Gone are the days when the buzz about cryptocurrency was just about huge profits and market speculation. The real-world applications of cryptocurrency are rapidly changing the game, proving it’s not just a digital fantasy. Imagine walking into a store, picking out new shoes, and paying with Bitcoin as easily as using a credit card.

Or how about earning crypto coins just for shopping at your favorite spots? Yes, it’s happening all around us. I’ll show you how crypto is making waves in retail, not just for geeks, but for everyone. It’s reshaping how businesses handle money and how we might buy houses or art. Dive into the perks of digital wallets and the financial freedom that DeFi offers. Hint: it’s more secure and streamlined than you might think. Stick with me to uncover the vast potential of crypto in your daily life, offering solutions and opportunities you can’t afford to ignore.

Integrating Cryptocurrency in Retail Shopping

Setting up Bitcoin Payment Systems for Merchants

You are a store owner. You’ve heard of Bitcoin. You now ask, “How can I use it?” You start by setting up a Bitcoin payment system. This simply means you allow customers to buy stuff with Bitcoin. It’s not hard to do. It helps you stand out and can save you money on fees. Unlike credit cards, Bitcoin fees are lower. This is good for your business.

First, you pick a payment service. This service acts like a bank but for Bitcoin. It changes Bitcoin to dollars or other currencies in no time. This keeps prices stable for you. Next, you set up a digital wallet. Think of it like a virtual cash register. It holds Bitcoin until you swap it for cash.

These steps make sure you can take Bitcoin easily and safely. Customers pay by scanning a QR code. The code is linked to your wallet. They use their phones to scan and pay. It’s quick and simple. For them, it’s like using cash but with their phone.

Designing Crypto-Powered Loyalty Programs

Loyalty programs are not new. But crypto can make them better. A crypto-powered loyalty program rewards customers with digital coins. These coins can be saved or spent on more items in your store. It’s a smart way to keep customers coming back.

With blockchain, these rewards are safe and cannot be faked. Each coin is a promise from you to your customer. It can’t be lost or stolen that easy. The tech behind it is strong. It’s the same tech that keeps Bitcoin safe.

You can make shopping with you a game. Customers earn more coins by buying more or bringing friends. They can trade these coins with friends or on the web. Some coins might get rare and worth more. It’s fun for shoppers and good for your sales.

So, crypto makes shopping exciting. It’s good for wallets and good for businesses. It’s a win-win. People save and spend money. You sell more and build trust. Everyone is happy.

Remember, using Bitcoin and crypto is safe. It can bring more people to your shop. As they use their phones to pay or collect coins, they’ll have fun. It’s a new way to shop and a smart choice for your business.

Leveraging Blockchain for Business Operations

Streamlining Cross-Border Payments with Cryptocurrency

Let’s cut to the chase: paying across borders can be slow and costly. Complexity has no room in modern business. That’s where Bitcoin steps in, it changes cross-border payments, making them fast and cheap. Imagine sending money overseas, with it arriving in minutes, not days. That’s Bitcoin’s power.

Bitcoin and similar digital currencies skip traditional banks. They move money using blockchain. It’s like a digital ledger that’s open and records every change. Picture you’re sending money to a supplier in another country. With blockchain remittances, you bypass all the middlemen. This means less time and less cost for your business.

What’s more, the transparency of blockchain is unmatched. Every transaction is there for you to see. No hidden fees or delays. This kind of straightforwardness is what businesses crave. It helps build trust between traders who’ve never met. Plus, it avoids currency exchange hassles. Using Bitcoin for business means dealing in a universal currency. It levels the playing field, no matter where you or your business partners are.

Enhancing Supply Chain Transparency Through Tokenization

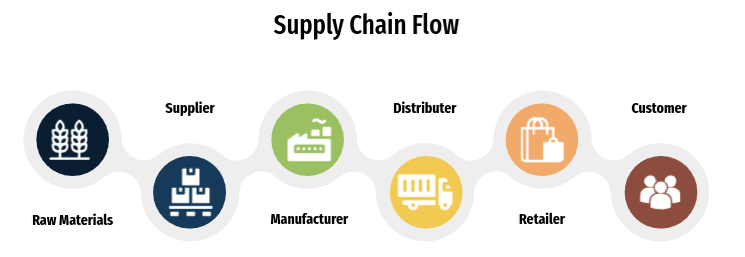

Now, let’s dive into your supply chain. It’s more than moving goods from A to B. It’s about trust, traceability, and cutting slack. And here’s where tokenization, thanks to Ethereum smart contracts, shines.

