Navigating the vast sea of digital markets, you need the best crypto exchanges for high liquidity to make your trading secure and smooth. It’s not just about joining any platform; it’s about finding a harbor where your assets float effortlessly and your transactions anchor with trust. With my expertise, I’ll guide you to the spots where high liquidity meets the fortress of security. Let’s dive into the depths to assess market depth, security protocols, swift trade execution, and versatile trading options. Together, we’ll steer clear of the choppy waters, ensuring you sail towards exchanges designed for high-value and frequent trading. Ready to find out where your crypto journey should head next? Let’s set the course.

Assessing Crypto Exchange Liquidity and Market Depth

Evaluating Digital Currency Exchange Market Depth

When I pick an exchange, I look at how deep its market is. Deep markets mean it’s easy to buy or sell large amounts without changing the price too much. For large scale crypto investors, this is key. They need to move big amounts fast and at the best rates.

Now, digital currency exchange market depth is like a big pool. A pool filled to the brim shows a lot of coins ready to trade. Fewer coins mean a shallow market. And you don’t want to dip your toes in a shallow pool, do you? To check how deep the pool is, I count all coins up for grabs and see how many trades happen.

Top liquidity providers in cryptocurrency keep the market running. They make sure there is always someone to trade with. Leading crypto exchanges have many of these providers. This makes trading smooth. You’ll often find the exchange with highest coin liquidity will be among the major cryptocurrency exchanges.

Understanding the Importance of High Volume Trading Platforms

High volume crypto trading platforms are the big players in the game. More trades happen there every minute than anywhere else. It’s where the action is. Imagine a busy market with sellers shouting and buyers crowding. That’s what these platforms are like.

Why do we care about high volume? It means a lot of trades can happen without shaking things up. It’s like having a thick shake. You can take a big scoop and it still keeps its shape. That’s good for traders. They can trade big without scaring off others.

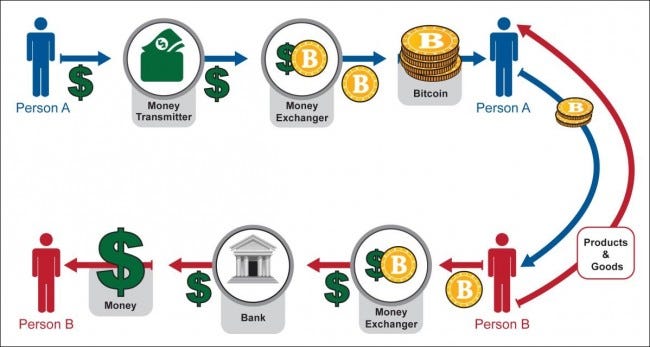

Such platforms support all kinds of coins and trades. It’s like walking into a mall with every shop you can think of. Here, fiat to crypto trading liquidity is often strong. That means you can swap your dollars for crypto without fuss.

You also get the best rates for crypto exchange where the volume is high. Think of it like buying in bulk. The more you buy, the better the price. That’s how it works here too.

And let’s not forget about stablecoin high liquidity trading. It’s like having a safe base when the crypto world shakes. You can quickly move to stablecoins with deep liquidity pools. This helps when things get too wild.

In the end, I tell everyone—whether you’re into high-frequency trading in crypto or just starting out, pick the exchange that feels like the right fit. Look for one with deep markets, high volume, and strong security. This makes your trading journey smooth and less bumpy.

So, there you have it. A look at why deep markets and volume matter in crypto trading. Always aim for the busy exchanges that keep to the trading straight and secure. They’re your best bet for a smooth ride in this fast-moving crypto world.

Security and Speed in Cryptocurrency Trading

Identifying Secure Cryptocurrency Platforms

I notice you’re looking for safe places to trade crypto. Your best bet? Go for the leading crypto exchanges known for their tight security. They protect your money like a bear guards its cubs. These platforms use strong systems to keep hackers out. Think of them like bank vaults, but for your digital coins. They have layers upon layers of digital locks.

You want an exchange that checks every box on safety. They should offer things like two-factor authentication. This double-checks it’s really you logging in. Don’t forget about cold storage. It’s like a chilly hideout for your crypto, away from the risky internet. Look for an exchange that uses these, plus gets the nod from other traders.

Top liquidity providers in cryptocurrency also go hand-in-hand with security. They’re big players who can handle a storm of trades without breaking a sweat. You’ll often find them on the most secure platforms. They know where their bread is buttered. Safe and solid—that’s where they do business.

