Crypto Charting Tools Unveiled: Unlocking the Secrets to Market Mastery

You’ve seen the ups and downs in the crypto world. To win, you need the right tools. Features of crypto charting tools are your secret weapon. Think of them as your market roadmap, guiding you through the chaos with clear signs and signals. With my expertise, we’ll dig into these tools. I’m talking about the kind that cut through the noise, showing you the market’s heart. Get ready to master the charts and make smart, informed trades. It’s not magic, it’s knowing the game—and I’m here to show you how to play it right.

The Essentials of Crypto Chart Analysis

Deciphering Candlestick Formations and Price Action

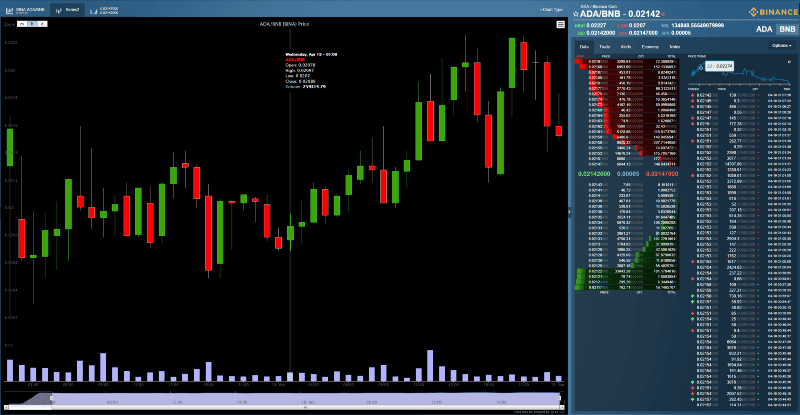

Candlestick formations are key in crypto charting. They show price moves within a set time frame. Each candlestick shows the open, high, low, and close prices. Why is this important? It gives clues about market sentiment and possible price changes. For instance, a long-bodied green candle hints at strong buying pressure. Meanwhile, a short red one may signal sellers taking control.

Utilizing Advanced Drawing Tools for In-Depth Analysis

Advanced drawing tools shape how we view charts. They allow us to mark trend lines, set support and resistance levels, and trace Fibonacci retracement. What does this mean for you? Your trading decisions get sharper. The trend lines show where the price is heading. Support and resistance levels highlight where the price might halt or reverse. Fibonacci retracement gives potential turn-around points based on past moves.

Let’s dive deeper!

Deciphering Candlestick Formations and Price Action

Understanding crypto price action starts with candlestick formations. These tell the story of price changes. Each candlestick’s color and size reveal buyer or seller momentum. Spotting patterns, like doji or hammers, can help spot trend reversals. Traders who master this can guess where prices might go next.

Traders must watch trading volume data on crypto charts too. Volume confirms if a price move has real weight behind it. High volume during a price rise signals strong interest. But if the price climbs on low volume, be careful. It might just be a false move.

Utilizing Advanced Drawing Tools for In-Depth Analysis

In-depth analysis needs advanced tools. With these, traders get precise entry and exit points. Drawing tools let us find historical price levels that might matter again. They bring past and present together, shining a light on where the price could turn.

Fibonacci retracement is a golden key in crypto analysis. It’s a series of lines that predict where the price might find support or resistance. This tool bounds to the candlestick highs and lows to highlight these key zones.

Trend lines, too, are a staple. They connect price highs or lows to map progress. When the price breaks a trend line, it can signal big moves ahead.

Understanding and using these tools changes the game. Real-time cryptocurrency analysis comes alive as traders foresee shifts. They can see the “what ifs” before they happen and act with confidence.

Each tool, each indicator adds a piece to the puzzle. The art of chart analysis is in putting them together. It’s how we find the hidden order in the chaotic world of market prices. Insights gained here can be the edge one needs. Indeed, every successful crypto trader has their trusty charting toolbox close at hand.

Harnessing the Power of Technical Indicators

Applying Moving Averages and Bollinger Bands

Using moving averages helps you spot trends. It’s like a heat-seeking missile for following the market’s direction. You take past prices, add them up, then divide by the number of days. This gives you a line that shows where the price may be heading.

Now, think about Bollinger Bands; they’re like rubber bands around price charts. They snap back when the price stretches too far. These bands expand when things get wild and tighten in calm markets. They’re perfect tools for guessing when prices might bounce or fall.

Moving averages smoothen out price data. The more days we use in our average, the smoother it gets. A commonly used one is the 50-day moving average. If prices are above it, that’s a “thumbs up” for the bulls. Below it, the bears might come growling.

Mastering RSI, MACD, and Stochastic Oscillators

Indicators like RSI tell you if crypto is bought or sold too much. If it’s over 70, investors think it’s overbought—time to sell maybe? Under 30, it’s possibly oversold. This could be your cue to buy.

MACD gets a bit trickier. It stands for Moving Average Convergence Divergence—quite a mouthful, huh? It has two lines: one follows the asset’s price, the other its trend. When they cross, it may hint at a price shift. If the trend line jumps above the price line, it might be time to sell. If it dips below, buying could be a smart move.

Stochastic oscillators, well, they’re like RSI but with a twist. They compare the closing price to a range over time. If it’s high within the range, the momentum is up. If it’s low, down goes the momentum. It uses two lines: %K and %D. When %K crosses over %D, and it’s down below, it signals a potential buy. Up top, it might mean “sell”.

Remember, folks, these tools are great guides, but not fortune tellers. Always look at the big picture, and keep your wits sharp. When you mix these indicators up, that’s when you get the real secret sauce for your trades. Happy charting!

