Mobile Crypto Wallet vs Desktop Wallet: Which Secures Your Digital Gold?

You’re on a quest to keep your crypto safe and sound. But where to park your digital dough? It’s the million-bitcoin question: Mobile crypto wallet vs desktop wallet—which is the real digital Fort Knox? Dive in as I unpack the nitty-gritty of both wallet types. I’ll dissect their security muscles, compare convenience, and dish out pro-tips to shield your cyber silver. Get the inside scoop to lock down your loot. Let’s break it down and build up your crypto defense.

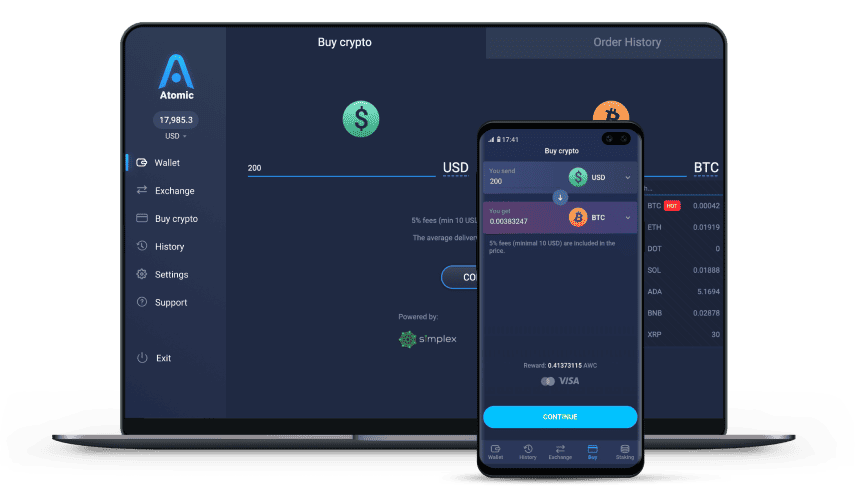

Understanding Mobile vs Desktop Crypto Wallets

Defining Mobile and Desktop Wallets

When we talk about mobile cryptocurrency storage, we mean keeping your digital cash on an app on your phone. This type of storage makes it easy to spend and trade your coins on the go. On the flip side, desktop digital wallet advantages are about keeping your crypto safe on a computer. They’re not as handy as mobile wallets but can be safer.

Core Differences in Security and Accessibility

When comparing digital wallet security mobile vs desktop, each has its pros and cons. Desktop wallets can be safer because they are more challenging to steal from. A thief would need to get into your computer. But, if a virus or hacker attacks, you could lose your coins.

On the other hand, mobile wallet risks come mostly from losing your phone or it being stolen. But, they often have better backup and recovery options—think of the cloud. Mobile digital wallet convenience shines in everyday use, like buying coffee with crypto.

Security isn’t just about keeping coins safe from theft. It’s also about protecting your private keys. That’s like the secret code to your crypto vault. Good crypto wallet backup methods are key for both phone and computer wallets. And if you’re big into different types of coins, using multi-currency wallets can save a lot of hassle, no matter the platform.

Both mobile and desktop wallets use wallet encryption standards to keep your coins safe. Encryption scrambles your data so only you can unscramble it with your password. Remember, whether you choose mobile or desktop, strong passwords matter—a lot.

Mobile Crypto Wallet vs Desktop Wallet:

Offline vs online crypto storage comes into play too. Online—or “hot” wallets—are super easy to use but are constantly connected to the internet, so they’re more at risk. Offline—or “cold storage wallets”—keep your crypto off the net and are safer from hackers. But you can’t trade or spend as easily.

For everyday use, mobile wallets are champs. They often allow QR code payments, super handy at stores or to quickly pay a friend back. But desktop wallets are better if you’re sitting on your crypto like a digital dragon, not spending much.

Lastly, remember that two-factor authentication wallets offer an extra layer of protection. This is where you use two different methods to prove it’s you, like a password and a code that’s sent to your phone. It can stop someone with just your password from getting into your wallet.

Choosing between a mobile or desktop wallet boils down to balancing security with how you use your crypto. Do you spend it like regular money, or is it more of an investment? Your answer will guide your choice and help you pick the best wallet for cryptocurrency that works for your life.

Now, are you leaning more towards the take-it-anywhere mobile wallet, or the fortress-like security of desktop storage? Your unique crypto journey will decide which pockets—or digital pockets—your digital gold calls home.

Assessing Digital Wallet Security: Mobile vs Desktop

Encryption and Protection Features

When we talk about digital wallet security for mobile versus desktop, encryption is key. Both kinds of wallets use strong protection. Your secret codes, or private keys, are locked away. This is like a vault for your digital gold, or cryptocurrency.

For mobile cryptocurrency storage, you have the benefit of portability. You carry your wallet like you carry your phone. Most times, these wallets encrypt your data on the device itself. Even if someone gets your phone, they can’t get your coins without your password or fingerprint.

On the other hand, desktop wallets also have high standards for wallet encryption. They keep your data secure on your computer and often give you more control over your keys. It’s like having a secure safe at home.

