Slash your transaction costs now by learning how to compare crypto exchange trading fees. Trust me, the fees you pay can eat into your profits fast! Before you trade your next Bitcoin or any altcoin, let’s dive deep into the murky waters of fee structures. We’ll start by breaking down the maker-taker fees and the real deal on spot trading costs. Next up, I’ll guide you through a tiered fee schedule analysis. Every detail could mean more coins in your pocket. It’s time to trade smart and save big. Let’s get your crypto journey on the most cost-effective path today!

Understanding the Fee Structures Across Crypto Exchanges

Exploring Maker-Taker Fees and Spot Trading Costs

When you trade crypto, you’ll hear about maker-taker fees. Let’s dig in. Makers add orders to the market, making liquidity. Takers match these orders, taking liquidity away. So, exchanges often charge less for makers to reward them. But if you’re a taker, you might pay more. That’s because you use up what makers put out.

Spot trading fees are different. They are what you pay to buy or sell crypto right away, at current prices. Each exchange sets its own fees for this, but they’re usually a small slice of your trade. This means, if you’re jumping in fast, you’re looking at paying something extra.

Remember these fees can eat into profits. So it’s smart to compare and see which platform lets you keep more of your money.

Tiered Fee Schedule Breakdown

Now, about those tiered fee schedules. What’s the deal here? Well, it’s like getting a bulk discount. The more you trade, the less you pay per trade. It’s all about volume. Some exchanges use levels to set these fees. If you trade small, you’re on level one and pay standard rates. But, trade a lot and you climb levels. Higher levels mean lower fees.

Think of it like a game where trading more unlocks a prize: cheaper fees. So, hefty traders get a sweet deal. They can trade more without emptying their pockets on fees. But remember, this rewards big players more. As a small trader, you might feel left out. Sadly, that’s how it often works.

Understanding these fees can make or break your trading game. Maker-taker fees, spot trade costs, and tiered schedules all play their part. And they can sneak up on you, chipping away at your cash. So keep sharp and look for low fee crypto exchanges. Pay less in fees, and your crypto can grow more.

Crypto exchange fees comparison takes time, but it pays off. I kid you not, it’s like hunting for treasure. And when you find a platform with low fees, it’s a win. Keep in mind, cheap can also mean less service or features. So, weigh the pros and cons.

Comparing transaction fees is easy once you get the hang of it. Start by making a list of your trading habits. Ask yourself how often and how much you trade. Then, match this up with the fee structures out there.

Spot trading fees, crypto and all those other costs don’t have to scare you. With the right know-how, you can keep them in check. It’s like taking charge of your crypto journey. And that’s a powerful feeling. It’s what smart crypto trading is all about.

Get ready to keep more coins in your pocket. Understanding fee structures isn’t just smart. It’s a must for anyone serious about making money in crypto. Let’s keep it simple and save those pennies. They add up!

How to Identify Low-Fee Crypto Exchanges and Save on Trades

Analyzing Network and Withdrawal Fees Across Platforms

When looking for low fee crypto exchanges, check the network and withdrawal fees first. Every platform has different costs when you move your coins out. Some charge a lot, some less. Do your homework. Compare these fees across different places.

Let’s get real—no one wants to see their crypto eaten up by high fees. Think about it. If you plan to move your Bitcoin around often, high withdrawal costs can hurt. Same with Ethereum. And don’t forget other altcoins.

Now, about network fees. These are like tips for the crypto miners or validators. When the network’s busy, you pay more to get your transaction confirmed fast. So, peak times can cost you more.

“Maker-taker fees structure” might sound complex. But it’s simple. If you make a new trade offer, you’re a “maker,” and you grow the market. If you take an offer that’s already there, you’re a “taker.” Makers often pay less because they add to the market.

Utilizing Crypto Exchange Fee Calculators for Best Deals

Okay, you want to find the best deals, right? Use a crypto exchange fee calculator. These tools are great. They do all the math for you. Just type in your trade size and boom. You’ll see how much trading will cost on different platforms.

Calculators help compare things like spot trading fees, too. Spot trading means buying or selling crypto for immediate delivery. It’s like saying, “I want that Bitcoin right now.” Platforms often charge a small percentage for this kind of trade.

Here’s a smart move. Look out for “tiered fee schedules.” This means the more you trade, the less you pay per trade. It’s like getting a bulk discount. This can make a huge difference if you trade lots of crypto.

