Cryptocurrency exchanges stumble when it comes to how to improve crypto exchange liquidity, and it’s no small hiccup. You see, liquidity is the lifeline of any crypto platform. Without it, trades slow to a crawl, spreads widen, and users might as well take their business elsewhere. That’s where I come in. I’ve got the inside track on cranking that liquidity up several notches – strategies straight from those who’ve turned their platforms from barren deserts into thriving marketplaces. Ready to dive into the world of advanced market making, tech leverage, and user incentives that can magnetize market participants to your exchange? Let’s transform your platform into a liquidity legend.

Enhancing Market Depth and Liquidity on Your Crypto Exchange

Adopting Advanced Crypto Market Making Strategies

In crypto, a good market maker can do wonders for your exchange. It’s like having a superconnector. They match buyers with sellers. This helps avoid wild price swings. Their smart crypto market making strategies keep trades flowing. Simply put, they add to your exchange’s market depth and liquidity.

How do they do it? Well, they use powerful computers and secret sauce algorithms. They keep an eye on price differences. They jump on them in a flash. This boosts trust in your platform. After all, no one likes waiting to have their trade matched. Or worse, seeing prices go wild just because no one was there to trade with them.

Scaling Up with Market Makers in Cryptocurrency

To reach new heights, bring in more market makers. Why? Because more players mean more action. Think about it like a busy marketplace. You want lots of fruit stalls, not just one lonely stall. Then folks have options. Prices stay fair. Customers stay happy.

Having more market makers also helps spread the word. They often have networks of their own. Their thumbs-up can bring in the big players—like institutional traders who move markets. Now, this kind of trading can scare some. True, it speeds things up a lot. But it also helps fill up your order book.

When that book looks healthy, new traders flock like birds. They see solid order book depth. It tells them they can trade large amounts. It won’t hurt the prices. They stick around. That’s a big win!

You also want to narrow that pesky spread—the gap between buy and sell. Slim spreads mean cheaper trades. Traders love that. So, work on spread reduction in crypto trading. It makes your exchange the go-to spot for the best deals.

Remember decentralization? Those exchanges face tough liquidity challenges. But no worries. They’re not insurmountable. Go for liquidity farming in DeFi. Or try cross-exchange liquidity aggregation. These can fill up liquidity pools in crypto trading.

