Dive into the world of Market Maker in Crypto and discover how to keep digital cash flowing. You might think crypto moves at light speed on its own, but there’s a hidden player in the game: market makers. They’re the ones who make sure you can buy or sell your digital coins whenever you want. Today, I’m opening the playbook on how these pros help your trades glide smoothly, no matter the tide. Join me, and let’s unlock the liquidity secrets that fuel the crypto universe, making wheels turn behind the scenes!

The Art of Crypto Liquidity Provision

The Role of Market Makers in Digital Asset Exchanges

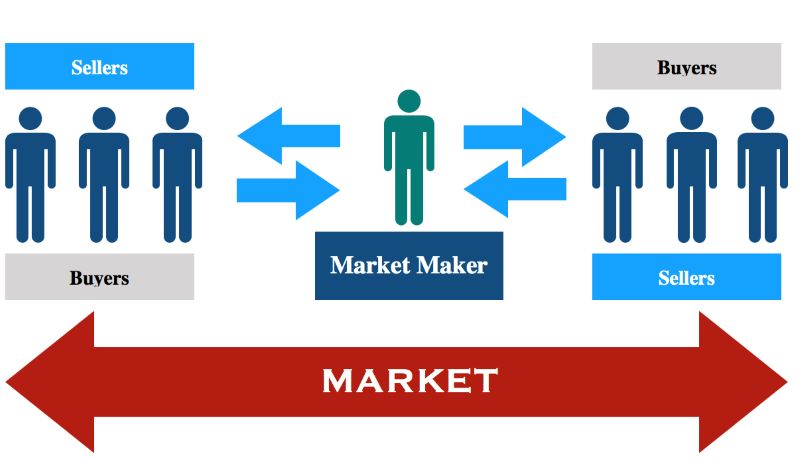

Market makers are like wizards. They play with numbers to make magic happen in the markets. Their magic power lies in creating chances to buy and sell. This helps everyone get the best prices for their digital coins. What’s their secret? They place a lot of buy and sell orders on the order book. Think of a giant list of what people want to pay and sell for crypto. By doing this, they make sure that when you want to trade, you can – and at prices that don’t jump around too much.

Let’s get into it more. When I say ‘order book management’, I mean the market maker’s ability to fill the book with orders. This means lots of numbers telling traders that they can sell or buy without moving the price too much. We call this ‘ensuring fair prices’. They work really hard to keep the spread – the gap between the buy and sell prices – as small as they can. Why? Because a small spread means you pay less to make a trade. It’s a win-win!

How Algorithmic Trading Enhances Crypto Exchange Liquidity

Now, imagine a chef who can cook a hundred meals at once. Algorithmic trading in cryptocurrency is kind of like that. It’s a super-fast way to cook up buy and sell orders by using computers that follow set rules.

Algorithmic trading takes what market makers do and kicks it into overdrive. It uses math, data, and complex programs to pick the right orders at the right time. This style of trading, called ‘high-frequency trading crypto’, works at crazy speeds. It can react to market changes in milliseconds. This means more chances for trades to happen without big price changes.

Here’s a cool part: algorithmic trading not only works fast but also never sleeps. So, even when we’re all tucked in bed, it’s there keeping liquidity alive. This is mighty handy when unexpected news hits and the market starts to stir.

What’s more, it helps find those hidden gems called ‘arbitrage opportunities in crypto’. These are like little treasures where you can buy low in one place and sell high in another. Quick, smart programs spot these fast and act on them, which helps everyone get prices that make sense.

Crypto exchange liquidity, or the ‘depth of market crypto’, gets so much better with these tools. It means that there’s always money ready for traders who want to jump in. It’s as if the market maker is saying, “Come on in, the water’s fine!” No wild price changes, no waiting around, just a smooth trading pool that feels just right.

And let’s not forget ‘automated trading strategies’. Market makers use these to set up plans that keep the market humming and thriving, all designed to avoid ‘crypto price slippage’. That’s when prices change between the time you want to trade and when you actually can. We all like our trades to happen at the prices we expect, right?

