Investing in digital currencies isn’t guesswork—it’s a science. You need to master fundamental analysis of cryptocurrency to make smart choices. To win big, you’ve got to know more than just buzzwords like ‘blockchain’ and ‘Bitcoin’. Let’s dive deep. I’ll guide you through valuing your digital assets, understanding the tech they’re built on, and how market moods can swing your investment. We’ll also tackle heavy hitters like security, growth potential, and the law’s grip on crypto. Ready to go from novice to pro in the high stakes world of crypto investing? Let’s get started.

Understanding the Essentials of Crypto Asset Valuation

Exploring Cryptocurrency Valuation Methods

When we look at a new cryptocurrency, its value goes beyond the price tag. Several methods help us figure that out. One known way is to check how a coin is different from others. This could be the tech it uses or what it’s for. To get this info, we dive into the project’s whitepaper. It’s a document that explains the tech details, plan, and goals of the project. We also look at the team behind the coin. Are they seasoned pros in blockchain tech? That’s a big plus if they are!

Another key thing we look at is ‘tokenomics’. That’s just a fancy term for the coin’s supply and demand rules. Knowing this, we can guess how the coin’s value might change over time. We also can’t forget about ‘use case’. That means what the coin is actually for. Is it just virtual money, or does it give access to a special service or app? These details can really change how we see its value.

The Significance of Market Capitalization and Trading Volume

Let’s talk big numbers now — market cap and trading volume. Market cap shows us how much money is in a coin when you add up all the units that are out there. This number helps us see how big a deal a coin is in the whole market.

Trading volume shows us how much of that coin gets traded in a day. When this number is high, it tells us that lots of folks are interested in buying or selling the coin. That could mean the coin’s price might jump up or drop down fast.

These are just parts of a big list of things to check when we value a cryptocurrency. Others include how well the coin keeps up with lots of transactions, or if it can work with other blockchain systems. There’s also mining to think about. That’s the computer work done to keep the network going and make new coins.

When we know about all these things, it helps us make smarter choices about our crypto cash. Remember, even though this stuff sounds complex, anyone can learn it bit by bit. It’s just about taking the time to really dig into these details and understand them. Then we can be smart with our digital dimes!

Examining the Technical Backbone of Cryptocurrencies

Why Whitepapers are Fundamental in Crypto Analysis

Whitepapers help us get the ‘big picture’ of a blockchain project. They explain the project’s purpose, technology, and goals. Think of them as a manual you check before you buy something. When looking at a whitepaper, check if it has clear goals and methods. A solid whitepaper shows if the team knows their stuff and if the project solves a real problem.

Assessing the Validity of Use Cases and Utility Tokens

Utility tokens give users access to a future product or service. Projects with strong use cases show us they’re not just all talk. Use cases should be realistic and fill a need. For example, if a token lets you use smart contracts, it should say so clearly. Look for how these tokens will work in the real world. That’s what gives them value. When a token has many uses, it shows the project has a lot of growth potential.

To make wise investments, understand how the bones of these projects work. With a good grip on technology and plans, you’ll make better choices. Always dive deep, ask tough questions, and never stop learning. Remember, the tech behind the coin is what really counts.

Analyzing Market Dynamics and Investment Strategies

The Role of On-Chain Governance and Economic Models

When we buy cryptocurrency, we look at how it’s run. Think of on-chain governance like a country’s laws. It’s a set of rules that everyone follows. This keeps everything fair and safe. Some coins let everyone vote on changes, just like in a real election. This can make the coin stable and help it grow. It’s important to know a coin’s rules before you invest.

Economic models are also key. They are like the engine of the coin. They decide how many coins are out there and how they get to people. Some coins have a lot of coins, some have a little. Knowing this can help you guess how rare a coin will be. Rare things often become more valuable. That’s why it’s smart to understand a coin’s economic model.