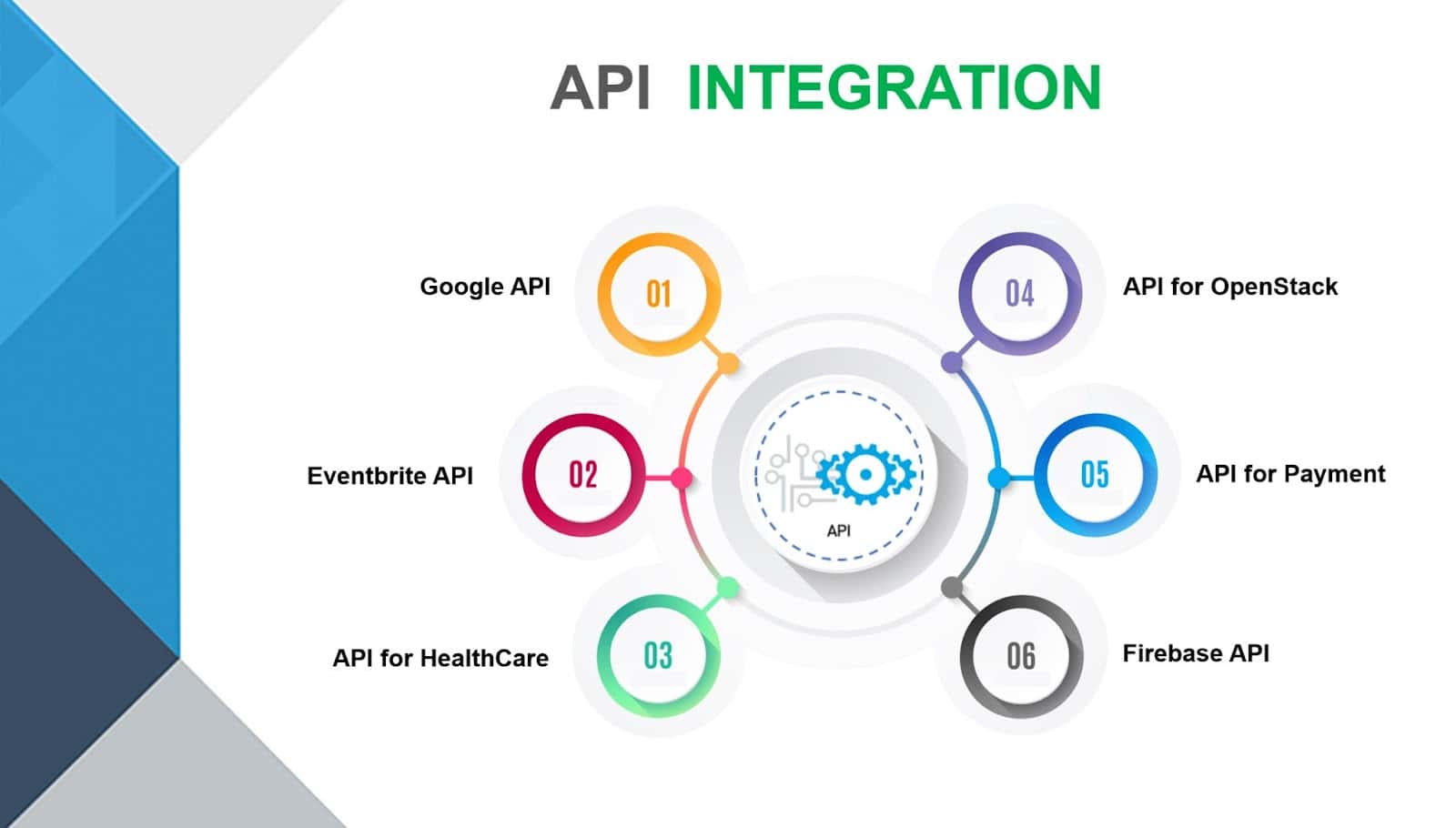

Got smart techie pals? Get them to set up liquidity incentives on exchanges. Use APIs to smooth out the process. It links traders, markets, and even other exchanges. It’s like creating a big, easy freeway for traders to zoom around and make deals.

In the end, making your crypto exchange more liquid is all about trust—earning it, keeping it, and building it. Use advanced market making, make friends with big traders. Aim for a bustling, fair trading spot with tight spreads. Help traders see your exchange as trustworthy. Before you know it, you’ll have a lively marketplace. Everyone will want in on the action.

Leveraging Technology for Sustained Liquidity

Implementing Automated Trading Systems for Consistent Liquidity

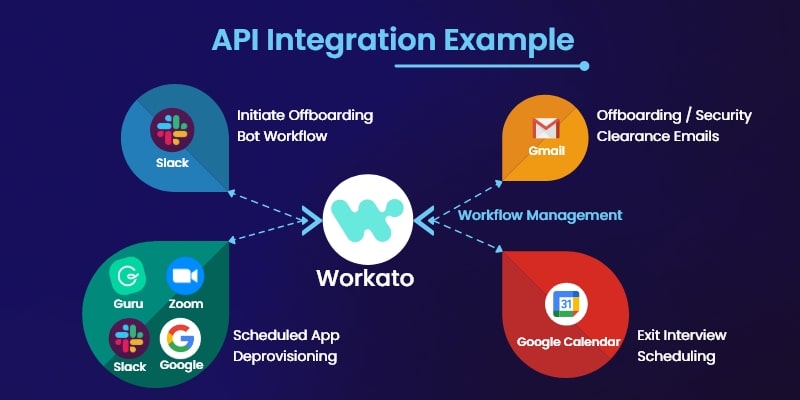

To boost your crypto exchange’s liquidity, automated systems are key. They trade around the clock, providing constant liquidity. You see, crypto never sleeps. But people have to. That’s where bots come in. They ensure that even while we snooze, trades can flow.

