As a seasoned crypto enthusiast, I’ve seen it all. Yet, the crypto market is a wild frontier where regulatory efforts to address hidden fees in crypto trading are stepping up the game. We’re at a crossroads where transparency isn’t just a buzzword; it’s a crusade against the smoke and mirrors of hidden costs. Gone are the days when sly fees ate into your profits without a trace. With regulators wielding their power, the veil is finally lifting, revealing the true price tag of our digital trades. Buckle up, folks. It’s time to get a full view of what your coins are really costing you.

Unveiling the True Cost: The Push for Transparency in Crypto Transactions

Understanding Crypto Trading Costs

Crypto trading can cost more than you think. Ever traded crypto? You’ve seen fees. They pop up for trading, withdrawing, even just holding crypto. Now, why should you care? Because these fees can bite into your profits. We all hate surprises, especially when they cost us money.

Some fees are out in the open, easy to find. Others hide, waiting to pounce. Hidden fees are sneaky. They’re the charges you don’t see coming. They can be small, but add up quick. We’re talking network fees, transfer fees, and service charges.

I get it, crypto can confuse. But it’s getting better. New laws push for clear fees. They fight hidden stuff and protect you. We need this now, more than ever. It’s like a health check for your wallet.

The Role of Financial Regulators in Advocating for Transparency

Financial regulators keep an eye on crypto. They’re the playground monitors. Regulators like the SEC and CFTC work for you. They make sure you see all the fees. All of them. No secrets. This means a fairer game for everyone.

These watchdogs don’t just bark; they bite too. If a crypto exchange plays dirty, hides fees, they jump in. They also teach us about these costs. We all need to know what we’re paying for.

The EU takes this seriously too. Across the pond, they’re setting rules. They want to make crypto as open as a book. They’re helping lead the charge for fee transparency globally.

Let’s talk protecting against crypto hidden fees. What can you do? Look for exchanges that show all fees up front. If it’s unclear, ask questions. It’s your money, so stay smart and alert.

Talk is great, but action matters. Regulators do both. They’re not just talking; they’re enforcing rules. It’s all to help us avoid nasty surprises. And when we all understand fees, we trade smarter and safer.

In summary, hidden fees are bad news. But with regulators on our side, transparency is winning. By understanding crypto exchange fees and supporting measures that bring them into the light, we’re all better off. It’s about keeping your money safe and your trades fair. After all, it’s not just crypto that should be transparent – our trades should be too.

Harnessing Regulatory Power: Legislative Measures and Oversight Frameworks

SEC and CFTC Guidelines for Crypto Exchanges

We’re stepping up our game to fight hidden fees. The SEC and CFTC get it. They’re making rules so you can see all costs up front when you trade crypto. No surprises. They say exchanges must tell you the real deal on what you pay. It’s all about keeping things clear and fair.

You might ask, “What are the SEC and CFTC doing to help?” Well, they’re setting standards. If a crypto exchange follows these, you can trade knowing they’re playing by the rules. We want you to trust your trading platform. And with these guidelines, we’re making sure they earn it.

International Efforts: EU Rules and Global Cooperation on Fee Regulation

Here’s a cool thing: it’s not just the US working on this. The European Union is also on board. They’re cooking up their own rules to cut through the confusion. By working together, countries are building a global fence against sneaky fees. It’s like a team sport where everyone is out to protect you.

When we look around the world, we want to make sure no one gets lost in a maze of fees. With countries joining hands, we’re building a net that catches those hidden costs. So no matter where you trade, you’ll know the score.

So, what’s next in battling hidden fees? Simple. We keep pushing for transparency. Every step we take is a step towards a market where you can trade with confidence. Remember, knowing the fees means knowing your power. The drive for clear crypto trading is on, and it’s gaining speed worldwide.

