In the digital age, where your finance depends not on banks but on bits, understanding the differences between custodial vs non-custodial wallets is crucial. With a custodial wallet, a third party keeps your keys and, with them, power over your funds. The allure is strong – they offer user-friendly features and recovery options that feel safe. But wait! Before you ride that wave of convenience, what about the risks? Let’s reveal the strings that come with having a custodian.

On the opposite shore, non-custodial wallets hand you the reins, asking you to steer your funds with care and caution. They promise full control and throw a challenge – can you uphold your financial sovereignty? Whether you’re new to crypto or looking to shift gears, we’ll dissect both sides, weigh security against ease, and guide you to make a choice that fits like a glove. Strap in as we explore the best ways to guard your digital gold.

Understanding Custodial Wallets: Benefits and Risks

The Role of Third-Party Custodians in Custodial Wallets

Imagine you have a digital money box, but someone else holds the key. That’s like a custodial wallet. In these, third-party custodians hold your crypto keys. They help you buy, sell, and store your coins. This can make your life easier. They manage security for you. With them, you don’t need to worry about losing keys. But there’s a catch. You trust someone else with your funds and private data.

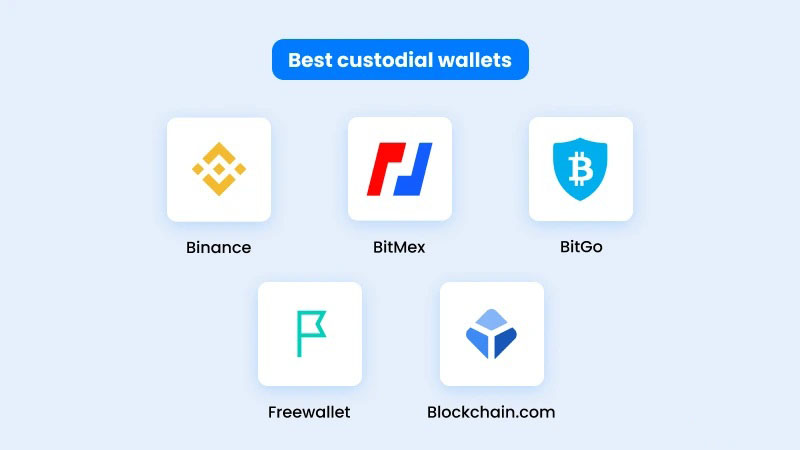

Trusted cryptocurrency exchanges often offer custodial wallets. They seem safe and user-friendly. Most times, they are. Top-notch security protects your funds. But risks remain, like exchange hacks or business failures.

Identifying and Mitigating Digital Wallet Risks

When using custodial wallets, think of risk management. Know how these custodians protect your assets. Ask questions. Do they have solid backup systems? How do they fend off hackers? Check their reputation and history with user funds.

Crypto asset security is essential. So use wallets from exchanges with strong security records. Also, most custodians operate under crypto regulatory compliance. This means the law requires them to keep your data and funds safe.

Don’t put all your eggs in one basket. Spread your crypto across different storage options—both custodial and non-custodial. This way, if one fails, you won’t lose everything. This strategy is key to managing digital wallet risks.

Always remember, your coins in custodial wallets are in someone else’s hands. Make sure those hands are as safe as can be.

