Hidden Fees on Crypto Exchanges: Unveiling The Costly Secrets

I’ve been trading crypto for years, and trust me, the hidden fees on crypto exchanges can bite. Ever felt like your crypto transactions take a bigger chunk of your wallet than they should? Take it from an expert; you’re not alone. Fees sneak up, and it’s time we spot them in the shadows. In this deep-dive, we’ll crack open the real cost of cryptocurrency trading, pinpoint those sly charges, and show how you can trade smarter, keeping more coins in your pocket. No fluff, just the must-knows to stop those hidden fees from eating into your digital dough. Let’s bust open these costly secrets together!

Understanding The True Cost of Cryptocurrency Trading

Grasping the Basics of Exchange Transaction Fees

When you trade crypto, every move costs money. Let’s talk about exchange transaction fees. These are the fees you pay for each trade. They vary a lot from one exchange to another. Think of it like this: every time you buy or sell crypto, the exchange says “thank you” with a fee. The more you trade, the more fees you rack up. So it’s good to know exactly what you’re paying.

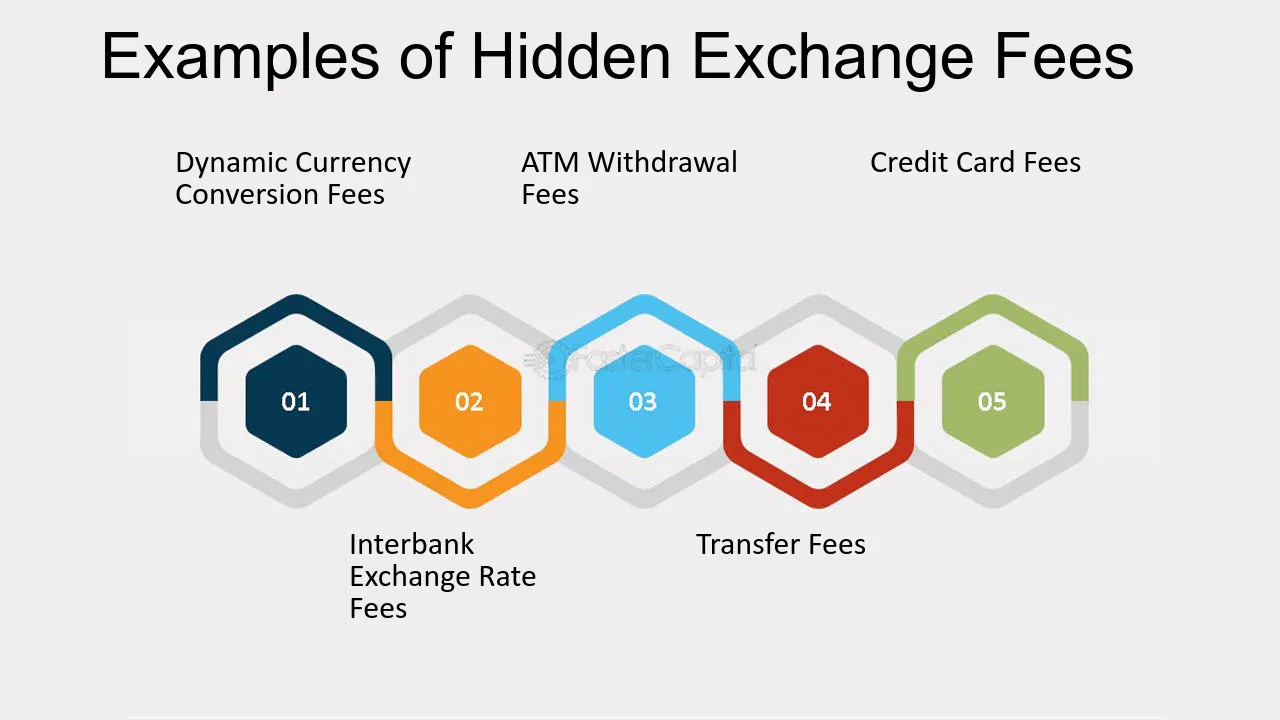

Identifying Hidden Charges in Your Crypto Trades

Now, get ready for some sneaky business—hidden charges. They’re not always on the bill. Imagine finding an extra charge on your lunch tab for cutlery. That’s how hidden fees in crypto can feel. They sneak into your trades as things like withdrawal fees on exchanges. Some are clear, but others are harder to spot. Look out for network fees in cryptocurrency or blockchain transaction charges. These can bite off a chunk of your funds without you noticing.

