Dive into the blockchain world! Accessing the right top crypto tools for beginners is like finding a treasure map in the digital age. It’s not just about buying and selling; it’s about smart moves and solid strategies. With this guide, you’ll get the essentials—platforms, wallets, analysis tools, and even tax help. Let’s make your journey safe, savvy, and structured. Step into the crypto ring equipped and ready!

Starting Your Crypto Journey: Essential Platforms and Wallets

Choosing Cryptocurrency Trading Platforms for Novices

Diving into the world of crypto can feel like opening a Pandora’s box. The number of cryptocurrency trading platforms for novices may seem endless. As a beginner, where do you start?

First, look for simplicity and security. These are key when you’re new. You want a platform that makes buying and selling clear-cut and keeps your money safe. For new users, big names like Coinbase or Binance are often advised. They are easy to use. Plus, they teach you as you go.

Each platform has its own perks, like lower fees or more coins to pick from. Some platforms have tools that help beginners understand the market. Don’t rush. Start with one that seems the most user-friendly for you.

Remember, fees matter! Each trade can have costs that add up. Check the fees before you start.

Lastly, ensure the platform serves your country and follows local laws. This step is very important. You don’t want to get stuck, unable to use your money!

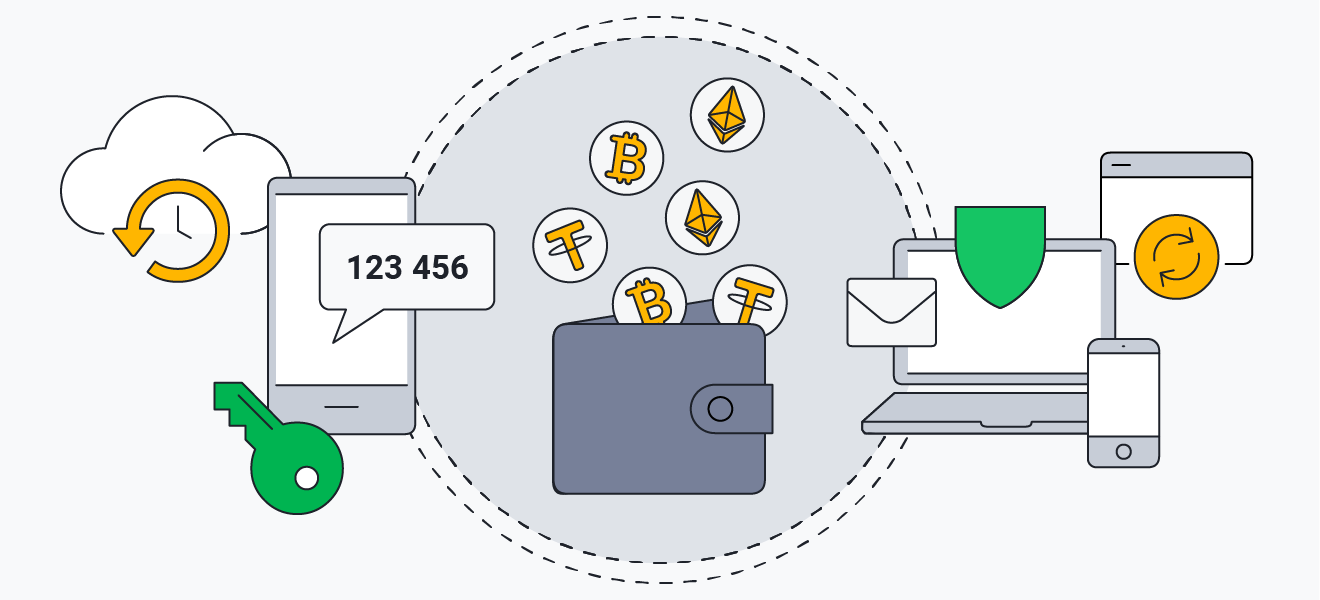

Beginner’s Guide to Digital Wallets

Next, let’s talk about keeping your digital cash safe—your digital wallet. Think of it like a real wallet, but for crypto. A good digital wallet is like having a strong safe. It stores your money securely.

You have two main choices: hot wallets or cold wallets. Hot wallets connect to the internet. Cold wallets do not. Beginners often start with hot wallets. They are user-friendly and free. Apps like Trust Wallet or Exodus fit this description and can link to your trading platform.