Risk Factors and Vulnerabilities

Let’s talk risks now. For mobile wallets, the risk comes when your phone is stolen or hacked. If someone cracks your password or pin, they could get your coins. So, always keep your mobile wallet password safe and don’t share it.

Desktop wallets face different risks. If your computer gets a virus or malware, your wallet could be at risk. Hackers target computers to try to steal crypto. That’s why keeping your desktop wallet software up to date is so important. Updates fix security holes and keep your coins safe.

When it comes to online wallet security, be smart. Always log out and use strong passwords. Online means the wallet is on the internet, not just on your phone or computer. This makes it easier for hackers to try to break in.

Offline vs online crypto storage is a hot topic. Offline, or cold storage wallets, are not connected to the internet, making them super secure. Online wallets are more at risk because they are connected to the internet.

For best wallet security, some mix mobile and desktop wallets. They use mobile for daily use and a desktop or cold storage for saving. Think of it like using a wallet for spending cash and a bank for saving.

Now, about wallet syncing across devices – it’s handy but adds risk. If one device gets hacked, the others might too. Use this feature with care. And always use two-factor authentication. This adds an extra step to check it’s really you trying to get into your wallet.

Security in hardware versus software wallets also varies. Hardware wallets are physical devices that store your keys. They are like a keychain for your digital coins. Software wallets are programs on your device. These are more like an app for managing your money.

In short, mobile digital wallet convenience is great for on-the-go. Desktop digital wallet advantages shine with more control and features. Both have great security if used wisely. Always keep your software updated, use strong passwords, and be safe online. Your digital gold depends on it!

Comparing User Experience: Convenience and Functionality

UX Design in Mobile Wallets

Let’s dive into how your phone can be a treasure chest. Picture this: You’re out grabbing coffee, and you decide to pay with Bitcoin. Thanks to mobile cryptocurrency storage, it’s simple! Just whip out your phone, open your wallet app, and scan the QR code. Boom! You’ve paid in no time. Mobile wallets make spending crypto easy anywhere.

Mobile wallets shine with their user experience (UX). They put access to crypto right in your pocket. Why? Because they’re made for folks on the go. They have to be easy to use—tap here, swipe there. You get cool features, like QR code payments, which make transactions quick as lightning. And with wallet syncing, you can switch between devices without a hitch.

Mobile Crypto Wallet vs Desktop Wallet:

Now, what about keeping coins safe in mobile wallets? We’ve all heard horror stories of phones lost and coins gone. But many mobile wallets come with tough security, like two-factor authentication. This means you’d need something you know (like a password) and something you have (like your phone or a code) to get in.

These mobile wallet apps get updated often, too. Developers work hard to stay ahead of sneaky hackers. You’ll want to keep your app fresh to use the latest, strongest defenses.

The Comprehensive Nature of Desktop Wallets

Desktop wallets are a different story—they’re like a vault in your home office. They’re not really meant to move around with you. This works great for folks who prefer to manage their crypto from their desk. Plus, a desktop wallet can offer more bells and whistles than mobile wallets. Think of it like having a bigger toolbox. Desktops often support multi-currency wallets, letting you handle many types of coins.

Using a desktop wallet means getting a broad view of your crypto world. Unlike a mobile screen, desktops can show detailed charts and loads of data all at once. That’s a big win for keeping track of everything.

But what’s really cool is how desktop wallets pack a punch with security. We’re talking about serious encryption standards. This is like a super-strong lock on your digital gold. Also, desktops are less likely to be stolen than phones, which could mean less risk right there.

A solid desktop wallet also has impressive backup methods. These backups keep your private keys safe—like hiding a map to your treasure. If your computer takes a dive, you can still get to your coins.

That said, desktop wallets aren’t perfect. If your computer ever gets a virus, your desktop wallet could be at risk. And while you’re less mobile than with a phone, you’ve got a robust toolset at your desk.

Choosing between mobile and desktop boils down to your lifestyle and needs. Want quick access when you’re out? Go mobile. Prefer a powerhouse tool with lots of info? Desktop’s your best bet. Remember, check those backup and encryption features either way. They’ll keep your digital gold safer.

Best Practices for Managing Your Cryptocurrency

Backup Solutions and Private Key Management

When it comes to protecting your digital gold, knowing how to manage your stash is key. For every crypto owner, two things should be top of mind: backup solutions and managing private keys. Let’s talk about how to keep your coins safe.

Best Crypto Wallet for Security

For backup, think of it as a safety net. It’s like having a spare key to your house. If you lose the first one, you won’t be locked out. Portable Bitcoin wallets make this easy. They let you copy and store your key info on different devices. You should always do this. If your device gets lost or breaks, you’re covered.

Private keys are like the passwords to your digital safe. You must keep them secret and safe. Writing them down on paper can work. It’s old-school but effective. The paper can’t be hacked. Just make sure this paper is kept far from prying eyes or fires.

The Role of Multi-Factor Authentication and Regular Updates

Now, let’s add more layers of security. Ever heard of multi-factor authentication (MFA)? It’s like adding extra locks on your door. Even if someone finds your key, they can’t get in without the second lock’s combo. For your wallet, this could be a code sent to your phone or an app.

