Diving into the world of cryptocurrencies, one thing is crystal clear: liquidity is king. Stuck assets are a big no-go for savvy traders looking for the sharp edge of a nimble market. This is why top crypto exchanges by liquidity stand out; they ensure your money is as dynamic as the market itself. You want to dive in and out at the right times, and here I’ll help you pinpoint exactly where to rely on for that agility. Say goodbye to sluggish trades and hello to markets where your assets move with the speed of thought. Ready to find out where you should be trading? Let’s jump right in!

Understanding the Landscape of Crypto Trading Liquidity

Importance of Deep Liquidity in Crypto Platforms

When you trade crypto, you want it fast and at the best price, right? That’s why deep liquidity is key. Imagine walking into a store with only one item on the shelf. Not great. That’s how trading on a platform with bad liquidity feels. Deep liquidity means plenty of options, like a store packed with goodies. It’s about how quick you can buy or sell your crypto without shifting its price too much. We call the price change “slippage” and we don’t like it.

Having a liquid market with lots of active buyers and sellers is like having a big party. You’re more likely to dance – or trade – with someone. It’s less awkward and way more fun. Deep liquidity crypto platforms are the life of the party. They match buyers and sellers quickly. Trades happen in a snap and everyone goes home happy.

Now, how do we find these platforms? Look at their trading volume. High volume means lots of activity. It’s where the action is. Crypto exchange volume ranking lists are good to check. They show who’s who in the market. A high rank usually means lots of liquidity. You get in and out of trades with ease. No fuss, no waiting.

Centralized versus Decentralized Liquidity: Implications for Traders

Here’s the big match-up. Centralized vs decentralized. Think of centralized like a big bank. They keep everything in order. The rules are clear and there’s always someone to help you out. Centralized means one spot has all the control and it’s well-run. You get high-frequency trading in crypto, fancy technology, and a whole team to make sure trades are smooth.

Decentralized is like a lot of small shops on a street. They offer different things and you get to choose. No “big boss” in charge of all. It’s all about freedom of choice. These platforms let the market make its own rules. They offer crypto liquidity swaps and sometimes better privacy. But there can be less stability. You might find a better deal or a rare item but you might also wait longer.

Now, traders like you need to think hard. What’s best for you? If you’re all about speed and having a big crowd, centralized platforms with their top-tier crypto trading platforms could be the ticket. They offer fast transactions, often better security, and lots of trading pairs availability. Liquidity is usually better and that means less slippage in cryptocurrency trading.

But maybe you don’t like everyone in the same place. You want to branch out. Try different flavors. Decentralized places have their charm. They offer cool things like liquidity mining on exchanges. They support this wild 24/7 market liquidity in crypto. Plus, they’re part of a tech revolution that could change how we trade.

Every trader has a home. Some like the bustle of a well-stocked, centralized scooter. Others prefer the quirky, winding roads of decentralized markets. The choice is yours! Just don’t forget to do your homework first. Understand the landscape, and those trades will feel as smooth as a ride down an open road.

Analyzing Top Exchanges for Optimal Trading Conditions

Measuring Crypto Exchange Liquidity: A Comparative Analysis

When you’re trading crypto, you want to move fast – buy and sell like lightning. Where to go? The top dog exchanges. They always have someone ready to match your trade. That’s deep liquidity – a big pool you can jump into anytime.

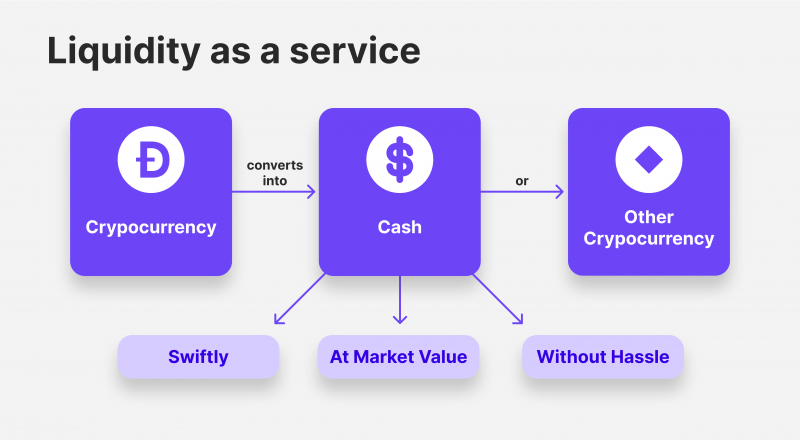

Let’s dive into how we measure it. Liquidity in cryptocurrency is all about how quick you can turn your asset into cash without affecting its price much. Picture a large stadium – that’s your exchange. More people mean more chance someone wants to trade with you. That’s high volume.

