Navigating the maze of the crypto market demands smart tools, and top crypto exchange tracking tools are your compass. Remember when tracking your crypto meant endless tabs, guessing games, and gut feelings? Scrap that. Today’s savvy investors arm themselves with stellar tools that pierce through the clutter, offering clarity and strategy to their trades. This ultimate guide lays out the must-have features, real-time data benefits, and performance analysis tips you need to steer your portfolio to success. Dig into our deep dive on the trackers that define a well-edited crypto investment approach and discover how to optimize your portfolio while staying sharp on tax reporting. It’s time to manage your digital coins with confidence!

Understanding Crypto Portfolio Trackers and Their Significance

The Role of Portfolio Management in Crypto Investment

Managing a crypto portfolio is like being a captain at sea. You navigate through rough waters, with a keen eye for danger and opportunity. Portfolio management is vital for your investment journey. It helps keep your investments in good order, just as a captain keeps the ship’s course true.

Key Features to Look for in Crypto Portfolio Trackers

When you’re picking a tool for tracking your crypto, think simple and smart. The best ones out there make your life a breeze and your decisions sharp. Here’s what to look for:

Real-Time Data: Like catching a wave at the perfect moment, real-time updates can make or break your trade. A good tracker gives you timely data so you can act fast.

Diversity of Coins: Always pick a tracker that knows the crypto world well. It should cover Bitcoin, altcoins, and those fresh new tokens too.

API Integrations: A tracker must talk smoothly with exchanges. With API link-ups, it should fetch your transaction data without a hiccup.

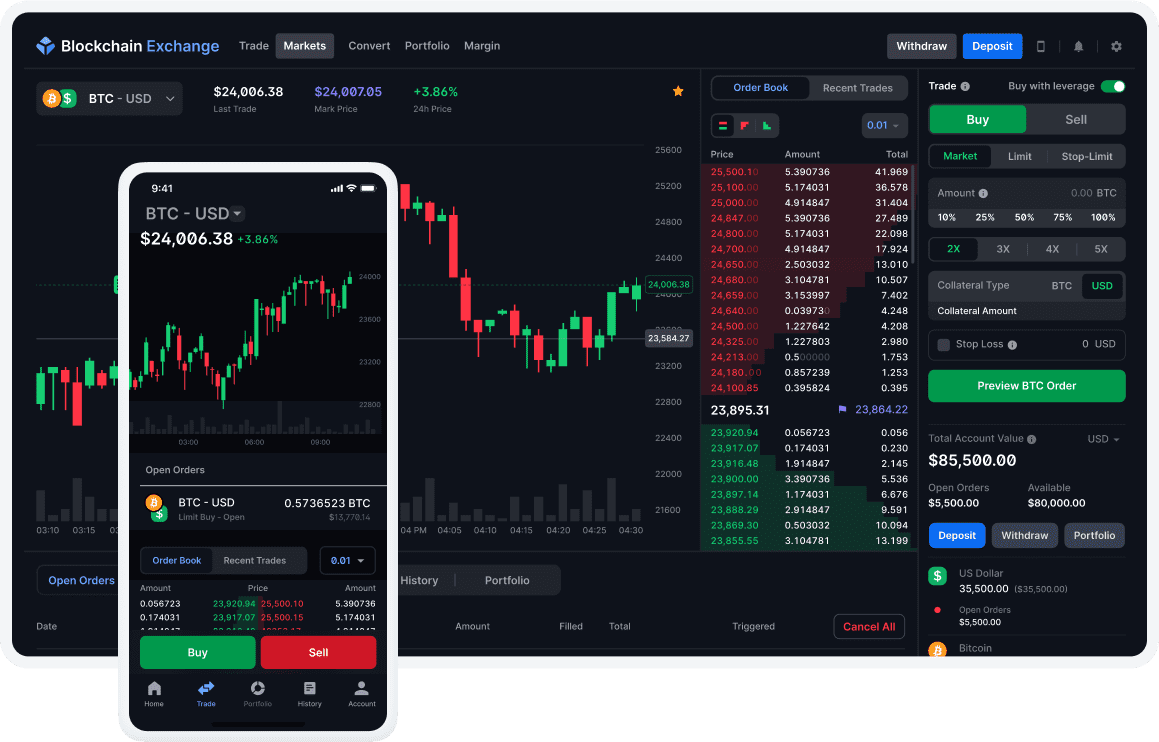

User-Friendly Interface: Keep it simple. You want a clear dashboard that shows you all you need, at a glance.

Security: This is the lock on your treasure chest. A secure tracker guards your financial data with top-notch defenses.

