In the whirlwind world of digital trade, the crypto exchange leaderboard by trading volume is the ultimate battleground for supremacy. Buckle up as we dive headfirst into this high-stakes arena, unmasking the dominant players who define the market’s rhythm. Are you ready for a no-frills assessment of who really tops the charts when the dust settles? This is your insider’s guide to the titans of crypto trade, where only the most resilient make the cut. From volume charts that lay bare the ebb and flow of capital to key drivers that shape the crypto exchange landscape, we’ve got the deep dive you’ve been craving.

Unveiling the Titans of Trade: Top Cryptocurrency Exchanges by Volume

A Glimpse into the Volume Leaders in Crypto Markets

When we talk about crypto, we often think of coins like Bitcoin and Ethereum. But another part of this world is just as vital: exchanges. Not all trading places are the same. Some are like giant malls, buzzing with buyers and sellers. Every day, billions switch hands in these high volume crypto markets.

Imagine a sports tournament. Exchanges are teams, and trading volume is the score. The ones with high scores are the stars of the show. They’re the spots where people go to trade the most. This means more coins and more deals happen here than anywhere else. We call these the leading crypto trading venues.

Some have lots of different coins you can trade. This is like a menu with many dishes to choose from. It’s good because you have more chances to find what you want. We look at exchange liquidity and trading pairs to see how many and how easy these trades are.

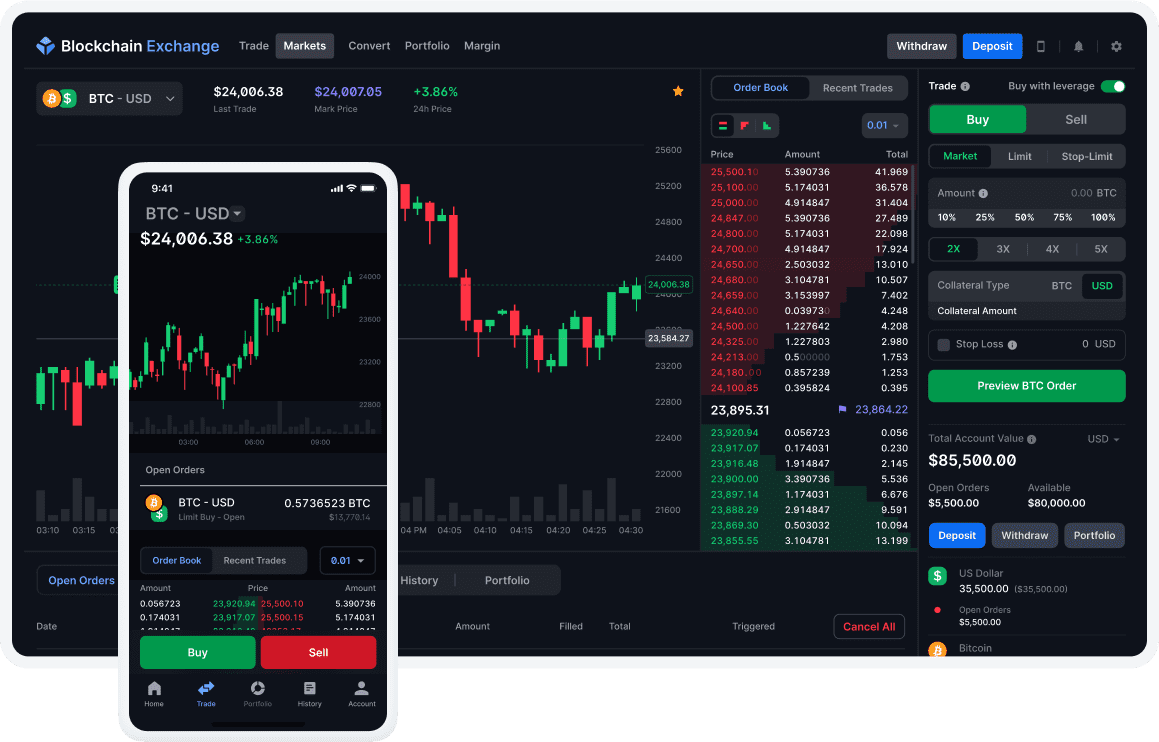

The Crypto Exchange Volume Chart: A Snapshot of Market Dynamics

Let’s dive into the crypto exchange volume chart. This chart is like a map that shows where the action is. Think of it like a leaderboard game. The higher an exchange ranks, the more people are trading there.

These charts help us see who’s who in the world of crypto trading. They show the popular exchanges for crypto trading. They give us a peek at the digital asset exchanges ranking. It’s cool because it’s always changing, just like a real race!

