Diving into cryptocurrency investment for beginners can feel like exploring a forgotten treasure trove—exciting yet daunting. Let’s unravel this digital maze, step by accessible step. Here, you’ll learn how to move confidently in the crypto realm, from grasping the nuts and bolts to crafting a savvy investment tactic. You won’t get lost in jargon; I’ll spell out complex ideas in simple terms. Ready to be the captain of your digital wealth? Let’s set sail into the future of finance together.

Understanding the Basics of Cryptocurrency Investment

Grasping Blockchain Technology and its Impact on Digital Currencies

What is blockchain? At its core, blockchain is a list of records. We call these records blocks. They link using math. Each block has a code that connects it to the last one. That makes it hard to change old blocks. Imagine it like a chain where every piece holds tight to the ones before. This chain keeps your digital cash safe.

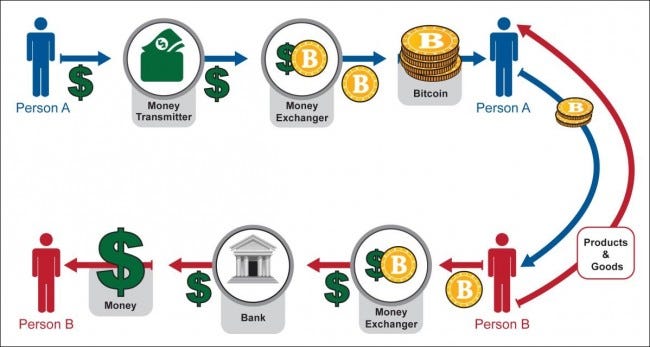

Blockchain is key to cryptocurrency. It lets people own a kind of money that’s hard to steal or fake. It works without needing a bank. They call this ‘decentralized’. Unlike paper money, digital currencies live on the internet. So, they can cross borders fast, without big fees. This is why so many are starting with cryptocurrency investment.

For beginners, it’s like magic. You send money as easy as an email. The blockchain makes sure it’s done right. It’s a smart way to move money in our online world. More easy to track than cash, and it’s yours, no one else’s.

Getting to Know the Top Cryptocurrencies for Beginners

So, you want to know how to buy cryptocurrency. First, get what each coin is for. Bitcoin was the first. It’s like digital gold. People buy it to save, not to use at the store. Ethereum came next. It’s more than just cash. It lets people write rules for money. These rules are called ‘smart contracts’. They can do deals without a middle man.

There’s more than just Bitcoin and Ethereum, though. We call these others altcoins. Each one has a different use. Some are for privacy, others for sending cash quick. There’s even one that’s like a dollar called ‘stablecoin’.

Before you buy, think about which fits your needs. Ask: What tech does it use? Who backs it? How does it fare against others? And how’s its rep? That last one’s big. A good rep means a coin can weather tough times better.

When picking the best cryptocurrencies for starters, look for steady ones. Avoid ones that are all over the place. They might seem exciting, but they’re riskier, too. And remember, learn your coins. Knowing what they do helps you pick.

As a beginner’s guide to cryptocurrency, think on this. Start slow. Pick one or two to focus on. As you learn, you’ll get braver. You might add more coins to mix it up. This is called ‘diversifying your portfolio’. It’s like not putting all eggs in one basket.

Setting up is key, too. You need something called a ‘wallet’. No, not the kind you carry. It’s an app or a device that keeps your digital money safe. It’s like the key to your online money box. Keep it secret. Keep it safe.

When you’re ready to buy, you’ll do it on a ‘cryptocurrency exchange’. Think of it as a digital marketplace. There are many, so choose wisely. Look for ones that are easy to use and have good support. And they should care about keeping your coins safe, too.

Just remember, every step counts. Learn each part before you leap. And always check if something seems fishy. That’s how you stay smart in the world of digital wealth. And that, right there, is your crash course in crypto investment fundamentals. Welcome to the journey!