Tax Tools: At year-end, you’ll thank a tracker that sorts out what you owe. Some come with built-in helpers for tax time.

Performance Analytics: A top tracker shows you the health of your investments. It’s like a doctor who keeps your portfolio fit and fine.

With these in mind, you’re all set to find a crypto portfolio tracker that can be your trusty sidekick. It’s not just a tool; it’s your map, compass, and spyglass rolled into one. Keep it with you as you venture through the ever-changing tides of the crypto world. Your tracker will make sure you stay on course, no matter how the wind blows.

Diving Deep Into Cryptocurrency Monitoring Platforms

How Real-Time Data Shapes Crypto Trading Decisions

In the fast-paced world of crypto, real-time data is a game-changer. No more guesswork. Now, crypto trading decisions rest on live info. With seconds counting, the latest updates give traders a key edge. They see price moves as they happen. They jump on chances or dodge losses. It’s like seeing the future, a tiny bit at a time.

Handling this flow calls for the right tools. Real-time crypto trackers offer this keen sight. These tools show live prices of Bitcoin, altcoins, and tokens. They help make smart choices based on what’s happening now. For traders, few things top the value of getting data this fresh.

Comprehensive Comparison of Top Cryptocurrency Monitoring Tools

When picking crypto tools, it’s easy to get lost in options. Here’s where I come in. As someone who lives by these numbers, I have put several to the test. Let’s break down the crypto toolkit to see what stands out.

First, know what you need. Some need a broad view, some seek details. Top tools offer both. A comprehensive crypto tracker list has big names you’ve heard of, and some you might not have. They track prices, volumes, and market moves. When I review these tools, I look for accuracy, speed, and depth of data.

Blockchain asset tracking is a must. It’s about following your coin’s every hop and skip. You should look at trade volume tracking tools and exchange liquidity analysis. They tell you how easy it is to move major sums.

Then there are crypto portfolio trackers, always a solid pick. They not only monitor but also help manage your assets. Think of them as your digital asset butler.

Automated exchange trackers save time and reduce errors. By using APIs, they sync with your accounts and keep tabs across platforms. This is key when you play on different fields.

For the tax-savvy, crypto tax reporting tools are gold. They ease the headache of filing by sorting your year’s trades.

High on the must-have list are exchange comparison tools. They lay out the pros and cons across platforms. This comparison builds the roadmap for where you trade.

Crypto tracking for traders means also peeking at crypto trading bots. These bots use real-time data to make trades for you. It’s like having a tireless trader in your corner.

Some final wise words? Stick to user-friendly exchange trackers. No matter how fancy, a tool is only as good as your ability to use it. Look for clear layouts and easy navigation. That means you spend time winning in the market, not wrestling with software.

Finding the top digital asset monitors comes down to need, ease, and dependability. Use this overview to steer clear of noise and toward the tools that keep you ahead of the game.

Leveraging Exchange Tracking Tools for Enhanced Performance Analysis

Assessing Exchange Liquidity and Trade Volume with Advanced Analytics

Need to pick the best crypto spot? Look at exchange liquidity first; it’s key. High liquidity means more action, better prices, quick trades. Solid exchange tracking tools help you see this. They highlight the busiest exchanges. Busy is good—it shapes better trade opportunities for you.

But wait, what’s trade volume? It’s the total of all trades on an exchange within a time, like a day. High trade volume can mean a lively market with lots of traders. You want a tracker that shows real-time volume. This shows you when and where the buzz is.

A tool with both liquidity and volume analytics is gold. This combo offers a clear view. It shows health and activity of crypto markets. You avoid the stale spots. With the best software, you get this info at a glance.

Let’s not miss out on advanced features, though. Some crypto market tracking tools dish out trend alerts. Others give tips on when to dive in or step back. They read market signs. They bring the wisdom of crowds to your screen.

The Benefits of Automated Exchange Trackers for Portfolio Optimization

Let me tell you about automated exchange trackers. They’re your eyes on the market, watching all the time. These revolutionize how you handle your crypto mix. They work non-stop to keep your portfolio sharp. Your gains and losses? Tracked. Exchange rates? Monitored. All neatly served to you.

Imagine a dashboard that updates with every market tick—a high-tech helper. Automated trackers also help plan your next move. No more guesswork or constant clicking around. These trackers blend a range of services into one spot. You’ll know your overall balance across exchanges—super handy.

Portfolio management in crypto is a breeze with these tools. Deal with changes fast and with solid backup for your choices. Want to share your tracks? Some crypto tracking apps link seamlessly with your friends or advisors.