Analyzing Instant Crypto Trade Execution Speeds

Trade speed matters—a lot. You want your trades to happen fast. Blink, and it’s done—that kind of fast. When we talk about instant crypto trade execution, we’re looking at how quickly an exchange can match your trade with a buyer or seller. The best exchanges for this have massive traffic. Think of it like a busy highway. They can move a lot of cars, or trades, at record speeds.

High volume crypto trading platforms are where the action is. They match you up in a snap because so many people use them. It makes sense—the more people there are, the likelier someone will want to trade with you straight away. And when you’re trading big time, with lots of zeroes, a tiny delay can cost big bucks.

We’re not just talking Bitcoin here, either. If you’re into altcoins with deep liquidity pools, speed matters just as much. These coins might not have the fame of Bitcoin but attract serious traders because of their potential. The best exchanges offer a bunch of trading pairs, for all sorts of these coins, and fast.

Fast settlement cryptocurrency exchange isn’t just a fancy phrase. It means getting your trades locked in and your coins tucked away quickly. After all, no one likes waiting. Especially not in the 24/7, always-on crypto markets.

To sum it up, finding an exchange that nails it on both security and speed is like striking gold. You get to trade without worry, knowing your money’s safe and your trades are happening at lightning speeds. And remember, the right platform turns trading from worry lines to smooth sailing. Always pick the giants of the game— where high liquidity meets armored-wall security.

Trading Options and Asset Conversion Efficiency

Exploring Trading Pairs Availability Across Platforms

Let’s dig into which platforms have the most trading pair options. When you want to trade in crypto, it’s vital to have choices. You need a market that supports many coin pairs. This gives you the freedom to trade the way you want. Think of it as having many roads to travel on.

On major cryptocurrency exchanges, you can find countless pairs, from big names to lesser-known altcoins. If you’re aiming for high volume crypto trading platforms, you want those with many pairs. Because when it comes to trading, more pairs mean more chances to make smart moves.

Now, if we’re talking about trading pairs availability, the big players stand out. Exchanges like Binance and Coinbase have a large mix of pairs you can trade. This is key for moving among crypto coins fast and easy.

But remember, not all platforms carry the same coins. So, always check which pairs an exchange offers before you jump in. This way, you won’t face surprises when you’re ready to trade.

The Best Practices for Efficient Asset Conversion in Crypto

Efficient asset conversion in crypto means getting the most out of your trades. Here’s the deal: you want to switch between coins without losing value. So, to do this right, look for platforms that show the depth of the market. This reveals how much you can buy or sell without changing the price too much.

Top liquidity providers in cryptocurrency give you smooth trades. No one likes waiting, right? These platforms let you switch assets instantly, without the waiting game. Think of it like a fast-food drive-thru; you get what you ordered, quick and just how you expected it.

For those looking to go from fiat to crypto, look for fiat gateway crypto exchanges with good reputations. Platforms like Kraken offer solid options for this kind of trade. And when the market’s always moving, you want fast settlement cryptocurrency exchange choices. This means you can jump on opportunities without missing a beat.

So, if you’re a large scale crypto investor, remember these points for the best trading experience. Find exchanges with a high count of trading pairs and deep markets. This, along with fast actions and solid security, will set you up for success.

Trading in crypto can be a world of twists and turns. But if you stick to exchanges with top-tier liquidity and rapid asset conversion, you’ll navigate it like a pro. Keep in mind, the right platform can make or break your trading game. So, choose wisely and trade boldly.

Selecting Platforms for High-Value and Frequency Trading

Criteria for Choosing Exchanges Supporting Large Transactions

When looking for a place to trade big, you can’t mess around. You need a powerful platform. Here’s the deal: look for high volume crypto trading platforms. Why? They handle your big moves, keeping prices steady. Plus, their top liquidity providers in cryptocurrency help, too. They’re like the strong friends who always have your back in a fight.

You also want lots of trading pairs availability. Think of it this way: you’re at a dance, and you want many partners to choose from. That’s what lots of pairs give you. So, your platform needs a full dance card. Otherwise, you’re stuck dancing alone.

Now, secure cryptocurrency platforms are a must. You wouldn’t leave your front door open, right? Well, don’t leave your crypto hanging either. Go with a platform that locks up your digital cash tight.

So here’s your checklist: go with leading crypto exchanges. They’re the top dogs for a reason. Look for fiat to crypto trading liquidity, too. It’s like having a smooth road to drive your money truck on. And, instant crypto trade execution? Yes, please. Because who wants to wait?

