Diving into the world of cryptocurrency can feel like entering a maze with no map. As a beginner, figuring out what crypto tools do beginners need? is the key to unlocking your digital wealth journey. But don’t stress! In this guide, you’ll get the simple, direct answers you need. From choosing user-friendly trading platforms to securing your shiny new crypto accounts with 2FA, it’s all about layering the right foundation. You’ll explore the high-security world of crypto wallets, understand why a hardware vault might just be your new best friend, and how real-time price tracking tools keep you in the know. We’ll decode the complex blockchain explorers, introduce you to the exchanges, and teach you portfolio management techniques that give you an edge. Finally, you’ll learn to combine technical and market analysis to make sharp, informed investment decisions. Ready to take control? Let’s unravel the crypto puzzle together.

Essential Foundations: Choosing The Right Cryptocurrency Trading Platforms

Exploring Options for Cryptocurrency Trading Platforms for Newbies

Picking your first crypto trading platform is like finding the right shoes. You want a fit that’s snug but comfortable and will support you on your journey. For newbies, it’s important to pick a platform that’s easy to use and understand. Think of it like a friend who simplifies the complex bits so you can learn to walk before you run.

A good platform will have clear guides for buying and selling. They also show real-time prices for different coins. This lets you make smart moves with your money. Plus, make sure they have solid support just in case you hit a snag. You can’t underestimate the peace of mind that comes with good customer care.

Remember, the world of crypto changes fast. Your chosen platform should keep pace, offering the latest coins and tech. This way, you’re never left behind as the market evolves. Also, look for places where they talk about safety a lot. That’s a good sign they take your security seriously.