Using crypto market making strategies, these systems work fast. They match buys and sells on your platform without pause. This creates a tight network of trades. Think of it like a busy bee garden. Trades are the pollen, and bots are the bees making honey – the sweet liquidity we need.

Bots also help with market depth. Imagine diving into a pool full of water. That’s what we aim for with liquidity. More water, deeper pool, better diving. The bots add to that depth. They let traders dive in and out with ease. And when high-frequency trading joins the mix, it’s like adding jet power to the liquidity pool. It moves fast, and there’s plenty of it.

Integrating APIs to Streamline Liquidity Improvement Efforts

Next up, APIs, or ways for computers to talk to each other. They’re crucial for improving liquidity. They connect your exchange with others, share info, and even help with attracting institutional traders. Big players want big pools to play in. They look for deep waters. APIs help them find your exchange and ensure it has the depth they need.

Integrating APIs makes everything smooth. Traders can jump in, do their thing, and jump out without a hitch. It makes your exchange like a well-oiled machine. No squeaks, no jams, just smooth trading.

Think of APIs like bridges. They link islands of trading together. This creates a supercontinent of liquidity. And who doesn’t want to be part of a massive land of opportunity?

With APIs, you also get to boost order book depth. This attracts more traders. It’s like having a big sign that says, “Come on in, the water’s fine!” And once they’re in, APIs help keep the waters stable and inviting.

Bringing in APIs also means you can offer more pairs for trading. Not just the big names, but also exciting new coins. And the more trades happening, the more liquidity your exchange has.

In a nutshell, if you want to stay ahead in the game, use technology. Automated trading systems keep trades flowing non-stop. APIs connect your exchange to a broader market. They both pull in more traders and make sure their experience is top-notch. And a happy trader is a loyal trader. They stick around, and that’s what you want. Long-term players who trust your exchange to deliver the goods 24/7.

Attracting and Retaining Market Participants

Crafting Tailored Incentives for Crypto Liquidity Providers

To keep a crypto exchange bustling, you need people. Specifically, you need market makers. These folks provide liquidity to exchange platforms. In other words, they make sure that when someone wants to buy or sell, there’s always a match.

Now, how do we attract these high-rollers? It’s all about the perks. Think of what a good incentive looks like for the crypto crowd. One word: rewards. We’re talking reduced fees for starters. If you trade a lot, the fees can nibble at your profits. So, lower fees for market makers mean more trading and more liquidity. Everyone’s happy.

And then there’s a chunky carrot we call ‘liquidity mining programs’. Players earn extra tokens for every trade they make. This isn’t just free money. It encourages even more trades, which beefs up the order book depth at your exchange.

Engaging Institutional Traders to Diversify the Liquidity Mix

But why stop at individual traders with their own strategies? Institutional traders come with big bucks and bigger networks. They carry a load of clout. Attracting these giants needs solid tech and stronger trust.

Here’s the big question: How? Well, these traders love a tight ship. This means advanced trading options, like smart order routing and crypto liquidity swaps. They dig an exchange that matches lightning fast. If you throw in solid fiat onramps, so they can hop in and out with real-world money, you’re onto a winner.

And let’s not forget stability. Big traders hate slippage. That’s when their big orders shuffle prices. You can hug them close with stablecoin pairings. They offer a safe zone for huge transactions.

Remember, attracting the big fish is one thing. Keeping them around is another game. Regular chats, feedback loops, and always, always showing that you’re boosting your tech will seal the deal.

Building a vibrant exchange isn’t magic. It’s about knowing your traders, big and small, and giving them reasons to pick you. And once you’ve got them, keep them close with the best tools and treats in the business.

Navigating Liquidity Challenges and Innovations

Tackling the Unique Liquidity Hurdles of Decentralized Exchanges

Decentralized exchanges (DEXs) face tough liquidity issues. Unlike their centralized pals, they can’t rely on one source for their trading flow. They need many traders to make markets thick and ready for trades. These bazaars of the blockchain world need clever ways to get folks to trade more.

