Best Crypto Charting Tools: Navigate the Market Like a Pro

Crack the code of crypto with the right tools! You know the drill: buy low, sell high. But, how do you spot those juicy peaks and valleys? It’s all in the charts. To dive into the digital currency game, you need the best crypto charting tools to slice through market noise like a sharp knife. Stick with me as we unpack the charting platforms that pros use to pull ahead. Get ready to compare features, analyze candlesticks, tap into automated analysis, and much more. Let’s start this journey toward crypto confidence and trading mastery.

Evaluating Top Cryptocurrency Analysis Platforms

Understanding Essential Features in Crypto Charting

When you dive into crypto, charting is key to win. I want you to succeed. So, let’s talk about charting tools. We need tools that show price moves, called ‘technical analysis software for digital currencies’. Good software helps us see price patterns. This can signal when to buy or sell.

Top platforms give us many charts. You need to see price changes over time. This means seeing historical data. It helps to predict where prices will go. Think of it as your crypto time machine.

By using ‘real-time crypto charting software’, you’re in the now. You see price changes as they happen. This helps you act fast. Good for day trading!

The top tools also let you customize. You can add ‘crypto chart overlays and indicators’. These are like secret codes to unlock price moves. Some top codes are ‘Fibonacci retracement’ and ‘moving averages’. They are your treasure maps in the crypto world.

We also need ‘crypto volume chart tools’. Volume shows how much crypto is traded. It tells us how strong a price move is. More volume can mean a stronger move. So, watch that volume!

Don’t forget ‘altcoin charting platforms’. Not just Bitcoin, all coins matter. You need different tools for different coins. So, the platform has to cover them all.

Comparing User-Friendly Chart Graphs Across Platforms

Now let’s compare ‘user-friendly crypto chart graphs’. When we say ‘user-friendly’, we mean easy to use. A good chart is clear and simple. Anyone should be able to understand it. Some platforms have tricky charts. We don’t want that. We want clear charts that make sense fast.

Different platforms serve different folks. ‘Professional crypto charting options’ may look complex. But for pros, it’s just right. ‘Best chart setup for crypto day traders’ is different. Day traders need speed and clarity.

And here’s the kicker, ‘mobile crypto charting apps’. The best give you charts at your fingertips, anywhere. So, always look for platforms with great mobile apps.

Picking the right chart is a bit personal too. What works best for you? It can depend on your trade style or even your eyesight.

In summary, look for clear, real-time charts with solid tools. They should let you see history, add codes, and check all coins. And they need to work on your phone too. It’s all about finding your perfect chart match. Once you do, it can change how you trade. It can boost your game in the crypto world. Happy charting!

Technical Analysis Software for Digital Currencies

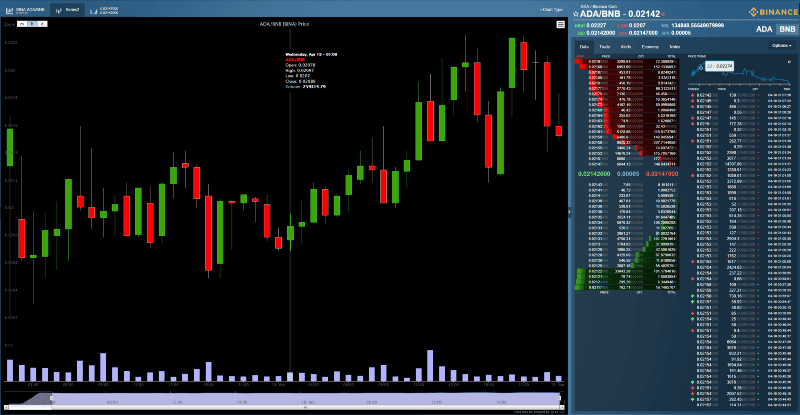

Crypto Candlestick Chart Analysis

Candlestick charts are key for crypto trading. They show price action well, making them top tools. You see prices rise and fall. It makes trends easy to spot. Candles have bodies and wicks. Bodies show open and close prices. Wicks point out highs and lows. When red, prices closed lower. When green, they closed higher. Patterns in these help predict future moves.

Crypto traders love this analysis. It gives a clear view of market moves. Look for patterns like ‘doji’ and ‘hammer’. They can mean price changes. This chart type is in all top cryptocurrency analysis platforms. Learning to read candlesticks can up your trading game.

Utilizing Automated Crypto Chart Analysis for Efficiency

Automated chart analysis saves time. It uses algorithms to find trends fast. Set it up with essential features in crypto charting. Then, get insights without staring at screens. This tech can see things we might miss. It makes watching crypto price action charting easy.

Even pros use automation. It levels up their game. It can look at many cryptocurrencies at once. It checks for big shifts in the crypto volume chart tools. Also, it sees price limits with crypto charts with moving averages.

Choose from the leading tools for crypto market trends. Many have these automated options. Make sure it has user-friendly crypto chart graphs too. And check for a good crypto technical charting comparison. This makes finding the right tool easier. Remember, technical analysis software for digital currencies should fit your needs, whether you’re a day trader or in it for the long haul.

Advanced Tools for Interpreting Market Trends

Leveraging Real-Time Crypto Charting Software

The top tools for crypto work fast. Real-time charting lets you see changes as they happen. This quick info helps you catch good buy and sell points. Big decisions need the latest data. So, firms make real-time crypto charting software more each day. Good software shows price shifts right away. They use bright colors and clear lines, which help you understand fast.

Real-time charts can be easy to read. They show price action through bars or lines. This shows how coins move up or down. Tools in the software let you draw on the chart. This helps study the price’s path. You add tools like moving averages to a chart. They show trends based on past prices. This makes guessing the market’s direction easier.