When we tokenize assets in the supply chain, we turn them into digital tokens. Each token represents a part of your product’s journey. This is crucial for verifying every step on the blockchain. It’s about getting the real-time info that your product is on its way and all’s good.

Imagine ordering raw materials. By using tokenization, you’ll know exactly where they are. This kind of info is gold for managing timelines and customer expectations. Plus, it slams the door on counterfeits. With each product verifiable on the blockchain, fakes can’t stand a chance.

This level of detail used to be unheard of. But now, with crypto in supply chain management, it’s today’s reality. It means safety, speed, and smarts for customers and business owners alike. Tokenization isn’t just a fancy tech word. It’s a game-changer for keeping tabs on goods worldwide.

The use of blockchain goes beyond these examples. It’s a tool for identity verification, ensuring that those you’re dealing with are who they say they are. What’s more, digital wallets for cryptocurrencies make it easy for anyone to hop on this ride. They store and secure digital currency, ready for when you are.

So, whether it’s revamping how you handle payments or securing your supply chain, blockchain is a valuable ally. Remember, businesses that embrace innovation tend to stay ahead. Riding the blockchain wave could well be your ticket to a more efficient, transparent, and profitable operation.

Expanding Crypto Usage in Niche Markets

Revolutionizing Art Ownership with NFTs

NFTs have changed how we own art. Artists can sell their work globally without a physical copy. Buyers own a “token” that proves they have the original piece. This is a win-win: Artists reach more people, and buyers collect digital art easily.

NFTs mean “non-fungible tokens.” They’re digital records on the blockchain. Each NFT is unique, with ownership and history clear to all. So your digital art can’t be forged or stolen without a trace.

NFT trading platforms let artists issue NFTs and fans buy them. Some famous artists and brands have made millions this way. Snagging an NFT can be like finding a rare treasure or gaining a pass to an exclusive club.

NFTs, still new, could keep growing. They might reshape not just art, but music, games, and videos. Imagine owning the only copy of a song or game level. NFTs make this possible.

Adoption of Cryptocurrency in the Real Estate Sector

Buying a house with cryptocurrency isn’t science fiction. It’s happening now. Transactions are fast and secure with blockchain tech. No banks or wires needed—just crypto.

Ethereum smart contracts are key. They’re programs that run on the blockchain. They make sure that when you pay in crypto, the property’s ownership changes hands without fuss.

This tech is huge for cross-border purchases. Crypto takes away annoyances like exchange rates and bank delays. People from different countries can buy and sell properties faster.

Real estate on the blockchain means fewer errors and more trust. Tokenization, where real property gets a digital twin on the blockchain, might be next. It could let people own parts of a property, just like stocks.

While it’s not everywhere yet, crypto is growing in real estate. It saves time and offers new chances for investors. One day, you might own a bit of a skyscraper, even if you’re miles away.

Linking real estate to the digital world with crypto is full of promise. It’s a bold new way for buying and selling one of our oldest assets: land. The journey’s just starting, but it’s already clear. Crypto isn’t just for computers. It’s becoming a key part of our real-world thrills and deals.

The Role of Cryptocurrency in Personal Finance

Exploring Decentralized Finance (DeFi) Applications

You’ve heard the buzz about DeFi, right? It’s a big deal in the crypto world. DeFi stands for decentralized finance. It uses tech to remove third parties in financial services. Think about regular banks or lenders. With DeFi, you don’t need them.

Ever dream of borrowing money without a bank? DeFi makes this real! Through ethereum smart contracts, loans happen peer-to-peer. Nobody needs a credit score check or piles of paperwork here.

But how does it really work? It starts with a smart contract. This is like a set of rules locked on the blockchain. If you meet the rules, you get your loan. Simple as that. All smooth and automated. No need to wait for someone to nod in approval.

Now, DeFi isn’t just about loans. It covers a whole bunch of stuff. You can trade assets, save money and earn interest. And just like a video game high score, you keep everything under your control. No hidden fees, no middleman sneaking a cut.

Remember how I said it’s all done on ethereum? This is where blockchain remittances come in. Sending money overseas is faster and cheaper. No hassle of currency exchange or bank waiting times. With just a few clicks, your cash flies across the world.

The DeFi world is growing. It’s turning heads and changing how we see money.