Navigating Crypto Trading Platforms: Identifying and Avoiding Hidden Charges

Detecting Unfair Fee Practices in Digital Currencies

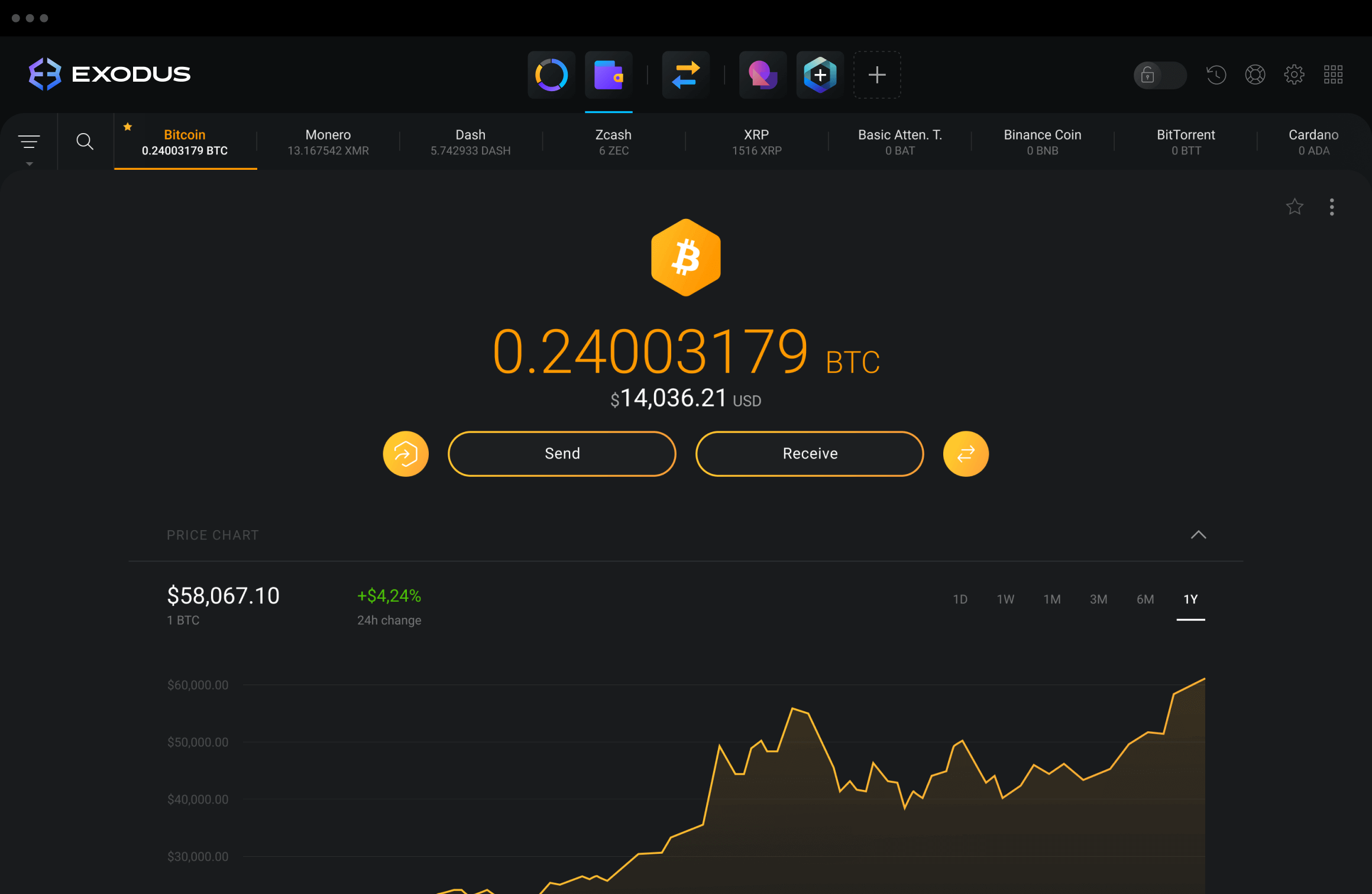

Trading crypto should be fair to all. Often, hidden charges can harm traders. You must know how to spot unfair fees. Watch for fees that don’t make sense. Compare costs between platforms. Look for extra charges after a trade. Check if the fees match what you knew beforehand. Some platforms may not tell you all the costs. They should. You have a right to know all the charges you’re paying.

Educating Investors on Fee Structures and Consumer Protection Mechanisms

Let’s talk about understanding fees on crypto exchanges. Knowing these fees helps you avoid extra costs. Each trade, deposit, or withdrawal may have a fee. These should never hide from you. You deserve clear info on every charge. Ask the exchange to explain all fees you see. Use forums and guides to learn about typical crypto fees.

Crypto trading costs can sneak up on you. Watch for them. If fees seem too high, ask why. Learning about fees protects your money. Make sure you’re trading fair.

Government oversight helps too. Bodies like the SEC ensure exchanges play by the rules. They want to stop hidden charges in crypto trading. The SEC may ask platforms to show their fees better. This is to help you trade with more knowledge.

And the FTC watches over your rights. They make sure exchanges don’t fool you. When you know what to pay for, you trade smarter. This keeps your trust in crypto markets.

Remember, financial transparency is key. Exchanges must be open about their fees. Without this, trust in digital currencies could fall. We all want a fair crypto market. This means no secrets about the costs.

Talking to financial regulators can help. They guide you on what’s fair and not. It’s part of their job to look after you. They can act if a platform’s fees are unfair.

There’s a global push for clear crypto fees. Groups around the world are talking about this. They want to make crypto trading fair for everyone. No one should face hidden fees.

