Crypto Exchanges with Insurance: Your Safeguarded Trading Haven Revealed

Diving into the world of cryptocurrencies can feel like navigating a minefield. One wrong step and boom – your digital assets could vanish in a hacker’s puff of smoke. That’s why I live and breathe crypto exchanges with insurance reviews; to guide you to a safer trading future. In my expert dive, you’ll grasp how these policies work, why they’re critical, and which platforms offer the top-notch security your hard-earned coins deserve. Get ready to trade with peace of mind, knowing that not all treasures need to be hidden – some are just well-insured.

Understanding Crypto Exchange Insurance Policies

Exploring the Scope and Benefits of Digital Asset Exchange Coverage

When we talk about digital asset exchange coverage, what does it mean? In simple terms, this coverage is a safety net. Think of it as a big, sturdy umbrella. It’s there to protect your assets if something goes wrong. Why is this important? Well, crypto, as you know, is quite new and can be risky. Things like hacks or system failures can happen. And when they do, you want to be sure you don’t lose everything.

Having insurance for your crypto is like wearing a seatbelt. It offers peace of mind that your assets are safe. The best part? This coverage benefits everyone involved. It helps make sure exchanges can cover losses. So if a hack happens, they can pay you back for your lost coins. But not all policies are the same. Some cover more than others. For example, some might protect you if an insider steals from the exchange. Others might only cover hacks from outside.

It’s key to look at what risks you’re worried about. Then find a policy that covers those risks. Safety should always be a top concern. And exchange coverage can give you that safety.

Deciphering the Cryptocurrency Insurance Claim Process

What happens if you need to claim insurance on a crypto exchange? Let’s break it down. First, you report the loss to the exchange. This is a key step. It’s like when you tell a teacher if someone takes your lunch. They can’t help if they don’t know there’s a problem.

Then the exchange looks into what happened. This is important. They need to make sure the claim is true. They check all the details of what you said. Once they finish checking, they talk to the insurance company. The insurance company then checks too. If all checks out, they start the process of getting you your money back.

Getting your money back can take time, though. It’s not always quick. But the good thing is, if the claim is real, you should get compensated. This whole process is there to help you. It makes sure that if your crypto gets stolen, you’re not left with nothing.

In a nutshell, the process makes sure you’re safe when trading. It helps you trust the exchange more. And that trust is key in the crypto world. We all want to feel secure when dealing with our hard-earned money. Crypto insurance can give us that security. It gives us a safety net so we can focus on trading, not on what might go wrong.

Evaluating Insured Cryptocurrency Platforms

Assessing Exchange Security Measures and Safeguarding Crypto Assets

When we dive into insured cryptocurrency platforms, we look at how they keep our coins safe. Think of a vault, tough and secure. That’s what we want for our digital money too. We check how these sites protect our assets from hackers and other risks. The goal is simple: to trade with peace of mind.

