Crypto market crash news got your head spinning? You’re not alone. The digital currency world is reeling, and everyone’s feeling the shake-up. From Bitcoin’s big dives to Ethereum’s sharp drops, the impacts are real and widespread. But there’s more to these twists and turns than just numbers falling. I’ll guide you through the chaos with insights and strategies that can help you steer clear through this financial storm. Stay with me as we explore the factors tipping the scales, compare different crypto scenarios, and chart a course for uncertain times. Buckle up; it’s a wild ride, but you’ve got this.

Understanding the Current Crypto Market Crash

Analyzing the Factors Behind the Cryptocurrency Collapse

A crypto crash hits hard and fast, often without warning. The signs seem clear after the fact. Digital wallet losses grow and investor sentiment sinks. Folks, it’s no secret that fear drives the market down, and the recent downturn is a textbook case.

In just a flash, factors pile up: from talk about new rules to big countries saying “no thanks” to cryptos. And can we talk about stablecoins wobbling? It gets folks really worried. Then toss in some bad news, like a big coin company laying off people. Bam! Prices drop like a rock.

So, what’s really tipping the boat? One big thing is chatter about tightening rules. Governments and big groups like the SEC worry about what cryptos mean for everyone’s cash. They want to keep things safe, which makes sense, but it spooks people. And it’s not just that. There’s buzz about trouble in digital money land – like some coin projects are running low on cash.

Then there’s the tech and coin link we can’t ignore. When tech stocks take a dive, cryptos often follow. And with folks worried about a big money squeeze, you bet they’re pulling back from risk, including cryptos. It’s tough out there.

Comparing Bitcoin Plunge and Ethereum Market Dip Scenarios

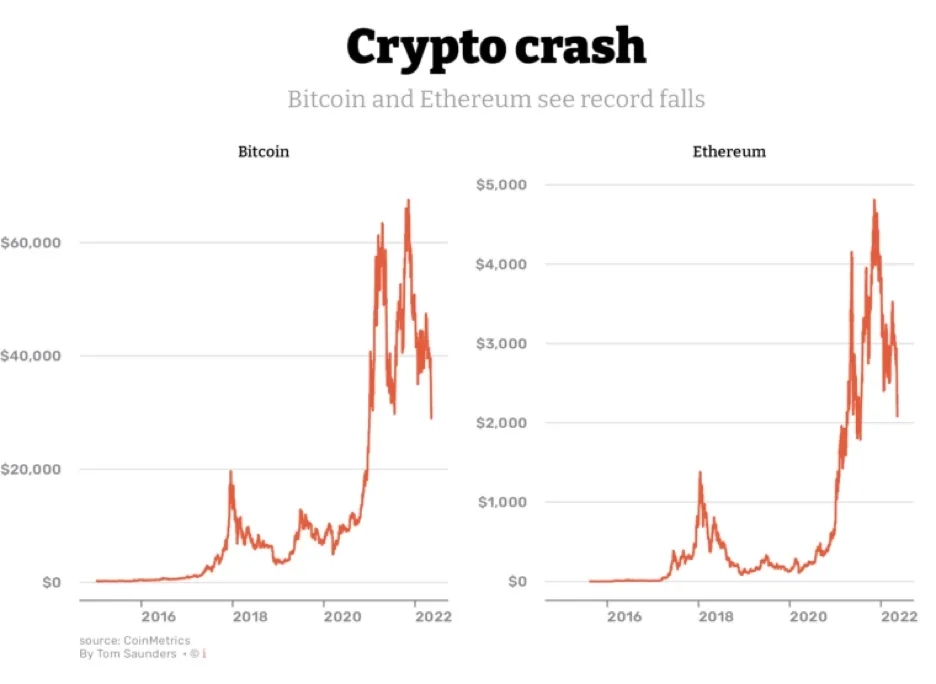

Now let’s look at Bitcoin and Ethereum, two big names on the crypto stage. When Bitcoin plunges, people notice. Bitcoin’s like the firstborn of cryptos – it sets the pace. A dive in its value sends ripples through the whole blockchain world. Altcoins, the siblings, often get hit even harder.

Ethereum’s not just any altcoin, though. It’s major too, and when it dips, we’re talking about more than just price. It’s about ETH investment risks and how they shake up things like DeFi – that’s the place where cryptos try to do what banks do, without the middleman.

A Bitcoin plunge report can look pretty grim, but an Ethereum market dip has layers to it. Are people bailing on new ideas? Are they worried about how safe their money is with these new-fangled smart contracts? You see, Ethereum’s got tech that lets you do more than just trade coins. It lets you build whole businesses on its backbone.

But here’s the deal: when either of them takes a big fall, panic selling kicks in. People start to think it’s more than a hiccup—it’s a full-on belly flop. This is where we see the difference between a market correction, a little slip, and a crash, a big smack.