MFA isn’t complex, and it makes a big difference. You should use it. Most mobile digital wallet apps offer MFA. Check your wallet’s settings and turn it on. The few extra seconds it takes to log in could save your crypto.

Keeping your wallet software updated is another must. Think of updates like a health check for your wallet. Developers find bugs and holes and fix them with updates. Both desktop wallet software and mobile wallet apps need these fixes. Not updating is like leaving your door half open. You wouldn’t risk your home, so don’t risk your crypto.

Mobile wallets are handy. With them, you can pay on the go. Just scan a QR code, and done! They’re also good for trading and checking your balance. But mobile cryptocurrency storage can have risks too. Phones get lost or stolen often. That’s why backups and MFA are vital.

A desktop digital wallet has its perks. Some say they’re safer.

They’re harder to steal, sure. But don’t forget about malware and hacking. Your computer needs good defense software. Hack and attack risks are real for desktops too. This is why online wallet security matters, whether on a phone or a computer.

So, what’s the best wallet for cryptocurrency for you? It depends. If you’re always on the move, maybe a mobile wallet wins. Love big screens and have lots of coins? Desktop might be your match. Just remember, no matter your choice, keep your backup current, your private keys private, and always use extra security. Don’t slack on updates, either.

Balance convenience with caution. You can enjoy the benefits of both mobile and desktop wallets. Just stick with best practices. With a bit of care, your digital gold stays safe in your digital vault.

In this post, we dove into the digital world of crypto wallets. We looked at mobile and desktop options, noticing key differences in their security and how easy they are to use. We found mobile wallets offer quick access while desktop wallets give us more in-depth features. We realized encryption keeps our digital cash safe, yet each wallet faces its own risks.

We also compared how it feels to use these wallets. Mobile wallets are sleek and user-friendly. Desktop wallets pack more detail into each screen. Safety tips like backing up keys and updating often are a must to protect our coins.

Now, as you consider your options, remember to match your wallet choice to your daily habits and security needs. Mobile might be right if you’re always on the move, but a desktop wallet could suit you if you dive deep into your crypto work. Stay smart and use those best practices – it’s how we keep our digital treasures safe and sound. Follow Dynamic Cryto network to update more knowledge about Crypto.

Q&A :

What are the main differences between a mobile crypto wallet and a desktop wallet?

When looking at the key differences between mobile crypto wallets and desktop wallets, it’s important to consider their flexibility, security, and overall user experience. Mobile wallets are known for their convenience, as they allow users to access their funds on-the-go through a smartphone app. On the other hand, desktop wallets tend to offer enhanced security measures and are accessed via a desktop or laptop computer. They generally have a more robust feature set and can be more suitable for users who handle large transaction volumes or require advanced privacy features.

How secure are mobile crypto wallets compared to desktop wallets?

In terms of security, both mobile and desktop wallets have their strengths and weaknesses. Mobile wallets can be more susceptible to risks, such as device theft or hacking, especially if the device is not secured with strong passcodes or biometric authentication. However, they often integrate additional features like remote wipe capabilities in case of theft. Desktop wallets, while they are less exposed to such physical thefts, can be vulnerable to malware and phishing attacks if the computer is connected to the internet. Both types of wallets can provide excellent security if proper safety practices are followed, such as keeping software updated, using strong, unique passwords, and enabling two-factor authentication.

Which is more convenient for daily use: a mobile or desktop crypto wallet?

For daily usage, mobile crypto wallets are often considered more convenient due to their portability and ease of use. They facilitate quick transactions and payments, allow for the use of QR codes, and are ideal for users who frequently trade or pay with cryptocurrencies. With mobile wallets, users can manage their crypto on the move, making them well-suited to a busy, mobile lifestyle. Desktop wallets, while less portable, can be advantageous for users who perform complex transactions or require advanced trading tools that are better suited to desktop software.

Are mobile crypto wallets more prone to hacking than desktop wallets?

The susceptibility of mobile crypto wallets to hacking depends on a variety of factors, such as the operating system, app security features, and user practices. While the always-connected nature of smartphones can increase the potential exposure to network-based attacks, reputable wallet apps employ strong encryption and security protocols to guard against unauthorized access. Desktop wallets that are regularly connected to the internet can also face similar threats; however, desktops which remain offline most of the time (cold storage) significantly reduce the risk of online attacks. Ultimately, regardless of the platform, maintaining updated security measures and being vigilant about sharing personal information are critical for both mobile and desktop wallet users.

Can I use my mobile crypto wallet on multiple devices?

Most mobile crypto wallets allow you to use your wallet across multiple devices, but it’s important to exercise caution. This convenience comes with a need for heightened security practices to ensure your wallet is not compromised on any device. Typically, users can restore their mobile wallet on a new device using a seed phrase or secure backup method. It’s crucial, however, to keep the seed phrase confidential and secure, as anyone with access to it could potentially restore your wallet and access your funds. Additionally, activating any available multi-factor authentication features can add an extra layer of security when accessing your wallet on different devices.