In search of the best margin trading platforms for crypto? Your trading success hinges on your platform choice. Our comprehensive guide steers you through the ocean of leverage options so you can trade with confidence. We’ve tested and evaluated, digging deep into leverage options and platform security. Our insights on trading fees and liquidity will help you balance cost and capital. Dive in and let’s unleash the full potential of your trades!

Evaluating Top Cryptocurrency Margin Trading Platforms

Comparing Leverage Options and Platform Security

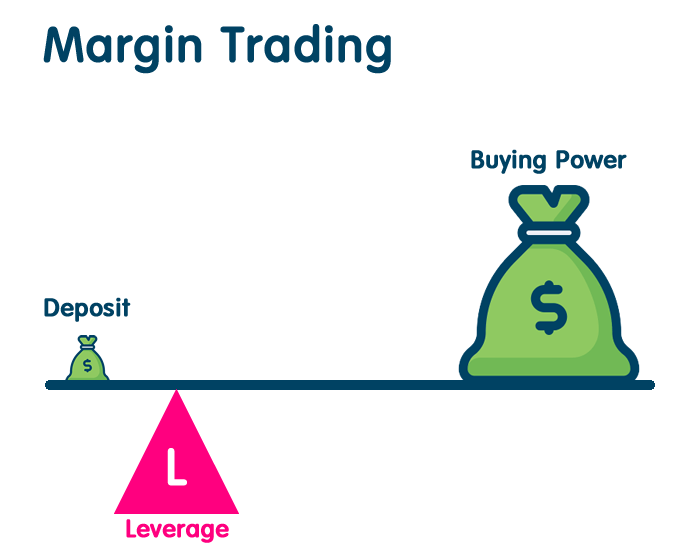

When it comes to crypto leverage trading sites, options vary widely. The best sites offer high leverage, which can be a game-changer. Leverage lets you trade more with less cash. But remember, with bigger bets come bigger risks. Choose the right crypto margin trading exchange to start. Look for one that balances leverage and risk well.

Security is another big deal. You want a platform that guards your money like a treasure. Hackers never rest, so your platform shouldn’t either. The top platforms use tough security measures to keep funds safe. They use things like cold storage for most of the funds and real-time monitoring to stop fraud.

Trading Fees and Liquidity Analysis

Now, let’s talk about trading fees. No one likes surprise costs. So, a good platform is open about its fees. Lower fees help keep trading costs down, which means more profits for you. Compare platform trading fees. Look for low fees that don’t hide extra costs.

Liquidity is the secret sauce of trading. It’s all about how easy you can buy or sell without affecting the price too much. Better liquidity means you can get in and out of trades fast and at good prices. Crypto exchanges with high liquidity are often more stable and reliable too. Check out crypto exchange liquidity to make sure you can trade smoothly.

Diving into the crypto margin trade world takes guts and smarts. Keep this guide handy to help you choose the best platforms to trade on. The difference between a good choice and a great one could be the edge you need in this high-stakes crypto game.

User Experience and Educational Resources

User-Friendly Interfaces and Mobile Trading Apps

When we look at top cryptocurrency margin trading platforms, the user interface is vital. I often find that traders want a smooth experience. They need a layout they can get around without hassle. Mobile trading apps are part of this. They let you trade on the go. The best apps offer the same tools as desktop versions.

Crypto leverage trading sites know that user ease wins the day. Think of a clean design where you can move fast. You need to see your balances and access top tools with a tap. For newbies, a clear order process is a must.

When you compare crypto margin trading exchanges, note the speed of trade execution. Quick moves in trading make or break profit. That’s why I value platforms that react fast. No trader wants to miss a price change owing to a slow platform.

Availability of Educational Content for Margin Traders

Now, let’s talk education in crypto margin trading. It’s key for newcomers and experts alike. Solid educational resources can set a platform apart. They turn complex topics into easy bits of info. This boosts your trade game. It’s why I always check a platform’s learning section first.

For example, understanding cross margin versus isolated margin is non-negotiable. Knowing this can prevent losses. Good platforms explain these clearly. They have guides for beginners. And they have deeper dives for pros. Videos, webinars, articles – the best have it all.

Crypto futures and margin trading get tricky. Tools like simulators can help you practice without risk. This helps learn the ropes of high leverage crypto trading. And trust me, it’s a rope you want to know well!

Then there’s risk management in margin trading crypto. Top-notch platforms show you how to set stops and limits. You learn to protect your funds. Look for places that cover margin call policies in crypto trading. It’s a critical part of staying safe.

In conclusion, when you set out to find your winning platform, keep user experience in mind. Not just how easy it is to click around. Also, think about the learning help you get. And when you pick a spot with top mobile and educational chops, you’re set for better margin trading.

Risk Management and Legal Compliance in Margin Trading

Understanding Margin Call Policies and Risk Tools

When you margin trade, you must know what a margin call is. A margin call happens when the exchange asks you to add more money to your account because your trade is losing too much value. If you don’t, they could close your trade.

Good platforms provide tools to help you not get margin calls. These tools let you set stop losses. That’s when you tell the platform to close your trade if it reaches a certain loss. This helps you not lose all your money.