What we’re seeing now has got folks whispering “recession” in the blockchain world. A liquidity crisis in crypto means people can’t sell as easily. Coins that were worth loads now get you less. Reality check – when people talk “bear market”, they really mean “watch out, it’s rough”.

Remember, every crash, every dip, teaches us something. It’s not about reading the news after your digital cash takes a hit. It’s about knowing the signs, the risks, and having a strategy before the storm hits. Stay sharp, stay informed, and don’t bet the farm on promises of moonshots.

Navigating Investment Risks During Market Turbulence

Strategies to Manage Digital Currency Downturn

When digital currencies fall, it’s like a storm hits. You see Bitcoin drop. Your heart sinks. Ethereum follows. Stress climbs. But hang in there! Know this: you’re not alone, and you can get through it.

Let’s talk about how to weather this crash. First, don’t panic sell. Selling in fear can cause huge losses. Instead, look at your long game. Is your crypto pick still solid? Then maybe hold on. If you’ve got doubts, review the facts. Only then, decide.

Avoid putting all your money in one coin. When one falls, you don’t lose it all. It’s like not putting all your eggs in one basket. Instead, spread your investments. Not only in cryptos but outside of them too. That’s diversifying.

Another tip? Keep cash ready. When prices dip, you can buy more at low costs. It’s called buying the dip. Just use money you can spare. Never money you need for living.

And finally, keep an eye on news about crypto rules and trends. These often shape prices.

Identifying Stablecoin Stability Concerns and ETH Investment Risks

Now, let’s talk stablecoins. They should be stable, right? But sometimes they wobble. Take Tether or USDC. Their value shakes when the market gets wild. Why? Because stablecoins link to real-world assets, like the US dollar. When those assets sway, stablecoins can too.

Watch out for rumors about these stablecoins. Bad news can lead to quick drops. And be watchful for ETH, the fuel of Ethereum. Ethereum is big on smart contracts. But it faces ups and downs, just like Bitcoin. It grows, then dips. Always keep an eye on the latest Ethereum market dip reports.

Keep tabs on DeFi and NFTs as well. They’re new and exciting. But they’re also risky. Their markets change fast. And lastly, remember blockchain assets can lose value, don’t let this surprise you.

In short, managing risks in a crash means staying calm, spreading your investments, and staying informed. Play it smart, and you’ll weather this storm.

The Ripple Effect of Crypto Market Dynamics

DeFi Market Turmoil and its Influence on Liquidity

DeFi, or Decentralized Finance, is a big deal in crypto. It cuts out the middleman. Think of it like a bank without a building. But sometimes, DeFi gets shaky. When this happens, liquidity can dry up. Liquidity is like oil in an engine; it keeps trades moving. Less liquidity means less trading, and prices can drop. Now, what causes the DeFi market to stir up? Often, it’s news. News like a big company failing or changes in how DeFi works.

When bad news hits, people might rush to get their money out. They sell, prices fall, and others start to panic too. This cycle can make the whole crypto world wobble. It’s like when one card falls in a house of cards, and the rest follow. People who know DeFi well look out for signs. They keep eyes peeled for changes in rules or dips in trading. By staying sharp, they ride the wave, not crash with it.

Market Capitulation Insights and Panic Selling Phenomenon

What sets off panic selling? Lots of things. Bad news, scary rumors, big investors bailing. It’s like a stampede. One loud noise and everyone runs. People sell because they’re scared, not because of facts. Capitulation is a fancy way of saying “give up.” This is when people sell no matter the price, just to get out.

Remember, in a panicky market, it’s not just about why folks are selling. It’s also about who’s buying. There are always people ready to snatch up cheap coins. They’re waiting for the dust to settle. But here’s a tricky part: knowing if it’s a real crash or just a bump. A crash is a big drop that stays low. A bump is when it bounces back after.

So, look at the facts and the history. Bitcoin and Ethereum have seen dark days before, yet they’ve bounced back. Think about that if you’re feeling spooked. Sometimes, the brave decision during chaos is to sit tight. But that’s not easy. It takes guts and smarts to see through the noise. Remember, crypto is still young. It’s like a wild ride, with high ups and deep downs.

Knowing what triggers a sell-off helps folks prepare or even avoid losses. It’s all about staying calm and not following the herd. The key is to zoom out and see the bigger picture. Are the basics of the market still looking good? Then maybe it’s not the end, just a bump. But if things are changing big time, like new laws or tech faults, then it could be rough ahead.

Crypto is a mix of tech smarts, people’s moods, and cold-hard cash. It’s tempting to join the panic when you see your digital wallet shrink. Try to remember why you joined crypto in the first place. Were you in for a quick win or the long haul? That answer can guide you when times get tough. Keep a level head, watch the waves, and don’t wipe out. Remember, after even the wildest storms, the sun will shine again.