Your trades could also face extra costs in crypto investments. Think about market data fees. Some platforms charge you just for the info you need to trade. Not fair, right? And don’t forget about the sneaky ones—hidden commission crypto exchanges might add on. These are fees they don’t talk about much.

Spotting hidden costs in crypto takes skill. You’ve got to read the fine print like a detective looking for clues. You want to avoid surprises? Go over the terms with a magnifying glass. Always check for things like crypto withdrawal limits and costs. And the sneaky inactivity fees on exchanges? They’ll charge you just for not trading!

Don’t get me started on maker-taker fees. They’re like a puzzle. Exchanges use these to set different rates for different traders. If you’re making orders, you could pay less. If you’re taking orders—surprise—you might pay more. Not all exchanges make this clear. So keep an eye out.

But here’s some good news. Some crypto exchanges comparison will show low fee crypto exchanges. Yes, ones without hidden fees. It’s all about looking around and comparing. Aim for crypto trading fine print that spells out all costs. No secrets. And when you spot the right exchange with true pricing transparency, you’ve struck gold. Not only do you save on surprise charges crypto exchanges might toss at you, but you trade smarter.

Remember, the total cost of crypto trading is not just the number on the screen. Add all those fees up, and you’ll see the real price tag. It’s your money. So make sure you keep as much of it as you can. That means staying sharp and avoiding unwanted crypto fees whenever you can. Keep these tips in your back pocket, and you’ll be a cost-savvy crypto trader in no time.

The Maker-Taker Pricing Model and Its Hidden Costs

How Maker-Taker Fees Work in Cryptocurrency Exchanges

Crypto exchanges use a system called maker-taker fees. “Maker” refers to users who add orders to the market. They provide liquidity. “Taker” means those taking the orders away. This affects how much you pay.

Makers often pay less in fees. Why? They make the market fuller and better. Takers use up this liquidity and usually pay more. Fees can range widely. They change based on trade volume and currency.

Spotting the Hidden Commission in Maker-Taker Fees

Hidden fees can surprise you. Spotting them is not always easy. Watch for small details. Exchanges may not always tell you about these fees. They are in the fine print no one reads. Understanding maker-taker fees is crucial.

Let’s say you buy Bitcoin. The price seems good. But, the final cost could be more. This is because of hidden fees. They’re tucked away in the trade. You think you’re paying one price. The truth is, you’re paying more because of extra charges.

Low fee crypto exchanges sound great. But, always look for hidden charges. Some platforms boast low upfront costs. Then, they hit you with unexpected fees later. This could be for withdrawing your money, inactive accounts, or other actions.

Knowledge is your power here. Learn about fee structures. Compare exchanges. See where they’re clear about fees and where they’re not.

Cryptocurrency platform fees can eat up your funds. Some exchanges are better than others. Find those with more pricing transparency. They can help you save.

Giving attention to the fine print is hard but helps avoid traps. You should know the total cost of your crypto trading. It’s not just commission. Remember network fees on blockchain transactions too. They’re part of the deal.

Extra costs in your investment can be sly. Always check withdrawal limits and associated costs. Volume-based fees in trading can also be an issue. Especially if you’re a big-time trader.

Pricing tiers make things more complex. Be aware. Sometimes, higher trade volumes can reduce trade costs.

Hidden costs in fund transfers are real. Never think you’re getting away with no costs. Even if it says “no hidden fees,” verify it. Double-check everything. Exchange transaction fees deserve your full attention.