Navigating Through Investor Sentiment and Market Trends

How people feel about crypto can change its price. If people are excited and talk a lot about it, more might want to buy. This can make the price go up. But if people are scared or unsure, they might sell. This can make the price drop. Trend lines on graphs can help us see where things might be going. They show the coin’s highs and lows over time.

Staying smart means not just following the crowd. Check facts and think about how they fit with what’s happening in the world. When big events happen, they can push crypto prices around. This could be a good time to buy or maybe to sell. It’s like being a detective, looking for clues to make the best choice.

We keep our eyes on what’s hot and what’s not. Sometimes coins get popular fast. If we see why it’s popular, we might want to join in. Other times, if a coin keeps dropping, we need to know why. We could lose money if we don’t.

There’s no magic trick to mastering the crypto market. But knowing how governance and economics work can help a lot. It’s like having a map in a big city. You know where to go and how to get there. That can make the journey a lot safer and more fun.

Advanced Concepts: Security, Scalability, and Regulatory Impact

Evaluating Scalability Solutions and Interoperability Measures

Scalability is how a blockchain grows. As a crypto whiz, I see this a lot. Networks need to handle more actions without slowing down. Picture a highway expanding from two lanes to four. More cars fit, and traffic flows better. In crypto land, this means more trades, faster, with less cost.

So, how do we make a blockchain hold more data without hassle? One way is by making blocks bigger. Bigger blocks can mean more info per block, but there’s always a trade-off. Another method is to use “off-chain” solutions, sort of like carpool lanes that let special kinds of traffic skip the main road.

Teams building crypto love to mix tech from different places. It’s called interoperability, and it’s like learning multiple languages to chat with more folks worldwide. For crypto, it means a token from one place can visit another network, no problem. It’s a big goal for many in the field.

When checking if a crypto is good to go, look at its whitepaper, team, and tech behind it. Projects that stand out usually work well with others and can grow big.

Understanding Regulatory Changes and Their Impact on the Market

Laws and crypto are an interesting mix. The rules for money that governments set shape how we use crypto. Countries are still deciding how to deal with digital coins. Some see them as money, some as property. Some places welcome crypto with open arms. Others, not so much.

Are rules good or bad for crypto? It’s a bit of both. Clear rules can help people trust in crypto more, making it more like real money. But if rules are too tough, they can squish innovation. They can scare off folks who make and use these digital treasures.

In the world of crypto, the winds can shift fast. A new law can push prices up or down quick. That’s why anyone with skin in the game must keep their ears open. They should listen to news, read a lot, and know what’s up.

Remember, each piece of the puzzle makes your choice better. Look at the tech, the people behind it, and the world around you. That’s how you spot the champions in a digital world brimming with potential. Security, smart growth, and keeping up with the rules are all part of this ride.

As we strap in and power up our computers, let’s ensure our digital treasure troves can stand up to what the future throws at them. Whether it’s laws changing or networks needing a growth spurt, we’ve got to stay on our toes. Because that’s what crypto’s about – moving fast, breaking limits, and crafting a future that’s truly ours.

In this post, we broke down key aspects of crypto value. We looked at how market cap and trade volume matter a lot. Whitepapers and real-world uses for tokens are huge too. We saw that who controls a coin and the economy of it can change its worth. People’s feelings and new trends also guide crypto prices. Lastly, we tackled tech security, being able to grow, and rules from the outside that affect it all.

When you get how these parts work, you’re set to make smarter moves in crypto. Keep an eye on tech updates, and stay sharp on the latest laws. Be the one who knows a coin’s real value. That’s how you win in this game. Stay smart, friends.

Q&A :

What is fundamental analysis in cryptocurrency investing?