Non-Custodial Wallets: Empowering Financial Sovereignty

The Freedom of User-Controlled Wallets and Private Key Management

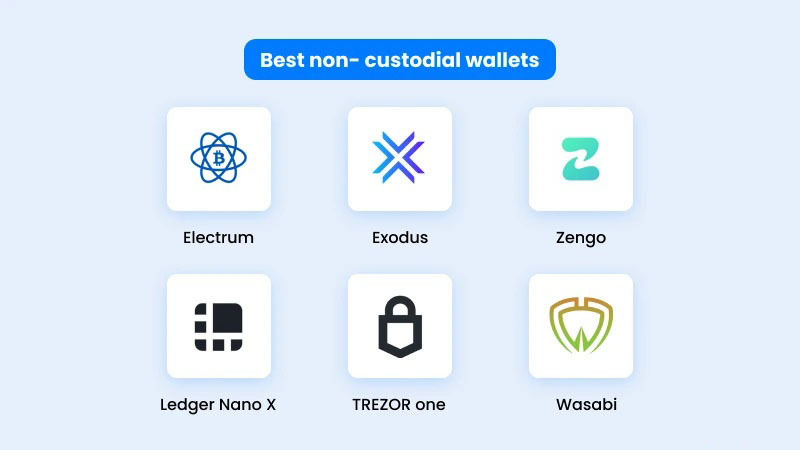

Non-custodial wallets let you be your own bank. You control your coins, not someone else. This means you manage your private keys. These keys are like secret codes that unlock your crypto wealth. Remember, if you own the keys, you own the coins.

The beauty of non-custodial wallets is the freedom they offer. No third-party can touch your crypto without your okay. This cuts the risk of losing your stash to a hack at a custodial platform. Yet, this power comes with big responsibility. You must handle your private key encryption. This means keeping your keys safe and out of others’ hands.

Safeguarding a non-custodial wallet means you must track your keys. If you lose them, your crypto is gone for good. Thus, writing down your seed phrase, a rescue code for your wallet, matters a lot. You should store this phrase somewhere safe.

Overcoming Self-Custody Challenges and Asset Accessibility

Being your own crypto guard can be tough. One slip, and you might lose your digital treasure. How can you face this challenge with smarts? Start by picking a strong, proven hardware or software wallet.

Hardware wallets are like safes for your crypto. They keep your coins offline and away from online threats. Software wallets, while more handy, can be at risk if your computer gets attacked. You need to find the right balance for your needs.

But what if you need to get to your crypto quick? Access is key. Unlike custodial solutions, where someone else has your keys, with non-custodial options, you can move your crypto at any time. Yet, you have to ensure that your computer or device is secure. This is to protect your access to your coins.

Asset accessibility isn’t just about ease of transfer. It’s also about being ready for what comes next. Imagine if your wallet company shuts down. With non-custodial wallets, your coins are still safe. Even if the wallet software is no more, you can use your seed phrase with another service.

In all, picking a non-custodial wallet means taking on responsibility. But for many, the trade-off is worth it. You get total control over your crypto and can act on the blockchain as you please. Plus, you’re not at the mercy of custodial platform reliability or exchange insolvency risks.

When you hold your keys, your financial sovereignty is in your hands. Yes, you must be careful and smart. Nonetheless, the power and freedom are yours.

Comparing Storage Solutions: Hot Storage vs Cold Storage

Types of Crypto Wallets: Deciding Between Hardware vs Software Wallets

Choosing a wallet can make or break your crypto safety. Think of how you store your regular money. Do you like having cash easy to reach, or locked up tight? We can apply the same logic when discussing hot and cold storage in the crypto world.

Hot storage, or online wallets, are like your back pocket. They’re easy to access, but more exposed. On the other hand, cold storage is like a safe. It’s secure, but takes more effort to access. Here, the main question is: What matters more to you – quick access or tight security?

Software wallets are part of hot storage. These are apps on your phone or computer. They let you send, receive, and check on your coins quickly. But, since they are connected to the internet, they face risks like hacking. Remember, your device’s security is your wallet’s defense here.

Hardware wallets are tied to cold storage. They are physical devices, looking like USB sticks. They keep your keys offline when not in use, safe from online attacks. Want to make a transaction? Just plug your hardware wallet in, and you’re good to go.

The Importance of Seed Phrase Protection and Backup Solutions

Protecting your wallet’s seed phrase is liking knowing a secret spell. It brings back your crypto if your wallet gets lost. This “spell” is a series of words given when you set up your wallet. Write it down, keep it safe. Think fireproof box, or maybe a safety deposit box at the bank.