Unlocking Digital Wealth

But for higher security, cold wallets are best. Trezor and Ledger are popular options. They cost money but are safer as they stay offline. This choice means fewer chances for thieves to get in.

Most importantly, set up all security steps offered. This means passwords, backup phrases, and two-factor authentication. Losing access can be costly. Always write down and safely store your wallet’s backup phrase!

In the end, the right tools make crypto less scary and more exciting. Take your time learning and choosing. Ask questions. Read up. And always think safety first!

Navigating the Crypto Markets: Analytics and Education

Simple Blockchain Analysis Tools

Crypto can seem like a maze. But fear not! You’ve got tools to help! To start, let’s chat about simple blockchain analysis tools. They’re like your crypto treasure map. These tools show who is buying and selling. You’ll see wallet addresses and their activities. It’s like peeking into the world’s checkbook!

Simple tools can track where a coin comes from and goes. They use graphs and charts to make it easy. Some are free, which is great for your wallet. Think of them like a tracking number for your mail, but for crypto. They are a must-have to stay smart in crypto. Always remember, knowledge here is pure gold!

Educational Resources on Cryptocurrency

Now let’s talk learning! Education in crypto is like learning to ride a bike. It seems hard at first, but it gets easier. Want to understand how Bitcoin works? Or what ‘blockchain’ even means? Start with online guides and videos. They are everywhere and most are free. You’ll find them on websites, YouTube, or even podcasts. Look for ones made for beginners.

Books are your friends, too. They can dive deep on topics you like. Find them at your local library or bookstore. Also, many sites offer courses. Many do not cost much. They walk you through steps, like a personal coach for crypto.

Don’t forget about forums and communities. Think of them as your team in the crypto game. People there love to help and share tips. They were once new, just like you. They can make your crypto path less bumpy.

And that’s your crash course in tools and learning. With these, you’re ready to dive in and swim in the big crypto ocean! So, let’s grab those tools and soak up all the crypto knowledge we can!

Optimizing Your Investments: Taxation and Portfolio Management

Finding Easy Crypto Tax Software

Let’s talk taxes—crypto style. I know, it can sound dull. But, with the right tools, it’s a breeze. You’ll need easy crypto tax software. This is a digital tool to crunch your crypto tax numbers. It figures out what you owe or get back come tax time.

This tool is a champ for anyone in the crypto game. It sorts your trades and figures out gains or losses. It also keeps up with tax rules, which change a lot. You want to stay cool with the tax folks, right?

Now, many ask, “What’s the best software for this?” Look for one that’s smooth to set up and use. It should track trades from various platforms without hiccups. It plugs into exchanges and wallets, chewing through data to give real numbers. This means less grind for you.

On the hunt for good software? Some sites let you compare. These reviews can guide you to pick the right one for your needs. Just make sure it ties well with the tax system where you live. Each place can be a bit different, so it’s key to get that right.

User-Friendly Portfolio Trackers

Next up are portfolio trackers. They are your investment’s command center. Think of them like GPS for your crypto journey. They show you where your money’s at, how it’s doing, and where it might go next.

When you’re new, the simpler, the better. User-friendly means it’s clear and not hard to get your head around. You want one that lets you see your whole crypto world in a snap. Ideally, it shows your coins, values, and changes without puzzles.

These trackers help you understand how your crypto moves day by day. This can help you make smart choices on what to buy or sell. They send alerts when prices leap or dip. You can act fast with that info.

Sometimes folks ask, “which tracker should I use?” Start with a free one. They’ve got plenty of power to help you begin. Just like tax software, some sites compare these tools. These points can help you decide what’s best for your style.

Good trackers blend with other apps and services you use. This is so you don’t need to jump between too many places. It’s all about making life easier, remember?

And there you have it. Tax software and trackers are two top tools for any crypto beginner. They keep you sharp and ready for tax time. They also guide you on your investment path. With these in your kit, you’re set to boss your crypto journey.

Enhancing Security and Investment Strategies

Crypto Security Practices for Beginners

In the crypto world, your money’s safety is rule number one. To keep your coins safe, you need the right habits and tools. Always be careful out there, and here’s how:

First, learn the basics of digital wallets. They’re like your online bank account for crypto. But it’s not just about having one, you need to keep it secure. Pick a wallet that suits you and has strong safety features. User-friendly wallets make this easier for starters.