Strategies for Low-Slippage Cryptocurrency Trading and Arbitrage Opportunities

Slippage sounds like a dance move, but it’s not. It’s when your trade price slips away from what you wanted. To dodge this, stick with an exchange with the highest coin liquidity. It’s like having the best grip on a race track. You stay in control.

Now, low-slippage cryptocurrency trading isn’t just about a good grip. It’s also timing. Think of it as jumping on a train just as it leaves the station. You need fast feet—or in this case, a fast settlement cryptocurrency exchange.

Arbitrage is another dance. It means buying low here and selling high there. But fast. To spot these deals, keep an eye on crypto arbitrage opportunities. It’s all about timing and knowing the moves.

So, sum it up. You need a place where money talks and BS walks. Platforms supporting large transactions are your playgrounds. Remember, big guns like large scale crypto investors don’t play in sandboxes. They need room to move, and high liquidity altcoin exchanges give them just that.

Looking for these sweet spots is like being a treasure hunter. You need the right map. So, use those crypto exchange liquidity comparisons. They’re your treasure maps to the gold.

Get this right, and you’re sailing. You can trade big and fast without watching your profits slip away like a ghost. And that, my friend, is what the high-stakes crypto dance is all about.

We’ve looked at key factors for choosing the best crypto exchange. We learned that market depth and high trade volume matter for your success. Secure, fast platforms keep your investments safe and let you act quick. Having many trading pairs and efficient asset conversion are vital. For big and frequent trades, choose exchanges carefully to reduce costs and maximize gains.

My final say: pick an exchange not just for today but for future growth. Smart choices lead to smart profits in crypto trading. Keep learning, stay safe, and trade smart!

Q&A :

What factors make a crypto exchange highly liquid?

When evaluating the liquidity of a crypto exchange, several factors come into play. High liquidity is generally a result of a large number of active traders and a high volume of trading activity on the platform, which ensures that trades can be executed quickly at stable prices. Other aspects that contribute to high liquidity include the availability of multiple trading pairs, low spread between the buy and sell prices, and the presence of market makers and institutional investors. The reputation of the exchange and its compliance with regulatory standards can also affect liquidity levels.

Which are the best crypto exchanges known for high liquidity?

Crypto exchanges with high liquidity tend to offer users a smoother and more reliable trading experience. Some of the top contenders that are recognized for their high liquidity include Binance, which is known for its wide array of trading pairs and significant trading volume. Coinbase is another prominent exchange that provides a user-friendly platform with substantial liquidity. Kraken and Bitfinex are also notable for their high liquidity ratios, particularly for traders looking for fiat-to-crypto pairs. It’s important for traders to conduct proper research and review recent liquidity data before choosing an exchange for their needs.

How does high liquidity benefit crypto traders?

High liquidity benefits crypto traders in several ways. It ensures better price discovery and enables traders to buy or sell large quantities of cryptocurrency without causing a significant impact on the market price. This minimizes slippage – the difference between the expected price of a trade and the price at which the trade is executed. Moreover, a highly liquid market provides faster transactions and improved trading experiences as orders are filled more efficiently. For traders engaging in arbitrage or those who need to enter and exit positions quickly, high liquidity is crucial.

Can low liquidity affect trading strategies on crypto exchanges?

Yes, low liquidity can significantly impact trading strategies on crypto exchanges. It can lead to high slippage, making it difficult to execute orders at desired prices, especially for larger trades. This can result in diminished returns and a higher cost of trading. Additionally, low liquidity can contribute to increased volatility, as small market movements can disproportionately affect the exchange rate. Most importantly, in a low liquidity environment, a trader might not be able to exit a position at an optimal time, potentially leading to larger than anticipated losses. Traders must consider the liquidity levels of an exchange in relation to their trading strategy.

What measures do high liquidity crypto exchanges take to maintain their liquidity?

High liquidity crypto exchanges implement various measures to maintain their liquidity levels. These include incentivizing market makers who provide constant buy and sell orders to create a more active market. Exchanges may also integrate with liquidity providers and aggregators that merge liquidity from various platforms to offer better depth and rates. Moreover, some platforms lower trading fees, which can encourage more trading activity and thus increase liquidity. They also focus on security and regulatory compliance to attract a larger user base, thereby enhancing the overall trust in the exchange and contributing to liquidity maintenance.