How to avoid hidden fees on crypto exchanges; you need the right tactics, and that’s exactly what you’ll get here. When you trade digital currencies, you may note a chunk of your profits eaten by sneaky charges. I’ve been there, and it’s a tough lesson in reading the fine print. But, don’t worry! You’ll discover insider tips to keep more of your money where it belongs – with you. This article peels back the layers on those pesky fees, from maker and taker fees to the less obvious costs in fee schedules. By understanding these, you can play the game like a pro. Let’s dive into turning those unwanted losses into gains.

Unveiling the True Cost of Crypto Exchange Fees

Understanding Maker and Taker Fees

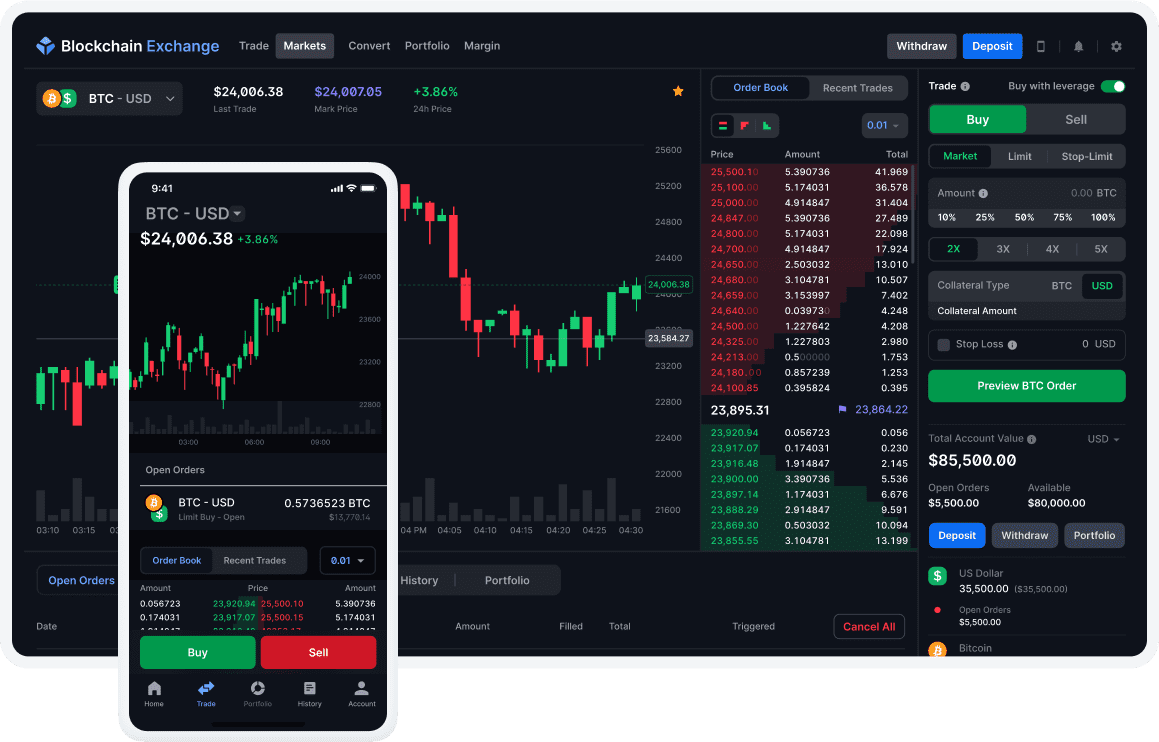

When you trade digital currency, two main fees matter: maker and taker fees. Maker fees apply when you add a trade to the exchange’s order book. This means you’re making liquidity. Taker fees come into play when you match with an order already on the book. In this case, you’re taking liquidity away.

To pay less in fees, you want to be a maker. How? By placing limit orders. These orders don’t fill at once. Instead, they wait for someone to take them. This usually snags you a lower maker fee. Taker fees are costlier and kick in with market orders. These orders fill fast, but you pay extra for the speed.

Decoding the Fee Schedules on Exchanges

Exchange fee schedules can be tough to understand. But cracking their code can save you cash on hidden charges. Let’s dive into that.

Every exchange has a fee schedule. It tells you how much trading will cost. Fees can seem small, but they add up fast, especially if you trade a lot. So, it pays to read these schedules close.

Spotting hidden fees on these schedules is key. Look out for fees tied to deposits, withdrawals, and trading. Don’t just glance at them. Really read through to spot any sneaky costs.

Some exchanges also change fees based on how much you trade. They use tiers. The more you trade, the less you pay per trade. This is an incentive to keep your trades on their platform. It’s like a volume discount.