From morning to night, these liquidity wizards are hard at work with their spells and incantations – or as they say in the crypto world, algorithms and automation. They make sure the market flows like a gentle stream, not a wild river, giving us all the magic of a market that works for everyone. Always remember, without these amazing folks and their cutting-edge tools, trading our favorite digital coins would be a whole lot bumpier!

Mastering Market Mechanisms

The Implementation of Automated Trading Strategies

In the fast-paced world of crypto, market makers are vital. They help buyers find sellers, and vice versa. They do this using what we call automated trading strategies. These are like set-and-forget tools that work non-stop. They match trades in the blink of an eye. That’s good for everyone, as we all want trades to happen quickly and at fair prices.

Automated trading strategies can spot trends. They use math and past trade info to guess where prices will go. This helps smooth out rough price changes. These strategies let market makers trade a lot, and fast. This type of trading is called high-frequency trading, and it’s a big deal in crypto. Fast trading helps make sure there is always someone willing to buy or sell. That’s what we call liquidity, and it’s super important.

Now, these strategies need to be smart. They have to handle many trades at once and make sure they’re making good trades. That’s where algorithmic trading comes in.

Understanding and Managing Order Book Dynamics

Let’s dive into order books. Think of an order book as a list. It tells us what people are willing to pay for crypto, and what people want to sell it for. The difference between these two is called the spread. A big spread means buying and selling prices are far apart. A small spread is better. It shows us that our crypto market is healthy.

Market makers aim to tighten this spread. By doing this, they can make markets more fair and steady. They add orders to the list that offer better prices. This helps them and also other traders. It’s a win-win. With clever order book management, market makers keep the crypto world spinning.

Now, not just anyone can manage an order book. It’s tricky. Crypto liquidity providers use special tools to follow changes in trading volume and order book depth. Depth means how many orders are waiting in the book. Think of it like a pool. A shallow pool doesn’t have much water. A deep pool has lots of water. A deep market has lots of orders, and that’s good for traders.

When there are enough orders, prices don’t jump around as much. This lowers what we call crypto price slippage. Price slippage is when your trade ends up at a different price than you expected. We don’t like surprises when trading, so we try to avoid that.

As crypto markets grow, we keep learning new tricks. That’s to keep things fair, quick, and easy for everyone. And it’s folks like market makers who are behind the magic. They find smart ways to use tech and their know-how. This way, they help us all have a better time trading our digital coins.

Strategies for Efficient Market Making

Balancing Risk with Market Maker Bots and Arbitrage

In the fast world of crypto, market makers are key. They make sure trading flows smooth. These pros work with cool tools like market maker bots. Bots act fast to keep up with the game.

These bots have a big job. They balance risk while they trade. They look for price gaps between places. This is called arbitrage. They buy low here, sell high there. Quick and smart.

Crypto liquidity is tricky. But these bots make it look easy. Liquidity means there’s enough coin to trade without big price moves. If you’re trading, you want that.

A market maker bot’s goal? Keep order in the chaos. They follow rules to trade smart. By doing this, they help everyone. Traders get better prices. The market stays healthy.

Strengthening Market Depth and Minimizing Price Slippage

Now, let’s dig into the order book. It’s like a big list. It shows who wants to buy or sell, and for how much. Market makers keep this list full. This way, when you want to trade, you can.

Deep market depth means a strong order book. Think of it like a team bench. You want lots of players ready to jump in. This way, the game never stops.

What happens when there’s not enough depth? Prices slip. That’s slippage. You don’t get the price you thought you would. Like when your favorite candy costs more than the sign said.

Market makers fight slippage. They place orders on both sides – buy and sell. This tightens the spread. Spread is the gap between buy and sell prices. A tight spread means fair play for all.

By using logic and math, they build a plan to trade. This helps keep the coin’s price just right. With their smart strategy, your trades are safe and sound. You’ve got a fair shot at making a win.

Market making isn’t easy. But when done right, it’s art and science in one. It brings balance and trust to the crypto world. Now that’s some real magic in the market.

The Future of Market Making in Crypto

Embracing Decentralized Finance Market Makers

Welcome to the world where money moves like magic. Today, we talk about the heroes who keep your trades smooth in crypto: market makers. Their job? Simple. They make sure you can buy and sell crypto fast, without waiting.