Preparing for Your First Investment

Setting Up a Crypto Wallet for Secure Asset Management

Before you dive into the crypto world, you need a safe place for your digital coins. Think of a crypto wallet like a bank account for your cryptocurrencies. It holds your coins and keeps them safe. Now, as a beginner, understanding crypto wallets is key. They come in two flavors – ‘hot’ and ‘cold’.

Hot wallets connect to the internet. They make trading easy but are less secure. Cold wallets, on the other hand, stay offline. They’re like a safe for your digital wealth. Most people use both. Use a hot wallet for trading, and a cold wallet for saving.

First steps in crypto investing include setting up your wallet. Pick a wallet that is easy and safe. Look for one that’s popular and has good reviews. If you’re not sure how to start, online guides are there to help. Remember to keep your private key secret – it’s the only way into your wallet!

Navigating through Cryptocurrency Exchanges and Initial Coin Offerings

Now let’s talk about where to buy cryptocurrency. Crypto exchanges are like digital marketplaces. They let you buy and sell coins. As a beginner, you need to find an exchange that’s simple and trustworthy. The best cryptocurrency exchange for starters is one that’s easy to use, has strong security, and offers support for your needs. It’s like choosing a good store to shop at.

But what about initial coin offerings (ICOs)? ICOs are like the grand openings of new coins. Companies offer new coins to the public, often to raise money. However, ICOs can be risky. Some are not what they seem. So, when starting with cryptocurrency investment, learn about ICOs before you jump in. This means reading a lot and asking questions.

Always start small. This way, you learn without risking too much. Look for cryptocurrencies basics for beginners or an intro to digital currency to expand your knowledge. Join forums, reach out to more experienced folks, and don’t rush your decisions. Patience is your best friend in crypto investing.

Cryptocurrency markets can change fast. Prices go up and down a lot. This is what people mean when they talk about cryptocurrency price volatility. Don’t let these swings scare you. They are normal. The key is to keep learning and stay calm.

Ready for your first investment? Great! You know what to do: get a wallet, choose a good exchange, and maybe look into ICOs. Keep learning every day. And remember, each step you take is building your path to digital wealth.

Developing a Crypto Investment Strategy

Diversifying Your Digital Currency Portfolio

Imagine your investments are a fruit bowl. You wouldn’t want just apples, right? It’s better to have oranges, bananas, and grapes too. The same goes when you start with cryptocurrency investment. Don’t put all your money in one coin. Spread it out. That’s called diversifying, and it’s key for beginners.

Let’s say Bitcoin is the big, shiny apple. It looks tempting, doesn’t it? But there are other fruits – I mean coins – to check out. These other picks are called altcoins. That’s short for alternative coins. Some are like a quirky kiwi fruit or a bunch of wild berries! Altcoins could be smaller but still worth a look.

When you diversify, you spread risk. If one coin drops in value, others might not. This can help your money stay safer. But how to buy cryptocurrency? Start small. Use a trusted cryptocurrency exchange. It will let you buy and trade different coins. Think of it like a fruit stand where you pick your mix.

Balancing Risk and Reward in Crypto Investing

Investing is always a see-saw between risk and reward. In the crypto world, prices can jump high or drop fast. It’s like a seesaw that moves quick! That’s called volatility. Knowing this helps you plan. Here’s where balance comes in. You want a mix – some safe bets and some with more risk.

Begin with a plan. How much money can you use without trouble if things go south? This is your investment capital. Beginners might want to start with a smaller amount. Place that money in different coins. Look for the best cryptocurrencies for starters. They often have more info and history to check out.

Remember, with high risk coins, you might win big, but you could also lose big. Safer coins might not grow as much, but you might sleep better at night. The balance between safe and risky bets changes for everyone. It’s about what’s right for you.

Crypto wallets help too. They keep your digital money secure. There are many types. Some are easy to use. Some have extra safety steps. Having a good wallet is like having a sturdy safe. It protects your digital money from thieves.

