Dive into the high-stakes world of crypto margin trading strategies for beginners with caution and curiosity. In your journey as a new trader, you will encounter a path lined with the potential for soaring wins and steep pitfalls. I’ll walk you through the essential tactics that can help you stand firm in this volatile realm. Mastering the basics is your first battleground — understanding leverage and knowing how much you need to start can make or break your trading career.

As you advance, crafting your strategic approach is crucial. Setting smart stop-losses can save you from heavy losses, while recognizing the right time to jump in or out could be your jackpot ticket. Remember, the art of crypto margin trading is not just about bold moves but also about managing risks and using news to guide your decisions. Selecting tools and trading within the rules will gear you up for success. Let’s start this adventure, but tread wisely — the margin market is no place for the unprepared.

Understanding the Foundations of Cryptocurrency Margin Trading

Demystifying Leverage and Margin Basics for Newcomers

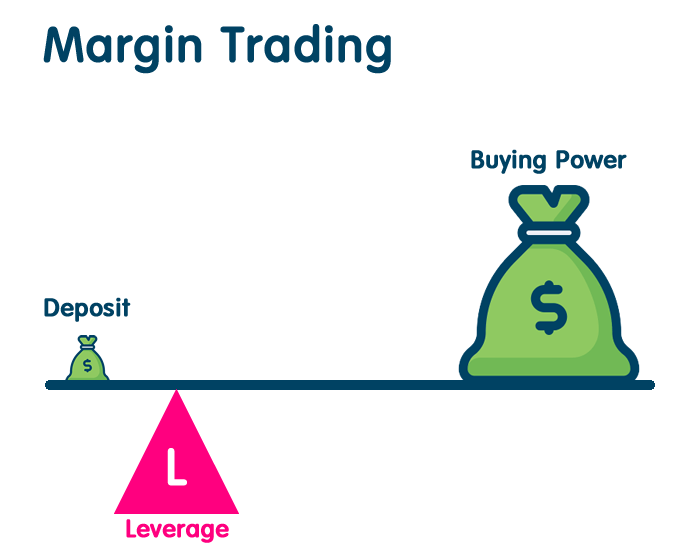

Let’s start simple – what’s leverage? Think about it as a boost for your trading power. You use a small amount of your money, and a margin broker tops up the rest. This can pump up your potential profits. But remember, it’s a double-edged sword. Losses can grow just as fast.

What causes a margin call? It’s like a warning bell. It rings when your account value drops and can’t cover the broker’s loan. When this happens, you must add more cash or assets to your account. Or else, the broker might close your positions to cover the gap.

Leverage lets you trade more than what you have. Here’s how the math works: say you have $10 and use 10x leverage. Now, you can trade as if you had $100! Leverage in cryptos can be as high as 100x. But for starters, slow and steady wins the race.

Play it safe. Use lower leverage to keep risks in check. Also, leverage rules change across countries. Always check local rules before you dive in.

Key Initial Margin Requirements and Calculating Margin Levels

What’s an initial margin? That’s your part of the deal. It’s the money you need to open a trade. Brokers have rules on how much this should be. For example, they might need 10% of the total trade value. If your trade is worth $1,000, you must put up $100 to start.

How do you figure out margin levels? It’s like keeping score. Your margin level tells you how close you are to a margin call. Calculate it by dividing the value of your assets by the amount you owe the broker. Multiply the answer by 100 to get a percentage. If this number goes too low, warning bells ring.

New to the game? Stay on the safe side. Begin with low margin trading. This means using a small part of your funds as the initial margin. It’s a way to dip your toes in and learn without taking on too much risk.

When is it good to use stop-losses in crypto? All the time. A stop-loss is your safety net. It automates a sell order at your chosen price. It prevents bigger losses when prices fall. Set stop-losses as you plan your trades to avoid sleepless nights.

Start with margin trading on demo accounts. It’s practice without real money at stake. Once you’re ready, choose a platform known for good support and teaching tools. Beginners, grab onto this knowledge. It takes time, but it’s the key to unlock true profit potential.

