Regulations surrounding crypto margin trading are no child’s play. Let’s cut through the complexity. If you’re diving into the deep end with leverage, you need to know the rules to stay afloat. Here, I unravel the legal knots and lay out the path to confident trading. From leveraging dos and don’ts, evolving laws, to keeping your trades clean and by the book, I’ve got you covered. Jump in — insightful, actionable guidance awaits as you steer through the dynamic seas of crypto margin trading.

Understanding the Legal Landscape of Crypto Margin Trading

Diving into Crypto Leverage Guidelines

Crypto trading lets people buy digital money. They can also borrow money for this, called leverage. This can mean bigger wins but also bigger losses. Rules around this help keep trading safe for everyone. They say how much you can borrow. Some places let you borrow a lot, others not so much. These rules can change and be tricky to follow.

Leverage means using money from a trader to buy more crypto. This can boost profits. But it can also raise the risk of losing more than what was put in. Leverage limits in cryptocurrency depend on the law. They also depend on each platform’s rules. The law aims to protect both traders and markets.

Knowing the rules is important for anyone trading. It helps to prevent problems. Following leverage guidelines keeps trading fair and safe.

The Evolution of Cryptocurrency Trading Laws

Cryptocurrency laws keep changing. As more people trade, the rules must adapt. New laws look to make sure trading is fair and stop any bad actions. Financial watchdogs set the laws and watch over trading. They ensure traders follow them and play fair.

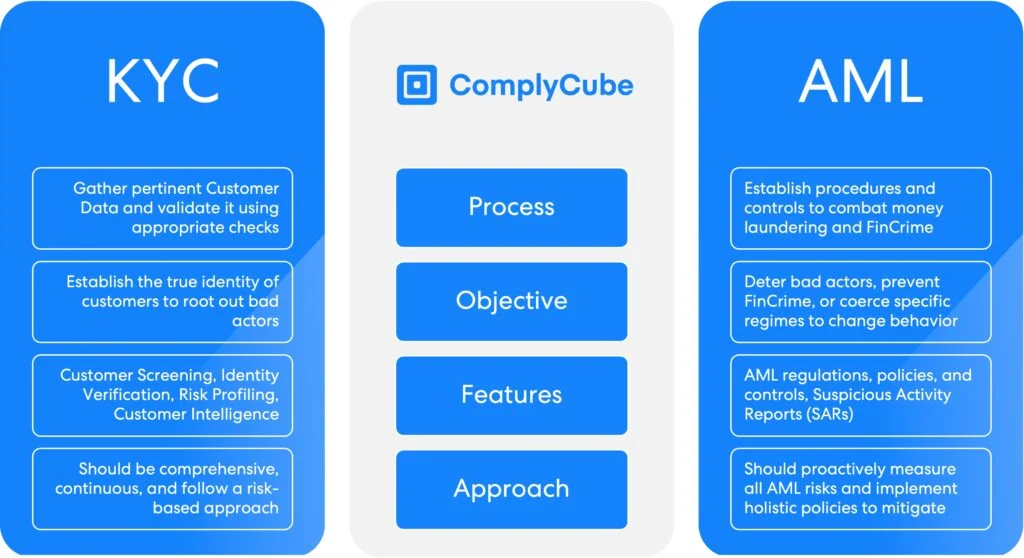

The rules focus on different aspects. They look at how much money is safe to use for trading. They also make sure people know who they are trading with. This is part of AML (anti-money laundering) and KYC (know your customer) laws. These laws help stop crime and keep trading clean.

Laws also look at how traders borrow and pay back money. This keeps everything working as it should. They set out how traders must handle risky trades. This includes margin calls, which help stop big losses.

Traders need to stay informed. New laws can come in at any time. They must also record their trades well. This helps if the rules ask for a check on their trade story.

Cryptocurrency trading laws aim to keep markets working well. They try to prevent tricks that can give an unfair edge. By staying aware of these laws, traders can keep their trading safe and within the law. Obeying the laws helps the whole crypto world stay trusted.