In conclusion, save by reducing what you pay in fees. Do your homework. Check each exchange’s rules. Understand the hidden costs. The truth is, every trade has a price. Your job is to make sure it’s the right one for you.

Question every fee. Spot surprise charges. And always look for the best deal. That’s how you make your crypto experience the best it can be.

Navigating Deposit and Withdrawal Expenses

Unveiling the Costs of Crypto Deposits

When you fund your crypto account, you pay fees. They’re like ATM fees, but sneaky. Some platforms say they charge nothing. But the truth? They often do, in ways you might miss. For example, platforms could add a markup to the asset’s price. This makes you pay more without knowing it. Or, they take a slice of your deposit as a “processing fee”. This can vary a lot. Some take a flat charge, while others take a percent. It pays to know this. You should always check the deposit section. This will tell you what the exchange will charge.

Today, you think you’re starting with the full amount you put in. But, as if by magic, it’s less than you thought. Where did it go? Into the exchange’s pocket. This doesn’t feel good, right? Yet, it’s common in crypto land. We must stay sharp and check the details. The answer to “What does it cost to deposit?” can be tricky. Always ask, “What’s the total cost?” This is Precision in action, answering with exactness. Exchanges can promise zero fees, yet you end up paying in other ways. They can use a higher crypto price or charge you when you buy or sell.

To avoid such unwanted surprises, choose exchanges with clear deposit fees. Yes, a zero-fee deposit sounds great. But if the trade costs more or has other fees, it’s not so great. Smart traders know every fee they pay. They dig into the terms and do the math. It’s about the total cost, not just a single fee.

Deciphering Withdrawal Fees on Various Exchanges

Now, let’s talk about taking your money out. Withdrawal fees can bite you suddenly. Each exchange sets its own rules. Some take a cut, like a flat fee or a percent. Others change it based on the blockchain workload. Picture this: Two people use different exchanges. They both pull out the same crypto amount. One pays a small fee, but the other pays way more. Why? Their exchanges have different fee rules.

Each withdrawal, you must check the fee details. The fee will often depend on the crypto type. For example, withdrawing Bitcoin might cost more than Litecoin. Knowing this can save you a lot in the long run. And just like with deposits, there can be hidden costs. Some exchanges might say “low withdrawal fees”. But they recover costs with a wider spread or a service charge. So, when they wave the low-fee flag, don’t let your guard down.

In the sea of crypto platforms, the truth about fees lies within their terms. Read them with a detective eye. Doing this keeps your money safe from sneaky fees. My own experience says – never skip the fine print. And always a look out for withdrawal limits. These aren’t clear fees, but they limit how much you can take out. This can force you to make multiple withdrawals, costing you more.

Smart trading means knowing every cost. From a coin’s buy price, to its sell price and everything in between. It’s how you keep your hard-earned cash from invisible hands. This is the key to making trading work for you. Remember, it’s not just about how much you earn, but how much you keep.

Avoiding Unwanted Fees and Reducing Trading Costs

Strategies for Choosing Low Fee or No Hidden Fee Exchanges

No one likes surprise costs. So, when you trade crypto, watch for unseen fees. Find exchanges that show all fees upfront. Do your homework. Read reviews and compare exchanges. Look past catchy ads. Search for facts on fees they charge.

Some crypto trading platforms boast low fees. But, they may hide charges elsewhere. It’s like that toy at the store with batteries not included. You think you got a deal until you have to pay extra.

Here’s the real scoop: you want a platform with clear pricing. No hidden fees tucked into the fine print. Go for exchanges that outline all charges, so you grasp the full cost before trading.

Always ask yourself:

What am I really paying?

Total cost should cover trading, deposit, and cashing out. Always check for details or ask customer service. They should explain all charges.

