Comparative DAG vs Blockchain: are they just buzzwords or game-changers? As an expert in digital ledger tech, I’ve seen my share of confusion. So, here’s the deal, I’m cutting through the noise. We’ve got two titans here—one’s a trusty workhorse, the other’s a sleek race car. And you, you’re right there in the pit lane with me, getting the real lowdown on their engines and what makes ’em run. Sure, blockchain’s been the talk of the town with its security and smart contracts, but DAG? That’s the new kid pushing speeds we didn’t think possible. It’s time to buckle up and dive into this tech tussle, comparing two different paths that just might shape our digital tomorrow.

Understanding the Core Differences: DAG vs. Blockchain

Exploring the Fundamentals of Directed Acyclic Graph Technology

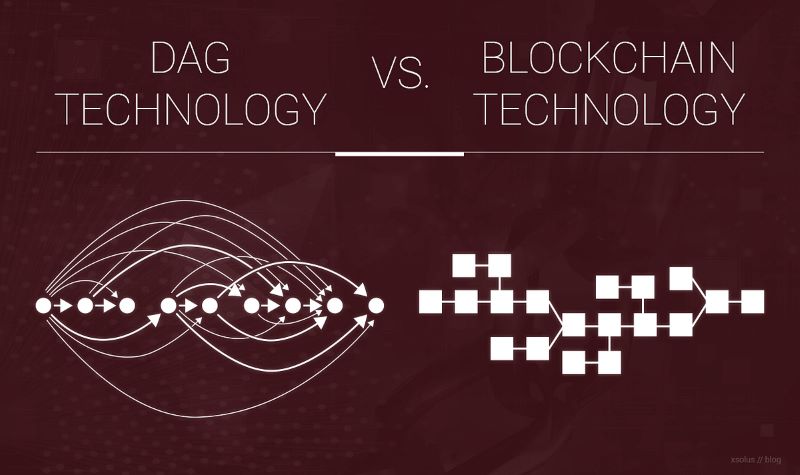

Let’s kick things off by digging into Directed Acyclic Graph technology, or DAG. At its heart, it’s like a tree that only grows one way – forward. Imagine a family tree that only shows your future kin – no sisters, brothers, or twins. That’s how DAG handles data. It’s this no-turning-back flow that makes DAGs unique.

Check out IOTA’s Tangle, a shiny example of a DAG. In Tangle, each transaction confirms the last, skipping miners or block makers. So, it’s faster and cuts out fees. As you use it, you also help run it – by confirming other folks’ deals.

Now, DAG shines in playing the numbers game. It can handle bunches of transactions in a snap. This is because every new transaction helps confirm old ones – spider-web style. So, the more action, the speedier it gets. This makes DAG a wiz at scaling up, which is a tough act for many crypto systems.

Dissecting the Traditional Blockchain Architecture

On the flip side, blockchain’s like a chain of memories. Each block holds a pack of transactions and links to the last, securing a clear record. It’s a straight shooter – one block after another.

Nowadays, people know blockchain through big names like Bitcoin. Here’s the thing – all players agree on new blocks. They use proof of work, where miners solve puzzles to keep things in line. But time and energy add up, and so do the fees.

One hiccup in blockchain town is scale. When too many deals rush in, traffic jams hit. Just like real roads, this slows everyone down. There’s a limit to how many transactions can fit in the block, you see.

With blockchain, adding blocks takes time. This caps the transactions per second. Even as more folks want in, too many transactions clog the pipes. You’ve got delays, and fees climb. Imagine pouring a bucket of water through a straw. It’s going to overflow, right?

Another thing is forks – like a road splitting in a wood. Blockchain can branch out if folks disagree. This splits the chain, making two tales from one history.

In the end, DAG and blockchain hold hands in the same big family of distributed ledger technology. They each want to record our digital doings without trusting just one boss. The path they choose – that’s where they split. DAG’s like a web, light and fast. Blockchain’s a sturdy chain, slow but secure. Both have their stage to shine on in the world of tomorrow.

So, what we’ve got here is a race – a race for tech titans. One with twisty-turny DAG tracks and long, straight blockchain roads. As they zoom into the future, many wonder: Who will take the cup and how? Will it be the zip of DAG’s web or the might of blockchain’s chain? Time will tell, friends. Time will always tell.

Evaluating Performance: Scalability and Transaction Speed

Transactions per Second: Analyzing DAG’s Edge

DAG, short for Directed Acyclic Graph technology, works wonders for fast transactions. Unlike blockchain, DAGs don’t need blocks. This means they don’t wait to fill a block before confirming transactions. Each transaction links to the next, forming a graph. This graph grows in many directions, which means more transactions get processed at the same time.