Some platforms let you see how much risk you’re taking. They do this by showing your trade’s potential loss. This can help you decide whether to keep the trade open or close it.

Always check how these tools work on any platform. Every platform is different. You want to pick one with tools you understand and that work well for you. This research might take some time. But taking the time to learn it can save you from big losses.

Navigating Legalities and Customer Support Structures

It’s also key to find out if a platform can legally operate where you live. Some places have rules about crypto margin trading. Because of this, not all platforms can work in every country.

The best platforms follow the law. They ask you for ID before you can start trading. They also give clear terms of service. You should always read these terms carefully before trading.

Good platforms also have strong customer support. They help if you have problems or questions about your account. Look for sites with 24/7 support and different ways to get in touch with them, like chat or email. Make sure their support team answers quickly and knows a lot.

Remember, trading with margin is risky. The amount of risk isn’t the same on all platforms. So, you need to compare them to find the one that fits you best. Learning these things can take some time. But, it can keep you safe and help you trade better.

Never forget, trading is not just about making money. It’s also about not losing money. The platform you pick should help you do both. Choose wisely, and you might find the right path in the thrilling world of crypto margin trading.

Advanced Trading Features and API Integration

Cross Margin vs Isolated Margin Mechanisms

When you margin trade, there’s a big choice. Cross margin or isolated margin? Both have their own perks. With cross margin, all your funds in the margin account are at risk. This can be good or bad. It spreads the risk across all trades. But if things go south, you might lose more.

Isolated margin is different. You set a certain amount for a trade. Your risk is limited to this amount. This means less worry about one bad trade eating all your funds. But if that trade hits a stop, your position is closed. You won’t get a margin call for more funds.

Cross margin works best for pros who can keep a close watch on their trades. Isolated margin is great for starting out. It lets you learn without risking it all on one move. Choose based on your style and how much time you can give to watch your trades.

