Looking to automate your profits? Grid Trading Bots offer a smart way for investors to capitalize on market fluctuations. Discover how this powerful tool allows you to profit consistently without the need for constant monitoring. Enhance your investment strategy with automation and watch your profits grow effortlessly.

Key Takeaways

- Spot grid bots offer a safer approach for long-term investors seeking steady gains.

- Futures grid bots leverage derivatives to amplify returns but pose a higher risk of losses.

- Understanding the risks and rewards of each type is crucial before deployment.

What is Grid Trading Bot?

Demystifying Grid Trading: A Powerful Tool for Crypto Investors

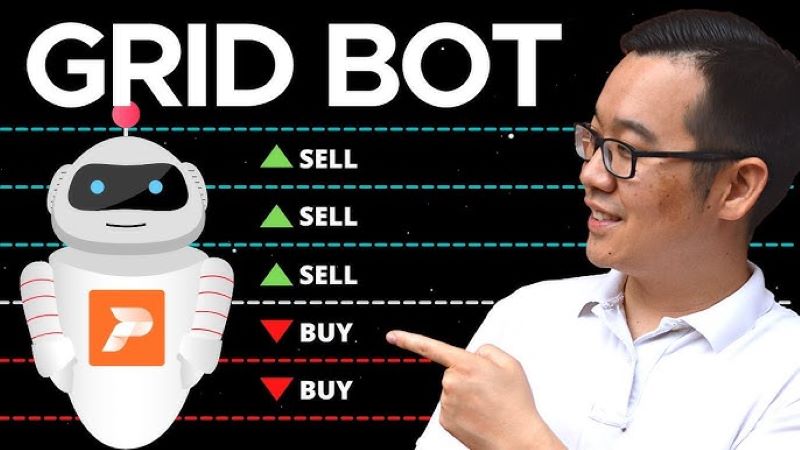

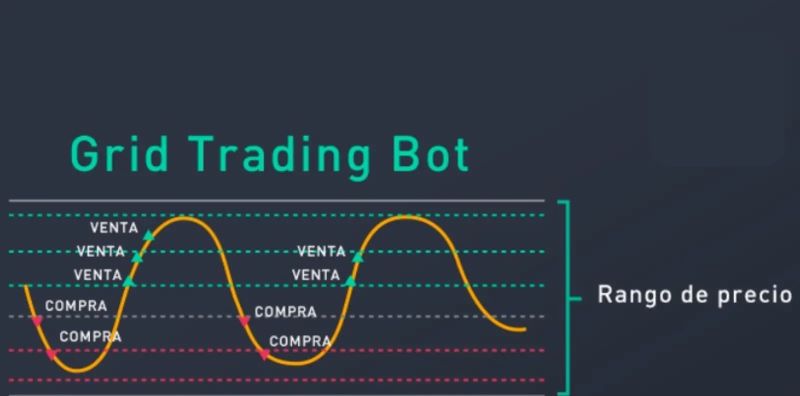

Grid trading is a strategy that involves setting up a grid of buy and sell orders at predetermined price intervals within a specific range. This strategy thrives on price fluctuations, aiming to capitalize on both upward and downward movements within a defined market zone.

Picture it as a series of price levels where the grid trading bot automatically places orders to buy when the cryptocurrency price drops below a particular level and sell when it rises above another. The bot continuously executes these orders, generating profits by exploiting price volatility.

The Mechanics of Profit Generation: Buy Low, Sell High, Repeat

The core concept of grid trading is simple: buy low, sell high. However, the strategy’s effectiveness lies in its ability to automate this process. Grid trading bots constantly monitor the market, automatically executing trades within the predefined price range. This allows investors to benefit even from minor price fluctuations, potentially accumulating profits over time.

The grid consists of multiple levels, each with a specified price point. When the price moves within the grid, the bot triggers buy or sell orders, aiming to capture the movement. For example, if the price falls below the buy level, the bot automatically purchases cryptocurrency. Conversely, if the price rises above the sell level, the bot sells the cryptocurrency, securing profits from the price swing.