In short, here’s your take-away for a strong start:

- Mix it up. Don’t buy just one coin.

- Start small. Learn as you go.

- Stay safe. Use a good wallet.

- Know your see-saw. Balance risk and reward

- Keep learning. The more you know, the better you do.

Investing isn’t a race. It’s more like a journey. Remember, you’re the traveler, so pack your bag wisely!

Safeguarding Your Investment and Future-Proofing Your Strategy

Understanding Cryptocurrency Taxes and Avoiding Scams

Investing in crypto can be exciting. But crypto taxes might seem hard at first. Here’s the lowdown: you must pay taxes on your gains. That means if you buy low, sell high, you have to share a cut with the tax folks. However, if you lose money in crypto, you might get a tax break.

Now, on to avoiding scams. They’re all over, sadly. Always double-check who you’re dealing with. If a deal seems too good, think twice. Use well-known crypto exchanges. Don’t give your crypto wallet’s private key to anyone. Think of it as a secret code. Only you should know it.

Staying Updated on Regulatory Changes and Community Insights

Laws for crypto change often. They can be as tricky as new game levels. You need to stay in-the-know. New rules can affect how much you earn or how you invest. There are websites that sum up these changes. Signing up for crypto newsletters can help too.

The crypto community knows a lot. People talk, and share useful tips and warnings. Joining online forums can help you stay smart about crypto. They’ll let you know what’s hot or not. By talking with others, you’ll learn the ropes faster and find help when you need it.

Rules make sure your crypto journey is safe. Listen to what seasoned players say. They’ve been where you are. Be smart. Keep learning. And remember, we’re in this for the long game.

In this blog post, I covered crypto from the ground up, helping you get started on the right foot. We explored blockchain tech and the biggest digital coins. I walked you through setting up a wallet and making your way through crypto markets. Then, I shared how to build a smart investment plan, mixing various coins to balance risk and reward. Finally, we looked at keeping your money safe, dealing with taxes, and staying sharp on law shifts and community tips.

I hope these insights give you the confidence to dive into crypto with a solid plan. Keep learning and stay alert in this ever-changing space. Remember, informed decisions are the bedrock of smart investing. Happy trading!

Q&A :

What do beginners need to know before investing in cryptocurrency?

Before plunging into the world of cryptocurrency investment, beginners should understand the nature of the asset class: its volatile and speculative nature, the technology behind cryptocurrencies (such as blockchain), and the different kinds of cryptocurrencies available. It’s also important to learn about proper security measures, such as using secure wallets, and to be aware of the regulatory environment in the investor’s country.

How can beginners start investing in cryptocurrency safely?

To start investing safely in cryptocurrencies, beginners should begin with small investments relative to their overall portfolio to manage risk. They should invest only what they can afford to lose. It’s also crucial for beginners to choose reliable and secure exchanges, utilize strong passwords and two-factor authentication, and to keep the bulk of their investments in offline cold storage.

What are the best cryptocurrencies for beginners to invest in?

For beginners, it might be best to start with well-established, widely accepted, and relatively stable cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). These cryptocurrencies have a longer track record and offer more liquidity compared to newer and less known coins. It’s essential to conduct thorough research or consult a financial advisor to make informed investment decisions.

How much money should beginners invest in cryptocurrency?

The amount beginners should invest in cryptocurrency depends on their financial situation and risk tolerance. A common piece of advice is to allocate a small percentage of the investment portfolio to cryptocurrencies – often suggested is 1-5%. As a rule of thumb, it should not be an amount that would cause financial hardship if lost.

Where can beginners get reliable information for cryptocurrency investment?

Beginners should look for reliable sources of information like established financial news websites, reputable cryptocurrency news platforms, and official communications from blockchain and cryptocurrency project developers. Academic papers, books from credible authors, and forums such as Reddit’s cryptocurrency communities can also be insightful, but should be approached with critical thinking and cross-referencing.