Now, let’s talk numbers. The transaction speed of DAG is a hot topic. How many transactions per second can DAG handle? A lot. This is vital because it says how fast a crypto can move. For instance, IOTA’s Tangle, which uses DAG, can handle a lot of transactions. The Tangle gets stronger and faster as more people use it. This is different from many blockchain systems, where more users can mean a slower network.

Blockchain can get stiff in speed and volume. With blockchain, all transactions wait to be part of a block. These blocks then join a single chain, one by one. It works well, but it can be slow. When lots of people want to make transactions, there can be delays. Blockchain tech struggles to go beyond a few dozen transactions per second. This is not enough for global systems.

Understanding this difference is key. It helps us see where tech can go, especially for things like paying for coffee or streaming videos.

The Impacts of Scalability on Network Efficiency in Blockchain

Blockchain is like a train. Each car is a block full of data and they link together on a track, one after the other. This system is secure and strong but can get crowded and slow. When more people use the network, it takes more power and time to keep the train running smoothly. Plus, it can only handle so many transactions at once. That’s a big deal because it means it might not suit everyone’s speed needs.

When we compare, blockchain has its strengths, like security. People have trusted it for years to keep data safe. But when it comes to scaling up for many users doing many things, it falls short. DAG’s blockless method doesn’t face the same limits. It’s built to grow easily with more use. This is why experts like me see loads of promise in DAG for the future. Feeless transactions in DAG also change the game for how we pay and interact online.

Decentralization, where no single control point exists, is a shared goal for blockchain and DAG. But how to keep things fair and secure differs. Blockchain uses methods like proof of work. This takes tons of energy and time. DAG, though, is looking at new ways to keep every user’s data agreed upon without so much energy.

These ideas are shaping up to change how we buy, sell, and trust our data with tech. As an expert in Directed Acyclic Graph technology, I see an exciting future. A future where we swap slow and costly for fast and free. A world that runs on tech that scales without a hiccup. DAG is poised to pave the path. And I’m here, tracking every step to bring the latest and most trusted insights your way.

The Mechanics of Consensus: From Proof of Work to DAG Solutions

A Closer Look at Blockchain Consensus Mechanisms

Blockchain ticks like a clock, with trust built into its gears. Each block, a bundle of data, joins the chain only if network users agree. They say, “Yes, this is true,” through a vote called Proof of Work. Miners race, solving hard math puzzles to add new blocks. Winners get new coins—a sweet prize, but it eats up more power than some countries do.

DAG does differently. Each user pitches in, checking some past trades before making their own. It’s like each person helps to hold up the line at the store, so everyone gets served faster. Without block-bound chains, there’s space to sprint.

Revolutionizing Consensus with DAG Implementations

Now, let’s dive into how DAG is shaking things up. This new tech, Directed Acyclic Graph, sounds complex. But it’s quite simple. Picture a web of trade history. Unlike a chain, it’s not one after another but a net of connected points. Each new trade confirms a few before it.

So, what’s the big deal? DAG trades ring in quick, with many happening at once. With blockchain, only one block of trades can join the chain at a time. This limit means slower trade times and higher costs when the network is busy.

Want fast and near-free trades? DAG might be your hero. Each user acts as a mini miner. They do tiny checks to approve trades. No race for puzzles means we save a lot of power. Good for our pockets, even better for our planet.

So, what about keeping things fair and safe? Blockchain makes sure no one cheats by making races hard and costly. But that’s heavy on resources and slow. DAG’s approach is lighter and spreads duty across its web. This cuts chances for any single point to play dirty.

Consider IOTA, a big name in DAG. Its Tangle lets gadgets trade data and coins with no fees. It’s like many tiny streams that join into a big river. It flows fast and free, making it great for a world filled with smart devices.

As for Nano, it zips trades across its net in seconds, for nothing. It shows how a feeless and swift digital money world could look.

But DAG isn’t perfect. The web can get tangled, and bad actors could try to trick the system if too few users are on guard. Plus, new tech scares folks sometimes. They trust what they know, and the blockchain has been around longer.

In the end, DAG and blockchain are here to do the same job but in their own ways. DAG systems aim for a future with fast, green, and low-cost trades. Blockchain stays strong, secure, and true, with a stamp of time-tested trust.

These tech titans are not in a duel, they’re more like paths in a wood. Each has its own set of hikers, with their sights on various peaks. Where we end up walking might depend on what we’re hauling on our backs. Could it be a quick note to a friend or a vault of gold? The path we pick will be shaped by our load.

The Future Landscape: Implications for Industries and Technologies

Envisioning DAG in IoT and Supply Chain Management

Let’s talk about how Directed Acyclic Graph technology is changing the game for businesses, especially in the Internet of Things (IoT) and supply chain management. First off, what makes DAG stand out? It’s simple: DAG networks can handle lots of data fast and without high fees.