Risk management is your best friend. Have a plan for when things go south. Quick gains are tempting, but safe trading lasts longer. Every beginner’s journey in margin trading is different. Patience and learning will power your success.

Building a Strategic Approach to Crypto Margin Trading

Setting Up Effective Stop-losses and Identifying Entry and Exit Points

When you start crypto margin trading, you need a plan. This starts with knowing when to jump in and out of trades. That’s called finding your entry and exit points. This is like knowing when to get on and off a roller coaster. You don’t want to hop on or off at the wrong time, right? Also, you need a good stop-loss strategy. This is like wearing a safety belt. It keeps your money safe if prices take a big drop.

To set up a stop-loss, first, you choose a price. If the coin hits this price, your trade closes to stop bigger losses. For beginners, this can be tricky. You might set your stop too tight and get kicked out of a trade too soon. Or, you set it too loose and lose more than you should. The key is to not let fear decide for you. Look at charts and learn from them.

Let’s say you put $100 in and go for 5x leverage. That means you’re trading with $500 now. If the coin’s price drops just 20%, you could lose your $100. This is where stop-loss saves you by closing the trade before you lose it all. Always remember to keep your stop-loss at a point where you can afford the loss but still give your trade room to breathe.

The Role of Demo Accounts and Educational Resources in Skill Development

If you’re new to margin trading, a demo account is your best friend. It lets you trade with fake money, so you can learn without risk. Like when kids use training wheels before real biking. You can try out strategies, use stop-losses, and find good entry and exit points. It’s all without losing your money. And when you feel ready, you take off the training wheels and go for real trading.

Educational resources are like your guidebooks. They help you along your trading journey. With them, you learn crypto trading basics, how margin works, and how to manage risks. These resources come in many forms. Like books, videos, or online courses. Make sure you use them! They teach you the skills you need to hopefully make money and not lose what you’ve put in.

Keep an eye on news, too. It can really move crypto prices. Say a big country says yes to crypto or a big exchange has a problem. Both can make prices jump or dive. Knowing this can help you decide when to start or stop a trade. And that’s why following news is part of your strategy.

Now add these parts together for your trading strategy. Have stop-losses set, know your entry and exit points, practice with demo accounts, and never stop learning. With these steps, you can start margin trading with more confidence and less fear. Remember, the goal is to make money while keeping risk low. It’s a balance, like riding a bike. You must keep moving and adjusting to stay up and get where you want to go.

Risk Management and Handling Market Dynamics

Strategies to Navigate through Volatility and Margin Calls

Volatility is like a wild beast in the market. It can boost your wins or lead to fast losses. To tackle this beast, you must have a strong strategy. A key tactic is setting up stop losses. This means you decide in advance the lowest price you can bear. So if the market dips, your trade closes before loss grows too big.

Here’s a pro tip: when you start out, trade with lower leverage. High leverage can increase wins but can also multiply losses if prices swing too much. Always keep an eye on margin calls. They happen when your account value falls below a set level. The broker then asks you to add more money or they may close your positions. To avoid margin calls, don’t invest all your cash in one trade. Spread it across different trades to manage risk better.

Incorporating News and Fundamental Analysis in Decision-Making

News can shake up the market heavy. A tweet, a policy change, or a global event can send prices flying or crashing. It’s vital to stay updated with news but also to understand its impact. Fundamental analysis helps here. This means studying everything that can affect coin values—like demand, tech updates, or market trends.

When big news hits, prices can leap. If it’s good news, prices of coins might zoom up. But if it’s bad, they might drop quick. Fundamental analysis teaches you to see beyond the noise. It helps you make wiser choices based on real value, not just on what others are doing.

Before you trade on news or analysis, practice on a demo account. It’s like a video game for trading where you can level up your skills without risking real cash. By practicing, you learn how news can swing prices. You also get to try out your strategies without the fear of losing your money.

Always remember, crypto trading is not a race. It’s more like a marathon. Use strategies for the long route, keep learning, and adjust your moves as you go. By trading smart, you can win big in the game of crypto margin trading.

