Margin Trading Showdown: Unveiling the Lowest Fees Across Crypto Exchanges

As you dive into the world of crypto, understanding the impact of fees on your trades is crucial. Today, we’re zeroing in on comparing margin trading fees on different crypto exchanges. It’s like looking for the best deal on a new phone—you want top-notch features without breaking the bank. I’ve scoured the digital landscape to guide you to where the grass is greener in terms of lower costs. We’ll unlock the secrets of fee structures, funding charges, and hidden costs that can eat into your profits. Let’s crack the code to margin trading without letting fees drag us down!

Understanding Cryptocurrency Margin Fees

Deciphering Fee Structures and Rates

When you enter the world of cryptocurrency margin trading, fees matter a lot. Each crypto exchange has its own way of charging you. Some take a cut as a percent of your trade. Others charge a fixed fee. It’s like entering different shops, each with unique price tags. You need a keen eye to spot the best deals.

Let’s kick off with the basics. Margin trading means you borrow money to trade more. Think of it like a loan from the exchange. But this isn’t free. You pay interest. It’s the cost of borrowing. Just like a bank loan, but these loans can last minutes to days.

Imagine you’re at a candy store. You want more candy, but your cash is low. You borrow some money from your pal. They want a small bit of your candy in return. That’s your interest. Now scale that up to crypto trading, and there you have margin fees.

Comparing Overnight Funding Charges and Interest Rates

Now, what about when you hold a trade overnight? Exchanges charge you extra. It’s like a hotel fee for your crypto’s overnight stay. We call this an overnight funding charge. It’s a fee for holding a trade past a set time, usually a day.

The fee depends on many things. How much you borrow. The currency pair you trade. Even how long you keep your trade. Some days it’s more, like weekends or holidays. This is important to remember.

How do we compare these fees? Look at each exchange’s fees side by side. Put them in a list. Some are lower than others. This helps you choose where to trade.

Low fee exchanges save you money. That means more profit for you in the long run. Think of it as finding a hotel with the best rate for your stay. You wouldn’t want to overpay when there’s a better deal next door, right?

In simple terms, trading crypto on margin means paying fees. You have your regular trading fees, then the extra bits for borrowing money, and more if you hold trades overnight. It’s like a balancing game. You need to keep your costs low to keep your profits high. That’s why knowing about fees is a power move in crypto margin trading. Now, let us dive deeper into which exchanges might be your best bet for low fees.

Evaluating the Best Platforms for Margin Trading

Assessing Low Fee Margin Trading Platforms

When you’re in the game of margin trading, finding low fee platforms is like seeking treasure. You want to trade without giving away your hat. The key: aim for the spots where costs stay low; these are the platforms you favor. But to get there, you need to dig deep into the rough. You have to compare the fees on these platforms. You do this not just for fun but to boost your wins.

Let’s say you’re on a hunt. You start by peeling back layers on cryptocurrency margin fees. They’re like onions, right? Some fees can make you cry if they’re too high! Every platform has its recipe. Some mix in higher leverage trading costs. Others might sprinkle just a few small fees. There’s no one-size-fits-all. Cross leverage crypto exchanges like it’s a busy street. You’re after the best deal.

Knowing interest rates on crypto margin can be your map. Some platforms offer better rates. Others swing as wild as a monkey! It’s a jungle out there, and you need to navigate smartly. You’ll find crypto margin fee structures vary like snowflakes. No two exactly alike. And those initial margin requirements crypto asks for? Buckle up for those. They vary and can shape your trading path.

But here comes the big question: “Which platforms are low fee margin trading platforms?” Well, isn’t that the million-dollar question? The answer: you find them by comparing, reviewing, and always asking why. Just like how bees pick flowers, you choose your platform wisely.