Security First: Setting Up 2FA for Crypto Accounts

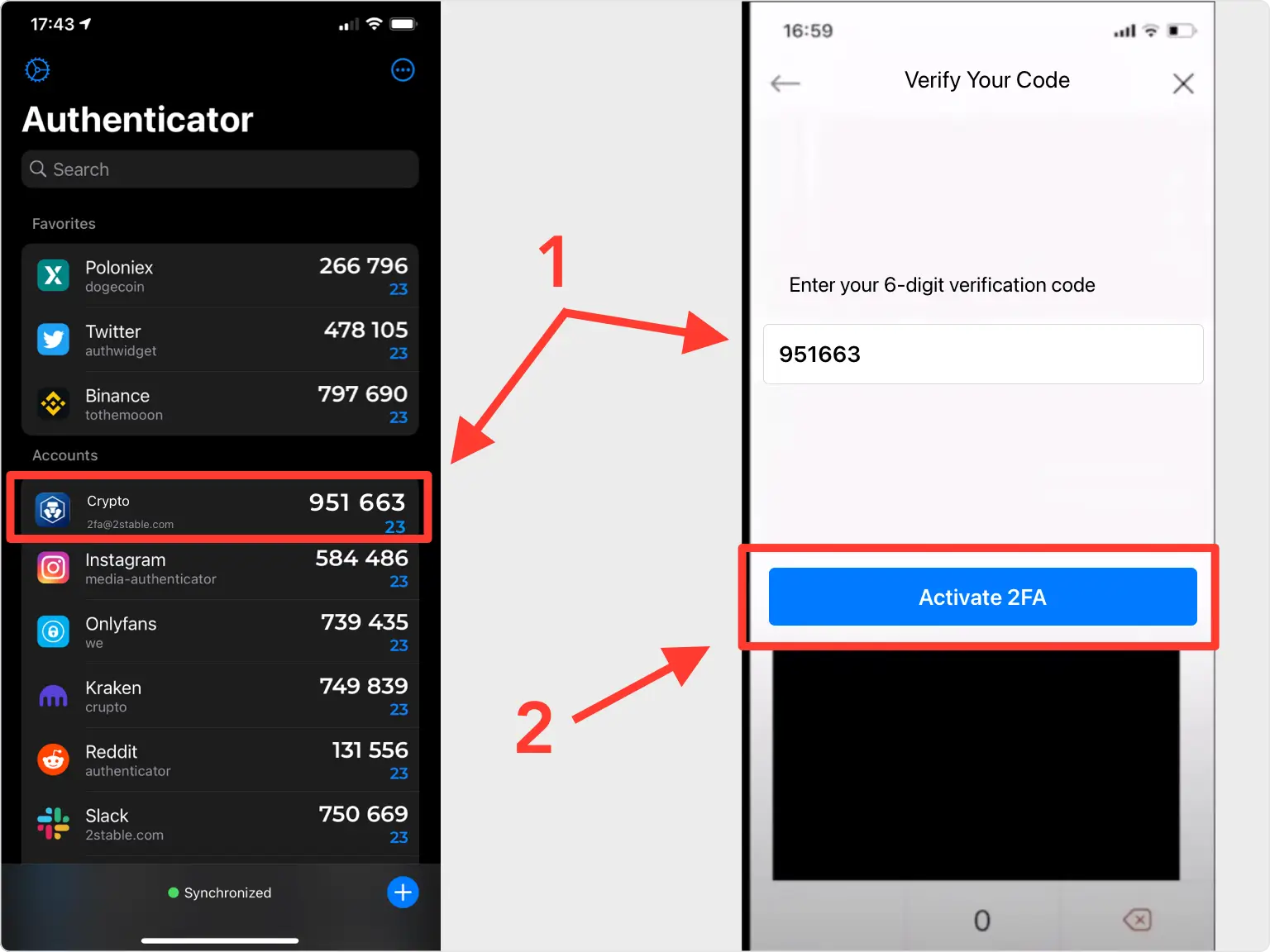

We all know that feeling when we can’t find our keys. It’s not fun. In the digital world, losing access to your crypto can be even scarier. To keep your coins from getting in the wrong hands, you need to set up two-factor authentication (2FA) on all your crypto accounts. This is your digital double-lock.

Enable 2FA on crypto wallet

Just like a second lock on your door at home, 2FA asks for another piece of info before letting anyone in. This could be a text with a code or a prompt from an app. Even if someone has your password, without this second key, they’re stuck outside.

Setting up 2FA is a breeze. Usually, you’ll find an option in the security settings of your crypto account. When you turn it on, they’ll guide you through the steps. It mostly involves getting a code on your phone or email. Once it’s set, every time you log in, you’ll have that extra layer keeping your account safe.

2FA is like your own digital guard dog. It might take an extra moment to log in, but it’s worth it for the peace of mind. So before diving into the crypto waves, make sure each account is snugly locked up with 2FA. It’s a simple step to keep your digital treasure secure.

The Key to Your Virtual Safe: Understanding Secure Crypto Wallets

Benefits of Hardware Wallets Versus Mobile and Desktop Options

Your crypto is like treasure. It needs a strong chest. This chest is a secure wallet. Secure wallets keep your crypto safe. Think of a hardware wallet as your treasure chest buried on an island. It’s a small device. You can hold it. It keeps your coins offline. This means hackers can’t reach it. No internet, no problem. Trouble comes. Your treasure stays hidden. Mobile and desktop wallets can be handy. They let you access your crypto fast. But they are like leaving your chest on the beach. More people can try to steal it. So, you’re more at risk. Remember, hardware wallets guard your treasure better. That’s key when sailing these digital seas.

Keeping Track of Your Digital Assets: Using Crypto Price Tracking Tools

You need to watch your treasure grow. Crypto price tracking tools help with that. These tools show live prices. They work 24/7. They follow the market like a hawk. Spot a storm or sunny day in coin prices. This gives you power. Power to decide. Should you buy more? Should you sell? Maybe hold steady? Price trackers tell you the crypto world’s heartbeat. They help you make smart moves. The moves that grow your treasure. Don’t sail the crypto seas without them. These tools make sure you’re never lost. They help keep your treasure map updated. Use them right, and set course for richer shores.

