Navigating the types of crypto wallets is more than just tech-speak; it’s the cornerstone of keeping your digital coins safe. Picture this: you’ve invested in digital currency, now what? Storing them becomes your top priority. You’ve got hot wallets online, cold ones offline – think of them as your digital bank and home safe. But which one matches your life? Let’s not leave out hardware versus software wallets. The former is like a vault, while the latter keeps things at your fingertips. And the choices don’t stop there. Whether you shuffle many coins or stick to one, the right wallet makes all the difference. Get this – some even require multiple keys! It’s like having a secret handshake to guard your hard-earned assets. Dive in as we unveil the power of securing your digital wealth, ensuring peace of mind as your crypto portfolio grows.

Understanding Hot vs. Cold Crypto Wallets

The Essentials of Hot Wallets

Hot wallets are like the wallet you carry in your pocket, but for digital coins. They are always online, making them easy to use for quick payments and trades. Think of mobile wallets on your phone and desktop wallets on your computer. They need an internet connection to let you access and send your coins.

Hot wallets are handy because they connect directly to the crypto world. They’re perfect for daily use, just like the apps you know and love. But there’s a catch – since they’re online, they could be more open to hacks. This is why keeping only a small amount of your coins in a hot wallet is wise, ready for daily use.

The Security Advantages of Cold Storage Wallets

Now, cold storage wallets are the safe in your digital coin bank. They are not connected to the internet, so they’re super safe from hackers. Hardware wallets, like little devices you can hold, are one type. They store your coins offline but can plug into a computer or phone when needed. Paper wallets, with your coin info printed out, are another kind.

Because they’re offline, cold wallets are like your savings account. They’re great for keeping more coins safe for the long run. You won’t have the quick access you get with hot wallets, but you’ll have more peace of mind. The trade-off is between convenience and high security. When your coins are tucked away in a cold wallet, they’re away from the online dangers.

Choosing between hot and cold wallets depends on what you want to do with your coins. For daily spending or trading, hot wallets work best. But for saving your coins, cold wallets are the way to go. Both types have their place in managing your digital wealth. Remember, a mix of both might be the best plan for keeping your coins safe and useful.

Types of Crypto Wallets

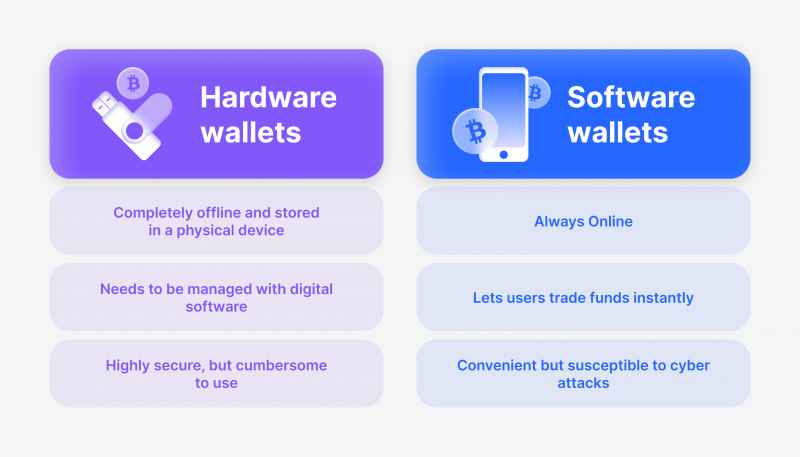

Hardware vs. Software Wallets: Which is Right for You?

The Robust Security of Hardware Wallets

Imagine your crypto stored safe and sound. This is what hardware wallets offer. They are like secure vaults for your digital coins. These tiny devices connect to your computer but keep your coins offline. Offline storage means they’re safe from hackers. Think of them as small keys to unlock your online riches, except these keys don’t get copied easily.

What makes them stand out? Top-notch security. Each time you transact, you confirm it physically on the device. It’s like adding an extra lock on your digital wealth. You might ask, “Are these devices a type of cold storage wallet?” Yes, they are the best. In cold storage, your crypto is away from the internet, away from danger.