Each day is different in this race. The 24-hour trading volume crypto stat shows what has happened in one full day. We spot the volume leaders in crypto markets with this number. It’s like looking at a snapshot of a busy day in the market.

So, why should we care about these charts and rankings? They help us know where we can trade safely and find good prices. A place with lots of trades often means you can buy or sell without waiting long. We call this good liquidity. It’s like having a big crowd at a food stand; it usually means the food’s great!

But remember, even with all this data, the world of crypto keeps changing. Today’s number one could be tomorrow’s number two. That’s why I keep an eye on the stats, watch the charts, and always stay up to speed. And so should you, whether you’re trading, investing, or just curious about this bustling market.

In summary, volume tells a tale of success and trust in the exchange game. The big names draw the crowds. Understanding these patterns is key to playing the crypto trade. Keep your eyes on these titans of trade – there’s always something new on the horizon.

Analyzing the Ecosystem: Trade Volume Metrics and Market Liquidity

Exchange Liquidity and Trading Pairs: Assessing Market Robustness

When we dive into crypto, trade volume speaks volumes. Imagine a bustling market. Traders shout bids, dash from booth to booth, crypto coins changing hands at breakneck speed. That’s high volume crypto markets for you – busy and buzzing. But why care about trade volume? It’s simple: a high trade volume often signals a healthy market.

So, what pumps up the volume? Two words – liquidity and pairs. Think of liquidity as how easily you can buy or sell without causing a price hike. More liquidity means smoother trades. And those trading pairs? They are like the different stalls in our market, each offering different goods. In crypto, we pair up currencies like partners at a dance, each pair moving to the market’s rhythm. More pairs, more dances.

Crypto Trading Volume Analysis: Understanding the Market’s Pulse

Let’s talk heartbeats. In our body, the heart pumps blood, keeps us alive. In crypto, trading volume pumps the market. It’s the heartbeat of our digital currency world. Big impacts come from the amount traded in 24 hours – that’s like checking the market’s pulse.

What do we look for? The volume leaders in crypto markets. These are the exchanges where action happens. More action means more trust, and we want to trade where trust is a given. We scan through lists, charts, and show the world who leads the pack. High traffic cryptocurrency exchanges, they’re the ones everyone wants to join. They’ve got the pull, they’re where the crowd is.

Diving into numbers, we see patterns, like clues to where things might go. Is there a high trade volume? It tells us people are trading, loads of them. The market’s alive, kicking. And if we spot a load of diverse trading pairs, we’re looking at a rich market, full of choices.

Now, let’s not forget those who make it easy for us – the vetted crypto trading platforms. They’ve passed tests, got the stamp of trust. We lean on them because they’ve proven themselves. They’ve shown they can handle the waves, the wild swings of our crypto seas.

We’re all about staying sharp, keeping close tabs on who’s trading what and how much. This knowledge? It’s gold. It lets us, and you, make wise moves. Think of it as a treasure map, guiding us through the twists and turns of crypto trade. With every number we crunch, we’re piecing together the story of the market’s ebb and flow. So, ride the wave with us, stay informed, and watch as we uncover the rhythm of the crypto market’s pulse.

Behind the Numbers: Key Factors Impacting Exchange Rankings

The Importance of High Traffic and User Experience in Popular Exchanges for Crypto Trading

When we peek at the big players in the crypto space, user numbers tell a hefty part of the story. More folks on a platform often means it’s a hit. High traffic shows trust and allure. Take a bustling city; thriving shops draw the biggest crowds. It’s like that with crypto exchanges too.

Think of each visit as a vote for that platform. A site that’s tough to use? That’s like a shop with a broken door. No one wants to go there. And in this vast web space, where options are plenty, users stick to what works smoothly and swiftly.

Now, we aren’t just talking about numbers. User experience is king. This is about how simple it is to trade, to move your money, and to feel safe doing it. No one likes a complicated layout. People crave easy, stress-free trading. Sites with clear design and swift trading claw to the top. And staying there means constant updates, keeping an eye on what the crowd needs.

Large-Scale Crypto Exchange Operations: The Technology and Security Balancing Act

Next, we dive deep into the gears of big-time crypto trading platforms. Imagine running a theme park with millions of visitors. Keeping them safe while they have fun is no small feat. These digital arenas have a heavy load to bear. They must guard against hackers, always hunting for even a tiny crack in the walls.

The tech must be top-notch: speedy trades, solid uptime, and bulletproof security. Even a short downtime is like closing shop on a busy day. Folks can’t buy or sell, and that’s bad for business.