Proactive Measures for Crypto Investors and Traders

Diversifying Portfolios to Mitigate Investment Portfolio Depreciation

We see it often: the crypto market crashes hard. You’ve seen Bitcoin and Ethereum nosedive, bridge spans in crypto land that can leave investors reeling. All is not lost, though. One key way to weather these storms is to diversify your investments. Cryptocurrency collapse updates shake the market, but if you spread your risks, one asset’s fall won’t break your entire portfolio.

What does it mean to diversify your portfolio? It’s simple: don’t put all your eggs in one basket. Mix up your investments with different cryptocurrencies. Balance with stocks, bonds, or real estate too. Look for assets that don’t move together. When Bitcoin plunges, maybe another coin or a stock holds firm or even rises. That’s diversifying at its best.

Investing in the DeFi market or NFTs? These are cutting-edge, but they’re also hit hard in downturns. A balanced mix of traditional and crypto investments can smooth out the ride. Keep step with the tech but guard against total investment portfolio depreciation. And don’t forget about cash or similar safe assets. They offer a cushion when the digital currency downturn hits.

Cyber Security Practices in Response to Increased Crypto-related Fraud

With a drop in crypto values, fraudsters get busy. Digital wallet losses hit the news. In a bear market, cyber security must be your top concern. Here’s the thing: you must protect your assets. It’s more than a good idea. It’s fundamental.

So how do you strengthen your defenses? For starters, use strong and unique passwords for each crypto service. A password manager can help you keep track. Two-factor authentication (2FA) is another must. Why? It adds an extra check whenever you log in or transact.

Always keep a close eye on your digital wallets. Not all wallets are created equal. Some offer better security features than others, so choose wisely. And please, never share your private keys. They’re the keys to your crypto kingdom.

Beware of phishing scams, too. These trick you into handing over sensitive info. If something looks suspicious, trust your gut and double-check before clicking any links or sharing details.

And remember, in crypto, personal vigilance is your first line of defense. Be smart. Keep learning about new cyber security practices, especially during the crypto trading halt. By tightening up security, you shield yourself from the worst of the crypto-related fraud surge.

Taking these steps will not bulletproof your portfolio from the next Bitcoin plunge report, but you’ll be better armed for combat in the altcoin bear market. Diversify and secure your assets. It’s how we stay standing in the face of a liquidity crisis in crypto and beyond.

In this post, we dove into the current crypto crash, pinpointing key reasons behind the downturn. We compared how Bitcoin and Ethereum have each felt the impact. I showed you how to handle these investment challenges, suggesting ways to manage risks and spot stable coin red flags.

We explored the wider effects, like DeFi woes that dry up cash flow, and why people sell in a rush. For those of you in the thick of it, I’ve urged smart moves to shield your portfolio, like mixing investments and staying safe online.

Remember, the crypto world is tough and unpredictable, but staying informed and cautious can help you navigate the chaos. Keep your wits, plan ahead, and adapt to thrive in this storm.

Q&A :

What factors caused the latest crypto market crash?

Understanding the forces behind the crypto market’s volatility is essential for investors. The latest downturn can typically be attributed to a combination of factors, such as regulatory announcements, changes in investor sentiment, technological issues within key crypto infrastructure, or macroeconomic factors like inflation rates, interest rate changes, or stock market shifts. Keeping up with news and analyses can provide deeper insights into specific triggers for each market movement.

How can I stay updated with crypto market crash news?

Staying informed requires utilizing a variety of sources. Investors should follow real-time updates on financial news platforms, subscribe to crypto-focused news outlets, join community discussions on social media, and leverage analytics services that offer alerts and insights into market trends. Diversifying your sources can give a more balanced view of the crypto market’s status and outlook.

What impact does a crypto market crash have on the global economy?

The repercussions of a crypto market crash on the global economy can vary depending on the scale of the downturn and the level of integration of cryptocurrencies into the broader financial system. While the market is still in a nascent stage relative to traditional markets, its crash can affect individual investors and companies deeply entrenched in digital assets. The influence on the traditional economy depends on factors like institutional adoption of crypto, regulatory actions, and the interplay between cryptocurrencies and other asset classes.

How should investors react to crypto market crash news?

Investors’ responses to market downturns should align with their risk tolerance, investment goals, and time horizon. Essential strategies include staying calm, avoiding panic selling, reassessing one’s portfolio diversification, considering long-term perspectives over short-term fluctuations, and staying well-informed about the market dynamics. Additionally, consulting with financial advisors or doing thorough research on the market can help investors navigate the volatility.

Are there any patterns or cycles in crypto market crashes?

Crypto markets have exhibited patterns and cycles that some investors analyze to predict future movements. Periods of rapid price increases have often been followed by sharp corrections. Analysts may outline various theories, such as market cycles that correspond to halving events in Bitcoin’s creation rate, or broader economic cycles that affect all asset classes. However, the relatively short history of cryptocurrencies means that reliable patterns can be hard to establish, and past performance is not necessarily indicative of future results.