Diving into the world of digital money can seem like you’re lost at sea. How to buy crypto with a credit card for beginners? It’s not as hard as you might think. I’ll walk you through, step by step, no sweat. Get ready to crack the code on using that plastic in your wallet for scoring some crypto. We start by breaking down the nuts and bolts of cryptocurrency and how your credit card fits into the mix. Watch out for fees and rates that can bite.

Then, we’ll help you choose which crypto exchange and card will give you the best bang for your buck. Safety is king, so I’ve got the lowdown on keeping your digital gold locked down tight. Ready to invest? We’ll talk about getting verified and setting up your digital wallet. Finally, I’ll be your guide in actually buying the crypto and nailing the aftermath — like keeping your credit score shiny and knowing your rights. Let’s turn that curiosity into crypto savvy—no jargon, no fluff. Strap in, it’s go time!

Understanding the Basics of Cryptocurrency and Credit Card Transactions

The Fundamentals of Cryptocurrency Purchases with Credit Cards

When you buy crypto with a credit card, it’s like online shopping. But instead of clothes, you buy digital money, like Bitcoin. Remember, buying digital currency is easy but comes with rules. You pick a place to buy, called an exchange. It’s where money meets crypto. To start, find a crypto exchange that takes credit cards. Not all of them do.

When you find one, sign up. They will ask for your info. This is to keep you and them safe. It’s called the KYC process and helps stop bad stuff, like fraud. Next, add your credit card details. Just like buying a game or a book online.

Now, choose what crypto you want. Bitcoin is popular, but there are more, like Ethereum or Litecoin. Decision time! How much do you want to spend? Be careful, as credit cards can tempt you to buy more than you need. Keep an eye on how much you can pay back.

Done deciding? Click “buy” and in a moment, you own crypto!

Recognizing Fees and Exchange Rates when Buying Digital Currency

Fees can bite. Every time you use a credit card to buy crypto, there’s a fee. The fee is for the service and varies with every exchange. Some may charge more, others less. So, before you buy, check the fees. Look for low-fee crypto exchanges for credit card. It keeps more money in your pocket.

Exchange rates matter too. They tell you how much crypto you get for your money. It’s not always the same and changes fast, like a race car! Watch the exchange rate before you buy. If it’s high, your money buys less crypto. If low, you get more for your buck.

But here’s a fun fact: Some credit cards give you cashback rewards when buying crypto. It’s like getting a small gift for shopping.

So when you’re ready to buy, don’t rush. Check fees, look at exchange rates, and maybe earn rewards. It’s like getting ready for a trip. You pack the right stuff and check the map.

And that’s it! You’ve just learned the basics of buying crypto with a credit card. Remember, always play it safe. Use what you can afford, watch those fees, and keep your eyes on the rates. Happy crypto shopping!

Selecting the Right Crypto Exchange and Credit Card

Comparing Crypto Exchange Credit Card Transaction Fees

When buying digital currency, you’ll deal with exchange fees. Currency trading platforms may seem alike but can differ in what they charge you. Each crypto exchange credit card transaction has its own cost.

To start, look at fees for credit card use on each platform. Fees can eat into your funds fast. Choose low-fee crypto exchanges for credit card use to save money. That leaves you more to invest.

Check out the fees before you sign up. Pick the place that keeps the most money in your pocket. A good rule is: fewer fees, more crypto for you.

Ensuring Secure Crypto Purchase with Mastercard or Visa

Buying crypto means taking care to keep your money safe. Most of us have Mastercard or Visa, and using them can make for secure crypto purchases. They’re known worldwide and have safety features built in.

When purchase Bitcoin using Visa or any major card, watch for HTTPS in the web address. This means your data stays safe. A lock icon by the web address is also a sign that you’re on a secure site.

Another layer of safety is two-factor authentication (2FA). It asks for more than just your password. It’s like an extra lock on your digital door.

Lastly, know your chargeback rights for crypto buys. If there’s fraud, these rights could help get your money back.