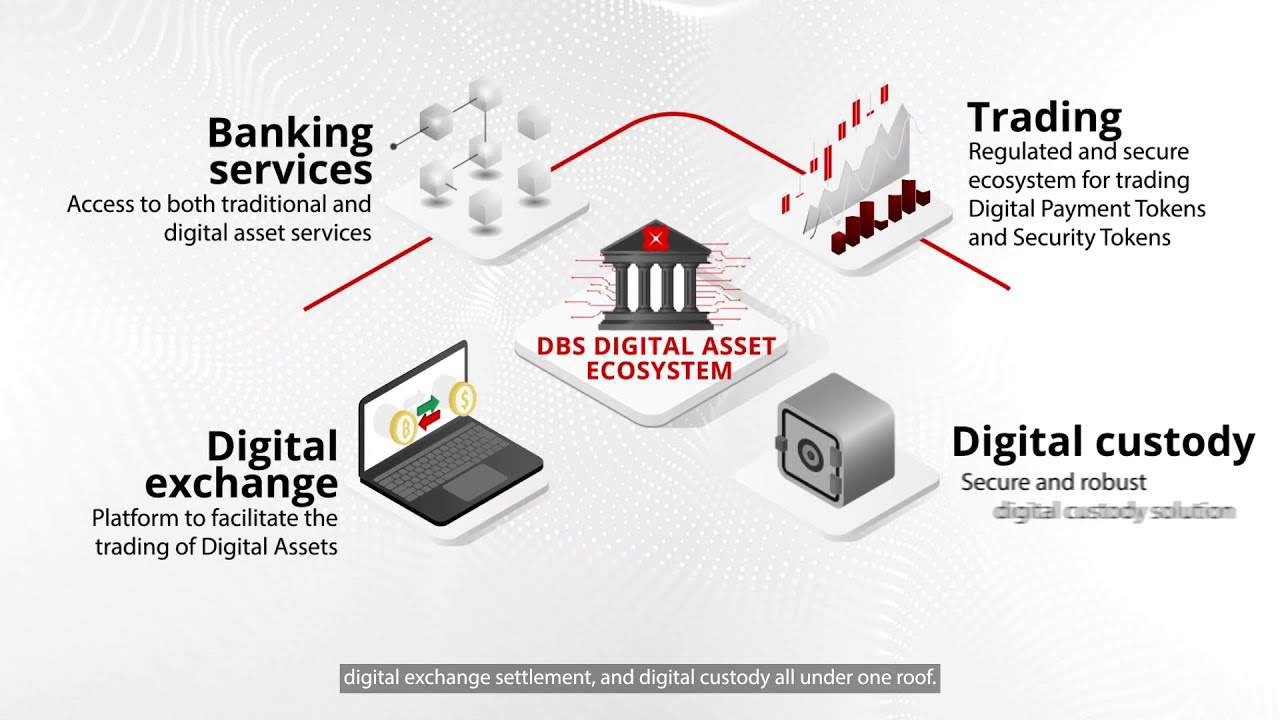

First, we inspect their security methods. Crypto exchanges use things like cold storage and hot wallet coverage. Cold storage keeps crypto offline, away from online thieves. Hot wallets are online and more at risk, but handy for quick trades. Good platforms make sure both are well-protected. They use top-notch tech to guard against cyber crooks.

Next, we ask about insurance policies. These policies are deals with insurance providers to cover our coins if something goes wrong. If a hack happens, the policy should have a clear way to handle claims. This is huge for us as users. It shows the exchange cares to back up its security with a solid plan.

Finally, we look at how these places follow the rules. Crypto is new and keeps changing. We want to make sure that these sites play by the rules today and can adapt to new ones tomorrow. This means they work well with insurance folks and the law to protect our trades.

Criteria for Ranking the Best Insured Crypto Exchanges

So, how do we pick the best out of these secure trading spots? We use a few key points. I keep these in mind when advising traders on where to go.

First, we look at the insurance details. What does the policy actually cover? We need clear answers. If your coins are stolen, what exactly will the insurance pay back? And how much? We don’t want any surprises here.

Next up, we check out the claim process. It should be simple and fair. If the worst happens, you don’t want to wrestle with complex forms. You want support to get your funds back fast.

Then, we consider the platform’s track record. Have they been hacked before? How did they handle it? Did the insurance do its job? We dig into past events to predict future safety.

We also compare costs. Insurance isn’t free, and these costs can affect your trading gains. We want prices that make sense. Cheap insurance might not offer enough cover. Pricey insurance might eat into profits. We’re after that just-right spot where cost meets cover.

Lastly, we push for transparency. A good crypto exchange will show you all the cards. They shouldn’t hide the bad stuff. If they’ve faced issues, they should tell us how they fixed them. That way, we know they’re always learning and improving.

By looking closely at these areas, we can spot the exchanges that stand out. They’re the ones that take our coins and keep them safe – like a digital Fort Knox. They mix tough security with smart insurance and clear rules to give us a trading space we can trust.

The Role of Insurance in Enhancing Exchange Security

Crypto Exchange Hack Protection Strategies

Hackers often target crypto exchanges. But, top exchanges fight back. They use insurance. This helps keep your digital coins safe. We call these defenses “crypto exchange hack protection”. They aim to block hacks and give you peace of mind.

Good exchanges use many tools to stop hackers. They use software that watches for strange actions. They call this ‘anomaly detection’. If something weird is going on, they step in fast. They also teach their teams to spot scams. This training is a big wall against hacker tricks.

Crypto exchange insurance policies play a large role. If hackers do get in, these policies help cover losses. With insurance, if the worst happens, you might not lose all. This comfort matters a lot when choosing where to trade. Insured cryptocurrency platforms are stepping up their game.

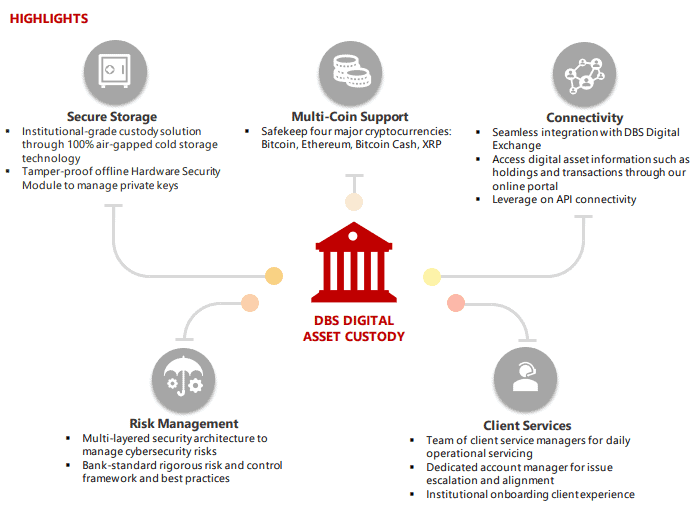

The Importance of Cold Storage and Hot Wallet Coverage

Some words are hard to understand, like “custodial risk in crypto”. Simply, it means the risk of losing your coins while someone else holds them. Big threats lurk when coins are in ‘hot wallets’. These are online wallets, so they are easier for hackers to attack.