As a pro tip, use a secure hardware wallet. They’re like a safe for your digital cash. They keep your crypto offline, away from online thieves.

Never forget your key. It’s a secret code that locks and unlocks your wallet. Write it down, keep it safe, and don’t share it!

Important features to consider when choosing a crypto wallet

Always double-check who you’re sending crypto to. One wrong letter in an address and poof, it’s gone. No take backs in crypto.

Update your software often. This keeps your defenses sharp against hackers.

And when you’re on the move, use mobile apps with a good rep. They can help you trade and keep up with your coins.

Last, but important, is KYC – “know your customer”. It’s a check done by exchanges to know who’s who. It’s a safety thing, even if it takes a bit of time.

Identifying Trustworthy Crypto Projects and Avoiding Scams

Let’s talk game plans for finding safe projects and dodging the sketchy ones. There are a ton of cryptocurrencies. Not all are good bets.

Start by learning the lingo. Terms like “blockchain” and “market cap” can be confusing. There are glossaries out there that can help. Knowing the terms can help you spot the good from the bad.

Look at who’s behind the project. Are they known folks with a clear plan? This can be a good sign.

Initial coin offerings, or ICOs, are a way to get into a project early. But be smart. Many ICOs have been scams. Do your homework. And if it looks too good to be true, it probably is.

Understand the project’s goal. It should solve a real problem and have a purpose beyond just making money.

Last up, remember that learning is a big part of staying safe. Hit the books—or rather, the web. There are simple guides, articles, and videos all about spotting scams.

Always ask, research, and when in doubt, ask again. Don’t rush. Take your time to learn. Crypto’s not going anywhere.

And that’s it! Stick to these tips to keep your coins snug as a bug. Dive in, have fun, and stay savvy.

In this post, we walked through the nuts and bolts of starting your crypto adventure. From picking easy-to-use trading platforms to understanding digital wallets, we’ve got you covered. We also dived into the basics of market analysis and where you can learn more about cryptocurrency to make smart choices.

On top of that, we looked at how to keep your coins safe at tax time and how to track your investments. Finally, we talked about how to secure your crypto and spot good projects while steering clear of the bad ones. Remember, knowledge is power in the crypto world. Stay informed, stay secure, and happy trading!

Q&A :

What are the essential crypto tools for beginners just starting out?

When venturing into the realm of cryptocurrency, beginners should equip themselves with a variety of tools designed to navigate the complex landscape. Essential tools include a reliable cryptocurrency exchange to buy, sell, and trade digital assets, a secure wallet to store cryptocurrencies safely, and price-tracking applications to keep abreast of market shifts. Crypto market cap websites for overall market analysis, educational platforms to learn about blockchain and crypto, and tax software to manage potential liabilities are also crucial for a well-rounded crypto toolkit.

How do crypto portfolio trackers benefit novice investors?

Crypto portfolio trackers are indispensable for novice investors aiming to stay organized and informed. By providing a consolidated view of all holdings across different platforms, these tools help track the performance of individual assets and the overall portfolio in real-time. This enables beginners to make informed decisions, notice trends, and adjust strategies accordingly. Alerts on price changes or achieving investment goals are additional features that make portfolio trackers beneficial.

Can beginners use crypto trading bots, and are they advantageous?

Yes, beginners can leverage crypto trading bots, but it is recommended to proceed with caution. Trading bots automate the buying and selling of cryptocurrencies based on preset criteria, which can be particularly advantageous in a volatile market that operates 24/7. They help execute strategies consistently without letting emotions interfere. However, beginners should first understand basic trading concepts and investigate bot settings before relying on automation to ensure they align with personal investment goals.

What security tools should beginner crypto investors consider?

Security should be a top priority for beginner crypto investors, who should consider tools like hardware wallets for cold storage of their assets, thus keeping them offline and away from potential online threats. Two-factor authentication (2FA) for all accounts, robust anti-phishing software, and using secure, unique passwords managed through a password manager are additional security measures that are highly recommended.

Are there user-friendly crypto tax tools for beginners?

Indeed, there are several user-friendly tax tools designed specifically for crypto investors, regardless of their expertise level. These platforms can automatically import transactions from wallets and exchanges, calculate gains or losses, and help users prepare necessary forms in compliance with regional tax laws. This simplifies the complex and often overwhelming process of crypto tax reporting for beginners, making it more manageable and accurate.