By knowing what fees to expect and how to keep your money safe, you’re on your way. You can make your first time crypto buying smooth and well-planned. Remember these tips and secure your digital future. Happy trading!

Setting Up for Your First Crypto Investment

The KYC Process for Crypto Purchase

“You need to verify your identity first.” That’s step one. Most crypto exchanges ask for your info due to rules they must follow. This is called the KYC process. It stands for ‘Know Your Customer’. They check who you are to stop crimes like money-laundering.

When you sign up at a crypto exchange, they’ll want some personal details. You’ll likely share your name, address, and maybe a photo ID. After this, they may ask for more proof, like a bill with your address. It can seem like a lot, but it’s for everyone’s safety. Once you’re done, you can start buying crypto.

The whole point of KYC is to keep things honest. Exchanges need to make sure you’re really you. Without KYC, anyone could buy crypto. That could mean trouble. So, while it takes some time, it ensures that your crypto purchase stays secure.

Establishing a Secure Digital Wallet for Your Assets

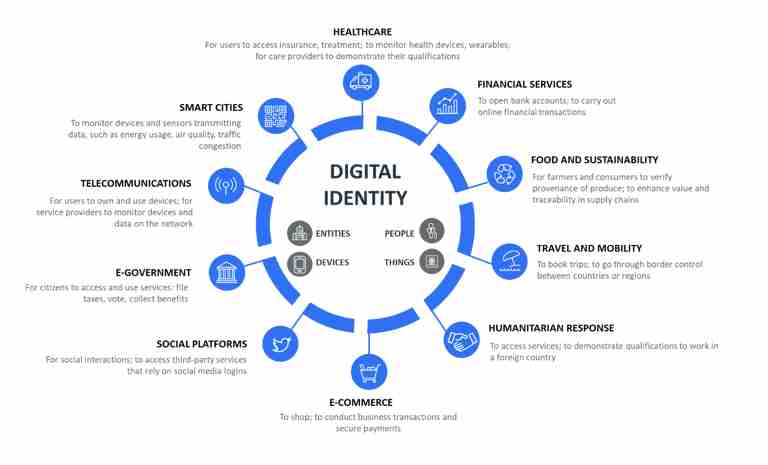

Now, let’s set up a digital wallet. It’s where you keep your crypto, kind of like your money wallet. A digital wallet holds your coins online or offline, and comes in many kinds. Wallets make sure only you can access your crypto.

An online wallet lets you access your crypto from anywhere with the internet. It’s handy but needs good security so no one else can get in. Offline wallets, also known as cold wallets, keep your crypto off the web. They are like a safe. You plug them into your computer to get your crypto. They’re super secure, as they’re not always connected to the internet.

Pick a wallet based on how you plan to use your crypto. If you’ll trade a lot, maybe go online. If it’s for the long haul, a cold wallet might be best.

Security is key, so choose a well-trusted wallet. It’ll need a strong password. Remember it, or else you might not get your crypto back. If you pick an online wallet, turn on two-factor authentication. This adds another layer of security.

Unlocking Digital Wealth

After your wallet is set up, take note of your private key. It’s a secret code to get into your wallet. Don’t share it with anyone. If someone finds it, they can take your crypto. So keep it safe, like under lock and key.

With your KYC done and your wallet ready, you’re on your way to buying crypto. The next steps involve choosing a crypto, using your credit card, and thinking about fees. But don’t worry, we’ll get to those soon.

Remember, these early steps are building blocks for your crypto journey. They set you up for a good start. Take care with each step, and you’ll be ready to join the crypto world!

Now you know how to start. You’ve learned about KYC and wallets, and why they matter. Next up, we’ll talk about making the actual purchase. It’s exciting to buy your first crypto, and doing it right means you can enjoy the ride without stress. Keep these tips in mind, and let’s move ahead into the world of crypto!