Ensuring Compliance: A Guide for Crypto Traders

The Role of Financial Authorities in Crypto Regulation

Financial authorities keep an eye on crypto trading. They set rules to make trading safe and fair. These bodies look at how crypto markets work. They aim to protect traders from big risks and unfair practices. They also stop illegal acts like money laundering. Financial watchdogs create laws. These laws help secure traders’ cash in the crypto world. They set out clear rules for how to operate. This makes sure that those who trade crypto follow the law.

Working with authorities helps traders stay within the law. If you trade with crypto, these rules matter to you. They guide how much you can trade with borrowed money. This is called leverage. Leverage can raise profits but also increase losses. So, limits on leverage help keep trading safe. Regulators want to stop traders from taking on too much debt. High debt can hurt the whole market. That’s why we have leverage limits.

Implementing KYC and AML in Crypto Margin Trading

‘Know Your Customer’ (KYC) and ‘Anti-Money Laundering’ (AML) are big in crypto. They fight fraud and keep our cash safe. These checks make sure traders are who they say they are. They track where money comes from. It’s about staying fair and clean in trading. Crypto exchanges use KYC and AML to check their users. They do this before letting them trade. This is important in margin trading. That’s when you borrow money to trade more than you have. If an exchange doesn’t check traders, it could lead to trouble. The law could come after them if they let bad money flow through.

When you sign up for a margin trading account, you’ll face KYC checks. You’ll need to provide ID and maybe more. Once you clear these checks, you can start trading. But remember, dealing with borrowed money is risky. You need to understand the rules. If a trade goes bad, you could lose more than your own money. A ‘margin call’ can happen. This means you must put in more money or close your trade. It’s like a safety net. It stops losses from growing too big.

Always keep these rules in mind. It’s not just about the profits. It’s also about trading the right way. Keep learning and trading smart. This ensures you, the market, and your money keep safe. Always remember, a wise trader is a compliant trader.