Sometimes exchanges even have deals, like “no-fee cryptocurrency trading.” But watch out. Sometimes, no fee in one place means higher fees in another place. Always read the fine print and check for hidden costs. They can sneak up on you.

Lastly, think about how often you’ll deposit money. “Deposit fees digital currencies” are real. You might pay just to put money into your trading account. And each currency might have a different fee.

When you put effort into understanding exchange fees, you can save cash. More cash means more crypto in your wallet. And that’s what we all want, right? So dive in, use those tools, and keep trading costs low. Your future self will thank you for it.

Comparative Analysis: Binance vs Coinbase and Other Major Platforms

Evaluating Fiat to Crypto Conversion Charges

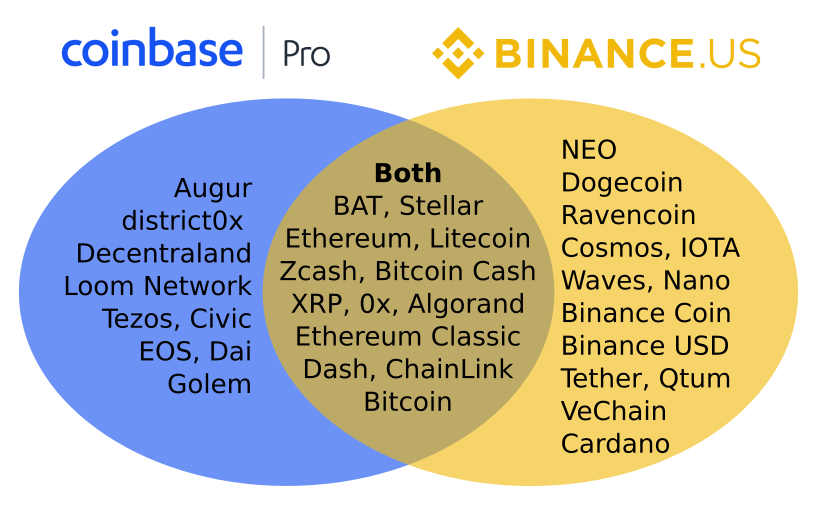

When you buy crypto with cash, you face fiat to crypto conversion charges. These costs vary across platforms. It’s crucial to compare them for the best deal. Binance and Coinbase are two heavyweights in this arena. Let’s put them side by side.

Binance is often the go-to for low fee crypto exchanges. Their charges tend to be less than Coinbase. This is true for both spot trading fees crypto and exchange withdrawal fees. Yet, Coinbase is known for its ease of use. It could be worth their higher fiat to crypto conversion charges for some users.

We can’t ignore the hidden costs in crypto trading when comparing transaction fees. These costs could be network fees or the crypto exchange fee structure itself. It’s important to check these before trading. Binance offers a tiered fee schedule. This means you could pay less if you trade more.

Coinbase has a simpler fee setup. But, it could cost you more in the end. This is even after any discount on crypto fees they might offer. Always check the full cost of your trade before you commit.

Discovering Volume-based Fee Discounts and Hidden Costs

Volume-based fee discounts are a big deal. Trade a lot and you could save big. Crypto exchange fees comparison shows that large traders benefit most. Binance users with a high volume get discounts. This makes them one of the cheapest bitcoin exchange options for big players.

Don’t overlook hidden costs in crypto trading. These could be things like deposit fees digital currencies. It might also be higher costs for certain types of trades. Maker-taker fees structure affects this a lot. If you make the market, you usually pay less.

Compare the likes of Kraken trading fees to Binance and Coinbase. You’ll find differences that could influence your pick. Altcoin exchange fees might also swing your decision. Each platform has its own set of rules. Use these to find the most cost-effective in crypto trading.

In brief, to save money, you need to dig deep. Look past the headline rates to find the true cost. Binance vs Coinbase fees? Binance often wins on cost. But, Coinbase comes out strong with ease of use and reputation. Always calculate the complete cost before you trade. This way, you secure the most bang for your buck.

Strategies for Minimizing Trading Expenses in Crypto

Leveraging Discounts on Crypto Fees and Decentralized Exchange Opportunities

Trading crypto can cost you unless you get smart about it. Every trade, buy, or sell hits you with a fee. This may seem small but adds up to a big chunk of your cash over time. To save on these fees, you need to know where to look.

Start by comparing transaction fees on different exchanges. You can often find lower fees on decentralized exchanges. They match buyers with sellers without a middleman. This can mean big savings for you. Many traders have found that platforms like Uniswap have lower fees than traditional ones.

