How does cryptocurrency work? It might seem like magic money, but it’s not. The secret lies in blockchain, a smashing system that tracks every coin. Think of it as a secure ledger that everyone can see but no one can cheat. Each shiny digital coin represents real value, just like the cash in your pocket. In this no-snooze guide, we’ll uncover how these virtual coins pop into existence and scoot across the globe. So buckle up; let’s dive into the digital coin mystery, uncover blockchain wonders, and decode what makes crypto tick. Ready to know more? You’re in the right spot!

The Foundation of Cryptocurrency: Blockchain Basics

Understanding How Blockchain Powers Crypto

Blockchain is the brain behind crypto. Think of it as a diary that keeps honest records. It’s not kept in one place, so it’s hard to cheat. Every time someone makes a move with crypto, it’s a new page in this diary. All the pages are linked with math puzzles.

This math keeps it safe. Let’s say you send money to a friend using crypto. The blockchain checks if you can. It looks at the pages in its diary. If yes, your friend gets the money. Everyone’s copy of the diary then updates.

Blockchain works because it’s a big team effort. No single person can control it. Instead, folks around the world help keep it running. They make sure everything is by the book. Because of smart people doing complicated work, we can trust blockchain.

Decrypting Cryptographic Hashing and Security

Now let’s dive into cryptographic hashing. It’s a big word for a lock that keeps crypto safe. It scrambles info and no two scrambles are alike. Just like snowflakes! You cannot guess the scramble because it’s super tricky. Even a tiny change makes a new puzzle no one has seen before.

This keeps crypto safe because it’s like an uncrackable code. It’s the reason people can’t fake transactions. When you hear proof of work, it means someone worked hard to solve a math problem. It’s a green light that everything checks out.

Proof of stake is a bit like having a ticket in a raffle where your crypto is the prize. The more you hold, the better your chances to check transactions. This uses less power and still keeps things secure.

Blockchain and crypto are close pals. Together, they make sure when you send and receive digital money, it’s fair and square. This trust is why lots of people think crypto is the next big thing for how we use money.

Generating and Transferring Value: Crypto Mining and Transactions

The Crypto Mining Process and How New Coins are Created

Imagine you’re a gold miner, but for digital coins. This is crypto mining. It’s how new bitcoin and other crypto coins are made. Miners solve tough math puzzles using powerful computers. When they solve one, they get new coins as a reward. This helps keep track of all the transactions on the blockchain too.

Transaction Verification and the Role of Nodes

Nodes are like the hall monitors of the crypto world. They watch over the blockchain and check every transaction. They make sure no one spends the same coin twice. Each transaction is like a locked box. It only opens with the correct key, which is a secret code. You have two keys, one public and one private. People see the public one, but only you know the private one. It’s what keeps your transactions safe. Nodes use these keys to lock and unlock transaction boxes. This way, they can make sure everything is correct.

Cryptocurrency is a kind of money you can’t hold in your hands. It’s all online. No banks, no paper, just numbers on screens. But those numbers mean a lot. They are worth real money and you can use them to buy things. Even without a bank in the middle, this system is very safe. It uses special codes that take a powerful computer a long time to solve. This makes sure only the right person can use their coin.

When you send or get coins, it’s like sending a coded message. Only the person with the right key can read it. This keeps it safe from prying eyes. Computers called nodes work day and night, making sure every transaction follows the rules. With so many eyes on them, it’s super tough to cheat.

Now, cryptocurrencies are not just about coins. They are about a whole new way of dealing with money. It’s called decentralized finance, or DeFi for short. It’s finance without the big banks, just people dealing directly with people. It all runs on blockchain tech. This is like a big book that keeps a perfect record of every deal ever made. It’s safe, clear, and can’t be changed by just one person. Everyone using the blockchain can see the same big book, so everyone knows what’s going on.

But what happens when lots of transactions happen at once? That’s a big question. The blockchain can get full, like a traffic jam. But don’t worry! Smart people are always finding new ways to make it run smooth, so your transactions go through fast and easy.