Initial and Maintenance Margin Requirements

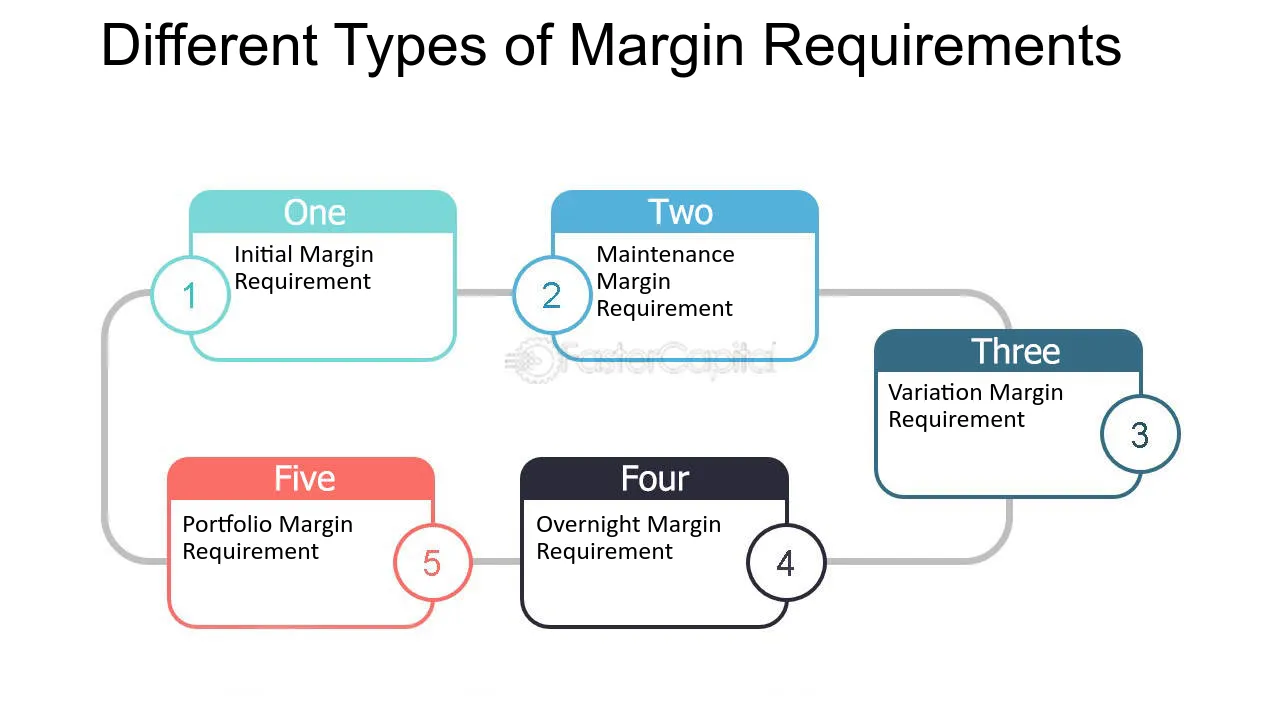

Now, let’s chat about initial and maintenance margin requirements. Initial margin is like the ticket to the show. It’s what you pay to enter the trade. It’s your skin in the game. Each platform has its doorman, and each one asks for a different cover charge. Some ask for a little; others want more. They guard the door to your trade opportunities.

Maintenance margin is the guard that watches you while you’re in the club. If your trade goes sour, this is what keeps you from getting kicked out. Platforms shout “Maintenance margin call!” like a referee blowing the whistle. They want to ensure you still have enough in the pot. If not, you face a margin call or, worse, liquidation. This is no fun at all.

For example, I found a platform that asked for 30% upfront. That’s the initial. But keep your trade above 15%, and they’ll let you stay—that’s the maintenance. Now, crypto exchange margin rules play ref too. They set the field. Know them, or you might trip on your own feet. Platforms share rules, but each has its twist. You must dance to their tune.

Platforms also fire different shots when you get a margin call. Margin call fees in cryptocurrency can creep up like a cat. Make no mistake; they can bite. To compare leverage crypto exchanges, focus on how they charge when you slip. Remember, avoid falls, and you won’t need to worry about the bite.