Navigating the Digital Ledger: Utilizing Blockchain Explorers and Exchanges

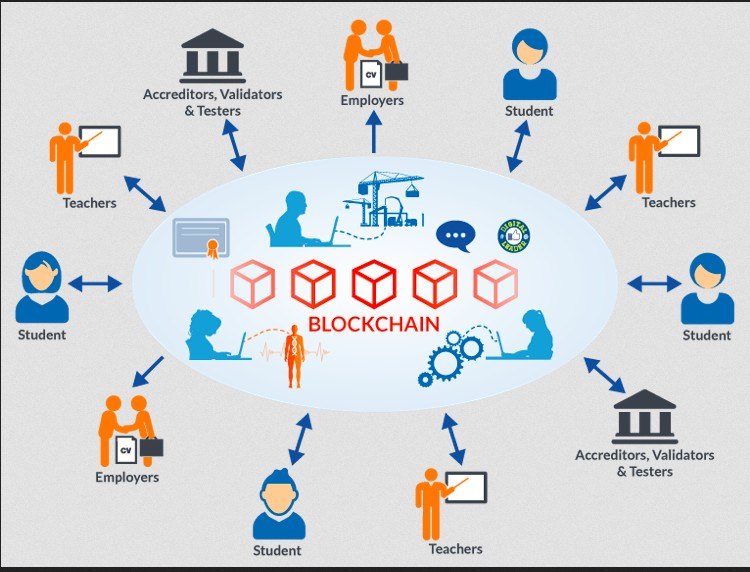

Deciphering Blockchain Explorers Usage for Transparency

Blockchains store all crypto deals. They’re public. To look inside this digital ledger, you need a key tool. That tool is the blockchain explorer. Think of it like a search engine. But instead of looking up websites, you find crypto transactions and activities.

How does it work? You input a wallet address, transaction ID, or block. Results show details like amounts, timestamps, and more. It’s great for checking transactions. This ensures that your digital cash moves as it should.

For beginners, this means peace of mind. You can confirm that your crypto buy or sell worked. You can also see how much crypto you have at any time. Just go to an explorer, type in your info, and there it is. This is crucial when moving to new wallets or tracking payments.

Let’s say you sent crypto but the other person hasn’t gotten it. Use a blockchain explorer. Check the status real quick. Maybe it’s not confirmed yet. Or perhaps there’s a small error. Whatever it is, the explorer helps you spot the issue.

Blockchain explorers are not all the same, though. Each crypto has its own. Some explorers have special features. They could show top wallet holders or even large transactions. This can be handy for seeing market moves. Large deals might hint at a price change for a crypto.

In short, blockchain explorers let you track crypto deals. They also help in understanding the whole market. These tools are like windows to the crypto world. New users can see all the action. They can learn how things work. It’s perfect for making sure your crypto travels safe and sound.

Mastering Digital Asset Exchange Basics for Effective Trades

Trading crypto is different from stocks. Digital asset exchanges are where you buy and sell crypto. They’re like traditional markets but for digital money. These platforms help change your dollars into crypto. You can also trade one crypto for another.

Getting started is simple. First, pick an exchange. Look at what cryptos they offer and their fees. Some exchanges are better for beginners. They have simple layouts and easy steps to trade. Others have more tools, like charts and analysis. These are great as you learn more.

Once you set up an account, you’re ready to trade. Add some money from your bank. Then you can pick which crypto to buy. After buying, you can hold it or trade it for others. The exchange keeps track of all your trades.

Safety first, though. Always use strong passwords. Turn on 2FA. That’s two-factor authentication. It’s an extra step for security. You use something you know, like a password. Then you use something you have, like a phone. That way, only you can get into your account.

Exchanges also show prices in real-time. So you can see the value of your crypto. Prices change fast. This lets you decide the best time to buy or sell.

Trading on these platforms can start off as a learning curve. But it’s key to growing your digital wealth. After a while, you’ll get the hang of it. You’ll see patterns in when to make your move.

Digital asset exchanges are powerful. They turn your trading ideas into action. With care and practice, you’ll be on your way. You’ll make those effective trades and master your crypto journey.

Building a Solid Investment Strategy: Portfolio Management and Market Analysis

The Art of Portfolio Management in Crypto

Managing a portfolio well is like steering a ship. You must balance it to avoid tipping over. With crypto, you need to mix different coins. This keeps your risk low. Early on, decide how much you’re okay with losing. Then, pick coins with care. Only use money you don’t need right away.