Imagine a big shop, filled to the brim with toys. In crypto, market makers fill the shop with digital coins. They are the ones you never see, working behind the screens. They set buy and sell orders to create a market for coins to swim freely.

Decentralized finance market makers are even cooler. They use smart contracts, which are like robot helpers, to run things. This means the market never sleeps – it’s a game that never stops, 24/7.

For you, this magic means better prices and more coins to choose from. Market makers help make your trading dreams come true with every click.

Innovative Approaches to Liquidity Pool Management

Dive deeper into the pool – the liquidity pool, that is. It’s like a big piggy bank for crypto where everyone can chip in. When you put money in, you get a piece of the pool. The more you put in, the bigger your piece.

Now, managing this piggy bank is no small task. Market makers are the savvy bankers here, making sure there’s always enough for everyone. They use algorithms, like smart recipes, to mix and stir the pool just right.

market-maker-in-crypto

Liquidity in digital assets can be like a wild river. Market makers build dams and channels to direct the flow, so your trades happen smooth and quick. These are the secrets that keep the crypto world spinning.

They also watch like hawks for chances to make extra money by spotting price differences. This is called arbitrage, and it’s like finding a toy cheaper in one shop, and selling it for more in another.

All this hard work is for the big win: to give you a market where prices are fair, and you can trade with a smile. Market makers use their tricks to chop the spread, which is the gap between buying and selling prices, to save you money.

Every time you trade, think of the market makers who help you glide through the market with ease. In return, they get a tiny piece of the cake. It’s their slice for keeping your trading dreams alive.

The future’s bright with these wizards at work. They turn complicated crypto chaos into simple clicks for you. Cheers to the market makers – the unsung heroes of the crypto world!

To wrap it up, we dived deep into the craft of crypto liquidity. We saw how market makers keep digital money flowing smoothly, and how smart trading systems boost that flow. We unlocked the secrets of automatic trade tactics and saw the order book’s inner workings.

We explored how to play it smart with bots and arbitrage, making sure risks stay low and the market stays full. We figured out how to tighten up the market to keep prices steady.

Looking ahead, we’re set to see big things in crypto. Decentralized finance market makers are changing the game, and fresh, clever ways to manage liquidity pools are on the rise.

In this world, staying sharp and ahead of the curve is what it comes down to. Keep learning, keep adapting, and you’ll play a key role in the crypto market’s success.

Q&A :

What Exactly is a Market Maker in Cryptocurrency Exchanges?

Market Makers in cryptocurrency are entities that increase the liquidity of the market by providing buy and sell orders constantly. They play a crucial role by allowing users to execute orders without waiting for a matching buyer or seller, thus facilitating smoother and more efficient market operation.

How Do Market Makers Profit in the Crypto Ecosystem?

Crypto market makers profit primarily from the spread – the difference between the buy (bid) and sell (ask) prices. They may also receive trading fees discounts from exchanges, and in some cases, they earn rebates for adding liquidity to the market. Efficient trading strategies and algorithms enable them to manage risks while executing large volumes of trades.

What are the Risks Associated with Being a Market Maker in Crypto?

Being a market maker involves several risks including, but not limited to, market risk due to high volatility, execution risk where the timing of trades could lead to losses, and inventory risk where holding a large amount of a particular cryptocurrency could lead to losses if its value decreases. Additionally, technological risks such as system failures or hacks are always a concern in the digital asset space.

Can Anyone Become a Market Maker in the Crypto World?

Technically, yes, anyone with sufficient capital, knowledge of market dynamics, and access to proper trading infrastructure can become a market maker in crypto. However, effectively competing with established market makers requires sophisticated algorithmic trading systems, an in-depth understanding of the market, and the ability to manage the associated risks.

How Important are Market Makers for the Crypto Market Liquidity?

Market makers are vital for crypto market liquidity. By consistently providing bid and ask orders, they help to ensure that there is enough volume on both sides of the order book, making it easier for traders to enter and exit positions without causing significant price impact, therefore enabling a more stable and liquid market.