This is where cold storage insurance helps. It means your coins are offline, away from hackers. It’s like a vault for your digital money. Main points to know? Cold storage is very safe. Hot wallets are handy but riskier. Good exchanges mix both, with protection through insurance for each.

Hot wallet coverage is tricky. It’s useful but often limited due to high risk. Yet, having some coverage is better than none. For peace of mind, look for exchanges that offer both cold storage and hot wallet insurance. They understand the risks and are ready to back you up. That’s a sign of a safe place to trade your coins.

Insurance is not just about reacting. It’s about avoiding damage before it starts. Exchanges with strong hack protections and solid insurance are like a safe home for your coins. Such places think ahead and act fast. They keep risks low and trust high. Always check for signs of good insurance when picking an exchange. It shows they take the safety of your coins as seriously as you do.

Balancing the Scales: Insurance Costs and Cryptocurrency Exchange Liability

How Coverage Limits and Rates Impact Crypto Investors

Crypto insurance is huge for your peace of mind. When you put money into an insured platform, you know it’s safer. Not just any insurance will do, though. It’s all about how much they will cover. This amount is what we call “coverage limits.” Lower limits might not fully protect your investment. Higher ones mean more of your funds are safe.

Crypto exchanges tell you their limits upfront. This helps you pick where to trade. Think of it as a guard against losses if something goes bad, like a hack. But don’t forget about rates. These are the costs you, as an investor, might have to pay. They’re part of using an insured service. A good rate shouldn’t empty your wallet. It should still give solid protection.

Establishing Comprehensive Reimbursement Policies for Exchange Users

After a hack, what happens to your money? That’s where reimbursement policies come in. They lay out how you get your funds back. Clear rules set by exchanges make sure of this. They tell you when and how much you can get after trouble strikes.

The key here is “comprehensive.” This means the policy covers a lot. It should give clear steps for you to follow. This way, if coins go missing, you won’t be left in the dark.

The best policies are simple. They let users move through the claim process without too much stress. They should also be fast. When an exchange uses these policies, it shows they care about their customers. They want to make right what went wrong.

In all, strong policies build trust. Users feel safe, knowing they’re covered. Plus, they can trade without worrying too much. This trust is golden in the world of crypto.

In this post, we tackled how insurance can boost safety in crypto trade. We looked into the cover plans and how they work. You learned about what happens when you claim lost digital money. When picking a crypto exchange, it’s key to check how it keeps coins safe and which platforms are top-rated.

We also talked about how insurance matters for hack safety. Having a mix of cold storage and wallet cover is crucial. Then, we delved into the costs of insurance against exchange duty. It’s about finding balance. Your choice needs to have clear payback rules if something goes wrong.

As an expert, I understand the crypto world can seem risky. With the right knowledge, you can make choices that protect your digital cash. Always stay informed and choose wisely. Your coins matter. Keep them safe.

Q&A :

What are the best-insured crypto exchanges available?

When looking for the best-insured crypto exchanges, users should consider platforms that provide robust security measures along with insurance policies to cover digital assets against potential hacks or theft. Reviews often highlight notable exchanges such as Coinbase, which is covered by a combination of FDIC insurance for cash balances and its own insurance policy for crypto assets, and Gemini, which is also renowned for its user insurance coverage.

How does insurance work on crypto exchanges?

Insurance on crypto exchanges is designed to protect investors’ funds in the event of a security breach or operational malfunction. Typically, these insurances cover a portion of or all the assets lost due to specific circumstances as outlined in the policy. Users should review the terms of the insurance policy, including the claims process and the types of risks covered, to fully understand the protection provided.

Can you trust the insurance reviews for crypto exchanges?

When evaluating whether you can trust insurance reviews for crypto exchanges, it is crucial to look for reviews from reputable sources, ideally ones that are independent and provide a clear analysis of the insurance terms, extent of coverage, and past claim settlements. Prospective users should also consider community feedback and any regulatory actions when assessing the reliability of these reviews.

What should I look for in a crypto exchange’s insurance policy?

When examining a crypto exchange’s insurance policy, users should pay attention to the coverage limit, the type of risks covered (such as hacking, fraudulent transfers, and internal theft), the policy’s exclusivity to crypto assets, and the claims process. It’s also important to assess whether the insurance is provided by a reputable underwriter and if there are additional steps the exchange takes to ensure asset safety.

Do all crypto exchanges offer insurance, and is it necessary?

Not all crypto exchanges offer insurance, and the level of protection varies greatly from one platform to another. While it is not a mandatory feature, having insurance can be crucial in mitigating the financial risk for users if the exchange is compromised. As part of their due diligence, users should assess the necessity of insurance for their investment needs and overall risk management strategy.