Digital Wallets and Secure Crypto Transactions

Moving on to digital wallets – your cash goes digital. Digital wallets for cryptocurrencies are like a secret base for your money. Only you have the key.

Why use one? First, it’s like having your bank right in your pocket. You can send or get crypto, snap-quick. Want to buy a gift online with bitcoin? Easy! With crypto payment integration, it’s done in one-two-three.

Safety first, though. Digital wallets keep your funds safe from theft. Encryption and security features make sure only you touch your stash. Plus, digital wallets can show off your crypto-powered loyalty programs. Earn rewards when you shop, just like air miles.

Let’s not forget shops that accept point of sale crypto transactions. Yes, you can walk in, grab a coffee, and pay with Bitcoin. The shop gets its money right away. You enjoy your coffee, crypto-cool.

Wrapping it up, it’s clear crypto is knitting itself into our money lives. Whether it’s snappy transfers, smart saving, or safe spending, it’s handy. More than just geek talk, cryptocurrency is your tool for smarter, smoother personal finance.

To wrap things up, let’s remember our journey through the twists and turns of crypto. We kicked off with how shops can go for Bitcoin payments and cool crypto rewards for customers. Then we jumped into how using blockchain can make business smoother, especially when dealing with money across borders and tracking goods every step of the way.

Next, we explored new markets where crypto is making waves, like turning art into unique digital tokens and buying property. Lastly, we dove into how crypto is changing our personal money matters, from DeFi to keeping our virtual coins safe.

So here’s my final spin on it: Crypto isn’t just internet money; it’s a tool that’s reshaping how we buy, sell, own, and manage assets. It’s more than a trend – it’s the new frontier in our digital world. Let’s keep our eyes peeled and wallets ready.

Q&A :

What are the most common real-world applications of cryptocurrency?

Cryptocurrencies like Bitcoin, Ethereum, and others are being used in various sectors including finance, technology, and retail. Some of the most prevalent applications include peer-to-peer payments, remittances, online purchases, and as an investment asset. They’re also increasingly integrated into payment solutions for businesses, enabling transactions that are often faster and cheaper than traditional banking systems. Additionally, cryptocurrencies are being explored for use in supply chain management, smart contracts, and even in sectors like real estate and energy trading.

How is cryptocurrency changing the global financial landscape?

Cryptocurrency is having a profound impact on the global financial system by providing an alternative to traditional fiat currencies. The use of digital currencies is reducing reliance on central banks and traditional financial infrastructures. Technologies like blockchain that underpin cryptocurrencies are promoting transparency and security in transactions. Moreover, cryptocurrencies are expanding financial inclusion by offering banking services to the unbanked population around the world. They facilitate cross-border transactions, making them faster and less expensive compared to conventional methods.

Can cryptocurrencies be used for everyday purchases?

Yes, cryptocurrencies can be used for everyday purchases, although this is dependent on the acceptance by merchants. Some retailers, both online and physical stores, accept cryptocurrencies as a payment method for goods and services. With the growth of payment processors and crypto payment cards, the use of cryptocurrencies for daily transactions is becoming more convenient. Mobile wallets and QR codes have also made in-person transactions easier. Nevertheless, the extent of use in everyday commerce is still limited compared to traditional currencies due to volatility, regulatory uncertainty, and adoption rates.

In what ways are cryptocurrencies being integrated into businesses?

Cryptocurrencies are increasingly being integrated into business operations through payment processing systems, as a means for capital raising through Initial Coin Offerings (ICOs), and through the use of smart contracts for automated, transparent processes. Furthermore, cryptocurrencies offer an alternative to standard equity and debt financing for startups. Other integrations include accepting cryptocurrency as payment for goods and services, which can expand a company’s customer base and reduce transaction fees.

What future developments are expected to occur with cryptocurrency applications?

The potential for future developments in cryptocurrency applications is vast. Expect to see growth in decentralized finance (DeFi) platforms, which aim to recreate traditional financial services without central intermediaries. We’re likely to witness the evolution of central bank digital currencies (CBDCs), national cryptocurrencies that could redefine monetary policies. Further advancements may also arise in areas such as digital identity verification, non-fungible tokens (NFTs) for digital ownership, and expansion into various industries like healthcare, for secure patient data sharing. The integration with the Internet of Things (IoT) and AI could also create new cryptocurrency applications that we haven’t yet imagined.