Welcome to “Regulating Bitcoin Globally: A Tour Through Diverse Legal Landscapes”. It’s a wild ride of rules and regs out there. How do different countries regulate Bitcoin? The answer is complex and as varied as the nations of the world. From outright bans to welcoming policies, each country approaches this digital giant in its own way. I’m here to guide you on a journey through these regulations, dissecting the legal frameworks that define the use, taxation, and investment in Bitcoin. Ready to explore the intricacies of global Bitcoin regulation? Let’s dive into this financial frontier and uncover the laws that govern the crypto space – country by country.

Navigating Cryptocurrency Regulations Worldwide

Bitcoin Legal Status and Global Laws

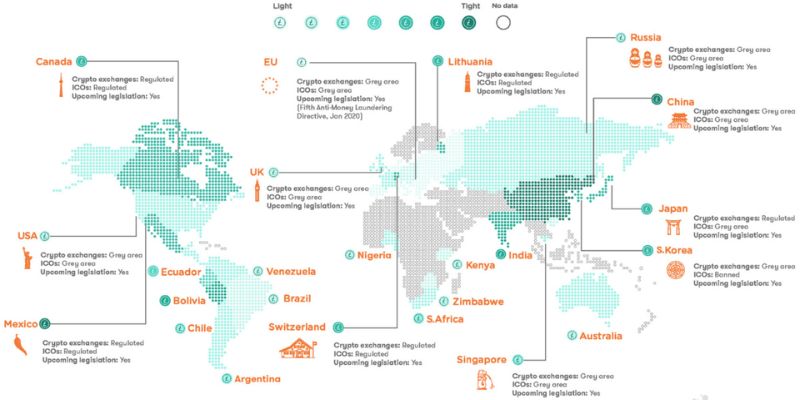

Let’s dive into how countries treat Bitcoin. Some are fans, others not so much. For instance, Japan sees Bitcoin as a legal way to pay. But, places like China say no to Bitcoin. They have banned it.

Bitcoin’s legal status varies a lot. This means the rules for Bitcoin differ too. To know more, click this guide on global Bitcoin laws.

Dissecting Cryptocurrency Legislation Across Borders

Regulating Bitcoin isn’t easy. It’s like trying to tame a wild beast. Each country picks its own way. Let’s take a look at how it goes.

Countries that love tech often make it easy to use Bitcoin. They set laws that help people and businesses. They use rules to keep control and fight crime.

Some places want nothing to do with Bitcoin. They fear it could cause trouble. Rules in these countries are strict. They might ban Bitcoin or make harsh laws.

Other places swing both ways. They like Bitcoin but worry about risks. So, they create balanced laws. These laws stop bad use but also back good innovation.

Financial regulators think hard about Bitcoin. They want to balance risk, freedom, and growth. Central banks are key. Their view of Bitcoin can shape a whole country’s approach.

AML rules are crucial for Bitcoin. These rules stop bad guys from hiding their money in crypto. KYC is about knowing who’s who. It stops secret deals and helps track money right.

Crypto exchange laws manage where and how people trade Bitcoin. They try to make trading safe and fair. This is hard as Bitcoin crosses borders with ease.

Owning Bitcoin can be tricky. Each country decides what rights you have. Knowing where you stand is vital.

Governments are working on laws for Bitcoin’s future. They aim to protect folks while letting Bitcoin grow.

In the end, laws are about safety and order. Using Bitcoin can be great. But we must be smart to keep its use on the right track.

The Fiscal Side of Bitcoin: Taxation and Investment

Unraveling Bitcoin Taxation Policies

You own some Bitcoin, so you might wonder, “Do I have to pay taxes on it?” The short answer? Yes, in most places, you do. After this quick answer, let’s dig right into the details. For Bitcoin holders, understanding the tax regulations that apply can be the difference between smooth sailing and rough waters come tax season.

Each country treats Bitcoin and other cryptocurrencies quite differently for tax purposes. For instance, the United States views Bitcoin as property for tax reasons. If you sell your Bitcoin and get more than you paid, you’ve got a capital gain. That means you pay tax on the profit. If you’re in Germany, it’s a whole different story. Keep that Bitcoin for more than a year without selling? You won’t pay any tax on your gains when you sell.

