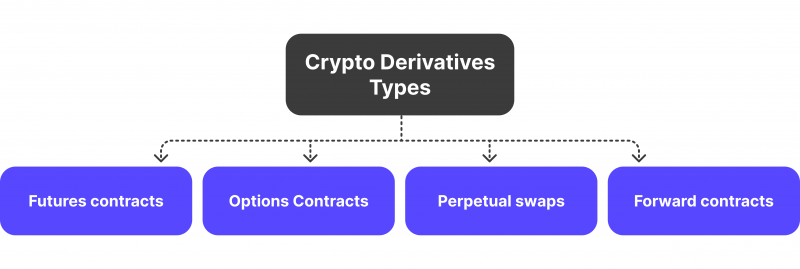

Dive into the Types of Crypto Derivatives: a world where digital assets meet limitless possibilities. These tools—a must-know for any trader—open doors to hedge risk or bet on prices. From the get-go, you’ll find out how these complex beasts work, from basics like futures and options to more exotic instruments. And you’ll see why they’re key to savvy trading moves. Buckle up; it’s not just about knowing but mastering the art. Ready to become a pro? Let’s unravel this puzzle together.

Understanding the Crypto Derivatives Market

Exploring the Basics of Crypto Futures and Options

Let’s dig into crypto futures and options. These cool tools help traders make money by guessing future prices. With crypto futures, you agree to buy or sell a digital coin at a set date and price. So, if you think Bitcoin’s price will rise, you’d buy a Bitcoin future. Then, if the price jumps as you predicted, you can sell it at a profit. Simple, right?

Options are a bit different but just as neat. They give you the right to buy or sell at a fixed price, without the must-do part. It’s like having a special key that you can choose to use or not. If Bitcoin’s price goes the way you hoped, you can use your key. If not, no sweat – you just let it go.

The Significance of Derivatives in Risk Management and Price Speculation

Now, why do these matter? Crypto derivatives are big deals for risk management and guessing prices. They’re like shields that keep your cash safe when prices go wild. Imagine betting on Ethereum’s price without losing your shirt if things go south. That’s what Ethereum contracts can do.

Traders also love to make bets on price moves. You think the price will zoom? Buy a future or option. If you’re right, you make money. If wrong, well, you only lose a bit. It’s all about smart betting and staying cool when prices move up and down.

These tools aren’t just for big shots. Anyone can try them. Just learn the ropes, start small, and always play it smart. Remember, it’s your money, so keep a sharp eye on it!

Diverse Derivatives: From Perpetuals to Swaps

Perpetual Swaps in Cryptocurrency: A Deep Dive

Perpetual swaps are like futures but they have no expiry. This means you can hold a position as long as you want. They track the price of an asset, like Bitcoin. In this way, you can bet on the price going up or down. Your profit or loss depends on this. Perpetual swaps in cryptocurrency use a mechanism to keep prices in line with the spot market. They do this through funding rates. If the rate is positive, longs pay shorts. If it’s negative, the opposite happens.

Now, let’s get into the meat of how these work. When trading these, you’re using leverage in crypto trading. You can control more than you have. This can multiply gains, but also amplify losses. So, tread carefully. Keeping up with the perpetual swaps in cryptocurrency scene means you understand the high risks and rewards.

Cryptocurrency Swaps and their Role in Hedging Strategies

Cryptocurrency swaps allow traders to exchange one asset for another. This can be to limit risk or to gain exposure to different cryptocurrencies. They form a key part of crypto hedging instruments. Hedging is about reducing your risk in the market. Using swaps, you can protect against price drops by locking in a price today for a future trade.

Let’s break down why swaps are a go-to for hedgers. If the market dips and you’re holding swaps, you’re better off. You’ve locked in a price that can serve as a safety net. They’re assets in the crypto derivatives market, they allow for movement between different coins without a major cash exchange. At their core, they are about making your portfolio safer, using smart moves.