Here’s my expert toss. Pick a platform like you pick your team. You look for those who pass well, stay strong, and don’t cost you the game. Make the wrong choice, and your trade might end before it really begins. Choose wisely, friends. Your treasure awaits!

Advanced Strategies for Leverage Trading Costs

Margin Trading Limits and Leverage Options

When you dive into margin trading, you hit a world of chance and challenge. Limits and leverage are key. Think of them like the ropes and pulleys in rock climbing. They can lift you higher, fast. But if you climb without checking your gear, you risk a fall. Each crypto exchange sets its rules. Some let you borrow a lot, some just a bit.

Some exchanges shout out with leverage up to 100x. That means one dollar in your pocket could hold up to 100 dollars in trades. Yet with great power comes great need for caution. When leverage climbs high, so does risk. Heavy losses can hit quick, hard.

Now, how do they decide your limits? It’s a mix of your account size, past trades, and the asset’s swing. The calmer the coin, the more they may let you borrow. Always check this first. Don’t let dreams of big gains blind you to the rules.

Analysis of Margin Lending Rates and Liquidation Policies

Cash isn’t free, friends, not even in crypto land. When you trade on margin, you pay for the borrowed coins. Rates can change day to day, like waves in the sea. They swing with the market’s mood. Some days they’re calm, easy. Other days, wild, harsh. It’s not just about finding the lowest rate today. Look for steady, fair rates that don’t jump too high when the wind turns.

And what if things go south? That’s where liquidation steps in. It’s the safety net that catches you, so you don’t fall too far. But it can also snap some funds away if you’re not careful. Each exchange has a point, a line in the sand. Cross it, and they’ll close your trades to get their cash back. They call it the maintenance margin. Know where it is, always.

So, you ask, where are these friendly rates? And fair liquidation rules? They’re out there, but it’s a hunt. Each platform plays its own game. One might show a nice, low rate now, but watch for hikes down the line. Another might hold back on big leverage but give steadier rates.

You need to peek behind the numbers. Look past the flash to see the true cost. It’s not just what you pay each night for holding trades. It’s the total toll on your account over each climb. Clear rules, open books on rates, and no sudden hikes make a good start.

And remember, knowledge pays. The more you know, the better your climb. So, read up. Ask around. Check the charts. And most of all, never trade what you can’t afford to lose. In the world of margin trading, it’s your bold moves and sharp wits that will carve the path to triumph.

Hidden Costs and Profitability in Crypto Margin Trading

Uncovering Hidden Fees and Margin Account Setup Costs

Let’s cut to the chase. You wanna make bank with crypto margin trading. But, pesky hidden fees and setup costs can eat your profits. I’m here to help you see them coming.

First off, when you start margin trading, you’re borrowing dough. Exchanges charge interest for this. Every platform has different crypto margin fee structures. That’s how they make their money, and fast. So, you must compare leverage crypto exchanges to find which ones won’t bite much into your pocket.

Next up, we’ve got the sneaky setup costs for your margin account. Some exchanges like to charge you just to open up shop. That’s right, before you even start trading, they’ve got their hand in your wallet. Now, that’s not true for all platforms, but it’s something to keep your eyes on.

Risk Management and Margin Trading Tax Implications

Now, let’s talk about the big ‘R’—Risk. Leverage can boost your gains sky-high. But, it’s a double-edged sword. It can also sink you deep if things go south. Here’s the deal with risk management in crypto margin trading: you’ve got to be sharp. Use stop-loss orders, understand initial margin requirements crypto, and keep tabs on maintenance margin cryptocurrency rules. This way, you won’t get a nasty margin call or face liquidation.

What about when tax time rolls around? Uncle Sam wants a piece of your crypto pie. The cash you make—or lose—matters when the tax man comes. You better believe margin trading tax implications crypto are a thing. You see, when you trade on margin, it can change how much tax you owe. You gotta keep tight records. And hey, don’t try to wiggle out of it – the IRS is no joke.