But here’s a pro tip: Compare fee structures. You might find one exchange’s fees lower than another’s. Or, you may find fee-free options for certain trades. Fiat to crypto conversion fees are a big deal, too. They can vary a lot. Shopping around pays off.

Avoiding slippage in trades can also save on costs. Slippage happens when there’s a difference between the expected price of a trade and the price at which the trade is executed. Good thing is, using limit orders helps you dodge this.

In the end, getting to grips with these two aspects – maker and taker fees, and reading those exchange fee schedules – can make a big difference to your pocket. Think of it like this: Every penny saved in fees is a penny extra in your crypto stash. So don’t skip the details. They can lead to more coins in your wallet and that’s the aim, right?

Strategies to Reduce Trading Fees on Digital Currency Platforms

Using Limit Orders to Avoid Slippage

Slippage in crypto trades eats your money, quietly. Avoid it with limit orders. These let you set your buy or sell price. No surprises. You stay in control. This means you only trade if the price hits your mark. No more, no less. It’s a powerful way to lock in prices and skip the hidden costs that come with market swings. You may think you’re buying at one price, only to find it’s higher because the market moved. With limit orders, that’s history. By fixing your price, you sidestep those sneaky extra charges.

Negotiating Better Rates with Crypto Exchanges

Talking to exchanges can save you cash. Many traders don’t know they can negotiate fees. But like a secret path, it’s there if you seek it. Start small. Build a history of trades. Then, reach out. Show your value as a trader. Make your case for lower rates. It’s business, after all. They want to keep good clients.

You need to be bold. Ask for what you want. The worst they can do is say no. Remember, exchanges differ. Some may offer better deals right away, especially if you’re a high-volume trader. Dig into their fee structures. Every exchange has one. Look for ‘volume discounts’ or ‘tiered pricing.’ This could mean the more you trade, the less you pay per trade.

Dig up the details. Fee schedules can be layered and complex. Like a puzzle, you need to piece together. Look out for deposit and withdrawal charges, too. Each move may cost you. And don’t forget about the maker and taker fees. Being the one who makes a market (maker) usually pays less than taking what’s offered (taker). Understanding these can tilt the scales to your favor.

It’s like a game, and knowing the rules keeps more money in your pocket. Spot hidden fees. Blast them away. Compare costs for moving altcoins versus popular coins like bitcoin. Sometimes, it’s cheaper to trade one for the other first.

In the end, it’s about keeping more of your hard-earned crypto. Don’t let hidden fees sneak up on you. Spot them, understand them, and then outsmart them. You got this. Use limit orders, talk for better rates, and always, always stay sharp. Those invisible charges won’t know what hit them.

Discovering Low-Cost Alternatives in the Crypto Space

Exploring Fee-Free and Low-Fee Crypto Exchange Options

Let me tell you about cutting costs. When picking a place to trade, compare the fees. Check every charge on the fee schedule. Ever heard of a “fee-free” platform? They may make money in other ways. Research is key here. That’s how you spot hidden fees bitcoin platforms might have. Some exchanges offer low fees for high-volume traders. Look into these if you trade often.

Check different platforms. Which ones keep costs down for your trading style? Some sites let you trade without a fee. Now, that sounds great! But, read the rules first. What do they charge for when you move your coins out? Make certain. Identifying hidden charges cryptocurrency has is like being a detective.

Remember, some places have lower costs for “maker” trades. What are these? When you set a price and wait, that’s making. When you take an offer right now, that’s taking. Makers often get better rates. Why? They help the market. They give other traders prices to work with.

Now, which coins are you trading? Bitcoin might have different fees than ether. Finding fee-free crypto exchange options? Possible. Compare transaction fees altcoins have. Watch out for deposit costs digital currency exchanges throw at you. Some exchanges let you use fiat money. But check the fiat to crypto conversion fees, too.

What about small trades? Well, every bit adds up. A tiny fee on a small trade is still money. Finding flat fee crypto exchanges can save you here. Look for exchanges that have a fixed cost, no matter the size of the trade.

The Benefits of Peer-to-Peer Crypto Transfer Methods

Peer-to-peer (P2P) lets buyers and sellers trade directly. This can help avoid extra costs. P2P means no middle-man. No extra hands in your cookie jar. This method often has smaller fees. Why? Because it’s just two folks trading, just like swapping cards.

Some P2P platforms have a fee. Yes, I know. But often, it’s less compared to big exchanges. Yet, watch out for peer-to-peer crypto transfer costs. They might be hidden. Remember, ask questions and read the details. Transparency in crypto fee structures matters a lot.

P2P can feel more personal. You’re dealing with real people, not just screens. That’s a plus for many. But be careful. Scams happen. Only use trusted sites and always check the other person’s ratings.