Now, you may wonder about lost or damaged wallets. No cause for panic. With your secret recovery phrase, you can get back your coins. Keep that phrase locked away and safe. Costs might be a bit more, but peace of mind is priceless.

The Convenience and Accessibility of Software Wallets

Software wallets bring your coins to your fingertips. They live on devices you use every day like phones and computers. Think of them as your digital pocket for crypto. They’re ready to use, anytime, anywhere. You can trade, spend, or receive crypto with just a few taps or clicks.

Why do people like them? Simple: easy access. You can check your balance in seconds or send crypto as fast as an email. With mobile and desktop options, they fit into your daily life. You might ask, “Are these always online? Like hot wallets?” Exactly. Since they’re internet-ready, we call them hot wallets.

They’re free or low-cost, making them great for beginners. But remember, being online means you must be extra careful. Scams and malware can threaten your crypto. Yet, software wallets have layers of security too. Think passwords, two-factor authentication, and backup options.

So, what’s right for you? It depends on your needs. If security is your biggest worry, hardware wallets are your best bet. If you need quick access and no extra costs, software wallets work well. Start with what you value most: safety or convenience. Then, explore the options within each type. Remember, the right choice keeps your crypto safe and serves your unique needs.

In choosing the best crypto wallets, consider your lifestyle. Are you often on the move or mostly at home? Do you invest a little or a lot? Your wallet needs to match your daily life. And don’t forget, combining both types could offer you the best of both worlds. Use a software wallet for spending and a hardware wallet for saving. Together, they keep your digital wealth secure and within reach.

Take your time, and choose wisely. Your crypto is your future. Secure it in a way that works best for you.

Multi-Currency vs. Single Currency Wallets and Multisignature Protection

Choosing Between Multi-Currency and Single Currency Wallets

When diving into crypto, you’ll need a wallet. Think of it like a digital pocket. You have two main types: multi-currency wallets and single currency wallets. Here’s the deal: If you want to keep many types of coins in one place, a multi-currency wallet is your go-to. It’s like a Swiss Army knife for crypto.

Is your focus only on Bitcoin or another single coin? Then a single currency wallet fits the bill. It’s less complex and could be more secure since it does just one thing well. But remember, no one size fits all here. It’s about your personal crypto journey.

Enhancing Security with Multisignature Wallets

Imagine a vault that requires multiple keys to open. That’s what multisignature wallets are about. They add an extra layer to your crypto castle walls. You need more than one private key to sign a transaction. This is ace for security.

Let’s break it down. Normally, a wallet has one key. If someone gets it, your coins could vanish in a flash. With multisignature wallets, even if someone steals a key, they can’t do much without the others. Think Ocean’s Eleven, but you’re stopping the heist on your digital wealth.

hard wallets

For a group or a company, multisignature comes in clutch. It stops one person from making a money move without others saying OK. Plus, it keeps everyone honest and in check.

Being smart with wallets keeps your digital coins safe. That’s priceless peace of mind, right? Whether you’re stacking different cryptos or riding solo with one, you’ve got options. And if keeping your crypto super secure is your goal, multisignature wallets might just be the secret sauce you need. Keep in mind, it’s not just technology that keeps you safe but also being wise with your choices. Choose your wallet like you choose a trusty friend – wisely and after some good thought.

Advanced Crypto Wallet Security and Management Features

Biometric and Multi-Factor Authentication Methods

Keep your crypto safe as houses. Adding layers of security is key. Think of your digital wallet like a fortress. You want it tough for intruders to break in. Enter biometric and multi-factor authentication. They are your guards on the walls.

What is biometric authentication in wallets? It uses your unique body features. Like fingerprints or face scans. These things are yours alone. So, it’s super tough for someone else to fake.

And multi-factor authentication? It asks for two or more proofs before you get in. Like a password plus a text code. Like asking for a secret handshake and a password. It’s a one-two punch against thieves.