Choosing the Right Tools and Staying Compliant

Selecting a Reliable Crypto Margin Broker and Trading Platform

When you start margin trading, a solid broker is your best friend. You want a platform that’s easy to use and one that’s safe. Good brokers help you understand leverage risks and margin calls. They explain how much cash you need upfront (that’s your initial margin), and they show you how to calculate your margin levels.

Always look for a broker that supports beginners. They should offer resources to learn the trade. Also, they teach you how to set trade limits. Plus, they’ll urge you to practice with demo accounts first. Remember, a good broker wants you to win. They don’t rush you into trading with high stakes.

Check if the platform has tools for technical analysis. This helps you spot the right times to enter and exit trades. A great platform guides you, offers tips for profitable trading, and explains things like interest rates on margin.

You might wonder, “What about fees?” Yes, look closely at them! Some brokers charge too much, eating into your profit. Don’t let hidden fees surprise you. Find out all the costs before deciding.

Safety comes first, always. Choose a broker with a strong safety record. One that keeps your money secure. If they have features like two-factor authentication, it’s a bonus.

Understanding and Complying with Margin Trading Regulations

Now, let’s talk about following the rules. Every country has its own laws for crypto trading. It’s important to know these rules. Staying compliant keeps you out of trouble.

What happens if you ignore the rules? Big problems. You could lose your investment or face penalties. No one wants that. So, before you dive in, learn about the regulations in your area.

One more thing – the crypto world changes fast. Keep up-to-date with the latest news. It can impact the market big time. Don’t let sudden changes catch you off guard.

In short, find a trustworthy broker. One that helps you learn and stay safe. And always, always play by the rules. Happy trading!

In short, we dove into the nuts and bolts of crypto margin trading. We started by breaking down leverage and margin basics to help new folks understand how it all works. Remember, knowing margin levels and initial requirements is crucial.

Then, we looked at making smart moves in margin trading. We talked about setting stop-losses and figuring out when to jump in and out of trades. Don’t forget, demo accounts and learning tools are your best friends for getting sharper.

We also covered how to stay steady when prices swing a lot. I shared ways to handle margin calls and reminded you to keep up with news, so your choices are well-informed.

Finally, picking a solid broker and trading platform is key. Plus, always trade by the rules to avoid trouble.

It’s a big world of crypto margin trading out there—stay sharp, trade smart, and manage your risks well. Keep these tips in mind, and you’ll stand a stronger chance of doing well in the bustling crypto market.

Q&A :

What are the best practices for beginners engaging in crypto margin trading?

Starting with crypto margin trading can be daunting for beginners. It is vital to understand the risks and develop a risk management strategy to protect your capital. Beginners should start by trading with small amounts, learning to read charts, and using stop-loss orders to minimize potential losses. Continuous learning and staying updated with market trends are also essential.

How can I effectively manage risk in crypto margin trading?

Risk management is crucial in crypto margin trading. Set clear risk parameters for each trade, never invest more than you can afford to lose, and use stop-loss orders to limit potential downward exposure. Diversifying your trades and not putting all your capital into one position can also help manage risk. Additionally, it’s important to keep emotions in check and not make decisions based on fear or greed.

What’s the difference between long and short positions in crypto margin trading?

In crypto margin trading, a long position implies that a trader is investing in the expectation that the cryptocurrency’s price will rise. Conversely, a short position means betting on the price to fall. Understanding these positions is fundamental to developing strategies for margin trading, as they can dictate different approaches to entering and exiting trades.

Can beginners use leverage in crypto margin trading, and what are the risks?

Yes, beginners can use leverage in crypto margin trading, but they must use it cautiously. Leverage amplifies both gains and losses, and without proper risk management, it can lead to significant financial loss. Beginners should start with lower leverage to mitigate the risks and gain more experience in handling leveraged positions before moving to higher levels.

What educational resources can beginners use to learn crypto margin trading strategies?

Beginners should explore a variety of educational resources to learn about crypto margin trading strategies. Online courses, webinars, trading forums, cryptocurrency news sites, and strategy guides from established traders can offer valuable insights. Additionally, many trading platforms provide demo accounts where beginners can practice trading with virtual money to build their skills before investing real funds.