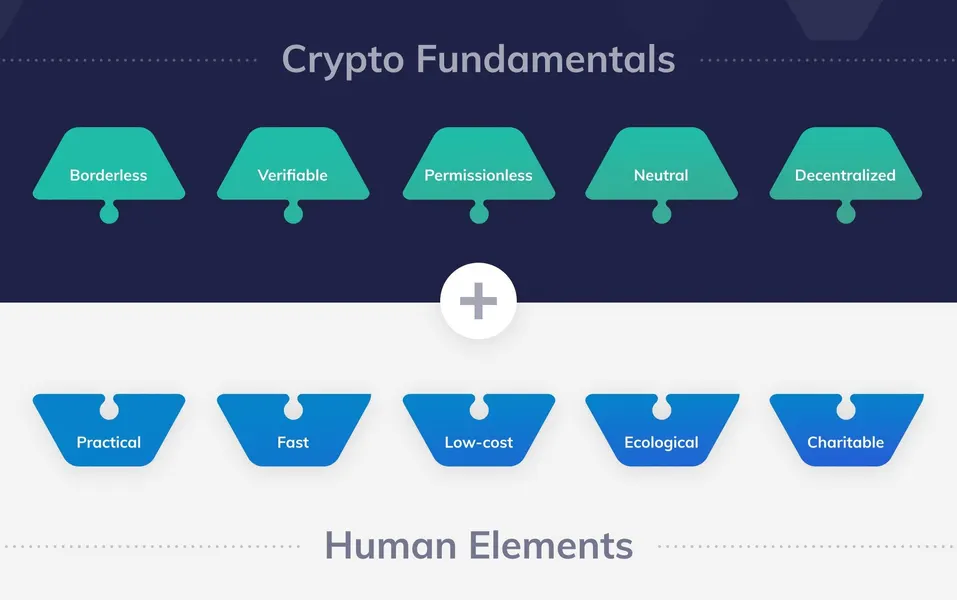

Fundamental analysis in cryptocurrency involves evaluating various internal and external factors that can affect the value of a digital currency. This includes examining market trends, the coin’s technology, the development team, competitive landscape, market demand, regulations, and financial metrics. Unlike traditional markets, where fundamental analysis may focus on financial statements and earnings reports, in cryptocurrency it involves a deeper look into the project’s whitepapers, adoption rates, and technological advancements.

How does fundamental analysis differ for cryptocurrency compared to stocks?

Fundamental analysis for cryptocurrency differs significantly from stocks due to the nature of assets and the data available. Stocks are evaluated based on company performance, financial statements, and economic indicators. Cryptocurrencies, on the other hand, do not have financial statements. Instead, cryptocurrency fundamental analysis may focus on factors such as the project’s use case, the team behind it, tokenomics, the technology’s security features, transaction speeds, and overall market sentiment. Additionally, the impact of regulations and updates to the network protocol play a big role in crypto valuations.

Can fundamental analysis predict cryptocurrency prices?

While fundamental analysis can provide deep insights into the potential value and long-term viability of a cryptocurrency, it is not infallible in predicting prices. The crypto market is known for its high volatility and can be influenced by speculative trading and market sentiment. However, fundamental analysis can help investors make more informed decisions about the intrinsic value of a cryptocurrency and its potential for future growth.

What key metrics are important in fundamental analysis of cryptocurrency?

In the fundamental analysis of cryptocurrency, investors consider a variety of metrics, including market capitalization, circulating supply versus total supply, project development activity (such as GitHub commits), network hash rate, wallet addresses growth, transaction volume and costs, and token utility within its ecosystem. Additionally, investor sentiment, regulatory news, and the overall adoption rate for the technology are also carefully monitored as part of a comprehensive analysis.

Does fundamental analysis work for all types of cryptocurrencies?

Fundamental analysis can be applied to all types of cryptocurrencies, but the approach may vary depending on the category of the cryptocurrency (e.g., utility tokens, security tokens, stablecoins). For example, fundamental analysis of a stablecoin would focus more on its backing assets and the mechanisms in place to maintain its peg, while analysis of a utility token would look closely at the token’s use case and demand within its respective platform or ecosystem. Understanding the specific nuances and economic models of each cryptocurrency category is crucial for effective fundamental analysis.