Backup solutions are your plan B. They save you when things go south, like when devices fail or you forget a password. With crypto, you are your own bank. So, your backups must be just as smart.

You can write down your seed phrase, or maybe engrave it on metal. Some even split it up in different places. That means, if one part is found, your crypto is still safe.

Non-custodial wallets, where you control your private keys, let you own your crypto fully. But with great power comes responsibility. Custodial solutions have someone else in charge, like an exchange. They might help with backups and recovery, but remember, your keys, your crypto; their keys, their control.

Pick wisely between hot and cold, software and hardware. Your choice shapes your crypto journey and guards your digital treasure. Remember, safety first, always.

Balancing Security and Usability in Custodial vs Non-Custodial Wallets

The Trade-offs of Centralization vs Decentralization in Wallet Security

When you pick a wallet for your crypto, think about control. Want someone else to watch over your crypto? That’s a custodial wallet. Want to be the boss of your own coins? That’s non-custodial. Now, custodial wallet security is solid; after all, pros are on guard. But hacks can happen, funds might get locked, or you may face delays getting your coins out.

Non-custodial wallet benefits? You call the shots, always. Need your coins? They’re ready to go, no waiting. Scary part? If you mess up, like forget a password or lose a key, nobody can help. It’s all on you. Plus, setting them up can be tricky. You’ll need to learn a bit about how crypto works.

Third-party custodians mean handing over your keys to a company. With that, they protect your investment. They handle upgrades and stick to security rules. That’s their job. Trusted cryptocurrency exchanges offer this kind of service. It’s comfy knowing someone’s there if things go sideways.

With user-controlled wallets, you get blockchain control. You sign off on every move your crypto makes. You must deal with private key management, which scares some folks. But knowing no third-party can touch your stash without your say? That’s power.

Best Practices for Wallet Encryption Methods and Multisig Wallet Setup

Guarding your crypto means using top-notch wallet encryption methods. Your private key is like the magic word; encrypt it! If someone grabs your un-encrypted key, it’s like handing them your wallet. Encryption flips your key into code. Crackers have to work hard to get through that.

A multisig wallet setup? It’s like having several locks on your vault, and you need a few keys to open it. You team up with others, and no single person decides what happens to the cash. It’s safer, ’cause even if one key gets lifted, your crypto’s snug as a bug.

Hot storage and cold storage are like different safes for your treasure. Hot’s connected to the internet – quick to get to, but riskier. Cold’s not – think a safe tucked away, harder to reach, way safer.

Crypto asset security isn’t just a “set and forget” thing. It’s a balance. You want tight security but also to use your coins without a headache. It has to fit your comfort with risk and your tech know-how.

See, balancing isn’t just a fun word for tightrope walkers. It’s a must for keeping your crypto safe and usable. Whether that means choosing encryption like a digital Fort Knox or picking a multisig wallet for team defense, it’s about finding a sweet spot. Your coins, your choice. Choose wisely, and stay savvy in this digital treasure hunt!

We’ve explored the world of crypto wallets, from custodial services to self-managed options. We’ve weighed the pros and cons of third-party custodians and learned how to dodge digital wallet risks. Self-custody gives you control, but it bears its own challenges – keeping keys safe while making our assets easy to get to when we need them.

We compared hot and cold storage, breaking down hardware and software wallets. Remember, protecting your seed phrase is like guarding a treasure map – it’s key to your crypto’s safety.

Finally, we tackled finding a balance between tight security and hassle-free use. Whether it’s a centralized system or you going solo, encryption and techniques like multisig keep our investments safe.

My final thought? Managing crypto means staying sharp, picking the right tools, and always being ready to adapt. Whether you lean on experts or take charge yourself, keep security your top goal. Stay safe, stay informed, and your crypto journey will be worth it.

Get the newest crypto tips by following Dynamic Crypto Network.