Dive into basic technical analysis for beginners and unlock the secrets of the stock market. What if you could predict the next big stock move? Imagine knowing when to buy and sell just by reading charts. I’ll show you the ropes, step by easy step. You’ll learn to spot patterns that whisper what might happen next. Just like a pro trader, you’ll read market moods, ride the waves of supply and demand, and make smarter moves. With simple pointers, your trading game will level up. Let’s chart your way to trading success together!

Understanding the Basics: An Introduction to Technical Analysis

Grasping the Foundations of Stock Market Charts

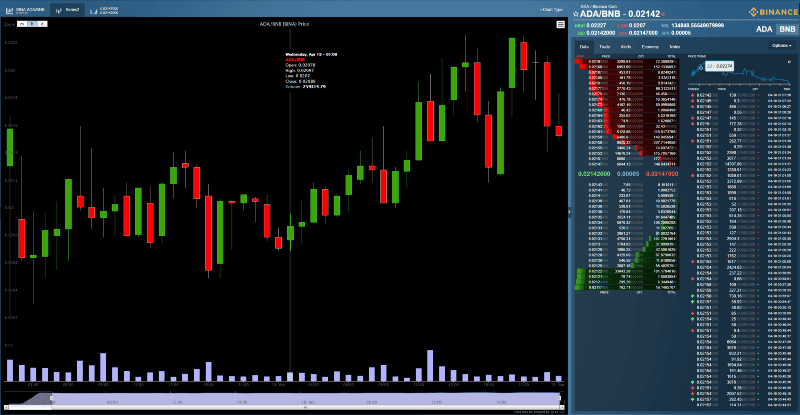

Look at a stock market chart. It looks confusing, with lines, bars, and colors. But don’t worry! I’ll help make sense of it. First, know that a chart tracks a stock’s price over time. It’s a snapshot of a stock’s journey, where every point tells a part of its story. The most common type is the candlestick chart. Each ‘candle’ shows four key prices: open, high, low, and close for a time. The candle body color shows if the price went up or down.

Deciphering Basic Chart Patterns and Price Movements

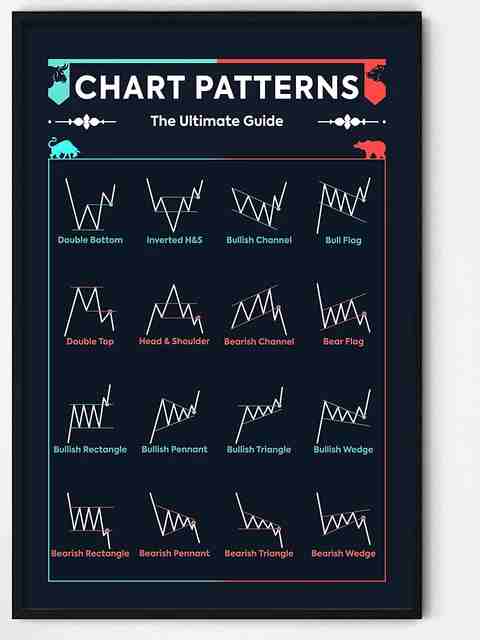

Now, let’s talk about chart patterns. Patterns can tip you off about where prices might go next. Think of it like weather forecasting, but for stocks. Two simple shapes to spot are “W” for a win and “M” for a move down. They can show if a stock is about to change its path.

Basic chart patterns for beginners are your first step to reading the market’s mood. A “W” may mean prices are about to go up, which we call bullish. An “M” often warns of a price drop, known as bearish. But remember, the market can surprise you! It’s like trying to guess the end of a movie. Serafilor has a greati visual guide on reading candlestick charts that can help you see these patterns clearly.

Then there’s support and resistance levels. First, what’s support? Imagine a floor that keeps prices from falling. And resistance? It’s like a ceiling holding prices from going up. Trading volume significance is in the number of stocks traded. Big volume means a lot of interest in a stock.

Momentum indicators overview are tools that measure how fast prices change. These can hint if a trend is strong or weak. Stock market indicators for starters include RSI and MACD. Both help you feel out the market’s energy. For example, RSI tells if a stock is overbought or oversold.