Now, what about recovering access? Let’s say you lose your phone. Or forget a password. You need a backup plan. That’s where seed phrases come in.

Effective Backup Solutions and Seed Phrase Importance

Everyone needs a Plan B. A crypto wallet backup is yours. The most common method here is a seed phrase. It’s a string of words. Not just any words. They are the master key to your wallet.

Why a seed phrase in a crypto wallet? If all else fails, this seed phrase saves the day. Scribble it down. Store it somewhere safe, maybe in a safety deposit box. Or split it. Give half to a trusted friend or keep it in separate places.

Here’s why it’s a lifesaver for your digital wealth. Lose your device? Get a new one and enter the seed phrase. It’s like a world tour for your crypto. Anywhere you land, punch in the words and you’re good to go.

Remember, guard that seed phrase with your life. If someone else nabs it, they grab your crypto. Keep it secret. Keep it safe. It’s the one key you don’t want to lose.

In short, two steps for rock-solid crypto security. First, set up biometric and multi-factor bits. They’re your digital bouncers. Second, jot down your seed phrase. Treat it like treasure. With these, you’ll sleep tight knowing your digital wealth is locked up tight.

In this post, we dove into the digital world of crypto wallets. We explored hot wallets, with their easy access but lower security, and cold wallets, which offer higher security but less convenience. We also unpacked the differences between hardware and software wallets – choosing either the solidity of hardware or the ease of software is up to you.

How about keeping multiple coins? We covered that, too. Multi-currency wallets give you diversity, while single currency wallets focus on one. Multisignature features add an extra layer of protection.

Don’t forget the advanced features: biometric security and multi-factor authentication add strength, and knowing how to back up your wallet can save your digital treasure.

Every choice in crypto management shapes your security, access, and ease. Make your pick wisely. Stay safe out there! Follow Dynamic Cryto network to update more knowledge about Crypto.

Q&A :

What are the different types of cryptocurrency wallets?

Cryptocurrency wallets can primarily be categorized into two groups: hot wallets and cold wallets. Hot wallets are connected to the internet and include desktop wallets, mobile wallets, and online or web wallets. On the other hand, cold wallets are offline storage options and include hardware wallets and paper wallets. Each type offers varying levels of security and accessibility to meet different needs of crypto users.

How do hardware wallets differ from software wallets?

Hardware wallets are physical devices that store cryptocurrency offline, providing enhanced security by being less vulnerable to online hacking attempts. They work by signing transactions with private keys in an isolated environment within the device. Software wallets, or hot wallets, are either desktop or mobile applications that are connected to the internet, making them more convenient but slightly less secure than hardware wallets due to the potential for online risks.

Can you explain what a paper wallet is and how it works?

A paper wallet is one of the simplest forms of a cold storage wallet for cryptocurrencies. It involves printing or writing down a cryptocurrency address and its associated private key on a piece of paper. Once done, funds can be sent to the printed address. Accessing or spending the funds requires importing the private key into a software wallet. While paper wallets can be extremely secure against digital threats, they are vulnerable to physical damage and loss.

What is the purpose of a mobile crypto wallet?

A mobile crypto wallet is an app on your smartphone that stores your crypto assets and allows you to manage, send, and receive cryptocurrencies directly from your mobile device. The purpose is to offer both convenience and mobility, enabling users to access their assets and make transactions on-the-go. Mobile wallets typically include various security features like PIN codes, biometric authentication, and backup options to keep funds secure.

Are web wallets safe for storing cryptocurrencies?

Web wallets, stored online and accessed via browsers, offer a trade-off between convenience and security. They are generally considered less secure than offline alternatives because they are susceptible to online threats such as hacking, phishing, and malware. However, reputable web wallets employ various security measures like two-factor authentication, SSL/TLS encryption, and regular security audits to minimize risks. It’s advisable to use web wallets for smaller amounts of cryptocurrency and ensure that you’re using trusted platforms with robust security practices.