International Laws and Cross-Border Crypto Trading

Navigating International Crypto Margin Rules

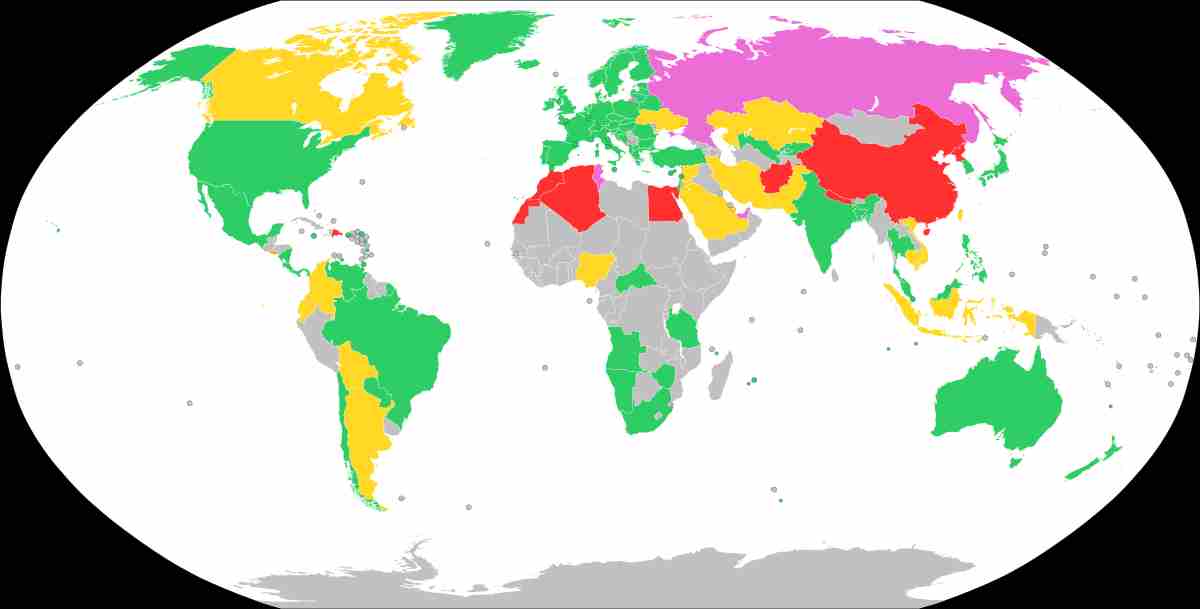

Trading crypto with leverage makes big wins possible. But it’s not simple everywhere. Some countries say okay to it; others don’t. For legal crypto margin trading, we must know the rules each place sets down. These rules protect traders and markets. Everyone must play fair.

So, what are leverage limits in cryptocurrency? They say how much you can borrow to trade. Each place has its own limits. Some say you can borrow 3 times your money, others say 10. It depends where you trade.

A big part of being safe in trading is risk management in crypto trading. This means knowing how much you can lose and stopping big mess-ups before they happen.

Now, let’s talk about financial authorities and crypto. They’re like referees in a game. They make sure no one cheats or breaks the rules. Without them, things can go bad fast.

One important rule everywhere is KYC and AML in crypto margin trading. KYC means “know your customer”. It stops bad guys from using trading to hide where money comes from. AML stands for “anti-money laundering”. It keeps dirty money out of trading. Both keep everyone safe.

Remember, each country’s rules are different. So before you trade, check the rules where you are and where your trading site is. It’s smart and keeps you out of trouble.

Dealing with Tax Implications in Crypto Trading

No one likes taxes, but we all have to pay them. In crypto trading, it’s more tricky. Every country taxes crypto gains differently. You have to report how much you make and pay part of it as tax.

Here’s a big question: How are taxes on crypto trading profits handled? You track all the money you make from crypto trades. Then you report it on your taxes. The tax you pay depends on your country’s rules.

When countries don’t share info, you could end up paying no tax or double tax. To avoid this, you must know your country’s tax laws and any deals it has with other countries.

For example, if you’re in the US, and trade on a site in Europe, you have to follow both places’ tax rules. This can get confusing, but it’s part of being a trader.

Remember, wrong info about your trades can get you in trouble. So, keep good records and report honestly. It’s better to be safe than sorry.

Everyone needs to play by the rules in crypto trading. If we do, we make the whole thing better and fairer for everyone. Trading is fun, but we have to do it right!

Protecting Investors and Preventing Abuses

Enforcing Investor Protection in Crypto Markets

Did you know your rights in crypto trading? Many don’t. Getting into crypto margin trading can be like diving into deep waters without knowing how to swim if you’re not careful. There is good news: rules to keep you safe do exist! The big idea is “investor protection.” This means making sure folks like you and me don’t lose our shirts when we trade with borrowed money, or “leverage.”

Here’s the deal—we’ve got these things called “leverage limits.” Imagine borrowing money to buy five times what you can afford. Sounds risky, right? Leverage limits keep it sane, usually capping at 10 times your bet. So, if you start with $100, the max you can trade is $1,000. Why does this matter? It helps prevent awful surprises where you owe more than you can pay.

Next up, we’ve got compliance for crypto traders. This is about following rules so everything stays fair. Think of it like driving—stop lights and signs help avoid crashes. Similarly, crypto traders must stick to the laws to keep the market from crashing.

Strategies to Prevent Market Manipulation in Crypto Trading

Alright, let’s get to the nitty-gritty of market manipulation. This isn’t a game. Bad actors try to mess with prices for their gain. But fear not! There are smart folks set on stopping this. They use cool tech to watch for fishy trades. Spot a weird pattern? They’re on it.

One powerful tool is monitoring for “pump and dump” schemes—like when a bunch of traders make a coin’s price shoot up, then sell quick for a big profit, leaving others in the dust. That’s a no-go, and there are systems in place to catch this sneaky move.