Making the Purchase and Managing Post-Transaction Details

Understanding Crypto Exchange Rates and Transaction Safety

Buying crypto with a credit card is easy. You put in your details, hit “buy,” and boom—crypto. But wait. The trades need spot-on exchange rates. You don’t want to lose cash because of a rate that’s not current. And let’s be real, who wants to lose money they just put down? Crypto websites should show the rates as they change, so check them. Don’t get surprised by a rate that moved while you were getting your coffee.

Let’s talk about safety with these purchases. Using a credit card should feel safe, just like when you shop for books or games. Secure sockets layer (SSL) should be everywhere so hackers can’t see your stuff. Trustworthy websites also ask for identity proof. It’s a hassle, but it means they care about keeping you safe from fraud.

Managing Your Credit Score and Rights after a Crypto Buy

Now, after you score some digital coin, that credit card bill will come. If you pay it on time, your credit score can stay shipshape. But let’s keep it real: if you miss payments, your score could take a hit. It’s key to know how much you’re okay to spend. Remember, buying crypto shouldn’t mess up your money goals.

You’ve got rights with these buys, too. If a deal goes south, you might be able to say, “I want a do-over” and get a chargeback. That’s your right if the exchange messes up. But chargeback is not a “crypto-back” if the value falls, so buy wisely.

Remember, beginner’s luck won’t always keep your credit score from dipping or secure your coin. Every step should be taken with care. Follow the steps, use the noggin, and your start in the crypto world can be solid. Buying digital currencies should feel like a proper move, not a risky jump.

In this guide, we walked through cryptocurrency’s basics and how to use credit cards for buying digital currency. We looked at fees, exchange rates, and choosing an exchange that won’t cost you too much. I showed you how Mastercard or Visa can make purchases secure.

We also covered how to get ready for buying crypto. This includes knowing your customer (KYC) rules and setting up a digital wallet. To wrap up, we talked about making your purchase. It’s important to understand exchange rates and keep your credit score safe after buying crypto.

Keep these tips in mind, and you’re set for a smart start in the world of cryptocurrency investing. Always stay safe, and be aware of costs and security when you dive into digital money with your credit card!

Q&A :

Can beginners buy cryptocurrency with a credit card?

Yes, beginners can buy cryptocurrency with a credit card. However, they need to choose a crypto exchange or platform that supports credit card purchases. The process typically involves setting up an account, verifying identity, adding a credit card as a payment method, and then selecting the cryptocurrency they wish to buy.

What steps should a beginner take to buy crypto with a credit card?

- Compare platforms: Look for reputable crypto exchanges or platforms that accept credit card payments.

- Create an account: Sign up and provide the required personal information for verification.

- Add a credit card: Link your credit card to your exchange account.

- Make a purchase: Choose the type and amount of cryptocurrency you want to buy and confirm the transaction.

- Secure your investment: Transfer your purchased crypto to a wallet for enhanced security.

Are there specific credit cards that are better for buying cryptocurrency?

While no credit card is specifically designed for buying cryptocurrency, some cards may be more favorable due to lower fees, better rewards, or a more straightforward approval process with crypto exchanges. Always check with your credit card provider about their policies regarding cryptocurrency purchases before proceeding.

What fees can beginners expect when buying crypto with a credit card?

When buying crypto with a credit card, beginners may encounter several types of fees, including:

- Transaction fees: Charged by the crypto exchange or platform per transaction.

- Credit card fees: Charges from the credit card issuer for processing the transaction, which can include cash advance fees.

- Network fees: On certain platforms, additional fees may apply for the specific cryptocurrency network.

- Conversion fees: If the purchase involves currency conversion, expect a fee for that as well.

Is it safe for beginners to use a credit card to purchase cryptocurrency?

While it is relatively safe for beginners to use a credit card to purchase cryptocurrency through a secure and reputable platform, there are risks to be aware of:

- Fraud risk: Always use trusted platforms to avoid scams.

- Credit risk: Purchasing crypto can be volatile; don’t spend more than you can afford to lose.

- Security risk: Protect your account with strong passwords and enable two-factor authentication to prevent unauthorized access.

- Debt risk: Be mindful that buying cryptocurrency on credit can lead to debt if not managed responsibly.