When using P2P, the fees vary. How urgent is your trade? If you can wait, you might save on costs. No rush, no high fees. This method gives you more control. You choose the price and when to hit the trade button. Plus, you’re helping keep the crypto community tight-knit. We’re all in this together, after all.

In short, avoid hidden fees with smart choices. Look at all options. Compare them. Trade wisely. And know your stuff. That’s how you keep those sneaky costs down and your profits up.

Advanced Tactics for Minimizing Costs on Blockchain Transactions

Leveraging Layer 2 Solutions for Fee Reductions

When you trade crypto, fees can eat your money like a sneaky cookie monster. Layer 2 solutions are the ninja moves to fight those costs. They’re like shortcuts on a busy road. You can dodge the traffic—the main blockchain—and say goodbye to long wait times and high fees. Think of them as express lanes; you pay less and move faster.

Want real savings? Use Lightning Network for Bitcoin. For Ethereum, grab some Layer 2 action with networks like Optimism or Arbitrum. They make things cheaper by moving transactions off the crowded Ethereum road. How much you’ll save depends on how many people are using the network and how complicated your trades are. But remember, always move your crypto back to the main road when done. That way, you keep it safe.

Smart Contract Execution and Gas Fee Optimization

Now, let’s chat smart contracts. They work like magic spells on the blockchain. A smart contract automatically does stuff when certain things happen. But they need gas to run—no, not the one for cars—the fee kind. Gas fees change based on supply and demand. Picture it like this: more people want to send spells, I mean contracts, gas fees go up.

To cut gas fees, time your spells when the Ethereum road is less busy. Maybe at night or on weekends. Sites like ETH Gas Station can tell you the best times. Another tip: set a gas limit. It’s like telling your contract, “Here’s your allowance.” If the job costs more, it doesn’t go through. No nasty surprises on fees!

To sum up, save on fees by using Layer 2 roads, pick low-traffic times for your smart contracts, and always set a gas limit. It’ll take some learning, but your wallet will thank you. And hey, who doesn’t like more crypto cookies in their jar, right?

We’ve covered a lot in our dive into crypto exchange fees. You now know how maker and taker fees work and what those fee schedules mean. Remember, using limit orders can dodge extra costs, and talking to exchanges might score you better rates. We also looked at exchanges with low or no fees and peer-to-peer transfers to keep more coin in your pocket. Lastly, we explored layer 2 solutions and smart contract tricks to cut down on blockchain costs.

In this crypto journey, every bit saved on fees means more for your investments. Use these tips to trade smarter and keep costs low. With the right moves, you’ll see the difference in your digital wallet. Stay sharp out there!

Q&A :

How can I identify hidden fees before trading on cryptocurrency exchanges?

When considering cryptocurrency exchanges, it’s critical to read through their fee structure meticulously. Check out their withdrawal fees, deposit fees, trading fees, and any other miscellaneous costs that might not be immediately apparent. Some exchanges also offer a detailed fee schedule on their website or within their user agreements, which can shed light on any additional charges you may encounter.

What are the common types of hidden fees in crypto exchanges?

Common types of hidden fees on crypto exchanges include withdrawal fees, deposit fees, network fees, and inactivity fees. Transactions might also incur fees for currency conversion if they involve fiat. Sometimes, exchanges have tiered fee structures, meaning that fees can vary depending on the volume or type of transaction.

Can using certain payment methods on crypto exchanges avoid hidden fees?

Yes, choosing the right payment method can help avoid some hidden fees on crypto exchanges. For example, exchanges often provide several funding options, such as bank transfers, credit cards, or e-wallets, each with different fee implications. Generally, bank transfers might have lower fees compared to credit cards. Be sure to compare the fees associated with each payment method before making transactions.

Are there any crypto exchanges that don’t charge hidden fees?

While most crypto exchanges have some sort of fee structure in place, there are exchanges that pride themselves on being transparent with their fee policies. Look for exchanges that advertise themselves as having zero hidden fees, but be vigilant and read user reviews and their terms of service to ensure this is accurate. Additionally, some decentralized exchanges (DEXs) may have lower or more transparent fee structures compared to centralized ones.

What are the best practices for minimizing fees on crypto exchanges?

To minimize fees on crypto exchanges, you should:

- Compare the fee structures of different exchanges before signing up.

- Use limit orders instead of market orders to avoid high taker fees.

- Consolidate your trades to reduce the number of transactions, thus lowering potential fees.

- If possible, use the exchange’s native token to pay for transaction fees, which often comes with a discount.

- Keep an eye on any promotions or discounts that the exchange might offer for reduced fees.

Remember, being well-informed and periodically reviewing your chosen exchange’s fee policies can help you avoid unexpected costs when dealing with cryptocurrencies.