You might ask, “Why do I care about all these numbers?” Well, my friend, it means getting more bang for your buck. Let’s say you’ve got Bitcoin you want to sell. On a platform with deep liquidity, there are loads of buyers. Good for you – you’ll get a fair price. On quieter platforms, not so many buyers – you might have to drop your price. Not cool.

Spot Exchange Liquidity Analysis: Key Metrics to Consider

So what numbers to look at? It’s all about the order book depth and trading volumes. Think about it like this – order book depth shows how many other players are in the game. Trading volumes tell you how much game is being played.

Order books can be thin or thick. Thin ones don’t have much to offer, and your trade changes the score – that’s slippage. Thick ones – they barely notice your play. And that’s just centralized exchanges! Decentralized ones are a whole different ballgame. Imagine playing in an unstaffed field – it’s wild, but still got plenty of game to be had.

High volume is your golden ticket. More trades happening means you jump in, do your thing, and jump out. Zip, zap – done! You see, high-frequency trading in crypto smoothes it all out. It’s like having a super-fast conveyor belt moving assets 24/7.

The big players in this league? They’re the best liquidity providers in crypto. Names like Binance, Coinbase, and Kraken – they’re like the major leagues of crypto trading. They not only trade in Bitcoin or Ethereum but also have a deep bench with a ton of different trading pairs.

Now, all this trading needs super-fast transaction speeds. No one likes to wait. The best exchanges get your trades across the line faster than sending a text.

Remember, when you’re looking for a place to trade, think of the exchange like a busy market. You want a place that’s always open, always busy, and has what you need, when you need it. That’s your ticket to trading smoothly in this electric world of digital cash.

Navigating Market Liquidity and Trading Activity

The Role of Stablecoins in Sustaining Vibrant Markets

In crypto, we talk a lot about “stablecoins.” They’re like anchors in the stormy sea of the market. They hold their value steady, making them a safe spot for traders. Think of stablecoins as the backbone of a liquid market for digital assets. They provide a base for trading pairs, helping traders move in and out of different coins without wild price swings.

Stablecoins have a big job. They keep things running smoothly by letting you trade quickly and with confidence. If you’re using a top tier crypto trading platform, you’ll notice these coins are there for you, like a trusted friend. This helps stop slippage in cryptocurrency trading. That’s when your trade price slips away from where you wanted because the market’s moving too fast. Nobody likes that!

High-Frequency Trading and API Trading: Enhancing Market Fluidity

Now, let’s kick it up a notch with high-frequency trading (HFT) and API trading. These are the superheroes of trading. High-frequency trading is about rapid, super-smart moves in the market. It’s like a game of hot potato with stocks, where the potato never cools down. It makes the market more fluid, which means your assets move faster.

API trading? It’s your way to connect with the exchange without clicking around. Picture a pipeline between your trading strategy and the market’s heart. You can roll out trades smoothly and swiftly. With these tools in play, the best liquidity providers in crypto help the market’s heart beat strong. It helps in measuring crypto exchange liquidity, so you know where your trade stands.

Both HFT and API trading help create deep liquidity. This means when you want to buy or sell, there’s always someone on the other end. This magic happens on both centralized and decentralized platforms. It’s like having a party where everyone’s invited and no one’s left without a dance partner.

To sum it up, these strategies are vital for a buzzing crypto scene. They help avoid delays that can lead to missed chances or lost money. When you tap into a liquid market, everything feels right. Trades are smooth, prices are fair, and you’re in the groove. Always aim for exchanges that champion stablecoin volume and embrace HFT and API trading. They’re your ticket to a world where asset movement is quick and sure.

Enhancing Trading Experience through Liquidity Management

Strategies for Minimizing Slippage in Cryptocurrency Trading

Let’s talk about making your crypto trades better. We all want that! Slippage? That’s the enemy. It’s the gap between the price you want and the price you get. Annoying, right? So, how do you beat it? First, use exchanges with deep liquidity. That means they’ve got lots of buy and sell orders in their order books. Easy to match trades equals less slippage. You should look for crypto exchanges with the most trading going on, as they often have lower slippage.

Order book depth is key too. It tells you the market’s ability to absorb big trades. More volume means you can trade big without a fuss. Top tier platforms wear the crown here. They handle high volume trading like a champ, keep prices steady, and make traders smile.

Crypto trading isn’t a playground. You can win or lose in a blink. My advice? Stick with the exchanges that match orders quick and keep the game fair. Avoid the rest like a sour apple.

Also, don’t forget the role of the best liquidity providers. They fill the order books, so when you’re ready to trade, there’s always someone on the other end. Check the crypto exchange volume ranking to find them. These providers are your best pals in crypto trading.