Start by learning the market. Look at the history and trends. Coins go up and down in value. Try not to put all your eggs in one basket. Spread your bets to guard against loss. Track your investments with apps. They’ll show your gains and tell you when to adjust. This way, you can respond fast to market changes.

Combining Technical and Fundamental Analysis for Crypto Investment

To pick winning coins, use both technical and fundamental methods. Technical analysis is like checking the weather. You spot patterns and predict what comes next. Look at charts and learn the signs that prices may rise or drop. It’s a tool to time your trades right.

Fundamental analysis digs deeper. It’s understanding the why behind coin movements. This includes the coin’s purpose, team, and tech. It also looks at market news and global events. Both methods together guide you to smarter choices. They give you clues on what coins might do well long-term. Use both to improve your investing skills.

In crypto, knowledge is power. Reading whitepapers and news sites is a must. They teach you the ropes so you can sail through market waves. They help you spot good and risky bets. By using secure wallets and tracking tools, you keep your coins safe and watch their progress. Staying in the loop with these tools is smart. It’s your ticket to a well-managed crypto journey.

In this post, we’ve walked through key steps to smart cryptocurrency actions. We started off looking at the best trading platforms, especially for those just starting out. We stressed how important strong security, like 2FA, is for your crypto accounts.

Then, we talked about secure crypto wallets. We saw hardware wallets usually beat mobile and desktop ones for keeping your coins safe. We also checked out tools that help keep an eye on your coin prices.

We moved on to exploring blockchain and exchanges. Using blockchain explorers can show you where your crypto’s going. Plus, knowing how to trade on exchanges is vital for buying and selling.

Lastly, we shared how to manage your crypto investments and use market analysis to make smart choices. This includes looking at both the math and the big picture behind your investments.

So, keep these tips in mind as you dive into crypto. Use good platforms, protect your accounts, choose the right wallets, and manage your investments wisely. You’ve got this!

Q&A :

What essential tools should every crypto beginner consider using?

Investing in cryptocurrencies can be an intimidating endeavor for beginners, but having the right set of tools can make the process more accessible and secure. To start, beginners should consider utilizing a reliable cryptocurrency exchange for buying, selling, and trading digital assets. A secure hardware wallet is vital for keeping your investments safe from online threats. Additionally, portfolio trackers and market analysis apps can help newcomers stay informed about the trends, while educational resources like forums, blogs, and online courses are crucial for understanding the rapidly evolving crypto ecosystem.

How can beginners choose the best cryptocurrency exchange?

For those just stepping into the world of digital currencies, selecting an exchange is a critical decision. Beginners should look for exchanges that prioritize security, user-friendliness, and customer support. It’s also essential to verify the exchange’s legal compliance and whether it’s regulated in the user’s jurisdiction. Fees, available cryptocurrencies, and payment methods are other factors to consider. Beginners should start with well-established and reputable exchanges before branching out.

Is it necessary for beginners to use a hardware wallet for crypto storage?

While not mandatory, hardware wallets are highly recommended for cryptocurrency storage, especially for those who are serious about their digital asset security. These physical devices offer enhanced security by storing cryptocurrencies offline, thereby protecting them from online hacks. For small amounts or for those just experimenting, a software wallet might suffice initially. However, as the investment grows or if the individual seeks extra peace of mind, a hardware wallet becomes an increasingly wise investment.

What are the benefits of using crypto portfolio trackers for beginners?

Crypto portfolio trackers are invaluable for beginners as they provide a comprehensive view of all their cryptocurrency holdings in one place. They allow users to monitor their assets’ performance in real-time, analyze profits and losses, and observe market movements. This information can be pivotal in making informed trading decisions and in understanding how different events affect their portfolio’s value.

Can market analysis apps help novice crypto investors, and if so, how?

Market analysis apps are essential tools for anyone in the crypto space, including beginners. These apps deliver real-time data, news, and charts, which are crucial for understanding market trends and making timely investment decisions. They typically offer a range of indicators and analytics that can guide beginners through the complexities of market sentiment, trading volumes, and price fluctuations. Although there is a learning curve associated, these apps can significantly contribute to a novice investor’s ability to navigate the crypto markets more effectively.