How do we get over these hurdles? One big move is liquidity pools. Think of a giant pot of digital coins, where folks add their own to make trading easy. They get fees as a thank you. This way, the exchange never runs out of steam, and traders can buy and sell without waiting.

But there’s more. We also have automated market makers (AMMs). They’re like robots that always say “yes” to a trade. They use those big pots of coins to trade with you 24/7. With AMMs, DEXs rock non-stop trading action.

Exploring the Impact of Liquidity Farming and Aggregation in DeFi

Now, let’s dive into liquidity farming. What’s that, you ask? It’s when folks earn extra tokens, just for helping with the big pot of coins we talked about. It’s a cool way to reward the crowd for pitching in. And guess what? It works wonders. A lot of people jump in to earn those extra goodies.

Then we have liquidity aggregation. That’s a fancy term for mixing all the different pots together. It makes one big pool that’s even easier to trade in. So instead of hopping between exchanges, you can stay in one spot. It’s like having the whole market in your pocket.

Liquidity farming and aggregation in DeFi? They’re game changers. They let everyone get a slice of the trading action, and that keeps the markets buzzing. With these DeFi tricks, DEXs can give those big, old crypto exchanges a run for their money.

Both newbies and old hands need these smooth trades to stick around. So, our goal? Simple. Crush those pesky hurdles and let the good times flow. We do this by setting up ways to pull everyone in, making trading not just easy, but fun. That way, our crypto bazaars stay full of life, with coins zipping around, making happy traders all around.

In this post, we explored how to boost market depth and liquidity on your crypto exchange. From adopting smart market making tactics to scaling up with proven market makers, we’ve covered key strategies that can lead to a more vibrant trading platform. We also dove into using tech like automated systems and APIs to keep liquidity strong.

We talked about drawing in and keeping market players, offering special perks for liquidity providers, and roping in big-time traders to mix up the liquidity pool. Lastly, we tackled the tricky parts of liquidity in decentralized setups and looked at new moves in DeFi, like liquidity farming and pooling.

So, here’s my final take: whether you’re running a bustling exchange or just starting out, the right moves in market making, tech use, trader engagement, and innovation are vital. These steps won’t just improve trading on your platform—they’ll also help build a trustworthy and robust marketplace. Stay aware, stay smart, and keep pushing the limits. Your exchange, and your traders, will thank you for it.

Q&A :

How can cryptocurrency exchanges enhance their liquidity?

Exchanges can boost their liquidity by integrating with larger pools, forming partnerships to increase order book depth, implementing liquidity incentives like reduced fees or yield opportunities, and providing a broad mix of trading pairs to attract a diverse user base. Ensuring a robust API for market makers and professional trading entities can also contribute to increased liquidity.

What strategies can be employed to attract liquidity providers to a crypto exchange?

To lure liquidity providers, crypto exchanges may offer competitive fees, introduce rebate programs, and ensure a secure trading environment. Moreover, implementing high-frequency trading systems, offering staking or earning opportunities, and establishing a reputation for reliability and compliance can prove effective in drawing liquidity to the platform.

Why is liquidity critical for a cryptocurrency exchange?

Liquidity is vital for a crypto exchange as it ensures that orders can be filled promptly without causing a significant impact on asset prices, leading to a more stable and less volatile trading experience. High liquidity also enhances the credibility of an exchange, attracting more traders and providing better price discovery for assets.

How do automated market makers (AMMs) improve liquidity on a crypto exchange?

Automated market makers (AMMs) can improve liquidity by providing a mechanism for instant token swaps without the need for a traditional buyer and seller match. They enable continuous and automated liquidity provision through smart contracts, which hold reserves of multiple tokens, thus helping maintain market fluidity and reducing price slippage.

What role do market makers play in crypto exchange liquidity?

Market makers are key participants that enhance liquidity on crypto exchanges by continuously buying and selling cryptocurrencies to provide depth to the order book. Their activities help narrow the bid-ask spread, facilitate efficient price discovery, and enable traders to execute orders with minimal delay and slippage.