It’s a teeter-totter, really. Boost your tech, and you raise the bar for safety too. Skimp on one, and both could topple. Traders look for strong tech that they know is safe. No one trusts a rickety bridge with their hard-earned coin.

So, there you go. A peek behind the curtain of the crypto giants. It’s crowds and tech, hand in hand, pushing up the best of the batch, and crafting a market where each trader’s step is sure and swift.

The Crypto Exchange Landscape: Shifting Sands of Market Share and Volume Dominance

Crypto Spot Market Volume Versus Derivatives: A Diverse Trading Arena

Spot markets and derivatives are both big deals, just in different ways. Spot markets are like going to a store and buying a toy with cash. You pay and walk out with the toy. In crypto, spot trading means you buy or sell a digital coin for immediate delivery. It’s simple, quick, and what many folks start with.

On the flip side, derivatives are like making a bet with a pal about whether that toy’s price will go up or down. You don’t own the toy yet. You’re dealing with contracts, like futures or options, that let you buy or sell at a set price later on.

Now, why should you care about these two? Well, they show different sides of the trading world. The spot market can tell us what people think a coin’s worth right now. Derivatives give a peek at where folks reckon prices are heading.

Volume-Based Crypto Exchange Leaders: Who’s Gaining Ground in Global Rankings

Looking at high volume crypto markets, we watch for big players. These are exchanges where lots of trading happens. They’re key to seeing where the action is and who’s pulling ahead in the race.

Volume leaders, like the giants Binance or Coinbase, show where the money’s flowing. These are the places traders pack into, making them top stops for buying and selling.

But there’s a twist. New kids on the block keep popping up. They offer neat things, like lower fees or unique coins, tempting traders to try something new. This shifts the market share, like sand dunes changing shape with the wind.

Monitoring 24-hour trading volume crypto gives us clues about who’s winning day by day. But it’s more than just numbers. We have to think about things like how easy it is to use the exchange or how many different coins you can trade there.

Exchange liquidity also comes into play. Think of liquidity like a busy store. More customers mean it’s easier to find someone to buy what you’re selling. This attracts more people, which can help an exchange climb up the rankings.

To sum it up, when you’re looking at global crypto exchange rankings, check out more than just the trade volume. Look for variety in coins, how easy trades are, and if the exchange feels like a busy marketplace. These can tell you which exchanges are really leading and shaking things up in the crypto world.

We dove deep into the world of top crypto exchanges by volume in this blog. We explored which ones lead the market and how trade volume shows us the market’s health. We then looked at why some exchanges outdo others. User numbers and tech matter a lot here. Also, we found that the mix of spot trades and futures shapes the market.

In closing, remember these points. Big volume means a strong market. It’s all about good tech and user trust. And the market keeps changing—today’s leader might not be tomorrow’s. Keep watching this space; it’s always evolving. Stay informed and trade smart!

Q&A :

What determines a crypto exchange’s position on the leaderboard by trading volume?

The ranking of a crypto exchange on the leaderboard by trading volume is primarily determined by the total amount of cryptocurrency traded on the platform within a specific time frame, usually 24 hours. Factors such as the number of active users, liquidity, the variety of trading pairs offered, and the frequency of trades also contribute to a platform’s trading volume and subsequent leaderboard position.

How can I find the current crypto exchange leaderboard by trading volume?

To find the latest crypto exchange leaderboard by trading volume, you can visit financial news websites, cryptocurrency analytics platforms, or use market tracking services like CoinMarketCap or CoinGecko. These sites update their rankings regularly to reflect the current trading volumes on various exchanges.

Why do trading volumes on crypto exchange leaderboards fluctuate so much?

Trading volumes on crypto exchange leaderboards can fluctuate significantly due to a variety of factors including market volatility, crypto asset price changes, trading competitions, and changes in market sentiment. Additionally, external events such as regulatory updates, technological advancements, or macroeconomic developments can also impact trading volumes.

Can high trading volume on a crypto exchange indicate its reliability?

While high trading volume can be a sign of a popular and widely-used exchange, it doesn’t necessarily indicate reliability. Traders should also consider other factors such as security measures, customer support, regulatory compliance, and user reviews before determining the reliability of a crypto exchange.

What impact do trading volumes have on the crypto market?

Trading volumes are an important indicator of market activity and liquidity in the cryptocurrency market. They can affect the market in several ways, such as influencing price stability, indicating investor interest, and determining the ease with which assets can be bought or sold without causing significant price changes. Higher trading volumes generally suggest a healthier market with more active traders and participants.