Exploring different crypto Grid Trading strategies

The realm of cryptocurrency trading presents a dynamic and volatile landscape, offering both lucrative opportunities and significant risks. Amidst this unpredictable environment, grid trading bots have emerged as a popular tool for navigating the market’s fluctuations and potentially maximizing profits.

Grid trading bots, essentially automated trading algorithms, operate by placing buy and sell orders at predetermined price intervals within a specified range, forming a “grid” of orders. These bots are designed to capitalize on price fluctuations within defined price ranges, enabling traders to potentially profit from both upward and downward market movements.

But not all grid trading strategies are created equal. To effectively harness the potential of grid trading bots, it’s crucial to understand the different strategies available and choose the one best suited to your trading objectives and risk tolerance. Here’s a breakdown of three prominent grid trading strategies:

Riding the Waves

Trend-following grids are designed to capitalize on sustained price movements in a specific direction. These bots utilize a simple approach: they establish a grid of buy and sell orders based on the prevailing trend.

When the price of a cryptocurrency rises, the bot automatically places buy orders at increasingly higher price intervals, aiming to acquire more assets at lower prices. Conversely, when the price falls, the bot sells at lower price intervals, locking in profits or minimizing losses.

The effectiveness of trend-following grids hinges on accurately identifying and capitalizing on strong market trends. However, if the market reverses its course or enters a period of consolidation, these bots could lead to losses as they continue to buy or sell against the new trend.

Profiting from Price Fluctuations

Mean reversion strategies are predicated on the belief that asset prices tend to revert to their historical average over time. Mean reversion grid bots place buy and sell orders in a specific price range, anticipating that the price will eventually bounce back to its average after deviating from it.

When the price falls below the established range, the bot automatically buys, expecting it to rebound back up. Conversely, when the price rises above the range, the bot sells, anticipating a correction downwards. This strategy aims to profit from frequent price fluctuations within the established range, assuming that the price will eventually return to its average.

The success of mean reversion grid strategies depends on the accuracy of the assumption that prices will revert to their mean. Market volatility or prolonged trends in a specific direction can disrupt this expectation, leading to potential losses.

Scalping for Small but Frequent Gains

High-frequency grid trading, often referred to as “scalping,” focuses on capturing small but frequent price fluctuations. Scalping grid bots utilize extremely tight price intervals with multiple buy and sell orders placed within a small range. By exploiting even minor price movements, these bots aim to generate a consistent stream of small profits.

However, scalping requires a high degree of market understanding and a robust trading infrastructure. Scalping grid bots often trade frequently, requiring extremely low transaction fees and fast execution speeds to be profitable. Furthermore, the potential for substantial losses arises if the market moves against the bot’s positions, particularly in periods of high volatility.

Futures Grid Bots: Leveraging Derivatives for Enhanced Returns

Futures grid bots, on the other hand, operate in the derivatives market, utilizing leverage to amplify potential returns. They take advantage of the inherent volatility of futures contracts, allowing traders to profit even during market downturns.

Futures Grid Bots: Leveraging Derivatives for Enhanced Returns

Futures grid bots function similarly to spot grid bots, placing buy and sell orders within a pre-defined grid. However, they utilize leverage to amplify potential profits, meaning even small price fluctuations can generate significant returns.

The leverage offered by futures grid bots makes them particularly attractive to traders seeking high-risk, high-reward opportunities. They provide the potential to generate significant profits even during periods of low market volatility. However, the use of leverage also comes with inherent risks, as losses can be magnified just as quickly as profits.

Understanding the Risks and Rewards of Each Type

Choosing the right type of grid bot ultimately depends on an individual’s risk tolerance and investment goals. Spot grid bots are a safer option for long-term holders seeking consistent profits while managing risks, but their potential returns are limited. Futures grid bots offer the possibility of higher returns but also carry the risk of substantial losses due to leverage.

Before deploying any grid bot, it’s crucial to understand the intricacies of their operation and the risks associated with leverage. It’s also essential to conduct thorough research on the underlying cryptocurrency and the overall market conditions to make informed decisions.

Grid Trading Bots have revolutionized how investors manage their portfolios, providing automated, profit-generating solutions. If you’re ready to elevate your trading strategy and capture more gains, explore the world of automated trading on Dynamic Crypto Network and unlock the full potential of this innovative tool.