Now, think of all the devices talking to each other in IoT. We’re talking billions of gadgets. They share tiny bits of data non-stop. DAG can manage all these transactions at once. Why? Because DAG does not wait to create big blocks of data like blockchain does. It sends out each piece of info as it comes. This means every device can talk and listen without delay or high cost. And in supply chains, this speed and cost-saving are gold. Products can be tracked in real-time as they move around the world. Each step is recorded fast and cheap, making everything run smoother.

So, when we see thermostats or car computers chatting away, it’s the speed and easy cost of DAG making this future possible. As more companies catch on, we’ll see a big shift. It’s an exciting change for anyone watching the tech world.

The Evolution of Smart Contracts: Blockchain or DAG?

Alright, now let’s dive into smart contracts. These are deals or rules set up to work automatically. They’re big in blockchain but, are they just as good in DAG networks? Yes, they can be, maybe even better.

You see, blockchain smart contracts work well, but they often get stuck if too many are running at once. This is because of the blockchain’s design, which takes time to add each block of data. But here’s where DAG shines. Its speedy nature means it can do more at once. No waiting for blocks to complete. That’s a big deal.

DAG platforms can run tons of these contracts without slowing down. In time, this could mean a lot for how we do business. Imagine deals and rules that can change and run on their own, no glitches, less cost, and faster than ever. For people in all kinds of work, the promise of DAG could make a huge difference.

Even better, without having to pay for each transaction, DAG makes things even more interesting. Costs drop a lot when you remove fees. People might start doing things in new ways because of how much they can save.

So, looking ahead, the use of DAG in smart contracts is an area with lots to watch. This could reshape not only tech but also how we all interact. Keep an eye on this space—it’s bound to bring some surprises!

We’ve explored a lot in this post about DAGs and blockchains. In essence, we’ve seen that DAGs shine with fast transactions, while traditional blockchains are well-known and widely used. When looking at performance, DAG often speeds past blockchain with its quick processing and does well as networks grow. Yet, blockchain stands strong with its established systems and proof-of-work methods.

When we dig into how each system reaches an agreement, or consensus, it’s clear that DAG could lead to new ways of thinking. It can be faster and need less power than blockchain. As we look ahead, industries like IoT and supply chains might lean toward DAG for their tech needs. Smart contracts are also evolving, and whether they’ll stick with blockchain or move to DAG is up in the air.

What’s clear is that there’s no “one-size-fits-all” here. Both DAG and blockchain have their place in our tech future. It’s an exciting time, and I can’t wait to see how we use these tools to build fresh, powerful systems. Remember, the key is choosing the right tool for your needs. Thanks for joining me on this deep dive – here’s to the tech that’s shaping our world!

Q&A :

What is the difference between a DAG and a regular blockchain?

A DAG (Directed Acyclic Graph) is a data structure that allows transactions to be structured in a graph that is not strictly linear, unlike a traditional blockchain that organizes them into a sequential chain of blocks. The key difference lies in the way transactions are validated and recorded: DAGs allow for simultaneous transactions to occur without the need for blocks or miners, potentially offering higher scalability and lower transaction fees.

How does a DAG improve upon blockchain technology?

DAG technology seeks to improve upon standard blockchain technology by addressing issues such as scalability and transaction speed. As DAGs do not require mining and blocks, transactions can be processed in parallel, reducing confirmation times. This can increase transaction throughput, potentially allowing DAG-based networks to handle higher volumes of transactions per second compared to blockchains.

Can a DAG operate without miners or validators like in a blockchain?

Yes, a DAG can operate without traditional miners or validators. In DAG-based systems, the consensus mechanism usually involves transaction validation by the previous transactions, meaning that users’ transactions help to secure the network. This contrasts with many blockchain systems, which rely on miners or validators to verify and add transactions to blocks in a linear chain.

What are some real-world applications of DAG technology?

Real-world applications of DAG technology are increasingly present in sectors demanding high-speed transactions and scalability. Some examples include IOTA, which is designed for the Internet of Things (IoT), enabling feeless microtransactions between devices. Other use cases involve financial transfers, supply chain management, voting systems, and any scenario where the limitations of conventional blockchains might be a bottleneck.

Is DAG technology more secure than traditional blockchains?

Security in a DAG versus a traditional blockchain often depends on the specific implementation and use case. Generally, DAGs may face different security challenges, such as increased vulnerability to certain types of attacks due to not requiring blocks or miners. However, they also offer unique security features through the mutual validation of transactions, which can make it difficult for fraudulent activity to occur without being detected by the network. As with blockchains, the security of a DAG will depend on its protocol, network size, and community vigilance.