Time is money. Keeping an eye on everything eats it up. API crypto tracking adds speed. It connects exchanges and wallets directly to your tracker. This means less manual entry of your buys and sells. Get updates without a single click. It’s like magic.

Don’t miss tracking cross-platform trades. If you play on more than one field, you need this. It shows how each exchange stacks up for you. It’s vital for smart swappers.

So, with these tools, you’re on top of the game. Cut through the noise. Catch the ripe deals. Let the automated trackers manage the grind. Then, you focus on strategy—making your crypto work for you.

Remember, great tools make great traders. Keep tracking smart, and watch your crypto grow!

Integrating Tools for Complete Portfolio Analysis and Tax Reporting

Making Sense of Crypto Tax Reporting Tools for Investors

Let’s talk taxes – yes, even for crypto. We’ve got crypto tax reporting tools that make life simpler. How? These tools track your trades and figure out your taxes. This saves you hours of headaches come tax time.

Picture every trade you’ve made, then imagine adding it up for Uncle Sam. Tough, right? Crypto tax reporting tools swoop in to save the day. They link to your exchanges, pull your history, and do the math. Now, you can file taxes with confidence, and you won’t upset the IRS.

These tools help you spot wins and losses fast. You can see how your choices help or hurt your tax bill. Plus, staying in line with the tax laws keeps you out of trouble.

Insights on Altcoin Tracking Tools and Their Impact on Portfolio Diversification

Altcoins can be tricky. But altcoin tracking tools make managing them a breeze. These tools show you how each altcoin fits in your whole portfolio. Then, making smart choices gets way easier.

Diversifying is key in crypto. Don’t put all your coins in one basket, so to speak. With the right tools, you can spread your risk and spot chances to grow your stash.

Using altcoin tracking tools, you can see which coins are stars and which aren’t helping out. This means you can adjust on the fly. This is how you stay ahead in the wild world of crypto.

Some tools even let you set alerts for your favorite altcoins, sending you updates when big changes happen. This means you’re never left in the dark. And, you can take action when the time is right.

So there you have it. Tools for taxes and diversification make your crypto life a lot smoother. They offer more than just numbers—they bring peace of mind to your investing game.

In this post, we explored crypto portfolio trackers and why they’re so vital. We checked out how they manage our crypto and the features we must look for. We dove into monitoring platforms, seeing how live data helps in making smart trade choices and compared some top tools. Next, we learned how exchange trackers can up our game by analyzing trade volume and liquidity. Lastly, we tackled how these tools can simplify tax reporting and help track different coins for better portfolio mix. All in all, smart use of these tools can make a big difference in your crypto game. My final thought? Get the right tracker and you’re on track for smarter, more informed crypto decisions.

Q&A :

What are the best tools for tracking performance on top crypto exchanges?

Tracking your portfolio performance across various top crypto exchanges is essential for any trader. The best tools for this purpose often come with real-time data updates, analytical charts, and comprehensive dashboard features. Some popular tools include CoinMarketCap, CoinGecko, and CryptoCompare. These platforms provide extensive data on exchange volumes, pricing, market capitalization, and can often be integrated with personal portfolios for streamlined tracking.

How can I monitor multiple crypto exchanges simultaneously?

Monitoring multiple exchanges can be a daunting task, but it’s made more manageable by using crypto portfolio trackers and management tools. These tools are designed to help users view and manage their assets across different exchanges in one unified interface. Look for platforms like Altrady, Coinigy, or Blockfolio, which allow you to add multiple exchange accounts, track real-time prices, and get alerts on significant market movements.

Can I track crypto exchange data in real-time with these tools?

Yes, many top crypto exchange tracking tools offer real-time data tracking. This feature is crucial for staying updated with the volatile cryptocurrency markets. Key services typically include live price feeds, order book data, and transaction updates. High-quality tracking tools such as TradingView provide in-depth analysis and real-time price charts for professional traders.

Are there any free crypto exchange tracking tools available?

Certainly, the market offers a variety of free tracking tools ideal for beginners or those looking to try out features without financial commitments. Tools like CoinStats or Delta provide free versions of their platforms with essential tracking features. While they often come with certain limitations or ads, they are still pretty robust for everyday tracking needs.

What features should I consider when choosing a crypto exchange tracking tool?

When choosing a crypto exchange tracking tool, consider features such as user interface ease-of-use, range of supported exchanges and cryptocurrencies, real-time data updates, price alerts, portfolio tracking, transaction history records, and security measures. Additional features like tax reporting, API integrations, and custom notifications can also be beneficial depending on your level of trading activity and needs.