Hidden fees—intriguing, right? But, they’re not your friends. They’re like termites in your trading strategy. Only difference is, you can’t call an exterminator. You’ve got to be the expert. Know the crypto margin trading fees explained. Dig deep to find them. Then, dodge them like a pro.

And remember, knowledge is power. In the wild world of crypto, the more you know, the more dough you could make—or keep. So take this expert’s advice. Look before you leap into the margin trading deep end. Keep your eyes peeled for hidden costs. Plan for the taxes that come with trading wins, and you’ll stay ahead of the game.

In this post, we dug deep into cryptocurrency margin fees. You now know how fee structures work and what rates to expect. You learned about overnight costs and interest. We looked at top platforms for margin trading, focusing on low fees and margin rules. We also covered advanced leverage trading, discussing limits, leverage choices, and lending rates. Finally, we uncovered hidden fees and talked about managing risks and taxes in margin trading.

To wrap up, smart trading means understanding every cost. I’ve shared my insights to help you avoid surprises and make better decisions. Trade with your eyes open and always consider the impact of fees on your profits. Remember, each detail in margin trading is key to your success. Stay informed, trade smart!

Q&A :

How do margin trading fees vary across popular crypto exchanges?

While comparing margin trading fees across different cryptocurrency exchanges, it is crucial to understand that each platform has its own fee structure. Typically, fees are calculated as a percentage of the borrowed amount and can be influenced by the level of your account tier, trading volume, and currency pair traded. Some exchanges offer lower fees for higher volume traders, while others might have a flat fee structure. It is advisable to review the specific fee schedules on the websites of the leading exchanges like Binance, Coinbase Pro, Kraken, and others to identify the most cost-effective option for your trading strategy.

What are the factors to consider when evaluating margin trading fees?

When evaluating margin trading fees, there are several factors to consider. Firstly, look at the interest rate charged on the borrowed funds, as this can significantly impact the cost of trading. Additionally, examine the duration for which you can hold a leveraged position, as some exchanges charge higher fees for longer periods. Another point to consider is the liquidation policies and how they might affect your trades if the market moves against you. Lastly, it’s important to consider any potential discounts that may apply, such as those for high-volume traders or those using the exchange’s native token.

Can fluctuations in cryptocurrency prices affect margin trading fees?

Fluctuations in cryptocurrency prices can affect margin trading fees indirectly. Since the fees are often a percentage of the value of the trade, a higher value trade will incur higher fees in absolute terms. Moreover, price volatility can lead to more frequent margin calls or liquidations, which can incur additional costs. Traders should be aware of the market conditions and how heightened volatility can affect the cost of opening and maintaining margin positions on crypto exchanges.

Where can I find the most competitive margin trading fees for cryptocurrencies?

To find the most competitive margin trading fees for cryptocurrencies, you should consider researching and comparing the fee structures of various crypto exchanges. Look at the detailed fee schedules available on the websites of top exchanges such as Binance, Bitfinex, Huobi, and Poloniex. Furthermore, it can be beneficial to join online forums or financial communities where traders share their experiences and insights regarding fees and overall platform usability. Always calculate the effective cost of trading, keeping in mind any applicable discounts or additional charges that can influence the total trading fees.

Are there any hidden costs to be aware of when margin trading on crypto exchanges?

When margin trading on crypto exchanges, be mindful of potential hidden costs that can affect your profitability. Some of these costs include funding rates or interest on the borrowed amount, withdrawal fees, and fees associated with forced liquidation if a position moves against you. Additionally, low liquidity in a trading pair can lead to slippage, which might not be a direct fee but can result in higher costs. It’s essential to read the terms of service and all related documentation thoroughly before you begin trading to ensure that you’re aware of all possible charges that might apply to your margin trading activities.