Hedging with swaps isn’t a guarantee against loss, but it resembles insurance. By choosing swaps, you’re planning ahead, ready for what the market throws at you. These tools are parts of your safety gear as a trader. They steady your ride on the often-bumpy crypto roads.

In sum, the world of crypto derivatives is rich and complex. Perpetual swaps offer flexibility and leverage to bold traders. Swaps in cryptocurrency extend that boldness to the art of hedging. Both play vital roles in the modern trader’s toolbox. They offer new ways to navigate the digital waves of the cryptocurrency markets.

Leveraging Derivatives for Advanced Trading Strategies

Navigating Leverage Tokens and Margin Trading in Crypto

Leverage tokens are a game-changer. They magnify your gains without the usual margin mess. They’re like turbo-powered crypto that moves more than the regular kind. You can win big or lose just as much, so it pays to be careful.

Margin trading is like trading on steroids. You borrow money to trade more than what you have. This can boost your profits if the market goes your way, but it can also hit you hard if it doesn’t. Always measure the depths before you dive into margin trading.

Scalping, Hedging, and Arbitrage with Derivatives

Scalping in crypto means quick trades to nab small gains. It’s like being a ninja in a market that never sleeps. You hop in, cut the profit, and jump out before anyone notices. It takes focus and speed, and derivatives make this easier.

Hedging is your safety net. It’s like insurance for your trades. You use crypto derivatives to brace for a fall, so you don’t get hurt if the prices crash. It’s a smart move to protect your cash.

Arbitrage is like finding money on the street. It’s when you spot price differences for the same crypto on different exchanges. You buy low, sell high, and pocket the difference. With derivatives, this can be slicker and quicker.

In each method, risks lurk, so know your game plan. Trading derivatives isn’t for the faint-hearted. It’s for those who learn, adapt, and play it smart. Dive in, but keep your head above the water.

Compliance and the Future of Crypto Derivatives

Navigating Crypto Derivatives Regulation and Compliance

Crypto futures explained: they’re like promises to buy or sell crypto at a set price on a future date. Bitcoin options are rights to buy or sell Bitcoin at a certain price before the option expires. Ethereum contracts work in a similar way for Ether. Perpetual swaps in cryptocurrency let you trade assets with no end date, unlike futures that have to settle on a specific date.

Crypto options trading involves bets on crypto prices, with fewer risks than owning coins outright. Digital asset forwards are contracts to buy assets later at a set price today. They require deep understanding to use well. Decentralized finance derivatives help you deal on a blockchain without middlemen.

We need rules to keep these markets safe and fair. The crypto derivatives market is huge, and without rules, things can go wrong. Imagine there are no traffic lights; cars would crash! That’s why crypto derivatives regulation matters. It sets the “traffic lights” for trading.

Leverage in crypto trading lets you trade more than you have. This can mean big wins but also big losses. Risk management with derivatives is key. It helps control how much you could lose if prices move against you.

Decentralized options platforms give power to the users. They cut out the middleman. Crypto insurance contracts can protect your trades against sudden big losses. Synthetic assets in DeFi are like normal assets, but they exist only on the blockchain.

The Role of Smart Contract Derivatives in Decentralized Finance (DeFi)

Smart contract derivatives in DeFi use blockchain contracts for trading. This sounds complex, but it means trades happen automatically when conditions are met. Think of it like a vending machine for financial trades. No human is needed to check the trade; the machine just does it.

Blockchain-based futures use the blockchain to make futures trading safer and more transparent. Pricing crypto forwards means deciding how much they’re worth, which can be tricky in the fast-moving crypto world. Crypto structured products mix different types of investments into one package, often to reduce risk or bet on outcomes.

The rise of DeFi means more people can get into crypto without big banks. This is great, but it also means we need to be careful. We don’t want a “wild west” where anyone can get hurt. Smart contracts make sure trades are fair, but we need watchdogs too. They check everything and keep traders safe.