Bitcoin Investment Restrictions and Reporting Requirements

Investing in Bitcoin is all the buzz. But it’s not as easy as buying candy. Each country has rules about who can buy, sell, or just hold Bitcoin. These rules often come from concerns about money laundering and keeping investments safe. Remember, Bitcoin can cross borders without a passport, but regulators still want to know where it’s going.

Some countries need you to say “hello” when bringing Bitcoin over the border. This means telling tax folks about any Bitcoin you own at certain amounts. The aim? To fight crimes like money laundering. Interestingly enough, some places like El Salvador have embraced Bitcoin as legal money. You can use it just like any other money there. In this Bitcoin-friendly spot, you won’t have to deal with heavy investment restrictions.

The rules surrounding Bitcoin can change faster than a roller coaster ride. So it’s super important to keep up with what your own country says about Bitcoin. All this tracking helps keep the Bitcoin world as open and safe as it can be for everyone.

Compliance Hurdles in the Digital Age

How Financial Regulators are Keeping Pace with AML and KYC Norms for Bitcoin

Around the world, new rules are coming for Bitcoin. Each country is different, but they all want to make sure no one uses Bitcoin for bad things. They use two main tools: AML and KYC.

AML stands for anti-money laundering. It’s like a set of rules to track where money comes from. KYC means Know Your Customer. It asks, “Who are you?” so bad guys can’t hide. Together, these rules help keep Bitcoin safe and fair.

Here’s how they work. Say you want to buy Bitcoin. First, you’ll show your ID or passport. This is part of KYC. It helps the Bitcoin seller know you’re not a bad guy. Then, there’s AML. They’ll watch how you use your Bitcoin. If it looks like you’re doing something wrong, they’ll report it. It’s like having a guard watching over our money moves.

But it’s tough for regulators. Bitcoin moves fast and it’s all over the world. The people making rules must be just as quick and smart. Some places like the U.S. and Europe have strong rules about Bitcoin. They look very closely at who’s buying and selling. But in other places, the rules are not so strict. This means for the Bitcoin world, things are often changing and can be confusing.

The Conundrum of Crypto Exchange Laws and Cross-Border Transactions

Talking about rules, let’s talk exchanges. They are places where you can trade Bitcoin for money or other coins. Like any market, they need rules too. Why? To keep everyone’s money safe and to stop theft and other crimes.

Exchanges must follow laws where they work. Some countries have tough laws. Others are still figuring it out. But what if someone from a place with easy rules wants to send Bitcoin to a place with tough rules? This is where things get tricky.

Here’s an example. A person in Country A sends Bitcoin to someone in Country B. Both countries must agree on the rules for this to work well. They must talk to each other and decide how to manage these trades. This makes sure everyone is safe, and no one gets in trouble.

What happens when rules don’t match? People might not be able to send Bitcoin easily. Or they might find ways to send it that are not so safe. This is what financial bosses are trying to fix. They want everyone to play by the same rules. This would make trading Bitcoin fairer and safer for everyone.

In the end, keeping up with Bitcoin rules means always learning. It means being ready for changes and new ideas. Bitcoin is like a river, always moving. Our job is to build bridges over this river that are strong and safe for all to cross.

Towards Harmonization: Global Strategies and Consumer Protection

National Cryptocurrency Strategy Development and Regulation

Every country has its own way of handling Bitcoin. Some countries have strict rules. Others give Bitcoin users more freedom. There are even places that don’t allow Bitcoin at all. It’s like a big puzzle with each piece being a country’s rule book.

Some places like the United States take it slow. They want to stop bad acts while not harming good uses of Bitcoin. They look at how it works to make fair rules. In the U.S., people watch over Bitcoin trades. They want to make sure bad guys don’t misuse it. They also want to help people understand what owning Bitcoin means.

Across the sea, in Europe, there’s a kind of group called the European Union. They work together on many things, including Bitcoin. They try to make rules that fit all countries in the group. This helps people use Bitcoin in a safe way across these countries. It’s a big job to make rules that are fair for more than one country.

