Technical analysis of crypto market isn’t a wild guess; it’s a skill. I’m here to guide you through a journey where charts whisper tales of peaks and valleys—and where you learn to listen. The market speaks in patterns and volumes; it’s not just instinct, it’s intelligence. Ready to chart your way to profit? Let’s decode the secrets together. We’ll start with candlestick patterns, dive into volume indicators, and then, only then, tackle advanced techniques that can sharpen your trading decisions. Trust me, with the right strategies, even the zigzags of Bitcoin become a path to potential success. Buckle up, it’s time to master the art of crypto trading!

Understanding the Basics of Cryptocurrency Technical Analysis

Deciphering Candlestick Patterns and Their Significance in Crypto Trading

Candlestick patterns in crypto show the price action. Each candle has four points: open, close, high, and low. The color and length of the candle are clues. Green means the price went up. Red is for a price drop. Long candles signal strong buying or selling. Short ones speak to little price change. Patterns like ‘Doji’ or ‘Hammer’ hint at future price moves. Crypto traders use these to guess where the price might go.

Look closely at several candles together. Patterns often suggest a trend change or a price move. Traders get ready to buy or sell based on this. Learn these patterns well. They help traders make better choices. But, remember to check other charts too. One sign alone doesn’t tell the full story.

The Role of Volume Indicators in Gauging Digital Currency Movements

Volume indicators are a key part of trading digital currency. They show how much of a crypto was traded in a time frame. Look for big volume changes. They often come before a big price move. Volume goes up when many people buy or sell. It means the price shift is stronger.

Some common volume indicators are the ‘On-Balance Volume’ (OBV) and ‘Volume Oscillator’. OBV adds up volume on up days and subtracts on down days. It helps see the overall buying or selling trend. A rising OBV means more folks are buying. The Volume Oscillator shows if trading volume is above or below the average. This tells if the current trend is likely to keep going or change.

Using volume with price action gives a clearer picture. It’s not enough to see the price go up. Volume must back it up for a real strong trend. So, watch the volume before making a trade. This helps traders act smarter. Remember, no tool is perfect. Combine them for the best results. Stay safe, and happy trading!

Utilizing Advanced Technical Indicators for Informed Trading Decisions

Implementing RSI and MACD to Identify Crypto Market Momentum

Have you heard of RSI? It stands for Relative Strength Index. It shows if a coin is overbought or oversold. If it’s above 70, many traders think it’s overbought. And if it’s below 30, they see it as oversold. Easy, right? But here’s where it gets exciting. RSI helps us feel the crypto market’s pulse. We look for patterns, like if RSI stays high, the coin may be strong. But if it dips too low, watch out!

MACD, or Moving Average Convergence Divergence, is another cool tool. It uses two moving averages. When they cross, it might be time to buy or sell. MACD can show us the start of a new trend, so we keep our eyes peeled for those crosses. A golden cross means a potential buying spree, while a death cross could spell sell.

Leveraging Bollinger Bands and Stochastic Oscillator in Altcoin Trading

Now, let’s chat about Bollinger Bands. They squeeze or spread out based on how volatile a coin is. When they’re tight, we might see a big price move soon. If the price hugs the top band, it could mean it’s strong. But if it’s chilling at the bottom, it might be weak.

The Stochastic Oscillator is all about momentum. It compares the current price to price ranges over time. This guy has two lines, %K and %D. When %K crosses over %D, that’s our cue. It could be a sign to buy or sell, depending on the direction.

By using these tools, we become crypto detectives. We spot clues and predict where prices might be heading next. It keeps trading fun and, fingers crossed, profitable!