In this digital world of coins, just remember: it all comes down to trust. The trust is built into the system, with every transaction checked and safe. This means you can be sure that when you give or get crypto coins, it’s as solid as when you hand someone a dollar bill. It’s pretty cool, right? This is the magic of cryptocurrency.

Different Cryptocurrencies and Their Mechanisms

From Bitcoin to Altcoins: A Look at Different Digital Currencies

Let’s dive into the world of cryptocurrencies! We start with Bitcoin, the first digital coin. It works on a system called blockchain. Like a long train of info blocks, each block holds details of every deal. They link securely to form a chain. It’s all overseen by a global team of people with computers. This team doesn’t let anyone cheat the system.

Now, what about altcoins? These are all the other digital coins that came after Bitcoin. They have their own rules but still, use blockchain’s clever tricks. Some are super fast. Others focus on keeping your stuff private. Each one has its own spice to offer!

Smart Contracts on the Ethereum Platform and Their Functions

Moving on from digital coins to smart contracts on Ethereum. Think of a vending machine. You pick a snack, put in coins, and out pops your treat. No one needs to hand it to you. It’s automatic! That’s how a smart contract on Ethereum works. It’s a program that runs when certain things are done.

People use Ethereum’s smart contracts for trading, loans, and more. They don’t need a bank or a lawyer. Just code that everyone can trust to do the right thing. Isn’t that cool? People build games and even digital cats that can’t be copied!

So there you have it. Cryptocurrencies and smart contracts are changing how we handle money and agreements. From Bitcoin to altcoins, and from storing to doing deals. The idea is to make stuff smoother and put you in charge. Keep learning, and you could become a digital coin wizard too!

Participating in the Crypto Ecosystem: Wallets, Exchanges, and DeFi

Crypto Wallets: How They Work and Why They’re Important

You step into the crypto world with a wallet. It’s your digital keychain, packed with keys that let you unlock and send your money across the globe. Picture this—each key has two parts. One is public, for others to send you coins. The other is private, like the secret pin to your bank card.

Holding that private key is serious business. It’s the pass to your digital cash. Lose it, and you can say bye to your coins. Wallets come in many shapes. You’ve got online wallets, apps on your phone, and even hardware wallets that look like USB sticks.

These wallets talk to the blockchain, the huge ledger of all transactions. When you want to send Bitcoin, your wallet creates a message. It says, “Hey, I am sending some Bitcoin.” It locks this message with your private key.

Then, it’s off to the races. Your transaction travels across a huge network of computers. These are nodes, working non-stop to check all crypto moves. They look at your message, match the keys, and if all’s good, your Bitcoin moves to a new home.

Navigating Cryptocurrency Exchanges and Decentralized Finance (DeFi) Systems

Now, let’s go shopping for some crypto. Where do you do that? On an exchange. Think of a marketplace, buzzing with buyers and sellers, but all online. You can swap your dollars for Bitcoin, Ethereum, or an ocean of altcoins.

Decentralized finance, or DeFi, kicks it up a notch. It’s like a financial wild west, all built on blockchain beauty. No banks, no middle-men – just you, smart contracts, and a bunch of services. Loans, savings, even insurance, all done with coins and code.

DeFi’s big secret is smart contracts. They are unbreakable promises, written in code on the blockchain. They work this way: When conditions are met, they automatically do what they’re programmed to do.

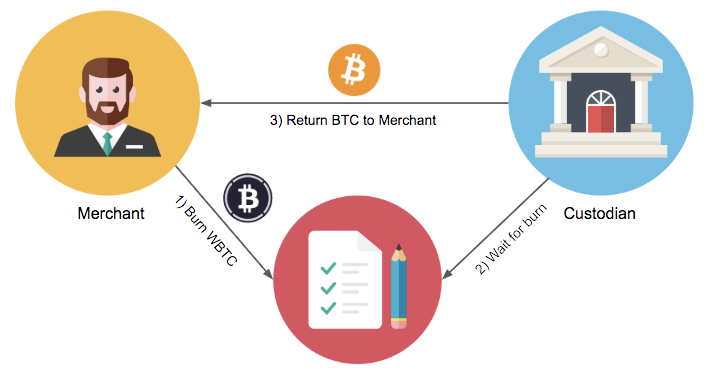

Let’s take a DeFi loan as an example. You put up some Ethereum as collateral. The smart contract locks it up. Then, it spits out your loan in a stablecoin. You later pay back that loan with some added interest. Once done, you get your Ethereum back. Magic? No, it’s DeFi.