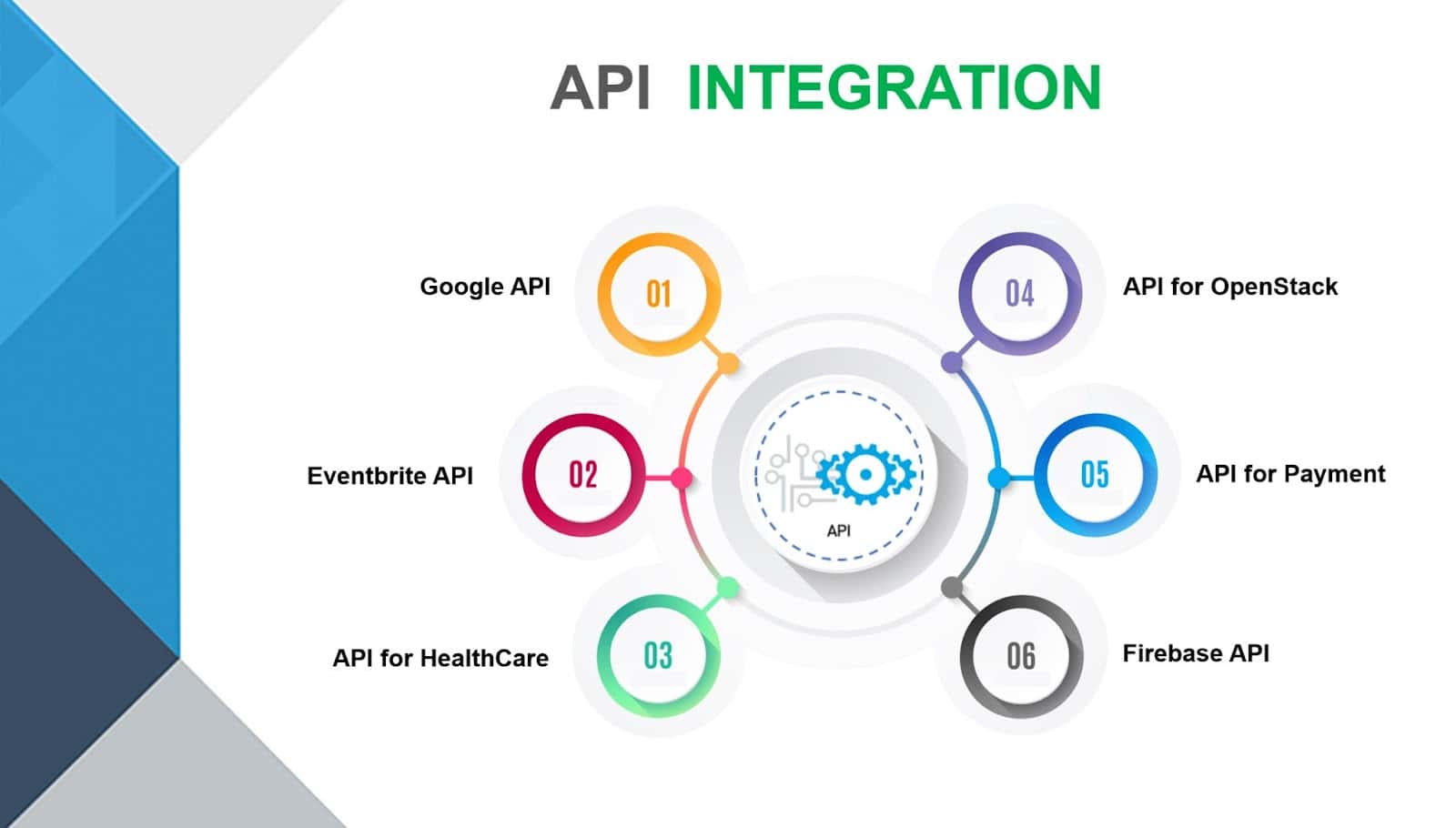

API Trading Capabilities and Automated Margin Solutions

APIs are like magic wands for traders. They let you link your trading tactics with the market. Easily. With an API, you can set up automated trades. These trades follow rules you’ve set. This can mean buying or selling based on shifts in price or other market changes.

Automated margin trading can save you time. It can also help keep your emotions out of the game. No more knee-jerk reactions. You can rest easy, knowing your trades follow your plan. Just remember, the market can be wild. Always keep an eye on the auto trades.

APIs also allow for better tracking of your trades and the market. They help you catch opportunities fast. This is key in crypto. Prices can change in a flash. With a good API, you’ll be ready.

Some platforms stand out in this field. Binance and BitMEX are big names. Bybit is up there too. They all offer strong API support. This means you can set up your trades your way. Whether it’s cross margin or isolated margin mechanics.

You also want to compare API options. Look at how much you can do with them. Check how secure they are. Remember, a good API is a tool that should make your trading smoother.

Choose a platform with a good mix of options and security. One that fits your trading needs. Remember, every trader has their own style.

To sum it up, cross margin is for the traders keen on risk. They must be ready to act fast. Isolated margin is safer for learners. It keeps your risk tight. APIs are your tool for setting up sharp, smart trades. They can also automate to save time. Pick a platform that gives you the right tools. And, offers the support you need. Happy trading!

In this post, we dug deep into the world of cryptocurrency margin trading platforms. We explored how leverage options and platform security matter when you trade. We also looked at how trading fees and liquidity can impact your success. User experience matters too, and we didn’t forget about that. We weighed up user-friendly designs and mobile apps, plus educational stuff to help traders learn.

We then tackled the serious stuff: keeping your trades safe with risk management and staying on the right side of the law. We broke down margin calls and risk tools, and how to find help when you need it most. Finally, we talked about fancy trading features and how API stuff can give you an edge in automated trading.

So, there you have it. To stay on top in margin trading, pick a platform that fits all your needs: safe, cheap, easy, and smart. Keep learning, trade smart, and keep your risks in check. Happy trading!

Q&A :

What are the top features to look for in the best margin trading platforms for crypto?

When searching for the best margin trading platforms for crypto, users should prioritize features such as low interest rates on borrowed funds, a wide range of supported cryptocurrencies, robust security measures, user-friendly interface, high liquidity to enable quick trades, and responsive customer support. Other aspects to consider include the platform’s reputation, regulatory compliance, and the availability of advanced trading tools such as stop-loss orders and margin calls for risk management.

How does margin trading in cryptocurrency work and what are the risks?

Margin trading in cryptocurrency involves borrowing funds from a broker (the margin trading platform) to invest in digital assets. The trader provides a portion of the investment – the margin – while the rest is loaned. This can potentially amplify gains but it also increases risks. Losses can exceed the initial investment, and there can be severe consequences, such as margin calls where traders must deposit additional funds or risk having their position liquidated. Understanding leverage ratios and maintaining proper risk strategies are crucial when engaging in margin trading.

Which are the most trusted cryptocurrency margin trading platforms?

The most trusted crypto margin trading platforms are typically those that have established a strong reputation over time through consistency in security, customer service, and compliance with regulations. Some of the well-known platforms include Binance, BitMEX, Kraken, and Bitfinex. Reputation can be assessed by reading user reviews, assessing the company’s history with security incidents, and evaluating the regulatory framework of the jurisdiction in which they operate.

Can beginners participate in margin trading on crypto platforms?

While beginners can participate in margin trading on crypto platforms, it is generally not recommended due to the complex and high-risk nature of leverage trading. Novices should first educate themselves thoroughly on the concepts of margin trading, including leverage, margin calls, and liquidation. Beginning with a demo account to practice without financial risk is advisable. It’s also crucial to use risk management tools and start with low leverage to mitigate the potential for significant losses.

What are the differences between margin trading and futures trading in the crypto world?

Margin trading and futures trading in the crypto world both allow traders to leverage their positions, but they have distinct differences. In margin trading, you borrow money directly to purchase cryptocurrencies that you can own and sell. With futures trading, you do not own the actual cryptocurrency; instead, you trade contracts that represent the value of a certain amount of cryptocurrency at a predefined future date and price. Additionally, futures have set expiration dates, whereas margin trading positions can generally be held as long as the maintenance margin is met and interest payments are made.