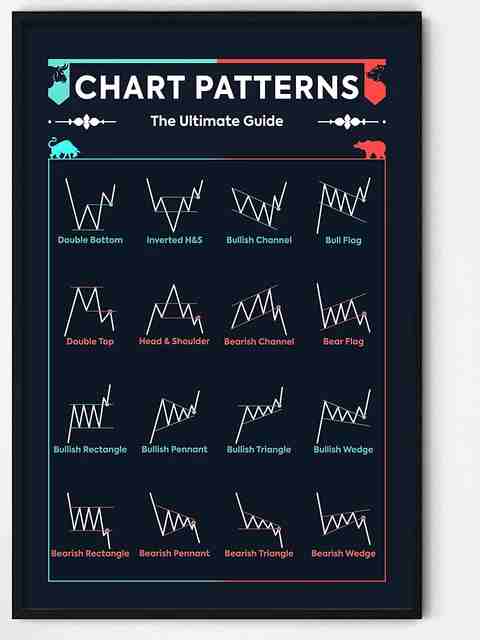

Mastering Chart Patterns and Trading Strategies in Crypto Markets

Navigating Support and Resistance Levels for Optimal Trade Execution

When trading crypto, knowing when to buy or sell is gold. Picture a game of tug-of-war. Support and resistance levels are like the lines in the sand. You watch those lines to know when to jump in or step out.

Support is where price drops but struggles to fall further. Think of it as a safety net. If you’re aiming to buy, that’s often the sweet spot. Resistance is the opposite. It’s where price climbs then hesitates, like hitting a ceiling. Sellers wait here, ready to jump ship.

Imagine we’re eyeing Bitcoin. We see it dabble around a price, bouncing up from it – that’s support. We’ve got our radar locked. If it dips to that zone again, we might grab some, betting it’ll rise. This is not a promise, but a well-educated guess with charts backing us up.

Diving into Ethereum trading, you draw trend lines. These are like paths showing where Ethereum’s been and hint where it might go. They connect high points and low points spanned over weeks or even months. Spotting these can give you clues on when to enter or exit trades.

Employing Breakout Strategies and Momentum Trading for Maximum Profit

Now, let’s crank up the heat with breakout strategies. A breakout is when price busts through our line in the sand – be it support or resistance – and keeps going. That’s the market shouting “I’m moving!” and you’ve got to listen.

For the thrill-seekers in crypto markets, when you see a breakout, that’s your launch pad. You hop on that ride, following the momentum for profits. It’s like surfing – catch the wave fast, ride it, then hop off before it crashes.

Momentum trading is for the speed junkies. You hunt for moves that show a crypto is about to zoom, like a rocket. You want in quick, then out before the fuel runs dry. If a digital coin starts to shoot up and our trusty RSI – that’s the relative strength index – blinks signs it’s not done yet, you might go for it.

But here’s where you box smart – not every breakout has true grit. Some are fake-outs. You back your bets with solid signs, like higher trading volume, a buddy to breakout. That tells you lots are in on the action. It’s not just smoke.

Lots of charting tools can help with this. You match what you see with what’s happened before. This isn’t crystal-ball stuff; it’s sharp thinking with historical charts in your corner.

To wrap up, remember that trading is risky. Always lay out plans for when a trade could go south, and stick to them. We call that risk management, and it keeps you in the game.

Peek at these patterns, and when you spot one that screams “it’s go time,” you may just pull off a winning trade. Remember, support and resistance levels are your treasure maps, and breakout strategies with a side of momentum can be your fast track to profit.

Refining Your Trading Approach with Sophisticated Analysis Tools

Integrating Fibonacci Retracement and Trend Lines in Ethereum Trading

Smart traders use smart tools. Fibonacci retracement is one such tool. It finds key levels. Prices often hit these levels, then bounce up or down. This can signal where prices may go next. In Ethereum trading, these levels are super useful. Crypto moves fast and far. So, catching these reversal points matters a lot.

You draw these levels on a chart from low to high. Or from high to low, depending on the trend. When prices dip, they might hit a Fibonacci level, then reverse. This is where you watch closely. Maybe enter a trade, maybe not. It depends on what you see.