Remember though, cowboy, DeFi’s a new frontier. It can be risky and a bit wild. Always stick to the good old rules—research lots, understand what you’re getting into, and only bite what you can chew.

The crypto ecosystem is a wonderland. Wallets, exchanges, and DeFi are just the front door. Once you’re in, there’s a whole new world of digital gold to explore. Happy trails on your crypto journey!

In this post, we’ve dived into the nuts and bolts of cryptocurrency. We started with blockchain, the tech that keeps crypto reliable and safe. We saw how blocks link up to make a chain that’s tough to break. Next, we learned how new coins are made through mining and how our deals stay clear and safe on the network.

Then we looked at different coins like Bitcoin and others, and how Ethereum’s smart contracts are game-changers. Lastly, we tackled how to keep and use your crypto with wallets and exchanges, and the rise of DeFi, which is changing the money game.

Here’s the take-home: Crypto’s more than just digital cash; it’s a whole new way to think about money and tech. It’s got its own lingo, tools, and rules. I hope this guide has shown you how it all fits together and gets you set for stepping into the world of crypto. Let’s keep our eyes peeled for what’s next and dive in smart!

Q&A :

How Does Cryptocurrency Function?

Cryptocurrency operates on a technology called blockchain — a decentralized ledger recording all transactions across a network of computers. The security of this technology is due to its cryptographic nature, making it resistant to fraud or hacking. Users can buy, sell, or trade cryptocurrencies via exchanges, using digital wallets to store and manage their digital assets.

What Is the Principle Behind Cryptocurrency Transactions?

Transactions in cryptocurrency are initiated by the submission of a transaction to the network by a wallet, and then confirmed by network participants, called miners or validators, depending on the cryptocurrency. They solve complex mathematical puzzles to validate transactions and add them to the blockchain, where they’re publicly recorded and become irreversible.

Are Cryptocurrencies Safe to Use?

While the technology underlying cryptocurrencies is considered secure, the safety can also depend on how users manage their digital wallets and personal security measures. It’s important to research and use reputable wallets and exchanges, employ strong passwords, and where possible, utilize two-factor authentication.

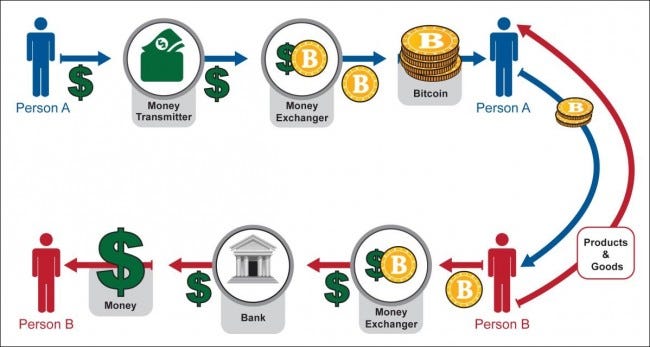

Can Cryptocurrency Be Converted into Traditional Money?

Yes, cryptocurrency can often be converted into traditional fiat money through cryptocurrency exchanges or platforms offering the service. Once sold on such platforms, the fiat can generally be withdrawn to a bank account, although this process and the ease of converting can vary between different regions and services.

What Are the Advantages of Using Cryptocurrency?

Cryptocurrency offers several advantages such as lower transaction fees compared to traditional banking systems, enhanced privacy, reduced fraud risks due to the decentralized and immutable nature of blockchain, and the potential for quick international transactions. Additionally, for many users, cryptocurrencies offer a form of investment and a hedge against inflation or currency devaluation.