency markets.

Are There Any Specific Risks Associated with Using Stablecoins for Transactions?

As with any financial instrument, stablecoins come with certain risks besides the general crypto market vulnerabilities. These include potential regulatory actions that could limit their use or affect their value, the risk of failure of the issuer, and technical risks related to the blockchain technology they rely on. Additionally, much of the trust in stablecoins lies in the transparency of their reserve holdings and the frequency and thoroughness of audits conducted on those reserves. Changes in the perceived trustworthiness of stablecoin issuers can also lead to risks in their usage or acceptance.