Comparative Market Studies: Altcoins and Beyond

The Role of Trading Volume and Market Depth

How do trading volume and market depth shape crypto investment choices? Known and used by pros, trading volume in crypto shows how much trade happened in a period. It’s like a crowd at a game—more people, more action. High trading volume can mean a price move is strong. But low volume may signal a weak move.

When you look at a crypto chart, lots of green bars talk of high demand. Red bars tell you sellers win. Together, red and green bars can hint at a trend’s strength or its end. It’s key to watch this in real time, as it unfolds.

Market depth digs deeper, peeling back layers to find how much buy and sell orders exist at various prices. Think of it as a wish list—how many buyers and sellers at each price level? This depth chart can reveal support and resistance spots where price struggles to break through or backs down.

Integrating Chart Overlays and Comparative Analysis Tools

Why mesh chart overlays and comparative tools in crypto? Just looking at one coin’s chart may miss the big picture. We must compare coins to paint a full scene. Use chart overlays for this. They show one coin’s price action over another. This trick tells us how two coins dance together—does one lead or follow?

Adding overlays in analysis is like added flavors in cooking—it brings the best out. You can see patterns over time and find clues for smart moves. Want to know if a small coin follows Bitcoin’s steps? Overlays can show you.

By using tools side by side, on different coins, investors can spot trends. They might find out when altcoins rise if Bitcoin falls. Knowing this, they can act fast, switch coins and make sharp, smart choices.

In short, we stitch volume and depth data with overlays for a full market suit. It helps see beyond one coin and grasp market moves. So, a wise investor uses these tools to make informed bets. As they say in crypto, chart right, and light the way to wins.

Innovations in Crypto Charting Techniques

Embracing New Age Analytics with ARNA and Elliot Wave Theory

Crypto trading thrives on sharp tools and fresh tactics. ARNA, short for Advanced Real-time Cryptocurrency Analysis, changes the game. It’s like having a future-seeing map. With it, you plot your trade-route through wild market waves. Elliot Wave Theory lends a hand too. It spots market rhythms, letting traders surf on price swells and dips.

ARNA shines in spotting trends fast. By crunching numbers in real-time, it feeds traders instant market pulse checks. You’re always in the know, riding the wave of buy and sell action. Elliot Wave Theory? It’s like reading a story in the price moves. With it, you find patterns hidden in plain sight. It tells where prices might head next, turning guesses into smart bets.

Enhancing Visual Insights with Heatmaps and Volume Profiles

Heatmaps glow with market mood swings, while volume profiles stack up trading action. Both give traders X-ray eyes for price moves. Heatmaps change colors with market feelings. They light up hot spots where trading is fierce. Cool colors hint at calm markets. A trader can glance and know where action heats up.

Volume profiles show where traders crowd. They map out where the most buying and selling happened. This paints a clear picture of price levels that matter. Traders use this to guess where prices might stick or slip. With these tools, charts turn into stories. Stories that tell where money flows and where it might go next.

Using these techniques, crypto traders grab the reins of market moves. They blend analytics and art, using savvy to spot real money-making chances. These charting tools aren’t just pretty pictures; they’re the savvy trader’s war maps, marking paths to treasure in the digital coin realm.

To wrap this up, we dove into the craft of crypto chart analysis, looking closely at candlestick patterns and price moves. We explored tools that dig deep into market changes. You learned about technical clues like moving averages and signs like RSI and MACD. We compared altcoins, looked at trading volume, and layered charts for better study. Then, we saw new ways to plot our crypto journey with ARNA and Elliot Wave theory, and how heatmaps and volume profiles can guide us.

My final take? Chart analysis in crypto isn’t just lines on a screen; it’s a vital skill that can reveal the heart of market trends. Use these tools well, and you’ll read the crypto world like an open book. Keep learning, stay sharp, and let the charts light your way in the buzzing digital currency space.

Q&A :

What are the key features to look for in crypto charting tools?

Crypto charting tools, essential for any trader or investor in the cryptocurrency market, should have a range of features to enable effective analysis and decision-making. Look for real-time price updates, a variety of chart types like candlestick, line, and bar charts, and the ability to incorporate a wide range of technical indicators such as moving averages, Bollinger Bands, and RSI. Accessibility across multiple devices and the ability to customize and save chart layouts are also valuable features.

How do technical indicators on crypto charting tools improve trading?

Technical indicators play a crucial role in analyzing market trends and predicting future price movements. Crypto charting tools with robust technical indicators such as volume, volatility, trend, and momentum indicators help traders identify entry and exit points, confirm trends, and signal potential reversals. By understanding these patterns and signals, traders can make more informed decisions, manage risk effectively, and optimize their trading strategies.

Can crypto charting tools help with portfolio management?

Yes, many advanced crypto charting tools go beyond mere chart analysis and provide features for comprehensive portfolio management. These may include tracking your holdings, profit/loss reporting, tax calculation assistance, and historic trade analysis. They can also offer alerts and notifications to keep you informed about significant market movements that could impact your portfolio value and investment strategy.

Are there any crypto charting tools compatible with mobile devices?

Certainly, as trading on-the-go becomes increasingly common, many crypto charting tools have mobile-compatible versions. These mobile apps offer most of the same functionalities found in their desktop counterparts, including real-time data, a suite of technical analysis tools, and interactive charts. This compatibility ensures that traders can monitor the markets, adjust trades, and analyze charts from anywhere at any time.

Do free crypto charting tools provide adequate features for traders?

There are several free crypto charting tools available that offer a good range of features suitable for beginner to intermediate traders. These tools typically include basic charting capabilities, a number of technical indicators, and sometimes even social sharing features. However, professional traders might require more advanced features, which are often found in premium versions of charting tools, such as more sophisticated indicators, enhanced customization, and better integrations with exchanges.