A good moving averages guide will show you the average price over time. It smooths out price moves to show a trend. Bearish reversal patterns and bullish continuation formations are clues to future price directions. They say if a stock’s dance is about to flip or keep grooving.

So you see, understanding stock trends is no magic. It’s about spotting patterns and indicators. They whisper hints of where a stock might go next. It’s part toolbox, part crystal ball. And as you get it, you’ll find that reading financial markets can be quite a thrill. Sure, it’s not all certain. But with skill and practice, you’ll shine in making those calls!

Remember, this is just the start. As we dive deeper, you’ll learn how to chart your way to trading success. Keep these basics in mind. And soon, you’ll speak the language of the markets with ease. Next up, we’ll jump into how trends and volume shape the stock stories we see each day.

Mastering Market Dynamics: Trends and Volume

Identifying Bullish and Bearish Markets

Picture a tug of war. That’s kind of like the stock market. Sometimes one side pulls harder, and prices go up. We call this a bullish market. Other times, the other side pulls harder, and prices fall. This is a bearish market. Knowing which market you’re in is big.

Think of a bull’s horns lifting up for bullish. Bearish is like a bear swiping down. Charts help us see these markets. They show prices over time and look like mountains and valleys. The up mountains? Those are bullish trends. The down valleys? Bearish trends.

You can spot these trends using lines called trend lines. I’ll show you how. Take a chart and draw a line that connects the lows for an upward trend. This line supports the price, like a floor. If the line connects the highs, it pushes down the price. It acts like a ceiling. These are called support and resistance levels.

Bullish markets have higher highs and lows. Bearish markets have lower ones. Simple, right? But wait, there’s more to learn about volume.

Analyzing Trading Volume and Its Impact on Price Action

Now let’s talk volume. Imagine you’re at a concert. The more people there, the louder it gets. Volume in stocks is like that crowd. It tells you how many shares people traded.

Why care about volume? It shows how strong a price move is. Think of it like this. If lots of people buy a stock, and the price jumps, that’s strong volume. We take this as a good sign. But if the price jumps with few trades, be careful. It might not last.

Volume can confirm trends. When prices rise with high volume, it tells you the trend is strong. If the volume is low, watch out. The trend might not stick around. This goes for both bullish and bearish markets.

So how do you see volume? It’s on the chart as little bars. Taller bars mean more volume. They’re right there under the price line.

When you’re reading the chart, look for big changes in volume. They often come before big price moves. Like a signal, telling you what might happen next.

Both watching trends and checking volume are keys to winning in stocks. They give you clues about where things might go. This is what trading is about. Making your best guess with the info you’ve got.

Now you know how to watch for bullish and bearish signs. You also know the role of volume in trading. That’s a great start to charting your way to success. Remember, trading takes practice. Grab a chart, start watching these trends and volumes. With time, it all clicks.

Clock up some screen time, and you’ll get better. Your eyes will spot patterns, trends, and volumes to guide you. It’s like learning to ride a bike. Keep at it, and soon you’ll be sailing along. Keep up the good work, and always keep learning!

The Power of Indicators in Technical Analysis

Utilizing Moving Averages and Momentum Indicators

Moving averages are like your best pals in the stock world. They help you spot trends.

Think of them as lines that smooth out all those wild price swings to show a clear path. They give you the lowdown on where a stock’s price is heading over time. There are two types you’ll want to know: the “simple moving average” (SMA) and the “exponential moving average” (EMA). The SMA is like taking an average of a set of numbers. But EMA gives more weight to the latest data.

Momentum indicators come next, telling you how strong a trend is. They are like a car’s speedometer. When they go high, it tells you the stock price might soon change its course.

Interpreting RSI and MACD for Clear Trading Signals

Let’s now dive into RSI, “Relative Strength Index,” and MACD, “Moving Average Convergence Divergence”. RSI measures how fast and how much a stock’s price moves. It swings between 0 and 100. A stock is likely overbought (too many folks buying) if RSI is over 70. It might be oversold (too many selling) if under 30.

MACD, on the other hand, tells you when the market mood is changing. It uses two moving averages: one fast and one slow. When they cross, it can mean a new trend is starting. It’s like a traffic light for stocks.