Then we have Japan. It’s a country that likes tech and new ideas. They have made clear rules. People feel safe using Bitcoin there. The government checks Bitcoin businesses to keep everyone on the right path. This helps stop trouble before it starts.

But some places say no to Bitcoin. Countries such as Algeria ban it entirely. They worry about risks and don’t see enough good in it yet.

Fostering Innovation in Blockchain Technology While Ensuring Consumer Protection

Innovation is exciting. It brings new ways to solve old problems. But new things can be tricky too. Blockchain is one of those new, big ideas. It’s the tech behind Bitcoin. Many countries want to help this idea grow. They know it can do a lot of good.

Let’s talk about “sandbox”. No, not the one you find in a park. A “sandbox” in this world means a safe place to try new ideas. The UK has one just for Bitcoin and its family. It lets people test their ideas in the real world without too much risk. If things work well in the “sandbox”, they might become a part of everyday life.

In Singapore, they like new tech too. They also have a “sandbox”. It helps keep users safe while still letting creators create.

While big folks like the U.S. and Europe work on their rules, smaller places like Malta have made quick progress. They put out a welcome mat for Bitcoin businesses. These businesses must play by the rules, but they help make the rules work too.

Countries are still learning the best ways to deal with Bitcoin. They watch each other and share what they learn. This way, they can help keep people using Bitcoin safe while letting new ideas bloom. It’s not easy getting everyone to agree. But many are trying to do just that. They hope to make something that works for everyone, all over the world.

In this post, we dove deep into the maze of cryptocurrency rules around the world. We looked at where Bitcoin stands legally and how different countries handle crypto law. Tax on Bitcoin can be tricky, and we untangled the knotty policies that govern it. Investing in Bitcoin comes with rules and reports too.

We also tackled the big task that financial watchdogs face keeping up with anti-money laundering (AML) and know your customer (KYC) rules in the crypto world. And we didn’t shy away from the tough stuff, like the tangled web of crypto exchange laws.

Lastly, we discussed how nations are trying to find common ground to manage digital money better. It’s all about balancing new tech growth with protecting you, the user.

As we wrap up, remember that the crypto landscape is always changing. Keep your eyes open and stay informed to navigate this exciting, evolving space safely.

Q&A :

How do various nations approach Bitcoin regulation?

Countries around the globe have taken diverse approaches to Bitcoin regulation. Some have embraced it with open arms, offering clear legal frameworks that encourage its use and growth. Others have imposed strict regulations or outright bans, citing concerns over security, monetary control, and illegal activities. The spectrum ranges from Bitcoin-friendly jurisdictions like Japan and Switzerland to countries like China and Nigeria, which have implemented severe restrictions on cryptocurrency transactions.

What are some examples of Bitcoin regulatory policies in different countries?

Examples of regulatory policies include the United States, where Bitcoin is treated as property for tax purposes, and transactions are monitored for anti-money laundering. In contrast, El Salvador has adopted Bitcoin as legal tender, meaning it is accepted in all transactions alongside the US dollar. Meanwhile, the European Union is working towards a unified regulatory framework for cryptocurrencies to ensure investor protection and financial stability.

How does Bitcoin regulation impact its use and adoption?

Regulation can significantly impact Bitcoin’s use and adoption by either providing a secure environment that fosters trust and integration into the financial system or by creating barriers that deter users and stifle the cryptocurrency’s growth. Clear and favorable regulations can lead to increased investment and innovation, while harsh or uncertain regulations can lead to a loss of interest and a decline in market activity.

Can governments ban Bitcoin effectively?

While governments can impose bans and make it difficult for individuals and businesses to use Bitcoin, its decentralized nature makes it inherently resistant to complete suppression. Despite bans, determined users have often found ways to continue using Bitcoin, such as through peer-to-peer networks or other decentralized platforms, making enforcement a significant challenge.

What is the future outlook for international Bitcoin regulation?

The international outlook for Bitcoin regulation is evolving, as governments and financial institutions continue to study the impacts and potential of cryptocurrencies. Some experts anticipate a trend towards harmonized global regulations that address concerns while supporting innovation. This might involve cooperation between countries to establish standards that prevent money laundering and fraud while ensuring a competitive and inclusive financial ecosystem.