Financial authorities and crypto watchdogs keep an eye out for any funny business. They also set “margin call requirements.” These are rules saying, “Hey, you need to put up more money or sell some assets if your trade looks shaky.” It protects everyone involved, especially when prices swing wildly.

Let’s not forget, if you’re trading across borders, there are more layers. Each country has its own take on the crypto game. So, you better know the play before you join the fray. It means double-checking international crypto margin rules before you jump in.

And there you have it. A snapshot of how pros keep you from getting tripped up in the crypto margin trading world. They’ve got rules to cap your risk with leverage, keep the playing field level, and boot out the cheaters. Remember, knowing these rules isn’t just smart—it’s your shield in the fast-paced world of digital currency trading. So gear up, play by the book, and you’ll be set to take on the crypto seas!

In this post, we’ve explored the legal terrain of crypto margin trading. We dove into leverage rules and saw how crypto trading laws have evolved. We discussed the critical part that financial authorities play and how knowing your customer (KYC) and anti-money laundering (AML) practices matter. We then journeyed through international laws that affect cross-border trades, and talked about what taxes mean for traders.

We wrapped up by focusing on investor protection and preventing abuse in the crypto market. It’s clear: trading crypto is not just about strategy. It’s also about knowing the rules of the game and playing fair.

Stay sharp, trade smart, and always stay on the right side of the law. That’s the best path to success in crypto trading.

Q&A :

What are the legal requirements for engaging in crypto margin trading?

Engaging in crypto margin trading involves borrowing funds from a broker (or exchange) to trade cryptocurrencies. The regulations surrounding this can vary significantly by jurisdiction. Generally, traders need to complete a Know Your Customer (KYC) process, adhere to Anti-Money Laundering (AML) laws, and meet the margin requirements set by the platform they are using. It’s crucial to check local laws and regulations, as some countries might have specific rules or even prohibitions regarding margin trading of digital assets.

How do crypto margin trading regulations differ by country?

Crypto margin trading regulations differ widely across countries, reflecting their varying approaches to financial oversight and consumer protection. For instance, the U.S. requires platforms offering margin trading to register with the Commodity Futures Trading Commission (CFTC) or Securities and Exchange Commission (SEC), depending on the instruments traded. Japan and South Korea also have strict regulations in place. Meanwhile, the European Union is working on creating a standardized regulatory framework for cryptocurrency activities, including margin trading. Always consult with a financial advisor or legal expert familiar with your country’s regulatory environment.

What is the role of leverage in regulatory considerations for crypto margin trading?

Leverage in crypto margin trading is the use of borrowed funds to increase potential returns on investment. Regulatory authorities often scrutinize leverage ratios because while they can amplify gains, they can also magnify losses and pose greater risks. Regulators may impose limits on leverage to protect retail investors. For example, the European Securities and Markets Authority (ESMA) has capped leverage for retail clients trading cryptocurrency CFDs. Traders should ensure they understand the leverage limits set forth by regulators in their jurisdictions.

Are there specific risk disclosures required for crypto margin trading platforms?

Yes, many regulatory bodies mandate that platforms offering crypto margin trading provide clear and comprehensive risk disclosures to their users. These disclosures typically include the risks of trading on margin, such as potential for rapid loss of capital, the volatility of the cryptocurrency markets, and the effects of market conditions on liquidity and margin calls. The platforms may also need to inform users about the particular risks associated with the specific cryptocurrencies being traded on margin.

How does consumer protection factor into regulations for crypto margin trading?

Consumer protection is a significant aspect of regulations for crypto margin trading. As cryptocurrencies can be highly volatile and margin trading amplifies the risks, regulators may enforce rules aimed at safeguarding retail investors from severe financial distress. This can include measures like requiring risk warnings, enforcing margin requirements, limiting available leverage, providing negative balance protection, and monitoring the practices of platforms that offer such services. It’s essential for traders to understand the protections in place and how these might influence their trading activities.