Tips to Understand and Mitigate Network and Blockchain Transaction Charges

Network fees can bite into your wallet. They pay for the computing energy that drives your transactions. Every crypto has its own network charge. This is like getting a snack at the movies. You know popcorn costs more there. Same with sending Bitcoin versus other currencies. Bitcoin can be more pricey.

Here’s your need-to-know: Network fees change often, so always look them up. Withdraw when network use is low. This may lower your fees.

Understanding blockchain charges is also key. This fee helps keep the crypto network safe and running. Think of it like an entry fee to a fair. It keeps things working and fun for everyone. But each fair, or in this case, cryptocurrency, has a different cost.

Use these tips to cut fees you didn’t bargain for:

- Choose transfers in off-peak hours.

- Use crypto with lower transaction costs.

- Plan your trades to avoid small, frequent fees.

Remember, knowledge is power. The more you know about fees, the better you can dodge them. Always eye the fine print and ask questions. Seek out exchanges that are honest about their fees. This way, you keep more coins in your pocket.

In our deep dive today, we covered the real price of trading crypto. We kicked off by understanding how exchange transaction fees can dip into profits. We then shone a light on those sneaky hidden charges you might not see coming.

We went further to unpack the maker-taker fee model. I broke down how those fees work and where they hide extra costs. Next, we looked at the cash you shell out when moving your crypto. We peeled back the layers on deposit and withdrawal fees across different platforms.

Finally, I shared smart moves to cut down fees. I showed you how to pick exchanges that keep it fair, with low or no extra fees. I also gave you the lowdown on network and blockchain fees and how to trim them.

My final two cents? Trading crypto is more than just the rush—it’s about smart plays. Keep a sharp eye on trading costs, and you’ll stay ahead. Thanks for reading! Aim high, spend low, and trade smart.

Q&A :

What are hidden fees to watch out for on cryptocurrency exchanges?

When trading cryptocurrencies, users should be mindful of several hidden fees that may not be evident at first glance. These can include withdrawal fees, deposit fees, and transaction fees that are not clearly stated on the exchange’s fee structure page. Additionally, percentage-based fees for trades, inactivity fees for dormant accounts, and even charges for transferring assets between wallets on the same platform can catch users by surprise.

How can one avoid incurring unexpected fees on crypto exchanges?

Avoiding unexpected fees on crypto exchanges requires diligent research and reading the fine print before committing to any platform. Users should:

- Look for detailed fee schedules provided by the exchange.

- Be wary of zero-fee claims, as these could be compensating through wider spreads.

- Consider the long-term costs for services like wallet storage or maintenance.

- Stay updated with any changes in the exchange’s fee policies.

Comparing fee structures between different exchanges can also help in finding one with the lowest cost for your specific needs.

Can exchanges change fee structures without notice?

Although reputable exchanges often endeavor to notify users of changes to their fee structure, it is not uncommon for some platforms to adjust their fees without clear notice. Always ensure you check for any updates to the terms of service and fee schedules regularly. In some jurisdictions, exchanges are required to provide notice before making changes, so knowing the regulatory framework can help anticipate such adjustments.

Why do fee structures differ between cryptocurrency exchanges?

Fee structures differ between cryptocurrency exchanges due to a variety of factors, including:

- The business model of the exchange.

- The level of liquidity and trading volume on the platform.

- The range of services and features offered.

- The targeted user base, with some exchanges catering to high-volume traders who may enjoy lower fees.

- Operational and security costs that get factored into user fees.

Understanding these factors can shed light on why some platforms have higher fees than others, allowing users to choose the right exchange for their trading habits.

Is it common for crypto exchanges to charge for deposits and withdrawals?

Yes, it is common for crypto exchanges to charge fees for deposits and withdrawals. These fees can vary widely depending on the cryptocurrency being deposited or withdrawn and the payment method used for fiat transactions. While some exchanges offer free deposits or withdrawals for certain coins or up to a specified limit, others may charge a fixed fee or a percentage of the transaction amount. It’s crucial to check an exchange’s fee policy regarding these transactions before using its services.