Next up, look for exchanges with fee discounts. Some platforms reduce fees for big traders. If you trade a lot, you may get those volume-based fee discounts. They reward you for trading more. It’s like a thank-you note in the form of savings.

Also, join loyalty programs and get tokens that exchanges offer. Using these can knock a few points off your fees. It’s like having a coupon when shopping. Some exchanges even offer zero fees for certain trades or periods.

Last, keep an eye out for new exchanges. They often have lower fees to attract users. That’s your chance to dive in and save before they grow big.

Understanding the Impact of Security and Liquidity Provider Fees

Now, let’s talk about the less obvious costs. Security fees, although they may not be listed, are part of what you pay. Secure exchanges invest more to keep your cash safe. This cost can trickle down to you. But, think of it as buying peace of mind. It’s better to pay a bit more on an exchange like Kraken, known for its security, than to risk your coins in a less secure space.

Another hidden cost is liquidity provider fees. Exchanges need a big pool of coins for smooth trading. Some charge you to keep this pool flowing with coins. This is important to know as it can affect your total trading costs. Ethereum trading costs, for example, will include these kinds of fees.

When we talk about security and liquidity fees, it’s not always clear how much you’ll pay. But, they are keys to fast and safer trading. These are the prices you pay for the services that keep your trading smooth and secure.

Altogether, knowing about discounts and understanding the hidden fees can make or break your trading game. You don’t have to lose your hard-earned cash to high costs. Make the smart moves, and you can keep more of your investment working for you. With this approach, you can improve the cost-effectiveness of your trades.

Staying on top of these expenses means you’re being a wise trader, not just a busy one. Use this know-how and the tools available to you to minimize what you pay out and maximize what you keep. Happy trading!

We dove deep into crypto exchange fees to help you trade smart. From maker-taker fees to tiered pricing, it’s clear that exchanges vary. Platforms like Binance and Coinbase differ, and each has its hidden costs. Remember, low fees can come with trade-offs in security and liquidity.

To keep more coins in your pocket, use fee calculators, hunt for discounts, and consider decentralized exchanges. This isn’t just about finding low fees—it’s about trading with confidence. These tools and tips can lead to better choices, so you save on trades and invest wisely. Happy trading!

Q&A :

How do I compare fees across different cryptocurrency exchanges?

When comparing fees across various cryptocurrency exchanges, it’s important to look at more than just trading fees. Consider the types of fees each exchange charges such as deposit fees, withdrawal fees, and any other service fees. Some exchanges may offer lower trading fees but charge more on deposits or withdrawals. Additionally, make sure to check if the fees vary based on the payment method or the type of cryptocurrency. Lastly, always be aware of any tiered fee structures that may apply regarding your trading volume.

What are the factors that affect trading fees on crypto exchanges?

Trading fees on crypto exchanges can be influenced by several factors. These include the user’s trading volume, with higher volumes often leading to lower fees. Other factors are membership tiers, where exchanges reward users with lower fees for higher levels of account verification or for holding certain amounts of the exchange’s native cryptocurrency. Market maker and taker fees also differ, with makers often paying less because they provide liquidity to the market. Additionally, the complexity of the trade and the currency pairs involved can affect the fee structure.

Are there crypto exchanges that have zero trading fees?

Yes, some crypto exchanges advertise zero trading fees as a feature to attract users. However, it’s crucial to read the fine print because exchanges need to make money somehow, and this can mean higher fees in other areas such as withdrawal fees or spreads. Zero-fee trading might also only apply to specific trading pairs or to users who meet certain criteria, such as holding a requisite amount of the exchange’s native token.

How do cryptocurrency exchange trading fees compare to traditional stock exchange fees?

Cryptocurrency exchange trading fees are typically structured differently than those of traditional stock exchanges. Crypto exchanges often charge a percentage of the trade value as a fee, which can make smaller trades relatively more expensive. Traditional stock exchanges might have a fixed fee per trade regardless of the trade size which can be more favorable for larger trades. Additionally, crypto exchanges might have different fee levels for market makers and takers, while traditional exchanges tend to have a more standardized fee structure.

Can trading fees on crypto exchanges change over time?

Yes, trading fees on cryptocurrency exchanges can change over time. Exchanges might adjust their fee structures to remain competitive, to reflect changes in the market, or to incentivize certain types of trades or volumes. Users should regularly review the fees of their preferred exchanges, as changes may occur without direct notification. Some exchanges also offer promotional fee periods or discounts for using their own tokens, which can temporarily alter the fee landscape.