Crypto derivatives exchanges are places to buy and sell these contracts. Their job is to make sure everything runs smoothly. Understanding perpetual futures is essential because they shape the crypto trading world.

Crypto derivatives risks are like the risks in any market: prices can change fast. Ethereum options trading and Bitcoin futures contracts are popular, but you can lose a lot if you’re not careful. Altcoin derivatives extend these concepts to other cryptocurrencies, not just Bitcoin or Ethereum.

Margin trading crypto means borrowing money to make bigger trades. This can multiply your wins, but also your losses. Leverage tokens are a bit like that, but they’re more complex. Volatility indices cryptocurrency track how much crypto prices jump around, which is important for traders.

You have to be smart and safe when you trade these products. That’s why knowing all about them, their risks, and the rules is so important. It’s like learning to swim before jumping into the ocean. This makes sure you can float and not sink.

In this post, we dove into the crypto derivatives world. We started with the basics of futures and options, showing how they can help with risk and betting on prices. Next, we looked at different types like perpetuals and swaps, explaining their part in smart money moves. We then tackled advanced trading methods, discussing leverage tokens, margin plays, and smart tactics like scalping. Lastly, we talked about the rules and what’s ahead for crypto derivatives, highlighting smart contracts in DeFi.

I think crypto derivatives are powerful tools. They could change how we trade and manage our crypto cash. We must track the rules and stay sharp. That way, we can use these tools well and keep our investments safe. Always learn and keep up with new info. It’s how you win in crypto trading. Stay smart and trade smarter!

Q&A :

What are the different types of cryptocurrency derivatives?

Cryptocurrency derivatives are financial instruments whose value is derived from the underlying cryptocurrencies. The most popular types include Futures, Options, Swaps, and Contracts for Difference (CFDs). Futures are contracts to buy or sell an asset at a predetermined future date and price. Options provide the buyer the right, but not the obligation, to buy or sell an asset at a specific price before a certain date. Swaps involve exchanging cash flows or other financial instruments, often to swap between fixed-rate and variable-interest rates. CFDs allow traders to speculate on the price movement of cryptocurrencies without actually owning the underlying asset.

How do crypto derivatives work and what purpose do they serve?

Crypto derivatives work by allowing traders to bet on the future price movements of cryptocurrency without needing to hold the actual cryptocurrency. They serve various purposes such as hedging, which is protecting against price movements; spreading, which involves taking advantage of the price differential between markets or products; and leveraging, which provides the ability to gain greater exposure to the market with less capital. Derivatives can also offer opportunities for arbitrage and provide a platform for investors to express complex market views.

Are cryptocurrency derivatives regulated?

The regulation of cryptocurrency derivatives varies by jurisdiction. In some countries, they fall under the same regulatory framework as traditional financial derivatives, while in others, the space is less regulated. Entities trading these products may be subject to Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, and platforms offering these services may need to be registered as exchanges, depending on the local laws. It is advisable for investors to conduct due diligence on the regulatory status of cryptocurrency derivatives in their respective regions.

What risks are associated with trading crypto derivatives?

Trading crypto derivatives carries several risks including market risk due to the volatile nature of cryptocurrencies, liquidity risk which is the challenge of entering or exiting positions, counterparty risk where there is a possibility the other party may default, and operational risk associated with the technology or platform used for trading. Other risks include regulatory changes and leverage, which can amplify both gains and losses, potentially leading to the loss of more than the initial investment.

How do I start trading in cryptocurrency derivatives?

To start trading in cryptocurrency derivatives, one must first select a reliable and regulated trading platform or exchange that offers these financial products. Next, traders typically need to sign up, verify their identity to adhere to the regulatory requirements, and then deposit funds or cryptocurrency into their trading account. Before executing any trades, it is crucial to understand the derivatives contracts offered, their specifications, and to have a well-defined trading strategy that includes risk management techniques. Additionally, education on the dynamics of the cryptocurrency markets and derivative instruments is recommended for anyone considering trading.