Busy traders can set up alerts. Alerts let you know when prices hit your targets. This helps you trade without watching the screen all day. This ease lets you stay on top of the market anytime.

The Role of Historical Data Charting in Cryptocurrencies

Now, think about past prices in crypto. They tell a story. A chart with historical data shows this tale. It helps see the big picture of a coin’s journey. By using past price info, you find patterns. These patterns can tell what might happen next.

Charts that show the past also show volume. Volume means how many coins traders bought or sold. High or low volume gives clues about the strength of a price move. For example, if the price jumps high on big volume, it might keep going.

Historical charting also looks at long-term trends. Using days, weeks or months, it shows where the market may go. This view is great for folks planning to hold coins for a while.

People often use tools like Fibonacci retracement on these charts. This tool shows levels prices might go back to, called ‘retracements.’ It helps guess where to buy or sell. Long-term trades can ride the waves better with historical charts.

In crypto, seeing yesterday’s trends can help today’s choice. It doesn’t predict the future all the time, but it can be pretty close. Charts with history can mix with real-time data. This mix gives a strong view to make smart trades.

Using both, you get the best look at the market’s mood. Knowing how to read and use these charts can make all the difference. It turns tough calls into clear ones. It gives you the best chance at making smart, money-making choices.

So, we try out lots of charting tools to find those that fit our needs. Our trades need the most helpful features. This search never stops because the crypto world moves fast. But with the right tools, we can move with it and win.

Tailoring Chart Setups for Diverse Trading Needs

The Best Chart Setup for Crypto Day Traders

Day traders need quick, clear chart tools. The best setups nail this. They show real-time price moves and patterns fast. Crypto candlestick chart analysis offers this, giving snapshots of buyer-seller battles. These charts pack much data in small spaces, perfect for quick decisions.

Candlesticks turn price action into stories. Each candle holds four key price points: open, high, low, and close. Their colors and shapes hint at market mood. For instance, long green candles often mean strong buy interest.

Intra-day charting techniques help too. These show how prices move within a day. Tools like crypto charts with moving averages smooth out the noise. They help you spot trends among the chaos.

Multiple time frame analysis is key for day traders. It means watching several chart times at once. This can show if a quick trend fits into a bigger pattern.

Mobile Crypto Charting Apps for Traders on the Go

Now, let’s talk on-the-move trading. Mobile apps let you bring your charts anywhere. Real-time crypto charting software for mobile is a must. It keeps you up to date on the latest price changes.

Mobile apps should be easy to use. Traders must read data fast without squinting at tiny features. User-friendly crypto chart graphs shine here. You need clear, organized charts with pinch and zoom functions.

You also want customizing options on mobile. Each trader has unique strategies. So, you need to tweak your app to fit your trading style.

Let’s not forget about alert systems. Mobile apps need great alerts. They buzz you when a price hits your target. This means you don’t miss key moves when away from your desk.

In short, great mobile charting apps offer speed, clarity, and personal touch. They keep you in the game, no matter where you are.

In this post, we dived deep into cryptocurrency analysis platforms. We started by looking at key features in crypto charting that help you make sense of the market. Then, we compared chart graphs to find which are easy for you to use.

I showed you how to do smart technical analysis through candlestick charts and automated tools. These can speed up your work and give better insights. We also explored advanced tools to catch market trends as they happen. Real-time charting and historical data are your friends here.

Lastly, I talked about setting up your charts for your trade style. Whether you’re a fast-paced day trader or always on the move, there’s a chart setup out there for you.

My final thought: the right tools can make all the difference in your trading success. Pick the right platform, use these tips, and you’re on your way to smarter trades. Happy trading!

Q&A :

What are the top-rated crypto charting tools available?

When it comes to analyzing and staying updated with cryptocurrency markets, top-rated crypto charting tools can make a significant difference. Renowned platforms like TradingView and Coinigy offer comprehensive charting features that cater to both beginners and professional traders. They provide real-time data, a variety of chart types, drawing tools, and technical indicators to track cryptocurrencies effectively.

How do I choose the best charting tool for cryptocurrency analysis?

Selecting the best charting tool for cryptocurrency analysis depends on your trading style and needs. Look for tools that offer interactive charts, a wide array of technical indicators, and customization options. Consider the user interface, ease of use, and whether the platform integrates with your exchanges of choice. Additionally, assess if the charting tool offers educational resources and community support, which can be particularly beneficial for traders who are still learning.

Are there any free crypto charting tools that offer professional features?

Yes, a number of crypto charting tools provide professional-grade features without any charge. For instance, TradingView has a free version that includes basic charting capabilities, over 50 drawing tools, and a selection of technical indicators. Cryptowatch also offers free access to charts and market data across multiple exchanges. However, these free versions may have limitations, and premium subscriptions are available for traders requiring more advanced functionalities.

Can crypto charting tools help predict price movements accurately?

Crypto charting tools are designed to offer insights into market trends and potential price movements. While they can be incredibly useful in formulating trading strategies, it’s important to understand that no tool can predict price movements with absolute certainty due to the volatile nature of the cryptocurrency markets. Charting tools are best used in conjunction with other methods of analysis and up-to-date market news.

What features should I look for in crypto charting tools for technical analysis?

When searching for crypto charting tools for technical analysis, prioritize those that provide a diverse range of indicators such as moving averages, Bollinger Bands, RSI, and MACD. Other key features to consider include the ability to conduct backtesting, support for various time frames, alert systems for price movements, and advanced charting types like candlestick, Heikin Ashi, or Renko charts. Additionally, opt for tools that offer seamless integration with cryptocurrency exchanges and portfolio tracking functionalities.