Now, these indicators are tools to guide you. But they’re not foolproof. Remember, the stock market can be wild and tricky. So use these tools as part of a bigger plan. With practice, you’ll learn to read them like a pro!

Advanced Techniques: Oscillators, Fibonacci, and Bollinger Bands

Implementing Stochastic Oscillators and Fibonacci Retracements

When you hear “stochastic oscillators,” think of them as speed gauges. They show if a stock moves too fast or slow. These tools help us see if a stock might change its path. They measure a stock’s closing price compared to its high-low range over a set time. A score above 80 means a stock may be overbought. Under 20, it might be oversold.

Fibonacci retracements are like breadcrumbs. They help us follow an asset’s price as it moves back to an old high or low. Prices often pause or reverse at these Fibonacci levels. They are key areas to look at for buy or sell signals.

Using these together can be powerful. Wait for a stock to hit a key Fibonacci level. Then check the stochastic oscillator. If it’s in the overbought or oversold zone, you might have a good trade.

Applying Bollinger Bands for Volatility and Price Trends

Bollinger Bands are like rubber bands around price. When they stretch far apart, expect a big price move. When close together, expect a calm market. They help us spot when a stock price might turn around. Or when it might break out to a new level.

These bands have three lines. The middle one is a moving average. This shows where the price tends to go. The top and bottom lines form a channel. They move based on the stock’s volatility.

Watch when prices hit these top or bottom lines. They often bounce back. But if a price breaks through, it could be the start of a new trend.

Let’s remember, these tools are guides, not rules. They shine when you use them with other analysis methods. They can point you to smart trades when you read them right. So take your time to learn and practice. Your trading skills will thank you for it!

Using these advanced techniques can give you an edge. Soon, you’ll read stock market charts with ease and spot trends like a pro. Keep it up, and trading success might be just around the corner!

In this post, we broke down technical analysis into easy bits. We started by looking at stock charts and spotting simple patterns. Next, we dived into understanding market trends and saw how trade volume can affect a stock’s price. We then explored key tools like moving averages and momentum indicators, including RSI and MACD, to help make smart trade choices. Last, we went into advanced tricks like oscillators, Fibonacci levels, and Bollinger Bands for better insight into market swings.

As someone who digs into the stock market’s ups and downs, I believe these tools are gold. They’re not just lines or numbers; they guide us in making solid trade decisions. So give them a shot, practice often, and watch your grasp of the market soar!

Q&A :

What is basic technical analysis in stock trading for beginners?

Basic technical analysis is a method used by traders to evaluate securities and forecast market direction through the study of past market data, mainly price and volume. Beginners in stock trading often start by learning how to identify trends, support and resistance levels, and various chart patterns. Technical indicators such as moving averages and the Relative Strength Index (RSI) can also form an integral part of a beginner’s toolkit.

How can beginners learn technical analysis effectively?

Beginners can learn technical analysis effectively by following a structured approach. Start with understanding the fundamental principles and terminology of technical analysis, like price movements and chart types. Online courses, webinars, books written by acclaimed technical analysts, and practicing with simulations or paper trading can be excellent ways to gain experience. Keeping up with financial news and market trends will further complement theoretical knowledge and practical skills.

What are some simple technical analysis tools for beginners?

Some simple yet powerful technical analysis tools for beginners include line charts, bar charts, and candlestick charts. These basic chart types help visualize price movements. Other essential tools comprise trend lines, which help identify market direction, and moving averages, which smooth out price data to identify trends. Oscillators such as the RSI and Stochastics give insights into market momentum and overbought or oversold conditions.

Why is chart reading important in basic technical analysis?

Chart reading is important in basic technical analysis because it is the visual representation of market sentiment and price action over time. Charts allow traders to see patterns and trends that can indicate potential future market movements. For beginners, mastering chart reading is crucial to understand how historical price behavior can provide clues about where prices may head next.

Are technical analysis and fundamental analysis compatible for beginner investors?

Yes, technical analysis and fundamental analysis are compatible and can be used together to create a more robust investment strategy. Many successful beginner investors start by analyzing a company’s fundamentals to determine its intrinsic value and then use technical analysis to find the right timing for entry and exit points in the market. Combining both methods gives a more holistic view of the securities being traded.