Trend lines are another great tool. They’re like a road map for prices. Drawn on peaks and valleys, they show where prices could head. When the price breaks through a trend line, get ready. This could mean a big move is coming. Up or down? Well, it depends on the break.

Let’s say you spot a trend line break in Ethereum. If it breaks up, that’s a sign. It could mean more rises are coming. But if it breaks down, be careful. Prices might fall more. This is where your strategy kicks in. Do you buy, sell, or wait?

Harnessing the Power of Backtesting and Pair Trading Techniques

Backtesting is like a time machine for traders. It checks how well a strategy would have done in the past. Think of it like this. You find a trading plan. It looks good on paper. But did it work before? Backtesting tells you. You pick a time period. You run the strategy. And you see the results. It’s super helpful before trading for real.

Pair trading is a different beast. It’s about two trades at once. You find two cryptos that move alike. When their prices diverge, you act. You buy the one that’s down. You sell the one that’s up. The hope is they will meet again. This can cut your risk. It’s like not putting all eggs in one basket.

So you use backtesting to prove your strategies. You use pair trading to smooth your risks. Both can help you make smarter moves in crypto markets. They’re tools in your toolbox. Just like a craftsman needs a hammer and saw, traders need these techniques. They sharpen your edge.

Use them right, and you can stay a step ahead. But remember, no tool is perfect. Always use them with care. Like looking both ways before crossing a street. Trading is risky. Always be ready for surprises. But with these tools, those surprises might just turn into profits.

In this post, we cracked the code on crypto technical analysis, from basics to advanced tools. We saw how candlestick patterns and volume indicators can show us currency movements. Then, we moved to expert tactics like RSI, MACD, and Bollinger Bands to spot market momentum and altcoin swings.

We also tackled chart patterns, learning how support and resistance levels mark when and where to trade. Breakout strategies and momentum trading can lead to big wins. Lastly, we explored tools like Fibonacci retracement and trend lines, plus smart backtesting and pair trading methods.

Remember, using these techniques well takes practice, but they’ll guide your trades with sharper insight. Keep learning and testing, and you’ll craft a winning crypto trading approach!

Q&A :

What is technical analysis in the context of the cryptocurrency market?

Technical analysis (TA) refers to the evaluation of cryptocurrencies to predict future market movements. This is done by analyzing historical price action and trading volumes, aiming to identify patterns and trends that can indicate potential price directions. TA in crypto involves various tools such as charts, indicators, and statistical figures that help traders make informed decisions.

How can traders use technical analysis to make informed decisions in crypto trading?

Traders use technical analysis by studying price charts and applying technical indicators like moving averages, relative strength index (RSI), and Fibonacci retracement levels. These tools help traders identify entry and exit points for positions based on the assumption that historical trading activity and price movements can signal future trends. By recognizing patterns such as support and resistance levels, traders attempt to forecast the market’s next moves.

Are there any specific technical analysis indicators that are best for crypto market analysis?

While no single indicator is best for every trader or market condition, some popular technical analysis indicators for the crypto market include the Moving Average Convergence Divergence (MACD), RSI, Bollinger Bands, and Ichimoku Cloud. Each of these provides different insights into market momentum, trend reversals, volatility, and equilibrium, which are valuable for crypto traders.

Can technical analysis be applied to all cryptocurrencies?

Yes, technical analysis can be applied to any cryptocurrency with sufficient trading volume and historical data. However, the effectiveness can vary widely across different assets and timeframes due to factors like market maturity, liquidity, and external influences that can affect trading patterns.

How reliable is technical analysis in predicting the future prices of cryptocurrencies?

Technical analysis is not a foolproof method for predicting future prices as it’s based on probabilities and historical data; it does not account for unforeseen events or market sentiment shifts. While some traders find TA to be a reliable tool when supported by proper risk management and other analysis forms, it should not be the sole basis for investment decisions in the volatile crypto market.