In the end, knowing fees in crypto trades puts power in your hands. Always ask, research, and use tools to spot hidden costs. It’s your money – make sure it’s treated right!

Toward Fairer Trading: Ensuring Financial Transparency and Consumer Rights

Remedial Strategies for Compliance with Oversight Agencies

Do you know the real cost when you trade crypto? Many folks don’t. We need clear prices. This means no hidden fees surprising you later. It’s about keeping your money safe and your mind at ease.

I see some companies play hide and seek with fees. That’s not right. It’s like buying a soda and finding out it costs double at the checkout. No one likes that. The good news is, there’s a big push to fix this. There are rules telling companies: “Show your fees upfront.” This is fair play for everyone.

These rules come from big names in money safety. You’ve heard of the SEC and CFTC, right? They draw the lines so that everyone plays the same game. These rules help you see the real deal. They say “No more hiding the ball.” Fees must be clear as day.

Financial regulators across the globe are working hard to protect us, the traders. They want us to trust where we put our cash. And they’re checking up on crypto exchanges like hawks. They’re making sure no one plays tricks on fees. If they do, there are penalties. This keeps the market steadier, like a ship in calm waters.

The Impact of Fee Disclosure on Investor Trust and Market Stability

Now let’s talk trust. When folks know all about the costs, they feel better. They know the game and the rules. And when they trust the system, they invest more. This is great for everyone.

Full fee disclosure does more than build trust. It levels the market field. Imagine a soccer match where one team knows all the rules, but the other doesn’t. That’s no good, right? It’s the same with trading. Fair rules, fair play, and we all win.

We also get a market that doesn’t jump around like a frog. It’s stable. When people see all the fees, they make smart choices. They spread their bets and don’t panic. This keeps the market from going wild.

So, we’re pushing forward with clear fee info. With this, we can plan our moves better and keep our money safer. It’s good to know someone’s got your back.

In all this, education is key. We need to learn about these changes—no big words, just the plain truth. This helps us all make friends with our money and the market. Better yet, it’s no longer a maze to figure out what you pay when trading crypto.

We, the investors and traders, hold the power now more than ever. And with a watchful eye on those handling our money, we can trade with trust. It’s like having a map in a forest. And we’re making sure the path is clear.

This is the kind of world I work for every day. A world where trading crypto is fair and square. I’m committed to this cause and I know we’re heading in the right direction. Let’s keep pushing for transparency together.

In this post, we dived into the tricky world of crypto costs, pulling back the curtain on what it really takes to trade. We looked at how regulators are stepping up for honest pricing in crypto markets. Laws are changing, with both the SEC and the CFTC in the U.S., and new rules in the EU, focusing on clear costs for traders.

Navigating crypto platforms can be tough. It’s about knowing where those sneaky charges hide and how to avoid them. We also shared tips on how to spot unfair fees and protect your pocket.

Now, with better rules and smart moves, trading can be fairer for everyone. When you know all about the fees, you can trade with trust. That makes the market better for all of us. Remember, in crypto trading, being informed is the key to keeping your money safe.

Q&A :

What are the latest regulatory efforts to combat hidden fees in crypto trading?

Regulatory bodies worldwide are increasingly scrutinizing crypto trading platforms to ensure transparency in fee structures. Efforts include proposing clearer guidelines on advertising, requiring detailed disclosure of all fees before transactions, and implementing stricter enforcement actions against platforms that fail to comply with consumer protection standards.

How do hidden fees in crypto trading impact investors?

Hidden fees in crypto trading can significantly erode investor profits and contribute to a lack of trust in the cryptocurrency market. They may include unexpected withdrawal fees, transaction costs, or price spreads. When these costs are not clearly disclosed, they can impact investment decisions and market fairness.

Can enhancing regulatory measures improve the transparency of crypto fees?

Yes, enhancing regulatory measures can lead to greater transparency in crypto trading fees. Regulators may require crypto exchanges and trading platforms to provide clear, upfront information on all fees charged, including how these fees are calculated. This helps investors make informed decisions and promotes a more trustworthy trading environment.

What can crypto traders do to protect themselves from hidden fees?

Crypto traders should conduct thorough research on any platform or service before engaging in trading. This includes reading the fine print, understanding fee structures, using cost calculators if available, and staying informed about common fee-related practices in the industry. Vigilance and education are key to avoiding unexpected costs.

Are there any international standards for disclosing fees in crypto trading?

While international standards for crypto fee disclosure are not fully uniform, initiatives like the Financial Action Task Force (FATF) provide guidelines designed to enhance the transparency of cryptocurrency transactions, including fee disclosures. National regulators may adopt these guidelines to set industry standards and protect consumers from hidden fees.