Remember, when you trade, time is your friend. Best trades happen fast. Use platforms that let you trade any time. Crypto never sleeps, and neither should your exchange. Instant trade execution is what we all hunt for. Make sure your platform delivers.

The Significance of Instant Trade Execution and 24/7 Market Operations

Ever wished your crypto trades happen as quick as turning on a light? That’s instant trade execution for you. It’s huge for traders. In crypto, prices move fast. Lightning fast! You need an exchange that keeps up, turning your trades into reality right away.

For exchanges that earn gold stars, look at their transaction speeds. You want them zippy with no hiccups. Great exchanges have the power to handle tons of trades at once. They make sure you’re in and out before you know it.

A good market never tucks in for the night. It’s always busy, all day and night. This is why 24/7 operations are a must. You get to trade when you feel like it, not when the market says so. A solid exchange with round-the-clock action is where you want to be. It means you never miss a beat or a profit.

In the wild world of crypto, having an exchange that plays like a well-oiled machine is your ace. It should make trading smooth and stand by your side, ready to roll whenever you are. That’s what winning looks like in this game.

We’ve covered a lot about crypto trading liquidity. We started by exploring the landscape of liquidity in crypto trading, breaking down deep liquidity and how it affects your trades. We compared centralized and decentralized systems, showing how each impacts your trading game.

Then, we sized up top exchanges to find where you’ll get good trading conditions. By looking at exchange liquidity and key metrics, we figured out which spots are best.

We also talked about how stablecoins keep markets alive and how high-speed and API trading make things run smoother.

Finally, we looked at how to manage liquidity. We shared ways to cut slippage and talked about why fast trades and markets that never sleep are a big deal.

In short, smart liquidity know-how can take your trading to the next level. Keep these tips close, and you’ll trade with more confidence and less hassle. Happy trading!

Q&A :

What factors contribute to an exchange being rated as a top crypto exchange by liquidity?

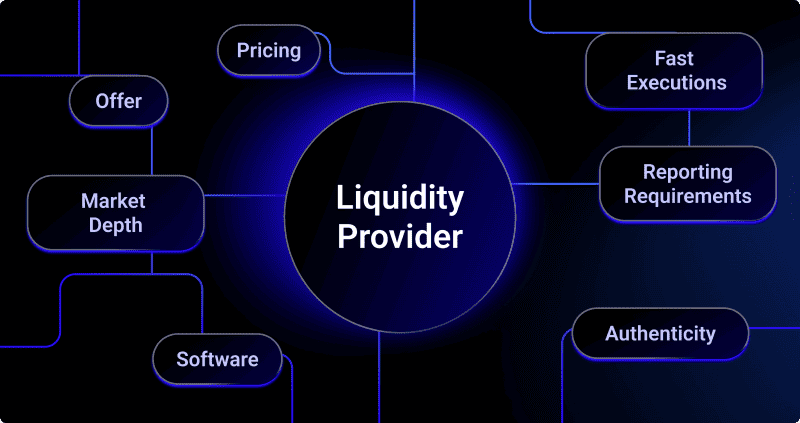

The rating of top crypto exchanges by liquidity depends on several factors such as the daily trading volume, the market depth, the ease of executing large transactions without a significant impact on the market price, and the variety of trading pairs available. High liquidity indicates a bustling market with numerous participants, which generally leads to more competitive pricing and quicker transactions.

How can you measure liquidity on a cryptocurrency exchange?

Liquidity on a cryptocurrency exchange can be measured by looking at the trading volume of a given asset, the spread between the bid and ask prices (narrower spreads indicate higher liquidity), and the exchange’s order book depth. Some market analysts also utilize tools such as the Liquidity Index, which gauges the health and liquidity of a market, or liquidity metrics from platforms like CoinMarketCap or CoinGecko.

Why is liquidity important when choosing a cryptocurrency exchange?

Liquidity is crucial when selecting a cryptocurrency exchange because it affects your ability to buy or sell assets quickly and at fair prices. High liquidity ensures minimal slippage, which means transactions are less likely to significantly move the market price. This is particularly important for large volume traders who need to execute orders without drastically altering the value of the cryptocurrency.

Can liquidity in crypto exchanges fluctuate, and what impacts it?

Yes, liquidity in crypto exchanges can fluctuate due to factors such as market volatility, regulatory news, investor sentiment, technological updates, and the overall trading activity in the market. Significant events, like forks, airdrops, or listings of new tokens, can also have an outsized impact on the liquidity of an exchange.

What are the potential risks associated with low liquidity on crypto exchanges?

Low liquidity on crypto exchanges can lead to high slippage, where the price paid or received for an asset is significantly different from when the order was placed. It also results in higher spreads, increasing the cost of trading. Furthermore, it might be challenging to enter or exit positions without affecting the market price, which could be detrimental in rapidly moving markets or during high volatility events.